2025 Burial Insurance Over 80

Not to be unkind, but at 80, you’re not a spring chicken anymore. Statistically speaking, 80 years of age, you don’t have many years left in you. We hope you live a long time, but the statistics are not on your side. You should be looking for burial insurance over 80 sooner rather than later!

If you are looking for life insurance for seniors over 80, you are the perfect candidate for a burial policy. Think about it…you know you’re going to die…why not take care of your burial needs now, so others don’t have to take care of what you should have taken care of while you are alive.

At age 80, you understand that every minute and every day is a precious gift. With that in mind, we give you all the details you need to know, so you can make the most informed decision possible and get the lowest final expense coverage premiums.

Burial policies are ideal for folks who don’t want to burden their loved ones with the cost of their funeral and final expenses. These life insurance plans for 80 and over are intended to pay for your funeral cost, cremation cost, and other end-of-life expenses.

They can also be used to pay off any outstanding debts, leave money behind for loved ones, or to make mortgage payments on your home until your loved ones can sell it, so the bank doesn’t get the equity in your home.

This is important …time is not on your side

If you are over age 80, you’ve likely seen many friends and family members pass away. You understand life is a gift, and you must roll with the punches that life delivers you. Your guess is as good as mine as to when you will die. But it’s always good to be prepared.

Life insurance for an 80-year-old male and life insurance for an 80-year-old female is available and affordable for most folks.

Very few life insurance companies will consider coverage for folks over the age of 85 years. So, if you’re in that 80 to 85-year age range, now is the best time to purchase a policy if you haven’t done so already.

If you are looking for life insurance for 86 to 90 years of age, the reality is that your options are extremely limited. Additionally, the few companies that offer this coverage don’t provide it in all states.

| TABLE OF CONTENTS | |

|---|---|

Burial Insurance Over 80

You have to apply for burial insurance for a company to accept you for burial insurance coverage. Just because you are over 80 doesn’t mean you cannot purchase burial and cremation insurance.

Here’s the lowdown on burial insurance for 80-year-olds:

- We are experts at helping folks in their 80s get approved for burial insurance policies.

- Even with health problems, you can get approved for this coverage.

- Once approved, your policy will not expire as long as you keep making the premium payments.

- Once approved, your monthly premium will never increase as you age.

- You can get approved for a policy with no waiting period (never purchase a policy from the television advertisement, magazine advertisement, or letter that shows up in your mailbox).

Here is some info for the older guys!

If you are a male looking for life insurance for over the eighties, you have final expense needs that are approaching quickly; we can help you find the following:

- Funeral insurance for 80-year-old male, or burial insurance for an 80-year-old male

- Funeral insurance for an 81-year-old male, or burial insurance for an 81-year-old male

- Funeral insurance for an 82-year-old male, or burial insurance for an 82-year-old male

- Funeral insurance for an 83-year-old male, or burial insurance for an 83-year-old male

- Funeral insurance for an 84-year-old male, or burial insurance for an 84-year-old male

- Funeral insurance for an 85-year-old male, or burial insurance for an 85-year-old male

Are you get getting the idea that, if you are a male over 80, we can help you?

But what about the ladies?

If you are a female looking for burial insurance over 80, you have final expense needs that are approaching quickly; we can help you find the following:

- Funeral insurance for 80-year-old female, or burial insurance for 80-year-old female

- Funeral insurance for an 81-year-old female, or burial insurance for 81-year-old female

- Funeral insurance for an 82-year-old female, or burial insurance for 82-year-old female

- Funeral insurance for an 83-year-old female, or burial insurance for 83-year-old female

- Funeral insurance for an 84-year-old female, or burial insurance for 84-year-old female

- Funeral insurance for an 85-year-old female, or burial insurance for 85-year-old female

Are you get getting the idea that, if you are a female over 80, we can help you?

Life Insurance For My Elderly Parents

If you’re looking for life insurance for elderly parents over 80 years old or life insurance for grandmother or father, we can also help you. Many adult children shop for the funeral, burial, or cremation policies for parents or loved ones. A large part of what we do at Funeral Funds is to help adult children find burial policies for senior parents.

We understand shopping around for final expense insurance is probably not your cup of tea. We are happy to provide burial policy quotes, so you can ensure your parents get the cheap burial insurance or cheap funeral insurance they require.

We understand our senior parents or grandparents are often on a fixed income and need affordable burial insurance options and affordable funeral insurance policies.

So, the ball is in your court. Do you want to figure out all this insurance stuff on your own, or have a final expense insurance expert or burial policy expert like Funeral Funds do the shopping for you?

Shopping for burial insurance isn’t all it’s cracked up to be, so let us do the shopping for you.

What Is The Average Cost Of Burial Insurance?

Your funeral insurance rates and burial insurance cost will depend on your age, height and weight, your medical records, and prescription history. The best burial insurance policies require no waiting period, so you can get immediate burial insurance coverage.

The cost of a burial is in the $8,000-$10,000 range and will go up yearly with inflation. Purchasing your policy now is your best bet to save loads of money in the future.

What Is The Best Life Insurance Option For 80 And Older?

If you’re a senior 80 and older, you probably have had life insurance coverage in the past. It may have been one of the following:

- An employer-provided life insurance policy (part of a group benefits plan)

- Term life insurance

- Universal life insurance

- Variable life insurance

- And many more

If you are over 80, most of your insurance options have expired or terminated. Most term life insurance coverage ends at age 80. When shopping for life insurance over 80, your best bet is a whole life insurance policy.

While some insurance policies, like indexed universal life, variable life insurance, and survivorship life insurance, are complicated, whole life policies are straightforward.

You die, and the insurance company pays.

Additionally, these policies are hands-down favorites for senior life insurance needs, as the underwriting is simple. The policies are simple and have no fine print to be nervous about! They also won’t expire as you get older.

Some advantages of whole life funeral policies and whole life final expense policies are:

- Easy underwriting eligibility

- No medical or doctor visits necessary to apply for coverage

- Monthly premiums that don’t increase as you age

- No maximum age of death or expiration date at any age

- Guaranteed benefit payment upon death that does not decrease as you age

These final expense policies make it easy for seniors to knock it out of the park and get the best rates and coverage they need at their current age and health.

What’s The Best Thing About Burial Insurance Over 80?

Insurance companies are fully aware that, as we age, we develop health problems. The reality is you may not be fit as a fiddle. The insurance companies have designed these final expense policies for seniors with that in mind.

It can be hard for some to swallow if they have been denied life insurance. The flexible underwriting criteria of these policies mean you can have many health issues and still qualify for the best rates; these burial policies are not like any other life insurance you may have purchased in the past.

You can have serious medical problems and still get approved for senior life insurance over 80 with no medical exam. How do they do that? Insurance companies simply state that, after a certain amount of time, it’s as if you’re health problem never occurred (from an underwriting perspective).

If you have recovered from a heart attack and it’s been more than two years, you can qualify for the best burial policy rates!

Past medical problems? No Problem! How cool is that?

There are many other medical problems the insurance companies simply don’t care about if more than 12 to 36 months have passed.

We help people find affordable premiums daily, with full coverage and no waiting period, even if they have had health problems in the past. So, just because you’re over 80 doesn’t mean you can’t qualify for an excellent burial policy! Life insurance over 80, no medical exam is available for you.

At what age can you no longer buy burial insurance?

What Kind Of Burial Policies Should I Avoid?

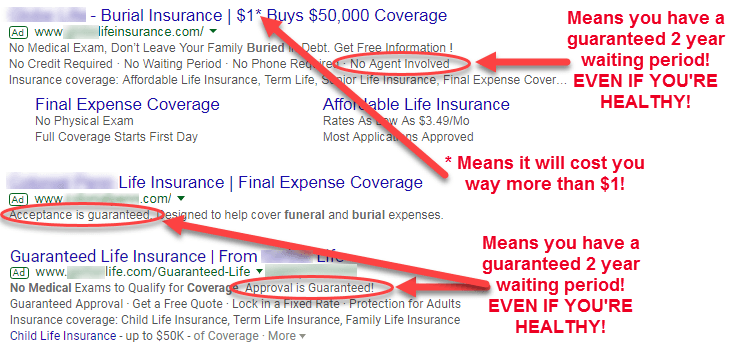

TV AND MAGAZINE ADVERTISEMENTS – Most burial policies or final expense policies you see advertised on television or in magazines are sold as “the no-brainer way” to shop for this protection.

In reality, most of these policies rely on you having NO BRAIN to purchase them.

Everyone is eligible for immediate coverage and better pricing allowed by these heavily advertised policies that cost an arm and leg.

To make a long story short, it is better to shop with a specialist in burial insurance, like FuneralFunds.com, than to sign up with a company that spends ba-zillions of dollars each month advertising on television and in magazines.

INCREASING PRICE POLICIES – Those TV and magazine final expense policies may increase in price every five years or have a two-year waiting period before your benefits kick in! What in tarnation!?!

These policies aren’t all they’re cracked up to be, and you often end up at the short end of the stick by purchasing burial insurance this way.

These tricky television magazine snake oil salesmen lure you in with an attractive rate, only to have the cost of your insurance increase every five years until you cannot afford the premiums, and then you must cancel your policy.

What happens after you cancel the policy? You’ll die and have wasted all that money because you bought a policy that increases in price as you get older. These policies just don’t cut the mustard for most folks!

Avoid policies that increase in price yearly or end at a certain age. You don’t want your family to get hung out to dry when they need this coverage the most.

Seen any misleading internet advertisements?

Yeah, the old “bait and switch” is still alive and well in America….buyer beware!

Why choose Funeral Funds for my burial policy?

Most life insurance agents are fine, respectable people. There are, however, the classic “snake oil” life insurance agents who will sell you the easiest and most expensive policy possible. The guaranteed issue folks claim you don’t even need to talk to an agent (but you will need to wait two years for your coverage to begin…even if you’re healthy). Answering a few health questions will often get you immediate coverage and MUCH better rates.

Avoid these people at all costs!

The rest of the life insurance agents, who are fine, respectable people, are most often generalists. They deal with all kinds of life insurance policies. They are Jack of all trades and Masters of none. They are nice people but are not the logical choice if you want the best pricing and policy.

We work with 20+ final expense companies, so we can get you qualified for the best price plan with the intent of getting folks like you immediate coverage when possible.

For the average burial insurance final expense insurance shopper, we must admit that all the companies and options will often leave you more confused than a woodpecker in a concrete forest.

How Can Funeral Funds Help Me?

Most insurance agents don’t cut the mustard when getting you the most affordable coverage. Affordable burial insurance doesn’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

The reality is that most inexperienced and less knowledgeable insurance agents just don’t cut the mustard and will cost you loads of money by selling you more expensive policies.

It is always in your best interest to work with an independent brokerage like Funeral Funds. With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Frequently Asked Questions

Can seniors over 80 get life insurance?

Yes, seniors over 80 can get life insurance. Most seniors over 80 may still qualify for burial insurance which covers funeral, burial, and final expenses.

Can you get life insurance if you are over 80 years old?

Yes, you can get life insurance if you are over 80. However, the premiums will be higher than for someone younger. Most life insurance companies will not issue a policy to someone over 85 years old.

What is burial insurance for seniors over 80?

Burial insurance for seniors over 80 is a policy that covers the cost of a funeral, burial, and final expenses. The premiums are usually lower than other types of life insurance, and most companies will issue policies to people over 80 years old.

Can seniors over 80 get no medical exam insurance?

Some seniors over 80 may be able to get no medical exam insurance. This type of policy does not require a medical exam, but the premiums will be higher than for a policy that does require a medical exam.

What are the pros and cons of life insurance for seniors over 80?

The pros of life insurance for seniors over 80 are that it can provide peace of mind and financial security for the policyholder and their loved ones. The cons are that premiums may be higher than for someone younger, and some companies will not issue policies to people over 85 years old.

What is the maximum age to apply for burial insurance?

The maximum age to apply for burial insurance is usually 85 years old. However, some companies will issue policies to people over 90 years old.

Is it harder to get life insurance if you are over 80?

It may be harder to get life insurance if you are over 80, but it is not impossible.

What is the average cost of life insurance for an 80 year old?

The average cost of life insurance for an 80-year-old is about $1,000 per year. However, this amount may vary depending on the policyholder’s age, health, and lifestyle.

Is there a limit to how much life insurance an 80 year old can get?

Most 80 years old can get up to $20,000 in whole life insurance coverage.

What is the best type of life insurance for an 80 year old?

The best life insurance for an 80-year-old is a policy that does not require a medical exam. This type of policy is usually more expensive than other types of life insurance, but it can be easier to qualify for.

Can I get burial insurance for my 81 year old mother?

Yes, you can get burial insurance for your 81-year-old mother. Most companies will issue policies to people who are over 80 years old.

Can I get life insurance if I am over 81 years old?

Yes, you can get life insurance if you are over 81. However, the premiums will be higher than for someone younger.

What happens to burial insurance after age 85?

After age 85, most life insurance companies will not issue policies (but existing policies will last until age 121 years old.

What is the best way to get life insurance if you are over 80?

The best way to get life insurance if you are over 80 is to contact a life insurance agent at Funeral Funds. They can help you find a policy that meets your needs and is affordable.

How does burial insurance for seniors work?

Burial insurance for seniors works by providing a policyholder with a death benefit that can be used to cover the cost of a funeral, burial, and final expenses. The premiums are usually lower than other types of life insurance, and most companies will issue policies to people over 80 years old.

Can you get burial insurance for a 90 year old?

Yes, some companies will issue burial insurance for an 89-year-old. However, the premiums will be higher than for a younger person.

Can you get a first-day coverage plan if you are over 80?

Yes, you can get a first-day coverage plan if you are over 80. This type of policy does not require a medical exam, but the premiums will be higher than for a policy that does require a medical exam.

What are the pros and cons of no medical exam life insurance for seniors over 80?

The pros of no medical exam life insurance for seniors over 80 are that it is easy to apply for, and no medical exam is required. The cons are that premiums are usually higher than for a policy that does require a medical exam, and the coverage may be limited.

What is the maximum age to purchase life insurance?

The maximum age to purchase life insurance is typically 85 years old. However, some companies will issue policies to people over 90 years old.

How does burial insurance over 80 works?

Most burial insurance policies are whole life insurance policies. This means that the policyholder will have a death benefit paid out when they die. The premiums are usually lower than other types of life insurance, and most companies will issue policies to people over 80 years old.

What is the best way to get burial insurance over 80?

The best way to get burial insurance over 80 is to contact a life insurance agent. They can help you find a policy that meets your needs and is affordable.

What is the best burial insurance for seniors over 80?

The best burial insurance for seniors over 80 is a policy that does not require a medical exam. This type of policy is usually more expensive than other types of life insurance, but it can be easier to qualify for.

Can I get burial insurance on my 82 year old father?

Yes, you can get burial insurance for your 82-year-old father. Most companies will issue policies to people who are over 80 years old.

Can I get life insurance if I am over 83 years old?

Yes, you can get life insurance if you are over 83. However, the premiums will be higher than for someone younger.

How much is burial insurance for 89 year old?

Burial insurance for 89-year-olds will depend on their gender, coverage amount, and location.

What is the best burial insurance for seniors over 80?

The best burial insurance for seniors over 80 is a policy that does not require a medical exam. This type of policy is usually more expensive than other types of life insurance, but it can be easier to qualify for.

Do I qualify for burial insurance at 85 years old?

Yes, you may qualify for burial insurance at 85 years old. Most companies will issue policies to people who are over 80 years old.

Can I buy burial insurance for my 89 year old grandfather?

Yes, you can buy burial insurance for your 89-year-old grandfather. Most companies will issue policies to people who are over 80 years old.

What is the average price for a burial insurance policy?

The average price for a burial insurance policy will vary depending on the coverage amount and the company.

Can I get burial insurance on my parents?

Yes, you can get burial insurance on your parents. You will need to provide consent and show insurable interest. Most companies will issue policies to people who are over 80 years old.

What is the best way to find a burial insurance policy?

The best way to find a burial insurance policy is to contact a life insurance agent. They can help you find a policy that meets your needs and is affordable.

Is burial insurance for seniors right for me?

Burial insurance for seniors is a policy that provides a death benefit. This type of policy is usually a whole life insurance policy, and the premiums are usually lower than other types of life insurance. Most companies will issue policies to people who are over 80 years old.

At what age does burial insurance expire?

Burial insurance is designed to last up to age 121.

What happens to the face amount of burial insurance if the insured reaches 100?

If the insured reaches 100, the face amount of the policy will not change, and the death benefit will still be paid out when the insured dies.

What is a rider on a burial insurance policy for an 80-year-old?

A rider is an addition to a life insurance policy that provides additional coverage. For example, a rider might provide death benefits for accidental death or death from cancer.

What should I look for when buying a burial insurance policy?

When buying a burial insurance policy, you should look for a policy that has a low premium, offers a death benefit, and does not require a medical exam. You should also check to ensure the company is licensed in your state.

How much does burial insurance cost for a 80 year old?

Burial insurance for an 80-year-old depends on what you qualify for and how much coverage you need.

6 Comments

Luisa Hidalgo

I am searching for my 90 year old mom.

Funeral Funds

Hi Luisa – There are no insurance or burial insurance plans out there for people aged 90 and older, so we would advise you to look into other means to pay for your mom's final expense needs.

j

My parent will be 90 in a few mos and I need burial insurance for when that time comes. I dunt have any way to pay for a burial at all. We are in AZ. Are there any availability or options for us?

Funeral Funds

https://funeralfunds.com/free-quote/

Charles Smith

Looking for burial coverage for 81yr old male.

Funeral Funds

https://funeralfunds.com/free-quote/