Burial Insurance Heart Stent

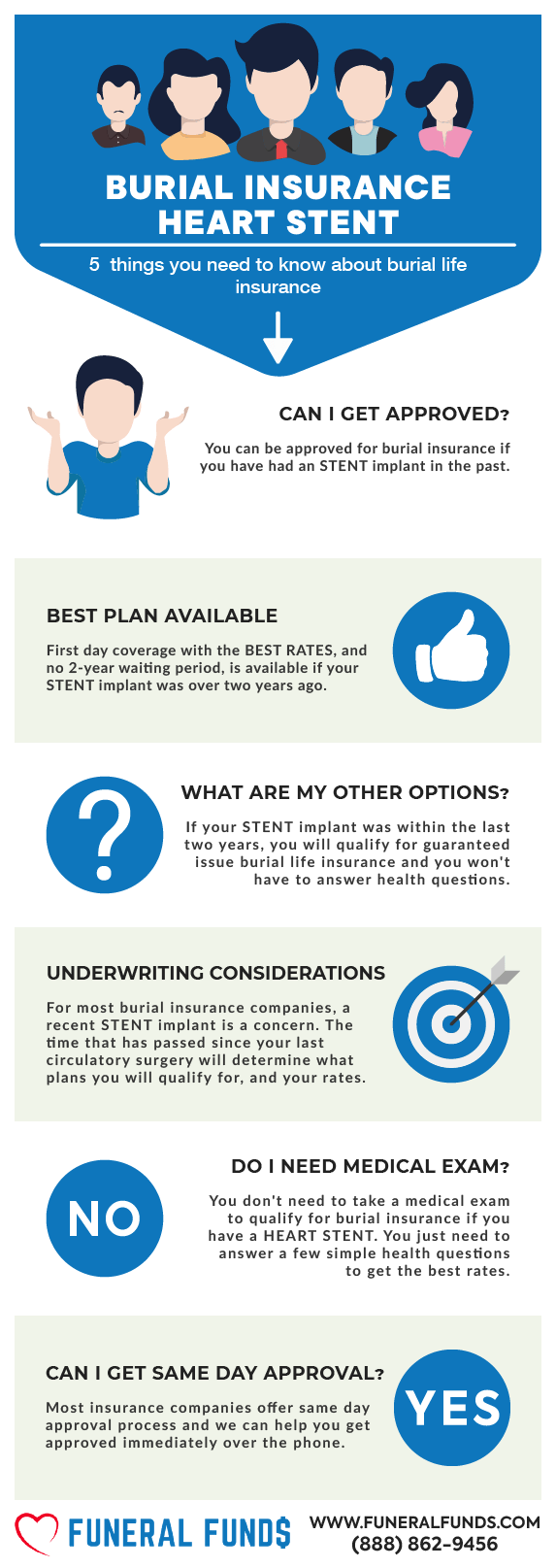

You can get affordable burial insurance with heart stent surgery, and most burial insurance companies are only curious about when your last stent implant was.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with heart stent, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Heart Stent?

YOUR HEART STENT SURGERY WAS OVER 2 YEARS NOW

If your surgery was more than two years ago, you’re in luck! You’ll score the best and lowest-priced options out there.

Burial insurance companies will roll out the red carpet with a level death benefit plan and first-day coverage at the lowest premium. You’ll be treated like your heart stent never even happened!

YOUR HEART STENT SURGERY IS LESS THAN TWO YEARS AGO

Our top insurance carrier for anyone with a heart stent in the past two years is gonna ask, “Have you been hospitalized twice in the last two years?” If you can confidently say “Nope,” you’re in line for first-day coverage – just as long as you’re in the zip where the right plans are available.

But if you’re still in the hospital or had two or more stays recently, your best move is grabbing guaranteed-issue whole life insurance. Sure, there’s a two-year waiting period, but it’s a whole lot better than regretting you didn’t act sooner.

What Is My Burial Insurance Rates If I Have Heart Stent?

Got a heart stent? Here’s what affects your burial insurance costs:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Looking for the best life insurance rates with a heart stent? Partner with the top insurance matchmaker, Funeral Funds. We’ll scour the market, compare rates from various carriers, and find your perfect insurance match.

Check out these sample rates for an accomplished 60-year-old female with a heart stent:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a seasoned 60-year-old male with a heart stent:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Do I Need A Medical Exam To Qualify For Burial Insurance?

Worried about needing a medical exam to qualify for burial insurance with a heart stent? Don’t be. You are NOT required to take a medical exam. Just answer some basic health questions, and you’re golden.

Applying for burial insurance is easier than pie. No need to dig up medical records or offer up blood and urine samples. The insurance company will give you the green light often within minutes!

Burial Insurance Underwriting If You Have A Heart Stent

So, you’ve got a heart stent and need burial insurance? No problem!

Here’s how these insurance companies size you up:

FIRST – They’ll hit you with a series of health questions. Your answers are the golden tickets to eligibility.

SECOND – They’ll do a sneaky little electronic review of your prescription history to check your health status.

HEALTH QUESTIONS:

A heart stent is a tiny metal mesh tube placed inside the coronary artery to keep things flowing. It’s usually done during procedures like cardiac angioplasty.

Here are the common questions you’ll encounter on the application about your heart stent surgery:

- In the past 24 months, have you been advised to have surgery for heart disease?

- In the last two years, have you been prescribed to have surgery for circulation or blood clots in the heart or brain?

- In the last two years, have you been prescribed to have surgery for circulation or blood clots in the heart or brain?

- Have you been treated for heart or circulatory disorder in the past 24 months, other than for preventive or risk lowering?

If you’ve had heart stent surgery, you’ll need to answer “yes” to circulatory surgery questions.

PRESCRIPTION HISTORY CHECK:

After your stent surgery, your doc probably prescribed some meds to keep your blood vessels in tip-top shape. Meds like Clopidogrel (Plavix®), prasugrel (Effient®), ticagrelor (Brilinta™), or just plain old aspirin are common.

Most burial insurance companies aren’t fazed by these “maintenance” medications. In fact, they like seeing that you’re on top of your health game. So, if you’re taking these meds, it might actually work in your favor!

Remember, many insurance companies see your medication use as a positive sign that you’re preventing future health issues.

How Much Insurance Do I Need If I Have Heart Stent?

Figuring out how much burial insurance you need isn’t rocket science. It depends on your personal and financial situation, but at the very least, it should cover the cost of your funeral, burial, and final expenses.

The biggest chunk of change will likely be your funeral costs. But don’t forget about other pesky end-of-life expenses like outstanding medical bills, living expenses, credit card bills, and any other debts you might leave behind.

How Should I Pay My Premiums?

Set it and forget it! The smartest way to pay your premium is through a savings or checking account. Set up a bank draft from your account, and let the bank handle it each month. No more stressing about missing a payment or your policy lapsing. Now that’s peace of mind!

Information We Need If You Have Heart Stent

Applying for final expense insurance with a heart stent? Spill the tea! The more details you give us, the better we can serve you.

We’ll ask you a series of health questions to get the full scoop on your condition, like:

- When was your first heart stent surgery?

- When was your last heart stent surgery?

- How many stents did you have?

- Have you had more than one heart stent surgery?

- Was your heart stent surgery a result of a heart attack?

- What medications have you been prescribed?

- Have you had any complications from your stent surgery?

- Have you been diagnosed with any other health or medical conditions?

Knowing all about your medical condition helps us give you the best recommendations. More info equals better, more affordable coverage options.

Benefits Of Burial & Funeral Insurance

The perks of buying a burial or funeral policy:

- No medical exam or doctor’s visit is required – Easy to get approved.

- Ease of issue – Easy to qualify and get insurance coverage.

- No Money Down to get approved – Start your policy whenever you want, no upfront cash needed.

- Level premium – Your premium will never go up. Nope, not ever!

- Fixed death benefit – Your death benefit will stay the same, no matter what.

- Permanent protection – As long as you keep paying your premiums, your policy can’t be canceled.

- Tax-free – Your death benefit goes straight to your beneficiary without Uncle Sam taking a cut.

- Cash value builds up – This whole life policy builds cash value over time, sweetening the deal even more.

How Can Funeral Funds Help Me?

Don’t let a heart stent stress you out! With Funeral Funds, finding a policy with pre-existing heart conditions is a breeze.

Skip the hassle of hunting down insurance companies. We’ll do all the legwork for you, shopping around to get your application approved. We work with top-rated insurance companies that specialize in high-risk clients, so you know you’re in good hands.

We’ll match you with the best funeral and burial insurance options, securing the coverage you need at a price you can afford. If you’ve got a heart stent in your medical history, we’ve got your back.

Fill out our quote form on this page or give us a call at (888) 862-9456, and we’ll hook you up with an accurate quote.

Frequently Asked Questions

Is a heart stent implant considered surgery in life insurance?

Absolutely! A heart stent implant is considered surgery in life insurance. This means you might have to wait a bit after your surgery before they roll out the red carpet for your policy.

Do I need to tell insurance about my heart stent?

Yes, spill the beans! You need to tell your life insurance company about your heart stent. It’s a pre-existing condition, and the company needs all the deets to assess your risk and set your premiums just right.

Can I get insurance if I have a heart stent and use blood thinners?

Yes, you can! Having a heart stent and using blood thinners won’t stop you from getting insurance. Your premiums might be a tad higher, but you’ll still find coverage.

Can you get first-day coverage insurance if you have a heart stent?

Yes, indeed! You can get first-day coverage insurance with a heart stent. Typically, you’ll need to wait two years or more after your implant surgery to qualify.

What are the things that may affect my eligibility if I have a heart stent?

A few things might impact your eligibility for life insurance if you have a heart stent:

- Why you had the stent implanted

- How long you’ve had the stent

- Whether you’re taking blood thinners