Burial Insurance After Heart Valve Surgery (2024 Update)

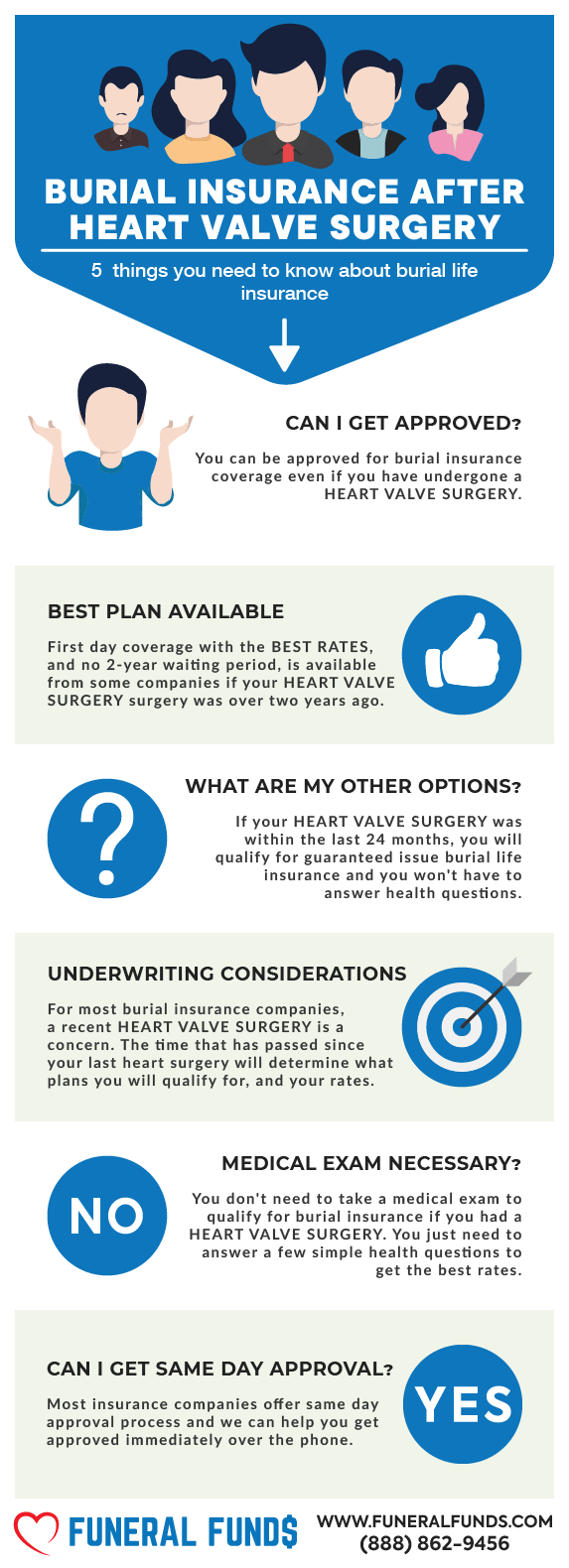

You can qualify for affordable burial insurance after heart surgery. Now, having heart valve surgery might mix up your insurance policy choices, but here’s the kicker: the longer it’s been since your surgery, the better your options and rates will be.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance after heart valve surgery, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Heart Valve Surgery?

The time since your heart valve surgery is the make-or-break factor with most burial insurance companies. It decides what plans you can get and how much you’ll pay.

YOUR HEART VALVE SURGERY WAS OVER 2 YEARS

If your surgery was over two years ago, you’re golden. Insurance companies love to see that kind of track record. They want to make sure your surgery was a success and that there aren’t any lingering issues.

When it’s been over two years, you get the crème de la crème of options: a level death benefit plan with first-day coverage at the lowest premium. Yes, you’ll be covered from day one, and your beneficiary gets 100% of the death benefit when you kick the bucket.

YOUR HEART VALVE SURGERY WAS LESS THAN TWO YEARS AGO

If your surgery was less than two years ago, don’t fret! You’ve still got options.

If you live in the right zip code, there are policies that offer 1st-day coverage for heart valve surgery as long as there are no other upcoming or pending tests or procedures.

Assuming you are still having some ongoing heart issues, you can still get a modified plan. You’ll be covered right away, with your death benefit phasing in over time.

Do I Need A Medical Exam To Qualify For Burial Insurance?

You do NOT have to take a medical exam to get burial insurance after heart valve surgery. That’s right -no poking or prodding required!

Applying for burial insurance is a breeze. Just answer a few basic health questions – no medical records, no blood, no urine samples. You’ll get the thumbs-up from the insurance company, often within minutes!

What Is My Burial Insurance Rates If I Had Heart Valve Surgery?

The cost of your burial insurance depends on a few things:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Here’s a quick look at what a 60-year-old woman with heart valve surgery might pay:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a quick look at what a 60-year-old man with heart valve surgery might pay:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Have A Heart Valve Surgery

Burial insurance companies have two tricks up their sleeves for underwriting:

FIRST – They’ll ask you some health questions. Your answers will decide if you’re eligible.

SECOND – They’ll take a peek at your prescription history to confirm your health status.

HEALTH QUESTIONS:

Every insurance company wants to know if you’ve had heart valve surgery. They’re curious about common heart valve repair procedures, whether it was a repair or replacement surgery.

Common heart valve repair procedures insurance companies will ask about:

- Heart valve repair

- Valvuloplasty

- Ring Annuloplasty

- Commissurotomy

- Decalcification

- Patching

But don’t worry, the type of surgery isn’t their main concern – it’s how long it’s been since your last surgery that matters the most.

You can see heart surgery questions in the health questionnaire asked this way:

- During the past 12 months, have you had a heart attack or failure or heart or circulatory surgery?

- Within the past 24 months, have you been medically diagnosed as having or been treated for heart attack, heart disease, or heart or circulatory surgery to improve circulation to the heart?

- Within the past 2 years, have you had or been diagnosed with angina, heart attack, cardiomyopathy, or any type of heart surgery?

You’ll need to say “yes” to the heart surgery question because heart valve surgery counts as a heart and circulatory procedure.

PRESCRIPTION HISTORY CHECK:

Patients with mechanical valves often need to pop blood-thinning meds for the rest of their lives.

You’re probably familiar with the usual suspects: over-the-counter drugs like Aspirin, or blood thinners like Coumadin, Plavix, and Warfarin. The good news? Most insurance carriers won’t bat an eye at these if it’s been two years or more since your first prescription.

How Much Insurance Do I Need?

How much burial insurance should you buy? That depends on your personal and financial situation, darling. But here’s the tea: your policy should cover the cost of your funeral, burial, and final expenses.

Step one in figuring out your burial insurance needs? Know your end-of-life expenses. Your funeral is likely the priciest ticket item. But don’t forget about those pesky medical bills, living expenses, credit card debts, and any other IOUs.

How Should I Pay My Premiums?

The best way to handle your premium payments is through a savings or checking account. Set up a bank draft from your account so the bank automatically pays your premium each month. This way, you can rest easy knowing your policy won’t lapse because of missed payments.

How To Apply For Burial Insurance After Heart Valve Surgery

- Consult with an Independent Insurance Agent – Talk to an insurance agent from Funeral Funds who knows a lot about heart problems. We can help you find the right burial insurance.

- Complete the Application Honestly – Be truthful on the insurance application. Tell them everything about your heart condition, what medicines you take, and if you’ve changed your lifestyle.

- Review and Confirm Policy Details – Read over the insurance policy carefully. Make sure it covers what you need and that you understand what it costs.

How Can Funeral Funds Help Me?

Finding a policy with heart valve surgery doesn’t have to be a headache. Let Funeral Funds do the heavy lifting. We’ll hold your hand through the whole process and find a plan that won’t break the bank.

You shouldn’t waste your time calling around to different insurance companies. We’ll do the legwork for you. We work with lots of top-notch insurance companies that know how to deal with people like you. We’ll find the best deal and get you covered.

Need help finding burial insurance after heart valve surgery? We’re your go-to people. Fill out our quick quote form or give us a call at (888) 862-9456.

Frequently Asked Questions

Can a person with a heart condition get life insurance?

Absolutely! People with heart problems can definitely get life insurance. There are lots of different kinds of life insurance, and some are better for people with heart issues than others. It’s smart to talk to an insurance person to figure out which one is best for you.

Is there an age limit for burial insurance with heart valve surgery?

Most insurance companies will sell life insurance to people up to about 89 years old.

Do I need to tell my life insurance company if I have heart valve surgery?

Yep, you have to tell the insurance company about your heart surgery. They need to know about your health to decide if they’ll cover you.

Can you get first-day coverage insurance if you have heart valve surgery?

Yes, Some insurance companies don’t make you wait to be covered if you’ve had recent heart surgery.

What are the consequences of not telling your life insurance company about your heart valve surgery?

If you don’t tell the insurance company about your heart surgery and something happens, they might not pay out. It’s important to be honest.

Can you be denied insurance for heart valve surgery?

Unfortunately, yes. If you just had heart surgery or were in the hospital recently, it might be harder to get insurance with some companies.

What is the coverage amount for burial insurance after heart valve surgery?

How much insurance you can get depends on the company. Most offer up to $50,000.