2024 Burial Insurance with Hodgkin’s Disease

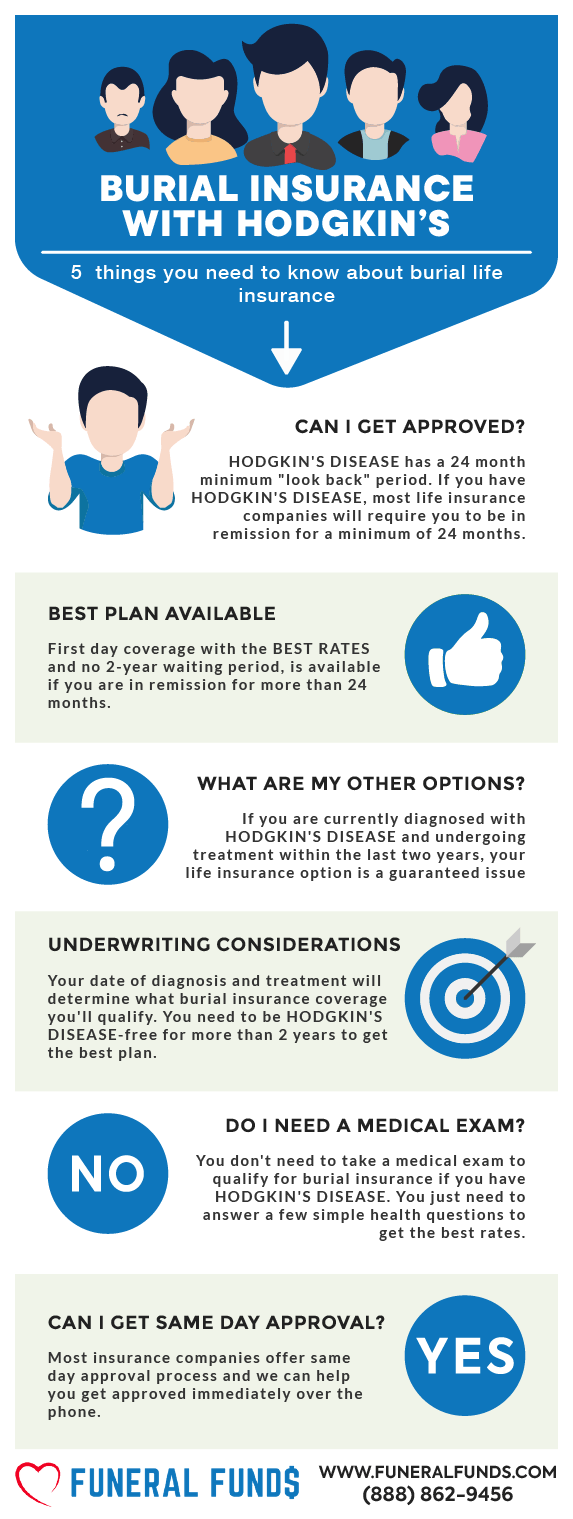

Burial insurance with Hodgkin’s Lymphoma or Non-Hodgkin’s Lymphoma is possible. Almost everyone can qualify for an affordable burial insurance policy!

We have helped many lymphoma clients secure an affordable burial insurance policy to have the peace of mind they need. We can help you to get approved for burial insurance with Hodgkin’s disease.

In this article, we will provide you with the information you need to understand how insurance companies view Hodgkin’s and Non-Hodgkin’s lymphoma, how they underwrite this condition and how to find the best burial insurance if you have Hodgkin’s Disease.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Hodgkin’s Disease?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Hodgkin’s Disease, Do I Need A Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Hodgkin’s Disease

- How Much Insurance Do I Need If I Have Hodgkin’s Disease?

- How Should I Pay My Premiums?

- Hodgkin’s Disease and Burial Insurance Riders

- Information We Need if You Have Hodgkin’s Disease

- Finding the Best Burial Insurance Rates with Hodgkin’s Disease

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Hodgkin’s Disease

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Hodgkin’s Disease

What Is My Best Insurance Option If I Have A History Of Hodgkin’s Disease?

Hodgkin’s disease is a type of lymphoma and is a cancer of the lymphatic system. There are two common types of cancers of the lymphatic system: Hodgkin’s lymphoma and non-Hodgkin’s lymphoma.

Your ability to qualify for burial insurance with Hodgkin’s disease depends on the following factors:

- Date of your Hodgkin’s disease diagnosis

- How long has passed since your lymphoma treatment

- Common Hodgkin’s disease treatments include: chemotherapy, radiation therapy, bone marrow transplant, drug therapy, and surgery

- Prescription medications taken

HODGKIN’S DISEASE-FREE FOR MORE THAN TWO YEARS

If you have been Hodgkin’s lymphoma-free for more than two years or your lymphoma treatment over two years, you will qualify for the best plan, lowest prices, and first-day coverage.

Best option: Level death benefit plan with first-day coverage

Most life insurance companies that only have a two-year lookback period on cancer will offer you a death benefit with first-day coverage. Because you have been lymphoma-free for two years or longer, you can honestly answer “no” to the cancer question. You can now qualify for the best plan with the lowest rate.

The level death benefit plan with first-day coverage has a level premium that remains the same your whole life. Your death benefit will never decrease, and your beneficiary will receive a 100% death benefit when you pass away.

CURRENTLY HAVE HODGKIN’S DISEASE OR CURRENTLY UNDERGOING TREATMENT

If you have either Hodgkin’s lymphoma or non-Hodgkin’s lymphoma and you’re undergoing treatments within 24 months, most life insurance companies with underwriting will flat out decline your application for first-day coverage.

No life insurance company will give you immediate coverage because of your current cancer situation.

Best Option: Guaranteed Issue burial insurance

If you currently have Hodgkin’s disease or are undergoing treatment, your lowest-cost option would be to take a guaranteed life insurance policy. Guaranteed issue or guaranteed acceptance life insurance does not ask health questions. This insurance policy will provide you insurance coverage regardless of your medical situation.

If you are between 50 and 80 years old and a U.S. citizen, the insurance company will approve your application without asking about your past or current health.

Currently having Hodgkin’s disease will result in a two-year waiting period on your burial policy.

Guaranteed acceptance life insurance will pay a full death benefit if you die in an accident during the two-year waiting period; however, you need to live for the first two years of the policy before it will pay 100% death benefit to your beneficiaries.

If you pass away during the two-year waiting period from natural causes or medical-related death, the company will only refund all your premiums plus interest, which is typically 10%. After the waiting period, you are fully covered, and your beneficiary will receive your full death benefit if you die for any reason.

Recurrences of Hodgkin’s disease will also affect your approval (which is why it is smart to get your burial insurance policy today).

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Hodgkin’s Disease, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with Hodgkin’s disease.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Hodgkin’s Disease

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

Here are the most common ways Hodgkin’s disease or cancer will be asked in the health questionnaire:

- During the past 24 months, have you been treated for internal cancer, lymphoma, or leukemia?

- Within the past 24 months, have you been diagnosed or treated for internal cancer, melanoma, or lymphoma?

- Have you ever had or been diagnosed with more than one occurrence of the same or different type of cancer, or do you currently have cancer?

HODGKIN’S DISEASE TREATMENTS THAT CONCERN INSURANCE COMPANIES

In the case of Hodgkin’s disease, burial insurance companies look at your treatment in the same category as having cancer. In simple words, having cancer treatment means you have it.

If you’re taking any of these, it will qualify as a treatment for cancer.

- Chemotherapy

- Radiation therapy

- Bone marrow transplant

- Surgery

- Other drug therapy

The insurance companies offering burial insurance with Hodgkin’s Disease will review or ask questions about these treatments on most insurance applications (except guaranteed issue life insurance).

PRESCRIPTION HISTORY CHECK

Different prescription drugs are used to treat Hodgkin’s disease. If you have filled any of these prescription medications within the last two years, burial insurance companies will consider you as having cancer treatment.

Drugs Approved for Hodgkin Lymphoma:

- Brentuximab Vedotin

- Carmustine

- Bleomycin

- Brentuximab Vedotin

- Carmustine

- Chlorambucil

- Cyclophosphamide

- Dacarbazine

- Doxorubicin Hydrochloride

- Pembrolizumab

- Chlorambucil

- Lomustine

- Procarbazine Hydrochloride

- Mechlorethamine Hydrochloride

- Nivolumab

- Pembrolizumab

- Prednisone

- Procarbazine Hydrochloride

- Vinblastine Sulfate

- Vincristine Sulfate

Taking any of these drugs will indicate that you are undergoing treatment for Hodgkin’s disease.

How Much Insurance Do I Need If I Have Hodgkin’s Disease?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Hodgkin’s Disease And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while others can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Hodgkin’s Disease

When applying for final expense insurance with Hodgkin’s disease, it is important to provide as much information as possible. We will ask you a series of health questions to better understand your condition.

These questions include:

- What type of cancer were you diagnosed with?

- What stage of cancer do you have?

- What type of treatment are you receiving?

- Are you finished with the treatments?

- When was the last date of treatment?

- Are you cancer-free now? or how long have you been cancer-free?

We need to know your medical condition to provide you with the best recommendation. The more information we get, the better your chances of finding affordable insurance coverage.

Finding The Best Burial Insurance Rates With Hodgkin’s Disease

Finding affordable burial insurance for cancer patients is easy (even if you have Hodgkin’s lymphoma or non-Hodgkin’s lymphoma). The key is to work with an independent life insurance agency like Funeral Funds.

We access more than 40 insurance companies, and we know which companies are more accepting of people with Hodgkin’s disease and other medical conditions.

We are familiar with the way insurance companies treat people with cancer. By shopping your case, we can find the best insurance company that will give you the lowest premiums for either Hodgkin’s lymphoma or non-Hodgkin’s lymphoma.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company if you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance With Hodgkin’s Disease

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with Hodgkin’s disease

- Cremation insurance plan with Hodgkin’s disease

- Funeral home insurance plan with Hodgkin’s disease

- Final Expense insurance plan with Hodgkin’s disease

- Prepaid funeral plan insurance with Hodgkin’s disease

- Mortgage payment protection plan with Hodgkin’s disease

- Mortgage payoff life insurance plan with Hodgkin’s disease

- Deceased spouse’s income replacement plan with Hodgkin’s disease

- Legacy insurance gift plan to family or loved ones with Hodgkin’s disease

- Medical or doctor bill life insurance plan with Hodgkin’s disease

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy for Hodgkin’s lymphoma or non-Hodgkin’s lymphoma needn’t be frustrating, but working with an independent agency like Funeral Funds will make the process easier and quicker.

You don’t need to waste your precious time searching for different insurance companies; we will do the work for you. We can shop your case to different companies to get your application approved.

We work with many A-rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate ever. We’ll match you up with your best funeral and burial insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for funeral or burial insurance with Hodgkin’s lymphoma or non-Hodgkin’s lymphoma in your medical history, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Hodgkin’s Disease

Can you get life insurance if you have Hodgkin’s disease?

Yes, you can get life insurance if you have Hodgkin’s disease. You can qualify for a first-day coverage plan if you have been lymphoma-free for two years or longer.

Is Hodgkin’s disease a pre-existing condition for life insurance?

Yes, Hodgkin’s disease is a pre-existing condition for life insurance. However, you may still be able to qualify for coverage if you have been lymphoma-free for two years or longer.

Do I need to tell insurance about Hodgkin’s disease?

Yes, you will need to tell your insurance company about your Hodgkin’s disease.

Do I need to take a medical exam if I have Hodgkin’s disease?

No, you will not need a medical exam if you have Hodgkin’s disease.

Is there an age limit for burial insurance with Hodgkin’s disease?

Most life insurance companies accept applicants who are 18-85 years old.

Can you get first-day coverage insurance if you have Hodgkin’s disease?

Yes, you can get first-day coverage insurance if you have Hodgkin’s disease and have been lymphoma-free for two years or longer.

Can a person with Hodgkin’s disease get burial insurance?

Yes, a person with Hodgkin’s disease can get burial insurance. Most life insurance companies accept applicants who are 18-85 years old.

Can Hodgkin’s disease be considered a critical illness in life insurance?

Hodgkin’s disease cannot be considered a critical illness in life insurance.

What are the benefits of having burial insurance if you have Hodgkin’s disease?

Burial insurance can help your loved ones cover the costs of your funeral and other end-of-life expenses. It can also give you peace of mind knowing that you have a plan in place in case something happens to you.

Is Hodgkin’s disease considered a terminal illness?

No, Hodgkin’s disease is not considered a terminal illness.

How does Hodgkin’s disease treatment affect life insurance?

Hodgkin’s disease treatment can affect life insurance in two ways. First, it can make it more difficult to qualify for coverage, most life insurance companies will only offer a first-day coverage plan if you’ve been lymphoma-free for two years or longer.

What are the things that may affect my eligibility if I have Hodgkin’s disease?

The things that may affect your eligibility if you have Hodgkin’s disease include:

- Date of your Hodgkin’s disease diagnosis

- How long has passed since your lymphoma treatment

- Common Hodgkin’s disease treatments include: chemotherapy, radiation therapy, bone marrow transplant, drug therapy, and surgery

- Prescription medications taken

What is the life expectancy after Hodgkin’s disease?

The life expectancy after Hodgkin’s disease has a 97% survival rate in the next 5 years.

Is Hodgkin’s disease a form of cancer in insurance?

Yes, Hodgkin’s disease is a form of cancer in insurance.

What type of insurance do you need if you have Hodgkin’s disease?

The type of insurance you need if you have Hodgkin’s disease will depend on your circumstances. If you have been diagnosed with Hodgkin’s disease, you may need to purchase a policy that has a rider for cancer or critical illnesses.

Is Hodgkin’s disease a disability?

No, Hodgkin’s disease is not a disability.

Can you get life insurance with stage 4 Hodgkin’s disease?

Yes, you can get life insurance with stage 4 Hodgkin’s disease. However, you will only qualify for guaranteed acceptance life insurance.

What disability category is Hodgkin’s disease?

Hodgkin’s disease is not a disability.

Can I qualify for cremation insurance with a history of Hodgkin’s disease?

Yes, you can qualify for cremation insurance with a history of Hodgkin’s disease. Most life insurance companies accept applicants who are 18-85 years old.

What is the best life insurance company for people with Hodgkin’s disease?

The best life insurance company for people with Hodgkin’s disease will depend on your circumstances.

How do you get life insurance after Hodgkin’s disease diagnosis?

You can get life insurance after Hodgkin’s disease diagnosis by contacting a life insurance agent who can recommend the best plan with the best rates.

What is my best insurance option if I have Hodgkin’s disease?

There is no one-size-fits-all answer to this question. The best insurance option for you will depend on your individual circumstances.

Is Hodgkin’s disease fatal in life insurance?

Yes, Hodgkin’s disease is fatal in life insurance.

Can I still get whole life insurance if I have Hodgkin’s disease?

Yes, you can still get whole life insurance if you have Hodgkin’s disease.

What is the standard rate for life insurance with Hodgkin’s disease?

There is no standard rate for life insurance with Hodgkin’s disease. Your premium will depend on your age, health, and smoking status.

Can you be denied insurance for Hodgkin’s disease?

Yes, you can be denied first-day coverage insurance for Hodgkin’s disease if you are currently diagnosed with this condition and are undergoing treatment. You can only qualify for a first-day coverage plan if you’ve been lymphoma free for two years or longer.

Is there a waiting period for life insurance with Hodgkin’s disease?

Yes, there is usually a two-year waiting period for life insurance with Hodgkin’s disease. Most life insurance companies will want you to be lymphoma free for two years or longer before offering a first-day coverage plan.

Can Hodgkin’s disease affect your life insurance rates?

Yes, Hodgkin’s disease can affect your life insurance rates. Your premium will depend on your age, health, and smoking status.

What is the best life insurance for people with Hodgkin’s disease?

There is no one-size-fits-all answer to this question. The best life insurance for people with Hodgkin’s disease will depend on your circumstances.

Can Hodgkin’s disease medication affect my premium?

Yes, Hodgkin’s disease medication can affect your life insurance premium. Your premium will depend on your age, health, and smoking status.

How can you get the best life insurance rates with Hodgkin’s disease?

The best way to get the best life insurance rates with Hodgkin’s disease is to work with an insurance agent who can compare quotes from different life insurance companies and recommend the best plan with the best rate.

How serious is Hodgkin’s lymphoma in insurance?

Hodgkin’s lymphoma is a serious condition in insurance. This cancerous condition can affect your life insurance rates and may result in a denial of coverage.

What are the best life insurance companies for Hodgkin’s disease?

The best life insurance companies for Hodgkin’s disease will depend on your circumstances.

What are some tips for getting life insurance with Hodgkin’s disease?

Some tips for getting life insurance with Hodgkin’s disease include:

- Work with an insurance agent who can compare quotes from different life insurance companies and recommend the best plan with the best rate.

- Be honest about your health history and disclose all information about your Hodgkin’s disease diagnosis and treatment.

- Ask about riders or add-ons that can help cover treatment costs or provide additional financial protection in the event of a cancer recurrence.

What are the premiums for burial insurance with Hodgkin’s disease?

There is no standard rate for burial insurance with Hodgkin’s disease. Your premium will depend on your age, health, and smoking status.

What is the average cost of life insurance for someone with Hodgkin’s disease?

There is no one-size-fits-all answer to this question. The average cost of life insurance for someone with Hodgkin’s disease will depend on your circumstances.

Can Hodgkin’s disease patients get final expense insurance?

Yes, Hodgkin’s disease patients can get final expense insurance.

Is Hodgkin’s disease covered by a critical illness rider?

Yes, Hodgkin’s disease is covered by a critical illness rider.

Can Hodgkin’s disease affect life insurance?

Yes, Hodgkin’s disease can affect life insurance. The premium you pay will depend on your age, health, and smoking status

What is Hodgkin’s lymphoma life expectancy?

The average life expectancy depends on the cancer stage, the patient’s age, and other factors.

What’s the best way to shop for life insurance if you have Hodgkin’s disease?

The best way to shop for life insurance if you have Hodgkin’s disease is to contact a life insurance agent who can help you compare rates and find the best policy for your needs.