2024 Burial Insurance For Cancer Patients

Burial insurance for cancer patients is available whether you’re just diagnosed with cancer, currently undergoing cancer treatment, in remission, or you are a cancer survivor. There are burial, funeral, or final expense insurance policies for you.

!!! READ THIS FIRST & WATCH VIDEO BELOW !!!

Current Cancer is a life-threatening health condition, and there are no insurance companies that offer 1st-day coverage to cancer patients undergoing current treatment.

We recommend current cancer patients purchase a guaranteed issue life insurance that asks no health questions but does come with a 2-year waiting.

Let us help you find affordable life insurance, burial insurance, or final expense insurance for you or your loved one who has cancer or a history of cancer in the past.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have History of Cancer?

- What Types of Insurance Policies Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Cancer, Do I Need a Medical Exam to Qualify For Burial Insurance?

- Burial Insurance and Cancer

- What About Basal or Squamous Skin Cancer?

- Burial Insurance Underwriting If You Have Cancer

- How Much Insurance Do I Need If I Have Cancer?

- How Should I Pay My Premiums?

- Cancer and Burial Insurance Riders

- When Is the Best Time to Get Burial Insurance for Cancer Patients?

- How to Get the Best Burial Insurance Rates for Cancer Patients

- Information We Need If You Have Cancer

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance For Cancer Patients

What Is My Best Insurance Option If I Have History Of Cancer?

Your ability to qualify for burial insurance with cancer depends on the following factors:

- Date of your cancer diagnosis

- How long has passed since your cancer treatment? Common cancer treatments include: chemotherapy, hormone therapy, immunotherapy, radiation, and surgery

- Prescription medications taken

- Time of remission

CANCER-FREE FOR MORE THAN TWO YEARS

If you have been cancer-free for more than two years or your cancer treatment has been over two years, you will qualify for the best plan.

Best option: Level Death Benefit Plan

Because you have been cancer-free for two years or longer, you can honestly answer “no” to the application’s cancer questions. You can now qualify for the best plan with the lowest rate. Most life insurance companies that only have a two-year lookback period on cancer will offer you a level death benefit with first-day coverage.

The level death benefit plan is a simplified issue policy with no medical exam and just health questions to answer. This plan with first-day coverage has a level premium that remains the same your whole life. Your death benefit will never decrease, and your beneficiary will receive a 100% death benefit when you pass away.

The best thing about the level death benefit plan is that it cost less than guaranteed issue burial insurance. If your treatment has been successful for 24 months and longer, you will easily qualify for this plan.

CURRENTLY HAVE CANCER OR CURRENTLY UNDERGOING TREATMENT

If you currently have any type of cancer which is not basal cell or squamous cell carcinoma, or you are presently undergoing treatments, most life insurance companies with underwriting will flat out decline your application.

No life insurance company will give you immediate coverage because of your current cancer situation.

Best Option: Guaranteed Issue burial insurance

If you currently have cancer or undergoing treatment, your lowest cost option would be to take a guaranteed issue life insurance policy. Guaranteed issue or guaranteed acceptance life insurance has no medical exam and no health questions. This insurance policy will provide you insurance coverage regardless of your medical situation.

You can easily get this policy if you are a 50-80-year-old U.S. citizen and can enter a legal contract. Guaranteed issue burial insurance costs anywhere from 15-30% more than a policy with immediate coverage. This is the small price you pay because the insurance company will approve your application without asking about your health.

While it costs a bit more than a plan with immediate coverage, you will not have to worry about being denied coverage because you are currently undergoing cancer treatment.

You must be aware: Guaranteed issue burial insurance comes with a two-year waiting period.

Guaranteed acceptance life insurance will pay a full death benefit if you die in an accident during the two-year waiting period; however, you need to live for the first two years of the policy before it will pay 100% death benefit to your beneficiaries.

If you pass away during the two-year waiting period from natural causes or medical-related death, the company will only refund all your premiums plus interest, typically 10%. After the waiting period, you are fully covered, and your beneficiary will receive your full death benefit if you die for any reason.

You should not worry if you will only qualify for a plan with a two-year waiting period. Many cancer patients have outlived the waiting period.

In fact, I get calls from beneficiaries of cancer patients I sold a guaranteed issue policy to. They told me they’ve been very thankful because I insisted their parents get a policy even if it has a waiting period. Thankfully, their parents outlived the waiting period, and when they passed away, they were able to get the death benefit payout in full.

TREATMENT IN THE LAST 2 YEARS

You have cancer and have been treated in the last 2 years

Every burial insurance company asks about cancer within a minimum period of two years. If you were diagnosed with cancer in the last two years and still undergoing any type of treatment, you get a better option.

You can now qualify for a first-day benefit plan. You will be covered from the first day and your death benefit will be phased in over time.

Best option: First-day benefit

IN REMISSION FOR 24 MONTHS OR LONGER

If you have finished cancer treatment and been in remission for more than 24 months, you have the best option.

If it’s been more than two years since your last cancer treatment, you can now honestly answer “NO” to the cancer question in the health questionnaire. If this is your case, I can help you get approved for simplified issue burial insurance with a level death benefit.

You will now qualify for a level death benefit. Your insurance policy will start on the first day because it does not have a waiting period. Your life insurance is cheaper compared with guaranteed issue life insurance.

What Types Of Insurance Policies Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

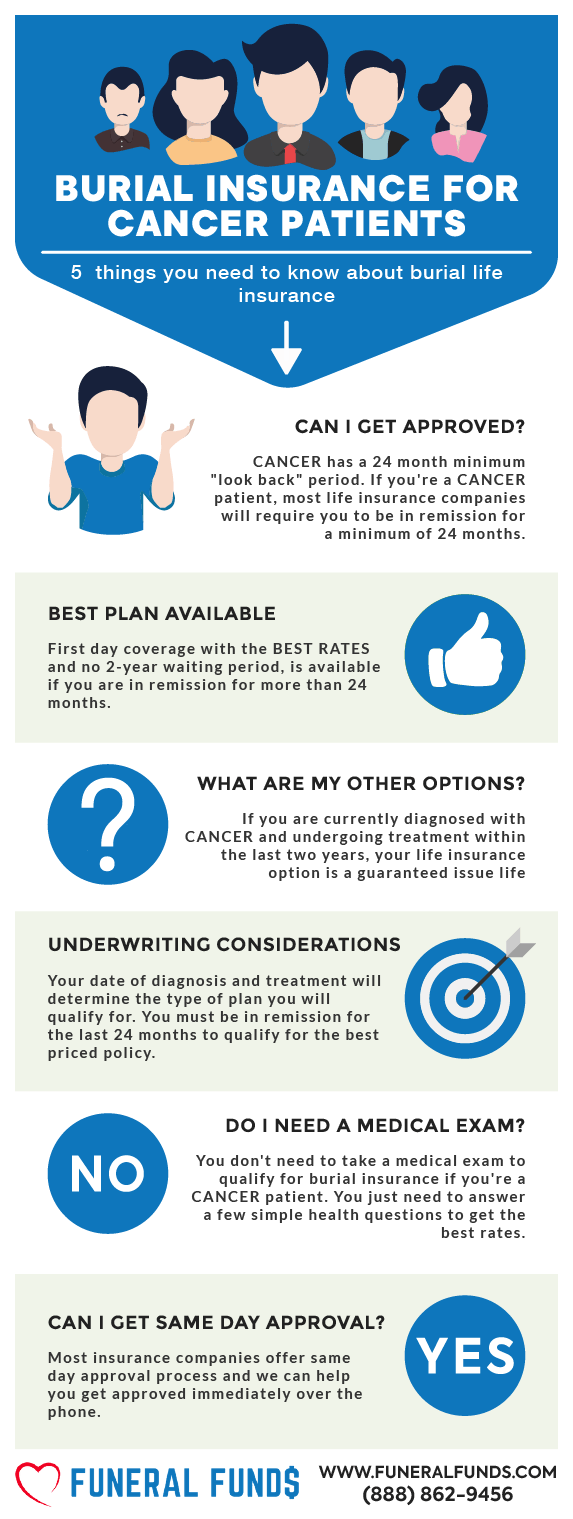

If I Have Cancer, Do I Need A Medical Exam To Qualify For Burial Insurance?

The good news is that whatever type of cancer you have or the treatment you are taking, you don’t have to take a medical exam to qualify for burial insurance with cancer. You don’t need to provide blood, urine samples, or medical records when you apply.

No exam burial insurance will only require you to answer a simple health questionnaire to qualify for coverage.

Burial Insurance And Cancer

Here are the most common types of cancer we help people with:

- Bladder Cancer

- Breast Cancer

- Colorectal Cancer

- Kidney Cancer

- Leukemia

- Lung Cancer –Non-small cell

- Lymphoma – Non-Hodgkin

- Melanoma

- Oral and Oropharyngeal Cancer

- Pancreatic Cancer

- Prostate Cancer

- Thyroid Cancer

- Uterine Cancer

If you have any of these cancer types, burial insurance options are open for you.

What About Basal Or Squamous Skin Cancer?

Two types of cancer are non-life-threatening and will not affect your eligibility.

These two specific types of skin cancer are a non-issue with every burial insurance company:

- Basal Cell Carcinoma

- Squamous Cell Carcinoma

Both are non-life-threatening. 90% of skin cancer patients are diagnosed with these skin cancer types. It’s the reason why these two types of skin cancer are virtually non-issue with life insurance companies. Most insurance companies will specifically mention these skin cancers as an exemption.

You will easily qualify for immediate coverage life insurance if you have basal cell carcinoma or squamous cell carcinoma.

Burial Insurance Underwriting If You Have Cancer

Burial insurance can provide your loved ones with the funds needed to cover your funeral and final expenses needs.

The best way to get the lowest premium in burial insurance is by applying for burial insurance with underwriting. Underwriting in burial insurance means you need to answer some health questions. Burial insurance companies with underwriting offer the best price and immediate coverage.

Cancer is considered a high-risk medical condition; every life insurance company asks about cancer in their health questionnaire.

Life insurance companies offering burial insurance with cancer will let you skip the medical exam as part of underwriting. Instead of a medical exam, the companies will check your:

- Answer to health questions on the application

- Medical history through the Medical Information Bureau

- Medication history through Prescription database

- Driving record through the Department of Motor Vehicle

- Other companies may want to do a phone interview

Your answer to the health questionnaire is the biggest factor in determining your eligibility.

Every life insurance company asks about cancer in the “knockout” section of the health questionnaire. Cancer has a two-year minimum lookback period. Most insurance companies will require you to be in complete remission for a minimum of two years before offering you the best plan.

You will typically see cancer questions asked this way:

- In the previous 24 months, have you ever been diagnosed with any type of cancer?

- In the last two years, have you been diagnosed with cancer or been advised to receive radiation or chemotherapy?

- In the previous 24 months, have you been diagnosed with cancer or been advised to receive surgery?

If you answer “yes” to these knockout questions, you will not qualify for a plan with first-day coverage. You will be offered guaranteed issue burial insurance if you have cancer.

Aside from asking health questions, the insurance companies will also check your current health by looking at your prescription history.

There are many prescription medications used to treat cancer. If you have taken any of these cancer drugs within the last two years, more insurance companies will assume that you are being treated or have had cancer.

Are you taking any of these common medications approved for cancer?

- Bortezomib (Velcade)

- Chlorambucil (Leukeran)

- Cyclophosphamide (Cytoxan, Neosar)

- Gemcitabine (Gemzar)

- Imatinib (Gleevec)

- Irinotecan liposome injection (Onivyde)

- Irinotecan (Camptosar)

- Methotrexate (Rheumatrex, Trexall)

- Oxaliplatin (Eloxatin)

- Tamoxifen (Nolvadex)

- Trastuzumab (Herceptin)

Taking any of these medications within the last 24 months will prove to the insurance companies that you are a cancer patient. They will now classify you as a high-risk applicant.

Cancer has a 24 months minimum lookback period.

Suppose you answer “yes” to any of the questions above. In that case, most insurance companies require you to be in complete remission for a minimum of 2 years before offering you a plan with immediate coverage.

Having any type of cancer in the last two years will only qualify you for no-questions-asked guaranteed issue burial insurance with a two-year waiting period.

How Much Insurance Do I Need If I Have Cancer?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

Here are the steps to calculate your burial insurance needs:

1. The first step to figuring out how much burial insurance coverage to buy is to calculate your funeral cost. Here’s the average cost of funeral and burial expenses from the National Funeral Directors Association to give you an idea of how much it will cost.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

If you want to be cremated when you leave this world, use the table below to have a rough estimate of your cremation costs.

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

Request a general price list from your nearest funeral director to get an accurate price for each service you need.

2. Compute your other final expenses. Include your outstanding debts, credit card debts, medical bills, legal costs, and other past-due accounts on your computation.

3. Don’t forget to include inflation in your final expense computation. The average inflation rate in the US is 2%, which means you lose 2% of your money’s worth due to inflation. The average funeral and burial costs are $10,000. It is wise to buy at least $15,000 coverage to cover inflation.

Adding your final expenses will give you an idea of how much burial insurance to buy if you have cancer.

How Should I Pay My Premiums?

Savings or checking accounts are the best way to pay your premium. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium monthly, and you will not worry about your policy lapsing due to non-payment.

Paying your premium monthly is the best because it is easier on the budget. You can also schedule your payment to coincide with your retirement benefit schedule.

Cancer And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while others can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

When Is The Best Time To Get Burial Insurance For Cancer Patients?

Getting life insurance before a cancer diagnosis is ideal. It would be best if you bought burial insurance NOW when you are younger, and you can lock in the best price. Every year you delay getting burial insurance, your life insurance premium increases.

Should you buy life insurance if you have cancer? You need burial insurance more if you have cancer because you don’t know what will happen in the days to come. You surely don’t want to burden your family with your final expenses, right?

Getting burial insurance for cancer patients is possible and can be done in most cases. You just have to be smart about your application. You need to choose the life insurance company that offers immediate coverage (if your health permits it) at the lowest price.

Please research before buying burial insurance, and it’s always better to work with a qualified insurance agency like Funeral Funds.

How To Get The Best Burial Insurance Rates For Cancer Patients

Getting burial insurance before a cancer diagnosis is ideal. If you’re diagnosed with cancer, undergoing treatment, or in remission, it would be best to get burial insurance NOW when you are younger. You can lock in the best price today and pay the same premium for life.

Your life insurance premium increases every year you delay getting burial insurance with cancer.

Getting burial insurance for cancer patients and survivors is definitely possible. You just have to be smart and work with an independent life insurance agency like Funeral Funds that can point you to the right insurance company that will offer the best rates.

Information We Need If You Have Cancer

When you request a burial insurance quote, we will ask you some health questions to better understand your past and current medical condition.

These are some of the health questions you need to answer:

- What type of cancer do you have?

- When were you diagnosed with cancer?

- What is the grade or stage of your cancer?

- What cancer treatments did you have?

- How long did your cancer treatment last?

- What medications do you take for cancer?

- Are you in remission now?

- How long have you been in remission?

- Have you experienced any relapses?

- Do you have a family history of cancer?

Please answer these questions honestly. Your answers to these cancer questions will help me determine the type of burial insurance plan you will qualify for and how much life insurance companies will charge you.

How Can Funeral Funds Help Me?

You can still qualify for affordable life insurance if you have cancer. If you are a cancer survivor and you’ve been in remission for more than two years, you have the best option.

We work with more than 30 life insurance companies and will shop your case with these companies. we can help you get the best insurance policy by pairing you with the life insurance company that offers the best rates for cancer patients.

If you are looking for cancer burial insurance, cancer funeral insurance, or cancer final expense insurance. Call us at (888) 862-9456 or fill out the quote form on this page to get an accurate quote.

If you have cancer, do not hesitate to call me. We specialize in helping cancer patients qualify for the lowest-priced cancer insurance policy available.

Frequently Asked Questions

Can you get life insurance if you have cancer?

Yes, you can get life insurance if you have cancer. However, the company will likely require you to provide evidence that you are in remission or have been cured. If you have a history of cancer, the company may want to know how long you have been cancer-free.

How does cancer affect life insurance?

Cancer can have a significant impact on life insurance. Recent cancer diagnosis and treatment may limit your chances of qualifying for first-day insurance coverage.

Do you have to tell life insurance if you have cancer?

Yes, you must disclose any cancer history when applying for life insurance. Failure to disclose a cancer diagnosis can result in the policy being voided.

How much will life insurance pay if you die from cancer?

Life insurance policies typically pay out a death benefit if the insured person dies from cancer-related causes. The amount paid out depends on the coverage amount.

Can you get burial insurance if you have cancer?

Yes, you can get burial insurance if you have cancer. Your chances of qualifying for first-day insurance coverage. However, many companies will still offer coverage if you are in remission or have been cured.

Can you get life insurance after getting cancer?

Yes, getting life insurance after getting cancer is possible, but the company will likely require you to provide evidence that you are in remission or have been cured. If you have a history of cancer, the company may want to know how long you have been cancer-free.

Can someone with terminal cancer get life insurance?

Yes, someone with terminal cancer can get life insurance. However, the only plan you will qualify for is a guaranteed issue life insurance that asks no health questions and has a two-year waiting period.

How do you get life insurance after cancer diagnosis?

To get life insurance after a cancer diagnosis, you must provide evidence that you are in remission or have been cured. This can usually be done by providing a letter from your doctor.

What is the best life insurance for cancer patients?

There is no single “best” life insurance for cancer patients. However, policies that do not ask health questions may be the best option for those recently diagnosed with cancer or undergoing treatment. Cancer can have a significant impact on life insurance. Recent cancer diagnosis and treatment may limit your chances of qualifying for first-day insurance coverage.

Can you get life insurance before cancer diagnosis?

Yes, you can get life insurance before a cancer diagnosis. The best time to get a life insurance policy is before a cancer diagnosis because you will easily get the best plan with the lowest pricing.

Can a sick person get life insurance?

Yes, a sick person can get life insurance. However, the company will want to know the type of illness you have and your general health.

Can you get life insurance with terminal cancer?

Yes, you can get life insurance with terminal cancer. The only plan you will qualify for is a guaranteed issue life insurance that asks no health questions and has a two-year waiting period.

How can I get life insurance if I have cancer?

You can get life insurance if you have cancer. However, recent cancer diagnosis and treatment in the last two years may limit your chances of qualifying for a first-day coverage plan.

Is it possible to get cremation insurance with cancer?

Yes, it is possible to get cremation insurance with cancer. Many companies will still offer coverage if you are in remission or have been cured.

What do cancer policies cover?

Cancer policies vary, but typically they will cover expenses related to cancer treatment, including hospital stays, chemotherapy, radiation therapy, life insurance, and may also cover death benefits.

Do I need to tell life insurance about cancer?

Yes, you need to disclose a cancer diagnosis and treatment to the life insurance company because every life insurance company that asks health questions always wants to know if you have cancer. Failure to disclose a cancer diagnosis can result in the policy being voided.

Is cancer considered a pre-existing condition?

Yes, cancer is considered a pre-existing condition. If you have a recent cancer diagnosis and treatment and try to get life insurance, you will likely be denied a first-day coverage plan.

Is it possible to get funeral insurance with cancer?

Yes, it is possible to get funeral insurance with cancer. Many companies will still offer coverage if you are in remission or have been cured.

How long is cancer a pre-existing condition?

Cancer is a pre-existing condition and will typically be considered one for two years after you have completed treatment. If you have a recent cancer diagnosis and treatment, you will likely be denied a first-day coverage plan for life insurance.

Can I get life insurance after my cancer is cured?

Yes, you can get life insurance after your cancer is cured. You may even qualify for first-day coverage and lower premium if you have been cancer and treatment-free for at least two years.

Can cancer patients get insurance after diagnosis?

Yes, cancer patients can get insurance after diagnosis. However, recent cancer diagnosis and treatment may limit your chances of qualifying for a first-day coverage plan.

What is the best life insurance for cancer patients?

The best life insurance for cancer patients with recent diagnosis and treatment is a guaranteed issue life insurance policy with no health questions and a two-year waiting period.

Does final expense cover cancer patients?

Yes, many funeral insurance policies will cover cancer patients. However, you must disclose your diagnosis and treatment to the life insurance company.

Can you get burial insurance with cancer treatment?

Yes, you can get burial insurance with cancer treatment. Many companies will still offer coverage if you are in remission or have been cured.

How does cancer affect burial insurance?

Having cancer will limit your chances of qualifying for a first-day coverage plan. Life insurance companies will require you to be cancer-free for at least two years before qualifying for a first-day coverage plan.

How can I get life insurance if I have cancer?

Insurance application for cancer is the same for people with any pre-existing conditions. You will likely need to disclose your diagnosis and treatment to the life insurance company.

Do I need to tell life insurance about my cancer diagnosis?

Yes, you need to disclose a cancer diagnosis and treatment to the life insurance company because every life insurance company that asks health questions always wants to know if you have cancer. Failure to disclose a cancer diagnosis can result in the policy being voided.

What is a cancer life insurance policy?

A cancer life insurance policy is a life insurance policy that will cover people who have been diagnosed with and are being treated for cancer. This type of life insurance policy typically has a higher premium than other life insurance policies.

Does cancer qualify for critical illness insurance?

Yes, cancer qualifies for critical illness insurance. This insurance policy will pay a lump sum if you are diagnosed with cancer.

What type of policy only covers cancer?

A cancer-only policy is a life insurance policy that will only cover people diagnosed with and being treated for cancer. This type of policy typically has a higher premium than other life insurance policies.

Is there a difference between cancer and critical illness insurance?

No, there is no difference between cancer and critical illness insurance. They are policies that pay out a lump sum if you are diagnosed with cancer.

What cancers does insurance cover?

Insurance companies cover a wide variety of cancers, including but not limited to:

- Breast cancer

- Lung cancer

- Prostate cancer

- Colon cancer

- Ovarian cancer

- Stomach cancer

- Cancer of the pancreas

- Cancer of the liver

- Bladder cancer

- Leukemia

- Lymphoma

- Myeloma

- Brain cancer

- Testicular cancer

6 Comments

Cynthia M. Mosley

A good read, very informative, thank you for sharing. Very useful and helpful, I hope people can get a chance to see this before they get cancer!

Funeral Funds

Cynthia – Yes…waiting until it's too late too long to get this insurance is a huge mistake!

Joe Hoffman

Hi:

My beloved sister, 59, has Stage IV breast cancer with metastses.

I would like to buy first day, guaranteed, burial and funeral coverage.

Can you please recommend my best options for such coverage?

Thank you.

Joe Hoffman

Funeral Funds

Hey Joe – We're sorry to hear of you sisters health issues. Unfortunately, no company will offer 1st-day coverage for someone who has Stage 4 cancer. The only thing she would qualify for is a 2-year waiting period plan…which we rarely recommend.

Aaron Stoffels

Good Day

I am from Beaufort West in the Central Karoo region

My sister in-law is daignose with cancer can I get her a funeral policy

Kind Regards

Aaron

Funeral Funds

I'm sorry to say that once someone as cancer the only plan they will qualify for is one with a 2-year waiting period.