How much does final expense insurance cost?

The cost of an average funeral can cost an arm and leg if you do not have a final expense insurance policy to cover it. Funerals are expensive, so you probably want to know how much burial insurance cost. Understanding how much is needed to provide your loved ones the funeral they deserve is vital to choosing the amount of final expense insurance you need.

The median cost of a funeral with viewing and burial is estimated to be $9,135 according to the National Funeral Directors Association. This price range includes the metal casket, funeral home services, hearse, and vault.

With the average cost of funeral services rising each year, you can choose to pay for the kind of funeral service you want by purchasing affordable burial insurance. In this article, you will learn about burial insurance, funeral insurance, and final expense insurance and how much does a burial policy cost.

FOR EASIER NAVIGATION:

- What Is Final Expense Insurance?

- What If My Health Is Good, Or Even Kind of Bad?

- Why Purchase Final Expense Insurance?

- When Do You Need Final Expense Insurance?

- How Much Does Final Expense Insurance Cost?

- How Much Final Expense Insurance Do I Need?

- How To Get Final Expense Insurance

- What Kind Of Final Expense Policies Should I Avoid?

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Final Expense Insurance Cost

What Is Final Expense Insurance?

Final expense insurance is also called funeral insurance, cremation, or burial insurance.

What is final expense insurance? Final expense insurance is a form of whole life insurance that provides funds for the cost of burial, funeral, and other end-of-life expenses. Burial insurance is different from prepaid burial plans. The funeral home is the beneficiary of preneed funeral insurance. While you can designate a beneficiary if you purchase burial insurance.

The face amount of this coverage is often smaller with proceeds usually ranging between $5,000 and $50,000 per policy. Policyholders are allowed to make manageable monthly payments – which can be convenient for seniors who are living on a fixed income.

Some funeral expenses that burial insurance may cover include:

- Cost of embalming

- Casket

- Cost of cremation

- Hearse

- Digging and filling of the grave

- Cost of the plot

- Vault

- Service car

- Funeral director services

Final Expense insurance policies are whole life insurance, and this is how they work:

- It is permanent; it does not expire due to age

- The premium rate is fixed for life, and cannot increase

- The death benefit can’t decrease for any reason

- The policy is not cancelable as long as premiums are paid

- Builds cash value that you can borrow from

There are two types of final expense insurance:

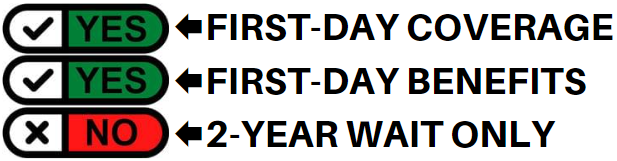

Simplified Issue Final Expense Insurance – requires no medical exam to qualify. This is final expense insurance that starts immediately, on the very first day. This final expense insurance with no waiting period will payout 100% of your death benefit if you die for whatever reason.

Guaranteed Issue Final Expense Insurance – is also called final expense insurance no exam, no questions asked. Your approval is guaranteed regardless of your medical condition. This is the best option for people with significant health problems who cannot qualify for traditional life insurance.

Here are our Top 10 Final Expense insurance companies.

ADVANTAGES OF GUARANTEED COVERAGE BURIAL INSURANCE

Guaranteed acceptance life insurance – every applicant will be approved regardless of any medical condition. Burial insurance is particularly beneficial to people with:

- Alzheimer’s disease

- End-stage renal failure

- Organ transplants

- Terminal illness

- Chronic illness

- AIDS or HIV

No medical exam – guaranteed issue life insurance policies will never require you to undergo a medical exam or answer health-related questions as part of the application process.

Low face amount options – if you’re only interested in buying little coverage to take care of your final expense, burial insurance for seniors will allow you to do that. You can buy as low as $2,000 in coverage with some companies.

Cash paid directly to your beneficiary – when you die, the insurance company will pay out the total death benefit to your beneficiary. If there is some money left over after the funeral expenses your beneficiary can use it any way they like.

DISADVANTAGES OF GUARANTEED COVERAGE BURIAL INSURANCE

Waiting period – all guaranteed issue policies come with a two-year waiting period. In case you die during the waiting period, the insurance company will refund all premiums paid plus interest.

Graded death benefit – the beneficiary is paid a percentage of the death benefit if the policyholder dies during the first two years of the policy. For example: in the first year, 30% death benefit will be paid, 70% in the second year, and 100% in the third year.

What If My Health Is Good, Or Even Kind Of Bad?

Read our “what kind of policies to avoid” section near the end of this post. You should only purchase a guaranteed issue burial policy if you have major health problems. This is because all of these policies are more expensive and require a mandatory 2 year waiting period before your benefits are paid due to illness or terminal disease.

95% of the people we talk to will qualify for better pricing and plans by answering a few health questions. You don’t have to visit a doctor or nurse to get approved for these better plans. We will help you get qualified lickety-split!

Why Purchase Final Expense Insurance?

If you don’t like purchasing final expense or burial insurance before, there are good reasons why you should consider it now.

The rising cost of funerals: Funeral costs have dramatically increased over the past decade.

Not too long ago, the typical cost of burial and funeral was around $6,000. Today the average cost of final expenses has climbed to almost $9,135, and it is expected to continue to increase. For most families, the burden of having to pay $9,000 for funeral expenses can be too much. You can help eliminate the financial hardship of paying for funeral expenses by purchasing burial insurance before your death.

Affordability: Burial insurance with no waiting period is far less expensive than traditional life insurance policies. The face amounts are often smaller. This makes the monthly premiums more affordable and easy on your budget (particularly for retirees on a fixed income).

Fewer restrictions: Burial insurance is designed to cover final expenses; it is easier to obtain by more seniors above the age of 80. Burial insurance for seniors over 70 is easy. There is no medical exam with these policies. Even if you have medical problems, you can answer some health questions to get even better rates.

When Do You Need Final Expense Insurance?

Your final expense insurance needs depend on your financial situation.

You specifically need burial insurance if:

- You have no life insurance coverage.

- Your savings don’t have enough to cover the cost of a funeral.

- You have outstanding debt.

- Your family and friends do not have the financial capacity to cover the cost of our burial and funeral expenses

- You don’t want your family to be burdened when you pass away.

- You want a separate permanent insurance policy to cover your final expenses.

The burial insurance policy provides the necessary funds to ensure your family does not have to use their own money to pay off your funeral expenses. These insurance policies pay cash directly to your beneficiary to pay for your funeral services.

How Much Does Final Expense Insurance Cost?

Final expense insurance policies can be purchased in the $5,000 to $25,000 range, although some companies offer up to $50,000.

The average cost of whole life insurance per month is approximately $25, and the most common face amount purchased is $10,000. Your specific premium rate might be higher or lower depending on your age, gender, health when you apply, tobacco use, and the face amount of the policy you choose.

Your funeral insurance cost can vary depending on the policy companies. Some factors that affect the price include:

Age

How much does burial insurance cost for your current age? Every burial insurance company has a set amount of premium for each specific age.

Most companies will offer life insurance rates by age (example: age 60, then age 61, and so on).

However, some companies set the premium according to age bracket. Typically, each age bracket is in the increment of 5 years. For example, they have one price for people who are 55-60 years old, or age 65-70.

Most life insurance policies will have an annual premium rate difference of 8% to 10% for each year of age. Waiting a year to purchase a life insurance policy may significantly increase monthly premiums. This increase each year is because each additional year is getting you closer to your life expectancy.

Gender

Being male or female also determines the cost of a burial insurance plan.

Look at the life insurance premium chart below, and you will see that life insurance is more expensive for men than for women. Men always pay more than women because, on average, women live longer than men. The average life expectancy of women is 81.1 years, while men are 76.2 years. Women live 5% longer than men.

Final expense life insurance no exam rates are based on life expectancy. Since life expectancy is longer for women than it is for men, life insurance premiums are lower for women. Since men are expected to pass away several years sooner than women, men are considered a higher risk to life insurance companies than women, and they will pay more premiums for the same age.

Health

Health is another qualifying factor for the average price of life insurance.

The older you get, the more likely you will have some health problems. The more health issues you have, the more it will affect your rate. With term life insurance, getting any health issues like high cholesterol and diabetes managed before applying for life insurance coverage is essential to get a competitive rate. This is not the case with burial policies, as underwriting is much more flexible than term life policies.

Your health will determine which risk classification you will be under.

Insurance companies usually use words like Preferred or Level to describe their best rating with term life insurance. People who are in perfect health qualify for this rating.

Graded or Level are used to describe ratings for burial policies. People who are in good health will qualify for level ratings. Modified are used to describe the more expensive ratings for people with significant health issues.

Tobacco Use

Burial insurance companies typically have one price for non-tobacco users and a higher amount of premium for those tobacco users. Tobacco users pay more for life insurance because of the health risk of smoking and shortened life expectancy.

Like any other company, life insurance companies are in business to make money. For this reason, they want to insure people are going to pay their premiums for a long time. Since smoking increases your chances of dying from various diseases, you are considered at a higher risk to insure than someone who does not smoke.

The increased risk of dying makes it more expensive for tobacco users to purchase life insurance.

Policy type and amount of Coverage

How much your final expense insurance cost will largely depend on the types of burial insurance the amount of coverage.

The larger the death benefit amount, the higher the premiums will be. To keep premiums down, only get as much coverage you need.

Consider how much you need to pay for your burial and other final expenses to determine how much burial insurance you need. If you’re looking for burial insurance for cancer patients, call us to know how much guaranteed life insurance costs, and we will give you an accurate quote.

How Much Final Expense Insurance Do I Need?

The amount of final expense insurance we need depends upon our final wishes. Use these questions to help you compute how much life insurance you need:

- Do you want burial or cremation?

- Will you be embalmed?

- What kind of casket do you want?

- What type of headstone do you want?

- How far is the funeral home to your house?

- How many death certificates will your family need to close your estate?

- Would you have a viewing? How many days?

- What type of funeral home facilities do you need?

- What kind of service will you use for transportation?

- How much allowance will you allot for other final expenses?

Request a general price list from your funeral home to know how much each service costs. That information makes it easy to compute the burial insurance coverage you need.

How To Get Final Expense Insurance

After determining how much coverage you need, determine how you can get burial insurance. These are the three ways to get final expense or burial insurance:

APPLYING ONLINE

It is easy to get burial insurance quotes from different companies online. The internet will give you different quotes you can compare. Many quoting tools can be found online. These quote tools work this way:

- Look for an insurance quote tool on your search engine.

- Fill in the required field like your gender, birthday, state of residence, and the coverage amount.

- Choose your health class

- Study the quotes provided to know your best option.

- Call an independent insurance agent to confirm your options.

- Apply online.

- Wait for your approval from the insurance company over the phone.

THROUGH THE MAIL

Another way of applying is through an application letter you receive through the mail. This is an easy way of getting your burial insurance policy, BUT be cautious because final expense insurance purchased this way not be the best plan for you and your family.

Mail-order life insurance policy doesn’t require a medical exam or health questions. They usually offer guaranteed issue life insurance policies which are capped at $10,000-$15,000. These policies are useful if you have severe and life-threatening pre-existing medical conditions. If you’re in fair to good health, you will pay much more for these policies than if you were to answer a few health questions.

Consider your health condition if you opt to get insurance coverage through the mail. If you are moderately healthy to healthy, or even if you have some minor health issues you will get cheaper burial insurance by calling us and answering a few medical questions.

Use our online quote form to see your best rates and eligibility.

THROUGH A BURIAL INSURANCE AGENT

Another method of getting insurance coverage is by meeting an independent insurance agent face-to-face. They will tell you your options to get the best plan at the best price.

We think the easier way to get affordable funeral insurance for parents is to do it online and over the phone like the way we do it at Funeral Funds.

Determining how much burial insurance you need can be challenging. You need to take the time to talk to an independent agent to determine how much you need for coverage. Consult one of our agents at Funeral Funds to help you. Ask any insurance coverage questions to ensure you get your family’s best burial insurance plan.

Making sure your family has the money to cover your final expenses is the best gift you can give them to show how much you care for their financial well-being. Burial insurance for seniors is easy to apply for, and you can easily be accepted. Call us at (888) 862-9456, and we will help you shop to get the best burial insurance for your needs.

What Kind Of Final Expense Policies Should I Avoid?

TV AND MAGAZINE ADVERTISEMENTS – Most burial insurance for parents or final expense policies you see advertised on television or in magazines are sold as “the no-brainer way” to shop for this protection.

In reality, most of these policies rely on you having NO BRAIN to purchase them.

Just about everyone is eligible for immediate coverage and better pricing allowed by these heavily advertised policies that cost an arm and leg.

To make a long story short, it is better to shop for the best burial insurance policies with a final expense insurance specialist, like FuneralFunds.com, than to sign up with a company that spends ba-zillions of dollars each month advertising on television and in magazines.

Increasing Price Policies

Those TV and magazine final expense policies may increase in price every five years or have a two-year waiting period before your benefits kick in! What in tarnation!?!

These policies aren’t all they’re cracked up to be, and you often end up at the short end of the stick by purchasing burial insurance this way.

These tricky television magazine snake oil salesmen lure you in with an attractive rate, only to have the cost of your insurance increase every five years until you cannot afford the premiums, then you must cancel your policy.

What happens after you cancel the policy?

You’ll die and will have wasted all that money because you bought a policy that increases in price as you get older. These policies just don’t cut the mustard for most folks!

Avoid policies that increase in price every year or end at a certain age. You don’t want your family to get hung out to dry when they need this coverage the most.

Why choose Funeral Funds for my burial policy?

Most life insurance agents are fine, respectable people.

There are, however, the classic “snake oil” life insurance agents, who will sell you the easiest and most expensive policy possible.

The guaranteed issue folks claim you don’t even need to talk to an agent (but you will need to wait 2 years for your coverage to begin…even if you’re healthy). Answering a few health questions will often get you immediate coverage and MUCH better rates.

Avoid these people at all costs!

For the rest of the life insurance agents, who are fine respectable people, are most often generalists.

They deal with all kinds of life insurance policies.

They are Jack of all trades and Masters of none.

They are nice people but are not the logical choice if you want the best pricing and a burial insurance policy with no waiting period.

We work with 20+ final expense companies, so we can get you qualified for the best price plan to get folks like you immediate coverage when possible.

We have to admit that, for the average burial insurance final expense insurance shopper, all the companies and options will often leave you more confused than a woodpecker in a concrete forest.

How Can Funeral Funds Help Me?

In reality, inexperienced and less knowledgeable insurance agents will cost you loads of money by selling you overpriced burial and final expense policies.

Getting an affordable burial or final expense policy doesn’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you the best burial insurance quotes from the final expense companies that best fit you.

Working with an independent brokerage like Funeral Funds is always in your best interest.

With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Additional Questions & Answers On Final Expense Insurance Cost

What is a final expense life insurance?

A final expense life insurance is a type of whole life insurance designed for people between 50 and 85 years old. This policy pays out when the policyholder dies and only in the event of death. Final expense policies are used to cover funeral expenses when they are needed immediately.

Is final expense insurance a good deal?

Generally, a final expense policy could be a fantastic deal for people ages 50 to 85 years old who want to have their funeral and burial expenses covered. Final expense insurance has lenient underwriting, and most health issues are accepted. If you are disqualified from traditional life insurance, final expense life insurance can be a great option.

What kind of insurance is final expense?

Final expense insurance is a whole life insurance policy that covers funeral or burial expenses. A final expense life insurance typically provides $10,000 to $50,000 coverage and builds cash value over time.

What are the features of final expense life insurance?

- No medical exam

- Permanent coverage

- Fixed premium

- Level death benefit

- Builds cash value

Who qualifies for final expense insurance?

Most people qualify for final expense insurance if they are over 50 years old and have pre-existing medical conditions.

What is the average cost of final expense life insurance per month?

The average cost of final expense life insurance is $50 per month. Your monthly premium could be lower or higher depending on your age, gender, location, coverage amount, and general health.

How much is life insurance for a 50 year old?

The average monthly cost of final expense life insurance for 50-year-old ranges from $20 to $50. Your actual cost varies by gender, state, coverage amount, and health.

Is final expense insurance whole life?

Yes, final expense insurance is whole life. This means the policy will not expire. You are covered for life; it builds cash value over time and can be borrowed against or used as collateral for a loan.

Why should I buy final expense insurance?

It is important to purchase final expense insurance if you cannot get traditional life insurance or have been denied coverage in the past. This policy will cover your funeral, burial, and final expenses. You will often qualify for coverage even if you have a pre-existing condition.

How much do life insurance policies usually cost?

The cost of a life insurance policy varies depending on the type of coverage, age at which you purchase it, your gender, health, and location.

Is there a final expense life insurance for seniors?

Yes, final expense life insurance is specifically designed for people 50 to 85 years old. It is a permanent plan and will remain active throughout the policyholder’s life.

How old do you have to be for final expense insurance?

You have to be 50 or older (up to 85 years old) to qualify for final expense insurance. This type of policy is not available for people younger than this age.

Can you have more than one final expense insurance policy?

Yes, you can have more than one final expense insurance policy, but it depends on your financial situation. Having more than one final expense policy is great if you want larger insurance coverage that you can leave to your family when you pass away.

Can you get a loan against final expense life insurance?

Yes, you are able to take out a cash value loan on your final expense policy. You can use this money for whatever purpose needed or want (e.g. paying off debt, college tuition for your children, etc.).

What is the average price of final expense insurance?

The cost of final expense life insurance varies depending on your age at application, gender, state of residence, coverage amount, and health.

How much do final expense plans cost?

Final expense plans cost an average of $25 to $75 per month. The rate will vary depending on age, gender, state, coverage amount, and health.

What should someone do if they are denied final expense insurance?

If you have been denied a final expense policy, it does not necessarily mean that it is the end of the road. It may be possible to purchase a different type of whole life insurance or a different company’s final expense policy instead or buy a guaranteed acceptance life insurance policy that accepts applicants regardless of their health condition.

Does final expense insurance make sense?

Yes, final expense insurance is a great option for people who cannot get traditional life insurance or those who have been denied coverage because of health issues. Coverage is available from 50 years old up to 85, which means anyone from this age group can apply even if they have pre-existing medical conditions.

What is the average cost of life insurance?

Life insurance costs vary greatly depending on the type of life insurance, age at which you apply for coverage, gender, health, and location.

What is the senior final expense program?

A final expense policy is a whole life insurance plan that covers your burial expenses, funeral services, and other final expenses. It builds cash value over time and can be borrowed against if needed.

What are some of the top-rated senior final expense life insurance companies?

Some of the top-rated final expense life insurance companies for seniors include Trinity Life Insurance, Family Benefit Life, Guarantee Trust Life, Royal Neighbors (check out our top 10 final expense companies.)

How does final expense insurance work?

Final expense insurance is a good option. With this type of life insurance policy, the benefits are meant for funeral costs and other expenses when someone dies. A typical benefit amount paid out is $5,000 but it can go up to $50,000.

Is it good to have final expense insurance?

Yes, it is good to get final expense insurance because you never know when you will die, and this type of policy covers your final expenses. It builds cash value over time.

Does final expense life insurance cover burial costs?

Final expense life insurance can cover your burial costs, funeral services, and other final expenses.

Who is a good candidate for final expense insurance?

A good candidate for a final expense policy is someone who needs a death benefit but has been denied traditional life insurance for health reasons.

What age is final expense insurance?

Typically, someone who is 50 years old or older (up to 85 years old) can apply for final expense insurance.

What can final expense insurance be used for?

A final expense policy can be used for your funeral, burial, cremation, or final expenses. Your beneficiary can use the death benefit payout however they see fit since it is not tied to any funeral home.

RELATED POSTS: