2024 Burial Insurance with Parkinson’s Disease

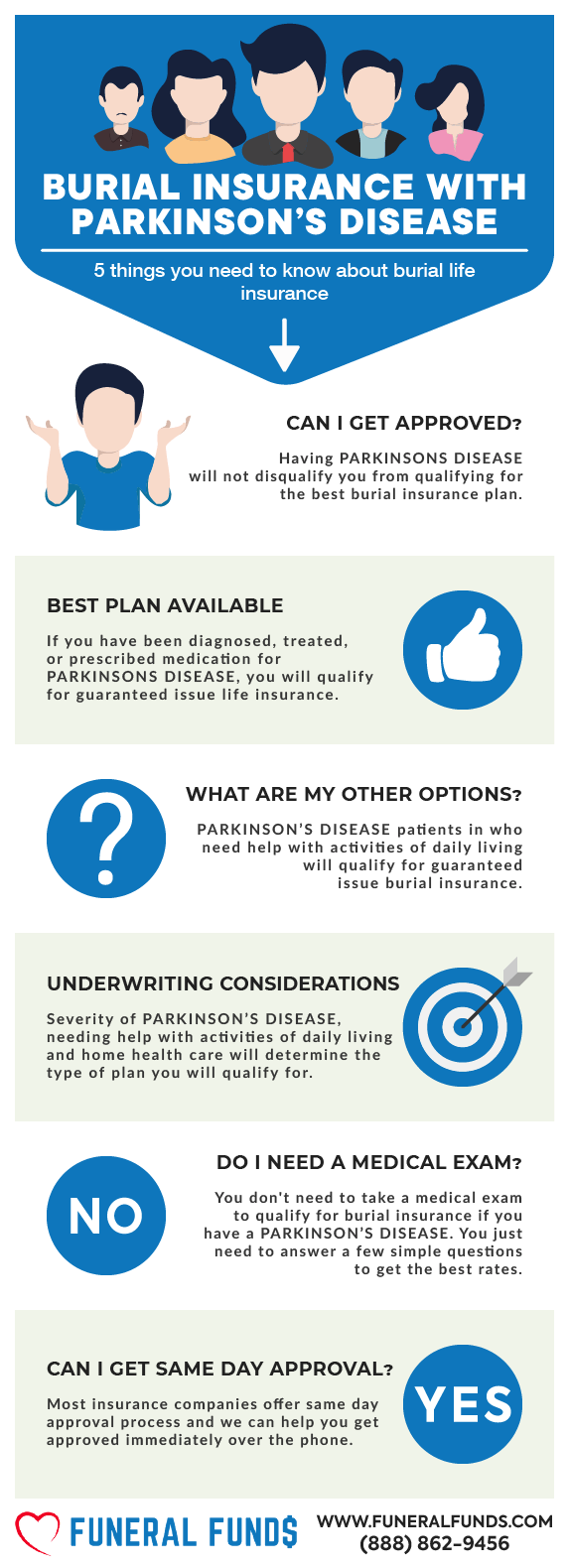

Getting affordable burial insurance with Parkinson’s disease or any other pre-existing condition generally depends on the severity of your condition and how well you manage it.

Whatever stage you are in with your Parkinson’s disease, affordable options are open for you.

This article will explore how insurance companies underwrite people with Parkinson’s disease and how to get the best burial insurance plan with Parkinson’s at the lowest pricing.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Parkinson’s Disease?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Parkinson’s Disease, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Parkinson’s Disease

- How Much Insurance Do I Need If I Have Parkinson’s Disease?

- How Should I Pay My Premiums?

- Parkinson’s Disease and Burial Insurance Riders

- Information We Need if You Have Parkinson’s Disease

- What If I Have Been Declined for Life Insurance?

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Parkinson’s Disease

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Parkinson’s Disease

What Is My Best Insurance Option If I Have A History Of Parkinson’s Disease?

While it is entirely possible to get burial insurance for Parkinson’s patients, the type of policies available for patients depends on the severity of the disease.

PARKINSON’S DISEASE STAGE 1 & 2

In the early stages of the disease, stage 1 (unilateral involvement) and stage 2 (bilateral involvement but normal stance), you can qualify for a level death benefit plan if you do not have any other medical conditions that may prevent you from qualifying.

You are instantly covered from day one. Your beneficiaries will get the full death benefit when you pass away.

If you’re just recently diagnosed with Parkinson’s disease, do not delay. Apply now while you are still independent and do not need help with activities of daily living.

Best Option: Level death benefit plan with first-day coverage

PARKINSON’S DISEASE STAGE 3

Parkinson’s patients in Stage 3 (with bilateral involvement with mild postural imbalance but able to lead an independent life), but their symptoms impair activities such as needing help taking medicines or dressing; your best option for coverage is a first-day benefit plan.

You will be covered from the first day, and your death benefit will be phased in over time.

Best Option: First-day coverage plan

PARKINSON’S DISEASE STAGE 4 & 5

Parkinson’s patients in Stage 4 (with bilateral involvement with postural instability, requires help with activities of daily living) and Stage 5 (severe condition, restricted to bed or wheelchair) are considered in the most advanced and debilitating stage of the disease.

If this is your condition, you will only qualify for guaranteed issue burial insurance. It is the final type of burial insurance for Parkinson’s patients in the advanced stage.

This type of policy does not require a medical exam or asking any health questions. All guaranteed issue life insurance offers a premium return plus interest of 8-10% in the first two years. If you pass away from a natural cause during the first two years of the policy, your beneficiary will get all the premiums you paid in, plus 8-10% interest.

Best Option: Guaranteed issue burial insurance

ASSISTANCE WITH ACTIVITIES OF DAILY LIVING

Insurance companies define assistance with activities of daily living (ADL) as needing help with the following:

- Eating

- Bathing

- Dressing

- Toileting

- Transferring

- Continence

Every life insurance company will ask if you need help with ADLs. If you are in the late stage of Parkinson’s disease, you will definitely need help performing daily activities because your condition worsens.

Most burial insurance companies decline anyone needing help with daily living activities for a first-day coverage plan.

Needing help with ADLs will only qualify you for guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

HOME HEALTH CARE

Every burial insurance company will ask about home health care, just like with activities of daily living. There is only one carrier that does not care about home health care.

If you can’t qualify with them because of other medical conditions, your best option is to take a guaranteed issue policy.

Most people with Parkinson’s disease require permanent home health care during the late stage. If this is your situation, it would be best to implement a guaranteed issue policy.

Best Option: Guaranteed issue burial insurance

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Parkinson’s Disease, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with Parkinson’s disease.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Parkinson’s Disease

“Underwriting” is the insurance company’s way of researching your level of risk.

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

HEALTH QUESTIONS:

Every final expense companies with underwriting ask about Parkinson’s disease differently, and sometimes you won’t see the words “Parkinson’s disease” in the health questions.

You will typically see Parkinson’s disease asked this way:

- Within the past 24 months, have you been medically diagnosed or treated for any neuromuscular disease, Parkinson’s disease, cerebral palsy, or multiple sclerosis?

- During the past 24 months, has the Proposed Insured been diagnosed by a physician as having or been treated for: neuromuscular disease (including Multiple Sclerosis, Lou Gehrig’s Disease, Epilepsy, and Parkinson’s Disease)?

- Have you ever been diagnosed with, received, or been advised to receive treatment or medication for Parkinson’s disease or Systemic Lupus?

If you are diagnosed with Parkinson’s disease and receiving treatment, you must answer yes to Parkinson’s disease questions.

PRESCRIPTION HISTORY CHECK:

Burial insurance companies will also electronically review your prescription history to check if you are being treated for any illnesses.

Here are the common medications flagged for Parkinson’s disease:

- Amantadine

- Apomorphine

- Benztropine

- Carbidopa

- Entacapone

- Levodopa

- Lodosyn

- Pramipexole

- Rasagiline

- Ropinirole

- Rotigotine

- Safinamide

- Selegiline

- Sinemet

- Symmetrel

- Tolcapone

- Trihexyphenidyl

The presence of these drugs on your script check or prescription history will make the insurance companies treat you as having treatment for Parkinson’s disease (even if you answered no to the Parkinson’s health question).

The appearance of these drugs on your prescription history clearly indicates that you are being treated for Parkinson’s disease.

How Much Insurance Do I Need If I Have Parkinson’s Disease?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Parkinson’s Disease And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Parkinson’s Disease

When applying for burial insurance coverage with Parkinson’s disease, you must provide as much information as possible. Not only will the information help us understand your health better but it will also help us provide you with an accurate quote.

We will ask you a series of health questions to better understand your overall health.

These questions include:

- When were you initially diagnosed with Parkinson’s disease?

- How do you treat your Parkinson’s disease?

- What prescription medication do you take for your condition?

- Do you live independently?

- Do you need assistance performing daily living activities such as eating, bathing, dressing, toileting, transferring, and continence?

- Do you have other health conditions other than Parkinson’s disease?

It is essential to be completely honest when you answer these questions. The more information you give us, the better we can match you with the right company.

What If I Have Been Declined For Life Insurance?

Many people with Parkinson’s disease that come to us have been declined at least once.

If your application has been declined in the past, don’t think that you can’t get an affordable life insurance plan through a different company. One of the biggest mistakes you can make is avoiding getting covered because of your medical condition.

The truth is if you or your agent did not choose the right company, you would be declined. That is why working with an independent insurance agency that knows the ins and outs of life insurance is critical.

This is also why working with an independent agency like Funeral Funds will always get you the best rates.

If you cannot qualify for a plan with immediate coverage, we will help you find the best life insurance company.

Funeral Funds specializes in helping people that are placed in the higher risk category. So, whether you have Parkinson’s disease or any other high-risk life insurance, we work with the best carriers that offer the best rates.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance With Parkinson’s Disease

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with Parkinson’s disease

- Cremation insurance plan with Parkinson’s disease

- Funeral home insurance plan with Parkinson’s disease

- Final Expense insurance plan with Parkinson’s disease

- Prepaid funeral plan insurance with Parkinson’s disease

- Mortgage payment protection plan with Parkinson’s disease

- Mortgage payoff life insurance plan with Parkinson’s disease

- Deceased spouse’s income replacement plan with Parkinson’s disease

- Legacy insurance gift plan to family or loved ones with Parkinson’s disease

- Medical or doctor bill life insurance plan with Parkinson’s disease

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy with Parkinson’s disease needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for Parkinson’s disease funeral insurance, burial insurance with Parkinson’s disease, or Parkinson’s disease life insurance, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Parkinson’s Disease

Can a person with Parkinson’s disease get burial insurance?

Yes, a person with Parkinson’s disease can get burial insurance. However, the insurance company may limit plans to those in the early stages of Parkinson’s disease who do not require help performing activities of daily living.

Do I need to take a medical exam if I have Parkinson’s disease?

No, you do not need to take a medical exam if you have Parkinson’s disease. However, you may need to provide information about your medical history and diagnosis to the insurance company.

Is there an age limit for burial insurance with Parkinson’s disease?

Most insurance companies offer coverage to people 18-85 years old.

Can Parkinson’s disease be considered a critical illness in life insurance?

No, Parkinson’s disease is not considered a critical illness in life insurance. However, some insurance companies may offer policies that include coverage for critical illnesses.

What are the premiums for burial insurance with Parkinson’s disease?

The premiums for burial insurance with Parkinson’s disease vary depending on the age and health of the policyholder, as well as the type of policy.

Is Parkinson’s considered a terminal illness?

No, Parkinson’s is not considered a terminal illness. However, a person with Parkinson’s disease may eventually die.

Is Parkinson’s disease a pre-existing condition for life insurance?

Yes, Parkinson’s disease may be considered a pre-existing condition for life insurance. However, the insurance company may offer coverage if the policyholder has been stable.

Do I need to tell insurance about Parkinson’s disease?

Yes, you should tell the insurance company about your Parkinson’s disease. This will help them to decide if they can offer you coverage and at what price.

Can I get life insurance after Parkinson’s disease?

Yes, you may be able to get life insurance after Parkinson’s disease. You may even qualify for a first-day coverage plan if you are in the early stage of Parkinson’s disease and do not need help in performing activities of daily living.

Can you get first-day coverage insurance if you have Parkinson’s disease?

Yes, you may be able to get first-day coverage insurance if you have Parkinson’s disease. However, the insurance company may only offer this plan to those in the early stages of Parkinson’s disease who do not require help performing daily activities.

What are the things that may affect my eligibility if I have Parkinson’s disease?

The things that may affect your eligibility if you have Parkinson’s disease include the type of policy you are applying for, the age and health of the policyholder, and the severity of the Parkinson’s disease.

What is the life expectancy after Parkinson’s diagnosis?

The life expectancy after a Parkinson’s diagnosis varies depending on the severity of the disease. However, most people with Parkinson’s live for an average of 7-10 years after diagnosis.

Which insurance is best for patients with Parkinson’s disease?

A first-day coverage plan is the best option for people with Parkinson’s disease. However, those with movement impairments who need help with activities of daily living will only qualify for a guaranteed issue life insurance with a two-year waiting period.

Is Parkinson’s disease a disability?

Yes, the Social Security Administration considers Parkinson’s Disease a disability (SSA) According to the SSA’s Blue Book, the list of disorders can qualify for disability payments. Parkinson’s Disease is listed in section 11.06 of the SSA’s Blue Book.

What disability category is Parkinson’s disease?

Parkinson’s Disease is a neurological disorder that falls under the category of “movement disorders.” This category includes conditions affecting movements, such as Parkinson’s, Huntington’s, and cerebral palsy.

Can I qualify for cremation insurance with a history of Parkinson’s disease?

Yes, you may be able to qualify for cremation insurance with a history of Parkinson’s disease. However, the insurance company will likely require you to answer a series of questions about your health and the history of your disease in order to determine if you are eligible for coverage.

What is my best insurance option if I have Parkinson’s disease?

If you have Parkinson’s disease, your best insurance option is a first-day coverage plan. This policy does not require a medical exam and will offer coverage immediately after purchase. However, those who have movement impairments and need help with activities of daily living may only qualify for guaranteed issue life insurance with a two-year waiting period.

Is Parkinson’s disease fatal in life insurance?

No, Parkinson’s disease is not a fatal illness in life insurance. However, the life expectancy after a diagnosis of Parkinson’s disease varies depending on the severity of the disease. Most people with Parkinson’s live for an average of 7-10 years after diagnosis.

Can you be denied insurance for Parkinson’s disease?

Yes, you can be denied insurance for Parkinson’s disease. Most insurance companies offering first-day coverage plans will deny your application if you need help performing daily living activities.

What should I do if I am denied insurance for Parkinson’s disease?

If you are denied insurance for Parkinson’s disease, you may want to consider applying for a guaranteed issue life insurance policy. This type of policy does not require a medical exam and will offer coverage immediately after purchase. However, those with movement impairments who need help with activities of daily living may only qualify for a guaranteed life insurance plan.

Is there a waiting period for life insurance with Parkinson’s disease?

Yes, there is usually a waiting period for life insurance if you have Parkinson’s disease. The waiting period will depend on the type of policy you are applying for and the severity of your disease. However, most insurers will require you to wait at least two years before coverage begins.

Can Parkinson’s disease affect your life insurance rates?

Yes, Parkinson’s disease can affect your life insurance rates. The severity of the disease and your age are two factors that insurance companies will consider when determining your rates. However, most people with Parkinson’s will not see a significant increase in their rates.

Do I have to disclose my Parkinson’s disease history on an insurance application?

Yes, you will need to disclose your Parkinson’s disease history on an insurance application. Most insurers will require you to answer a series of questions about your health and your disease history to determine if you are eligible for coverage.

Can Parkinson’s disease medication affect my premium?

Yes, some Parkinson’s disease medications can affect your life insurance premiums. The medication you are taking and the dosage will be considered when determining your rates. However, most people with Parkinson’s will not see a significant increase in their rates.

What is the average cost of life insurance for someone with Parkinson’s disease?

The average cost of life insurance for someone with Parkinson’s disease will vary depending on the type of policy you are purchasing. However, most people with this condition will pay more for life insurance than those without it.

Can Parkinson’s disease patients get final expense insurance?

Yes, Parkinson’s disease patients can get final expense insurance. This type of policy is designed to provide coverage for your funeral expenses and other related costs. Most insurers will not require a medical exam to qualify for this policy.

Is Parkinson’s covered by a critical illness rider?

Yes, Parkinson’s disease is often covered by a critical illness rider. This type of policy provides coverage if you are diagnosed with a critical illness. Most insurers will not require a medical exam to qualify for this policy.

Can Parkinson’s disease affect life insurance?

Yes, Parkinson’s disease can affect life insurance. The severity of the disease and your age are two factors that insurance companies will consider when determining your rates.

Can you be rejected for life insurance because of Parkinson’s disease?

Yes, you can be rejected for life insurance because of Parkinson’s disease. Most insurance companies offering first-day coverage plans will deny your application if you need help performing daily living activities.

How can you get the best life insurance rates with Parkinson’s disease?

The best way to get the best life insurance rates with Parkinson’s disease is to work with an independent life insurance agent who can shop around for quotes from multiple insurers and recommend the best plan based on your needs.

What is the best insurance option for people with Parkinson’s disease?

The best insurance option for people with Parkinson’s disease will vary depending on the severity of their condition.

What are the best life insurance companies for Parkinson’s disease?

Working with an independent life insurance agent who can recommend the best life insurance company for you based on your needs and budget is important.

What are some tips for getting life insurance with Parkinson’s disease?

Some tips for getting life insurance with Parkinson’s disease include working with an independent agent, disclosing your condition to insurers, and buying life insurance while you are in the early stage of your disease and do not help in performing activities of daily living.