2024 Burial Insurance with Sickle Cell Anemia and Sickle Cell Trait

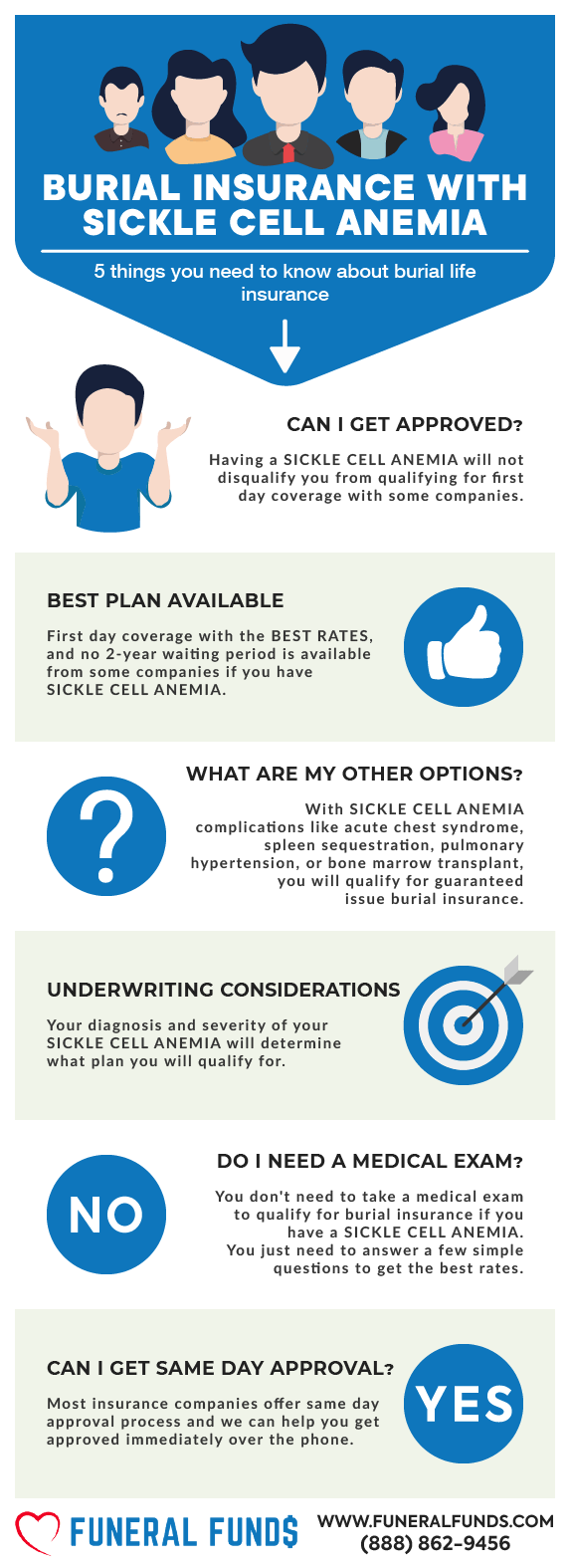

Purchasing burial insurance with sickle cell anemia is something we help people with, and if you have sickle cell disease and have no complications, you will easily qualify.

Even if you have complications, there are different insurance options for you.

In this article, we will tell you the best way to qualify for burial insurance with sickle cell anemia and sickle cell anemia complications. Read on, and learn how you can find the best policy with the best rates.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Sickle Cell Anemia?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Sickle Cell Anemia, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Sickle Cell Anemia

- How Much Insurance Do I Need If I Have Sickle Cell Anemia?

- How Should I Pay My Premiums?

- Sickle Cell Anemia and Burial Insurance Riders

- Information We Need if You Have Sickle Cell Anemia

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Sickle Cell Anemia

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Sickle Cell Anemia And Sickle Cell Trait

What Is My Best Insurance Option If I Have A History Of Sickle Cell Anemia?

SICKLE CELL ANEMIA WITH NO COMPLICATIONS

You can qualify for a level death benefit plan with first-day coverage if you have sickle cell anemia and have no major health complications from the disease.

You will have full coverage from the first day and pay the lowest rate if you do not have this health condition!

Best Option: Level death benefit plan with first-day coverage

POLICY OPTIONS IF YOU HAVE SICKLE CELL ANEMIA COMPLICATIONS

Sickle cell anemia patients may experience different complications because of their condition. Some of the complications may impact your eligibility, while others may not.

Here are some complications that may impact your eligibility:

BURIAL INSURANCE WITH HAND-FOOT SYNDROME

Swelling of the hands and feet is usually the first sign of sickle cell anemia. The swelling will appear with fever because the sickle cells get stuck in the blood vessels, and they block the blood flow in that area.

Hand-foot syndrome is a non-issue with every burial insurance company, and you will still qualify for a level death benefit plan with first-day coverage.

Best Option: Level death benefit plan with first-day coverage

BURIAL INSURANCE WITH ANEMIA

Mild to Moderate Anemia

Anemia is also a very common complication of sickle cell disease. The red blood cells die early when you have this condition, and there are not enough red blood cells to carry oxygen to the body. If you have mild to moderate anemia you will qualify for a level death benefit plan.

Best Option: Level death benefit plan with first-day coverage

Severe Anemia

Worsening of anemia can cause enlargement of the spleen that requires multiple blood transfusions. If your anemia is severe, you may need to buy guaranteed issue life insurance.

Guaranteed issue policies have a slightly higher monthly premium compared with a plan with underwriting. It also comes with a two-year waiting period. If you pass during the waiting period, your beneficiary will receive the refund of your premiums plus interest which is usually 10%.

Best Option: Guaranteed issue burial insurance

BURIAL INSURANCE WITH STROKES

A full-blown stroke can cause learning problems and lifelong disabilities. A stroke may affect life insurance eligibility depending on the time you had it.

If your stroke was over two years, you will qualify for the level death benefit to most burial insurance companies. We encourage you to read our full article on burial insurance with stroke.

If your stroke was over 2 years ago

Best Option: Level death benefit plan with first-day coverage

Stroke within the last 12 months

If your stroke is very recent or within the last 12 months guaranteed, life insurance may be your only option.

Best Option: Guaranteed issue burial insurance

BURIAL INSURANCE WITH ACUTE CHEST SYNDROME

Acute chest syndrome is a life-threatening condition that must be treated in a hospital.

The signs and symptoms are similar to pneumonia. Symptoms include fever, coughing, chest pain, and difficulty breathing. This sickle cell anemia complication could impact your life insurance option.

Having fever and difficulty breathing is a non-issue to life insurance. However, if you have chest pains or angina, it is an entirely different matter.

Chest Pain or treatment in the last 2 years

Every life insurance companies ask about chest pain or angina in their health questions. If you had chest pain or angina and you’ve been treated within the last 24 months, you can qualify for a level death benefit plan with first-day benefits.

You can read our article about burial insurance with angina. You will learn in detail about life insurance options if you have chest pain.

Best Option: Level death benefit plan with first-day benefits

BURIAL INSURANCE WITH SPLEEN SEQUESTRATION

Spleen sequestration is a non-issue with most life insurance companies, and you can still qualify for a level death benefit. But, if the spleen becomes severe and needs a blood transfusion, you may need to take a guaranteed issue life insurance.

Best Option: Level death benefit plan with first-day coverage

BURIAL INSURANCE WITH ORGAN DAMAGE

Lack of oxygen-rich blood due to sickle cell anemia can cause great harm to organs such as your kidneys and liver.

Kidney and liver organ damage can affect your life insurance eligibility. Severe organ damage can cause a decline in traditional life insurance, and your only option is guaranteed issue life insurance.

Best Option: Guaranteed issue burial insurance

BURIAL INSURANCE WITH PAIN EPISODES

The most common complication of SCD is pain, which is the main reason why SCD patients are hospitalized. When sickle cells travel and get stuck to the small blood vessels, it causes pain that can start suddenly. It can be mild to severe and last for an indefinite period.

Your life insurance eligibility will be affected if you are hospitalized for sickle cell anemia. Some burial insurance companies asked if you’ve been hospitalized in the last six months or one year.

If you’ve been hospitalized because of sickle cell anemia your only option for coverage is to take a guaranteed issue life insurance.

Best Option: Guaranteed issue burial insurance

BURIAL INSURANCE WITH PULMONARY HYPERTENSION

Hypertension is one of the most common complications of sickle cell anemia. Hypertension is common for most adult patients.

Thankfully, hypertension is not an issue to most burial insurance companies, and you could still qualify for a level death benefit.

Best Option: Level death benefit plan with first-day coverage

BURIAL INSURANCE WITH VISION LOSS

Blindness can occur when the blood vessels in the eye are blocked with sickle cells, and the retina is damaged.

Some patients may develop extra blood vessels in the eyes because of the lack of oxygen. Blindness is not an issue with burial insurance, but needing help with the activities of daily living may cause a decline. Your only option for insurance coverage is to take a guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

BURIAL INSURANCE WITH BONE MARROW TRANSPLANT

Every life insurance company asks about a bone marrow transplant in their health questions. You cannot qualify for a plan with immediate coverage if you had or have been advised to have a bone marrow transplant. Your only option for coverage is a guaranteed issue life insurance.

Best Option: Guaranteed issue burial insurance

If you suffered severe complications due to sickle cell anemia and you are unhealthy, it may be hard for you to qualify for a plan with immediate coverage. Complications and hospitalization will often disqualify you for a level death benefit. Insurance carriers typically impose a waiting period after hospitalizations.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Sickle Cell Anemia, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with sickle cell anemia.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Sickle Cell Anemia

Burial insurance companies with underwriting will do two things to determine if you will medically qualify for coverage.

- They will ask health-related questions in the application

- They will check your prescription history

They will need this information to determine your risk level and how much you will pay for coverage.

HEALTH QUESTIONS

Only a few insurance carriers will ask about sickle cell anemia.

You will see the health questions asked this way:

- Have you ever been diagnosed or been treated for sickle cell disease?

- Have you ever been diagnosed or been treated for a blood disorder?

It is important to know that if a life insurance company does not ask about a specific health condition, they are okay with it and they will not count it against you.

Most final expense and funeral insurance companies will not ask about sickle cell anemia in their health questions. If you have sickle cell anemia, you will qualify for coverage. We work with companies that do not ask about sickle cell anemia and will help you get coverage.

PRESCRIPTION HISTORY CHECK

Insurance companies will also check prescription history to validate your health condition. They will know through your prescription history if you fill a prescription to treat a particular health condition. Here is a list of medications used to treat sickle cell disease.

- Droxia

- Deferasirox

- Endari

- Fentanyl (Duragesic)

- Glutamine

- Hydroxyurea

- Hydroxycarbamide

- Hydromorphone

- Ketorolac tromethamine (Toradol)

- Siklos

- Tramadol (Ultram)

If you take any prescription medications, the insurance company will know that you have been treated for sickle cell anemia.

Don’t worry, the presence of these prescription medications in your prescription history records will not result in a denial of your burial insurance application. Some insurance companies don’t even care about these medications, and we can help you find them and qualify for affordable coverage.

How Much Insurance Do I Need If I Have Sickle Cell Anemia?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Sickle Cell Anemia And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while others can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Information We Need If You Have Sickle Cell Anemia

When applying for burial insurance life insurance coverage with sickle cell anemia, you must provide as much information as possible. Not only will it help us understand your condition, but it will help us to give you an accurate quote.

When you reach out to us regarding purchasing burial insurance with sickle cell anemia, we will ask you a series of health questions to better understand your condition.

These questions may include:

- Do you have sickle cell trait or sickle cell anemia?

- When was your initial diagnosis?

- What are the treatments for your sickle cell anemia?

- What prescription medications are you taking to treat your condition?

- Do you receive regular blood transfusions?

- Have you ever been hospitalized due to sickle cell anemia?

- Have you ever had a bone marrow transplant? When?

We need to know your medical condition to be able to provide you with the best recommendation. The more information we get, the better your chances of finding affordable insurance coverage.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance With Sickle Cell Anemia

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with sickle cell anemia

- Cremation insurance plan with sickle cell anemia

- Funeral home insurance plan with sickle cell anemia

- Final Expense insurance plan with sickle cell anemia

- Prepaid funeral plan insurance with sickle cell anemia

- Mortgage payment protection plan with sickle cell anemia

- Mortgage payoff life insurance plan with sickle cell anemia

- Deceased spouse’s income replacement plan with sickle cell anemia

- Legacy insurance gift plan to family or loved ones with sickle cell anemia

- Medical or doctor bill life insurance plan with sickle cell anemia

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy with sickle cell anemia needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for sickle cell anemia funeral insurance, sickle cell anemia burial insurance, or sickle cell anemia life insurance, we can help.

Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Sickle Cell Anemia And Sickle Cell Trait

Can you get life insurance if you have sickle cell anemia?

Yes, you can get life insurance if you have sickle cell anemia. You can even qualify for a first-day coverage plan if you don’t have any complications from the disease.

What is the difference between sickle cell anemia and sickle cell trait?

Sickle cell anemia is a more severe form of the disease that causes red blood cells to form into sickles or crescent shapes. This can block blood flow and cause pain and other complications. Sickle cell trait is a less severe form of the disease that occurs when one copy of the gene for sickle cell anemia is inherited. People with sickle cell traits usually don’t experience any symptoms, but they can pass the gene on to their children.

Can you get burial insurance if you have sickle cell anemia?

Yes, you can get burial insurance if you have sickle cell anemia. You may even qualify for a first-day coverage plan if you don’t have any complications.

Does sickle cell anemia affect life expectancy?

Yes, sickle cell anemia can shorten life expectancy. However, with advances in treatment, many people with the disease now live into their 70s and 80s.

Is sickle cell a disability?

No, sickle cell anemia is not a disability. However, it can cause complications that may make working or participating in activities difficult.

Is sickle cell a death sentence?

No, sickle cell anemia is not a death sentence. With advances in treatment, many people with the disease now live long and healthy lives.

Can a person with sickle cell anemia get funeral insurance?

Yes, a person with sickle cell anemia can get funeral insurance. You may even qualify for a first-day coverage plan if you don’t have any complications from the disease.

Can sickle cell anemia considered critical illness in life insurance?

Yes, sickle cell anemia can be considered a critical illness in life insurance.

Can you get first-day coverage insurance if you have sickle cell anemia?

Yes, you can get first-day coverage insurance if you have sickle cell anemia. You may even qualify for a plan that does not require any medical exam.

What is the best life insurance for people with sickle cell anemia?

A first-day coverage plan is the best insurance for people with sickle cell anemia. Your policy will have no waiting period.

Do I need to tell insurance about sickle cell anemia?

Yes, you need to tell your insurance company about sickle cell anemia. This will help them to determine if you qualify for a first-day coverage plan.

What are the things that may affect my eligibility if I have sickle cell anemia?

Some of the things that may affect your eligibility if you have sickle cell anemia include the severity of your disease, your age, your lifestyle, and your medical history.

Is sickle cell anemia a pre-existing condition for life insurance?

Yes, sickle cell anemia is a pre-existing condition for life insurance.

Do I need to take a medical exam if I have sickle cell anemia?

No, you don’t need to take a medical exam if you have sickle cell anemia. You may even qualify for a first-day coverage plan that does not require a medical exam.

What are the benefits of having life insurance if you have sickle cell anemia?

Some of the benefits of having life insurance if you have sickle cell anemia include the peace of mind that comes with knowing that you have a financial cushion if something happens to you, and the ability to leave your loved ones with money to cover the funeral costs and other expenses.

Can you be denied insurance for sickle cell anemia?

Yes, you can be denied insurance for sickle cell anemia if you have severe complications from the disease.

Is sickle cell anemia fatal in life insurance?

Yes, sickle cell anemia is fatal in life insurance. Sickle cell anemia complications that can cause organ damage can be fatal and can cause you to only qualify for a guaranteed issue life insurance.

Can sickle cell anemia patients get final expense insurance?

Yes, sickle cell anemia patients can get final expense insurance. You may even qualify for a first-day coverage plan if you don’t have any complications from the disease.

Can sickle cell anemia medication affect my premium?

Yes, sickle cell anemia medication can affect your premium. Some of the medications used to treat sickle cell anemia can cause your premiums to increase.

How can you get the best life insurance rates with sickle cell trait?

You can do a few things to get the best life insurance rates with sickle cell trait. You can quit smoking, maintain a healthy weight, and avoid risky behaviors. You should also disclose your condition to your insurance company to give you the best possible rate.

Can sickle cell anemia affect your life insurance rates?

Yes, sickle cell anemia can affect your life insurance rates. The severity of your disease and complications will all play a role in determining your premium.

How does sickle cell anemia affect my life insurance rates?

Sickle cell anemia will likely affect your life insurance rates. The severity of your disease, age, and medical history will all play a role in determining your premium.

Is there an age limit for burial insurance with sickle cell anemia?

Most life insurance companies accept applicants 18-85 years old.

What is the best final expense insurance for sickle cell anemia?

A first-day coverage plan is the best final expense insurance for sickle cell anemia. This policy will have no waiting period, so you can start coverage immediately.

Do I need to tell burial insurance about sickle cell anemia?

Yes, you need to tell your burial insurance company about sickle cell anemia. This will help them to determine if you qualify for a first-day coverage plan.

Can sickle cell trait affect life insurance?

Yes, sickle cell trait can affect life insurance. However, it is not as severe as sickle cell anemia, and most life insurance companies will still accept you for first-day coverage.

What are the benefits of having burial insurance if you have sickle cell anemia?

Some of the benefits of having burial insurance if you have sickle cell anemia include the peace of mind that comes with knowing that you have a financial cushion if something happens to you, and the ability to leave your loved ones with money to cover the funeral costs and other expenses.

Do I need a medical exam for sickle cell trait?

No, you don’t need a medical exam for sickle cell trait. Most life insurance companies will still accept you for coverage.

Can I get cremation insurance if I have a sickle cell trait?

Yes, you can get cremation insurance if you have sickle cell trait. Most life insurance companies will still accept you for coverage.

Can you be rejected for life insurance because of sickle cell anemia?

Yes, you can be rejected for life insurance because of sickle cell anemia. Insurance companies may reject your application if you have organ damage due to sickle cell anemia.

What are some tips for getting life insurance with sickle cell anemia?

Some tips for getting life insurance with sickle cell anemia include disclosing your condition to your insurance company, maintaining a healthy weight and lifestyle, and quitting smoking. You may also want to consider a first-day coverage plan, which does not have any waiting period.

What is the average cost of life insurance for someone with sickle cell anemia?

The average cost of life insurance for someone with sickle cell anemia will depend on your disease’s severity, age, and medical history.

What are some things to consider when choosing a burial policy with sickle cell anemia?

Some things to consider when choosing a burial policy with sickle cell anemia include the type of coverage you need, your budget, and the company’s underwriting guidelines. You should also ensure that the policy covers funeral expenses and related costs.

4 Comments

Myrtle Greer

My great grandson had sickel anemia IAM searching for life insurance for him

Funeral Funds

Myrtle – we would need a bit more information to help you with this. Important information would be how old your grandson is, what state he lives in, and if there are any other medical considerations. Give us a call and we can help you understand your options. (888) 862-9456

Diane Bullock

Helping a family member find life insurance for a pre existing condition. ( born with sickle cell anemia) is this something your company can help with.

Funeral Funds

Diane – yes, we can get you some information and help with that.