What is Burial Insurance?

What is burial insurance? Since many people are asking us many questions about burial insurance, we decided to give you a complete guide to burial insurance.

Burial insurance, also known as funeral or final expense insurance, is a helpful financial tool to pay for your final expenses. It is an excellent way to ensure your loved ones will not be burdened with your end-of-life expenses.

While many people don’t want to think about their death, burial insurance can relieve a lot of stress on our family if we make plans to make sure everything is paid for.

End-of-life planning should be a part of every senior’s financial planning. Burial insurance or final expense plans get more expensive as we grow older. Aside from this, most insurance providers have a maximum age limit to buy a policy. The younger you are, the less your premiums will be.

If you are over 50 years old and you think you and your family will benefit from burial insurance, click on the quote box to compare prices from multiple life insurance companies.

FOR EASIER NAVIGATION:

- What Is Burial Insurance?

- Burial Insurance Is Unique In Three Ways

- Is Burial Insurance And Life Insurance The Same Thing?

- Burial Insurance Vs. Prepaid Funeral Plans

- Who Needs Burial Insurance?

- Different Types Of Burial Insurance

- What Is Covered By Burial Insurance?

- What Is The Average Cost Of Burial Insurance?

- Determining The Amount Of Coverage, You Need

- Who Can Apply For Burial Insurance Policy?

- Applying For A Burial Insurance Policy

- How To Apply For Burial Insurance?

- Additional Questions & Answers On What Is Burial Insurance?

What Is Burial Insurance?

Burial insurance is a whole life insurance policy designed to pay the final expenses that come with passing away, such as funeral service, burial, and other final expenses. It is a permanent life insurance policy that lasts a lifetime.

Once you pass away, your insurance company will pay a tax-free check to your beneficiary. There are no limitations on how the death benefit payout is to be used. Your beneficiary can use the money to pay for your funeral. If there is something left over after paying the final expenses, your family can use the money; however, they see fit.

HOW DOES BURIAL INSURANCE WORK?

No medical exam – final expense insurance plans have simplified underwriting, which does not require you to take a physical or medical exam. You will only need to answer some health questions. The guaranteed issue policy will not even require you to answer any health questions.

Permanent coverage – Coverage will last a lifetime and won’t expire at age 80. The insurance company can’t cancel your policy because of your health conditions or advancing age.

CAUTION! Burial insurance is not a term life insurance policy that increases in price every 5 years and expires after you reach age 80! Be careful of these policies you see advertised on TV, in junk mail, and with credit unions!

Level premiums – the amount you pay will stay the same for life. Your premiums are guaranteed never to increase because they are locked in at the age when you bought the policy.

Fix death benefit – your death benefit amount will never decrease for any reason. Your beneficiaries will receive your death benefit when you pass away.

Builds cash value – your whole life insurance allows you to build up cash value with every payment you make. You can borrow from your cash value or use it to pay your premiums.

Burial Insurance Is Unique In Three Ways:

1. Easy Underwriting

One of the unique qualities of burial insurance is easy underwriting. Most of the health conditions accepted by funeral insurance would automatically be declined from traditional life insurance policies.

Relaxed underwriting allows many seniors with high-risk medical conditions to qualify for coverage.

2. No Health questions policies

Even though burial insurance has relaxed underwriting, some medical conditions are so risky they are considered uninsurable.

For these high-risk conditions, there are no health questions guaranteed issue policies. Applicants are guaranteed acceptance regardless of their medical conditions.

3. Smaller face value options

Some burial plans providers will let you purchase as little as $2,000 in coverage. No other life insurance policy will let you buy such a small amount of insurance protection.

Most final expense companies offer value options from $2,000 to $25,000. Some companies go lower, and some go higher, but you can only buy the coverage you need.

Is Burial Insurance And Life Insurance The Same Thing?

Burial insurance is, in fact, a form of whole life insurance with a smaller benefit amount than traditional life insurance policies.

It is designed to cover your final expenses.

On the other hand, life insurance policies are purchased to cover a wide variety of needs like income replacement — the difference between the two lies in your purpose of buying.

The death benefit payout from burial insurance can be used for other expenses depending on the beneficiary. However, payouts are designed to cover final expenses primarily.

For this reason, burial policies are generally offered in the amounts of $2,000 to $25,000, whereas life insurance provides benefits of hundreds of thousands of dollars.

Burial Insurance Vs Prepaid Funeral Plans

Prepaid funeral plans cover funeral expenses and services from a specific funeral home.

Prepaid funeral planning aims to have the funeral paid off in advance at the funeral home. Sometimes, the prepaid funeral plan might have a chain of affiliated funeral homes where you can transfer your plan.

One key benefit of life insurance is that you can have your funeral anywhere, not just at a funeral home where you bought your prepaid plan.

Additionally, burial insurance offers the beneficiary a cash benefit that they can use to cover the funeral of their loved ones. The death benefit payout can be used to pay for medical bills, funerals, and other final expenses and save any leftover money.

Prepaid funeral plans and burial insurance are two distinct products. Pre-paid funeral plans are similar to a burial insurance policy with a few differences:

- A prepaid funeral is generally sold by the funeral home or an insurance company associated with them instead of an independent agent.

- The beneficiary is the funeral director or the funeral home with prepaid plans.

- Payments are offered for a fixed period where you make installment payments.

- The death benefit is tied to the cost of particular services offered by the funeral home.

- If you decide that you no longer want the plan and ask for cancellation, you may either receive a part of your premiums or nothing.

Considering buying a prepaid funeral plan? Bear in mind that it’s not legal in every state to assign the funeral home as your beneficiary.

You must also consider the financial strength of the funeral home. There is a possibility that they may go out of business before you pass away.

Who Needs Burial Insurance?

People in the following situations should consider burial insurance:

- Those who have no life insurance coverage.

- Those who want a separate insurance policy to cover his final expenses

- Those who don’t want to burden his family when he passes away

- Those whose savings are not enough to cover the cost of a funeral

- Those who have cash but would prefer not to use it for final expenses

- Those whose family and friends do not have the financial capacity to cover the cost of funeral and burial expense

- Those who are paying off medical bills

- Those who have an outstanding debt

- Those who want to leave a charitable donation to an organization or person important to him

Different Types Of Burial Insurance

You can apply for a life insurance plan with underwriting (health questions) or choose a no health questions policy. Burial insurance, funeral insurance, and final expense insurance with underwriting have three different plans you can qualify for depending on your health.

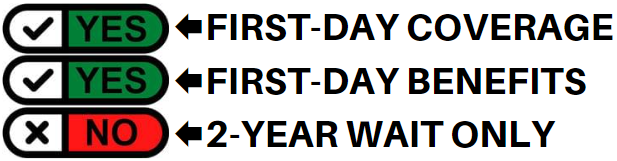

LEVEL BENEFIT

It’s a “simplified issue” burial insurance with health questions. You will qualify for a level benefit plan if you answer “NO” to all the health questions on the application.

You will get first-day coverage, and your beneficiary will receive 100% of the death benefit when you pass away. You will have no waiting period if you’re approved for this plan.

A level benefit is your best option because it offers the lowest possible rate. Some insurance providers use the word “preferred” instead of a level benefit to describe their plan with the best rating.

GRADED BENEFIT

A graded benefit plan is your next best option if you can’t qualify for the level benefit because of some health condition(s).

You will get this plan if you answer “YES” to any of the health questions. The insurer will consider your health profile as riskier. They will charge from 15 to 40% more for your policy.

A graded benefit plan provides immediate coverage with partial benefit during the first two years of the policy.

For example: If you have a $20,000 face amount, the company will payout 30% of the $20,000 if you pass away on the first day. 70% benefit in the second year and 100% in the third year and beyond.

Different insurance providers have different payout schedules. Reading the fine print to understand the plan before purchasing is important.

MODIFIED PLAN

People with many health issues will qualify for this plan. They will offer you a modified plan if you answer “YES” to the health issues in the modified section of the application.

Health issues like heart attack, cancer, or stroke within the previous year will put you in the modified benefit plan. The company will charge 15-50% more on your premiums.

There is a two-year waiting period for a modified plan. If you die during the waiting period, the company will return all the premiums you paid plus 10% interest. However, if you had an accidental death during the waiting period, they would pay out 100% death benefit.

GUARANTEED ISSUE BURIAL INSURANCE

Final expense insurance generally has lenient underwriting, but some health conditions are so severe they are considered uninsurable. If you have a severe medical condition or terminal illness, this is your best option for coverage.

Guaranteed issue whole insurance does not require a medical exam or any health question. Regardless of your medical condition, you will be approved if you satisfy the age requirement.

A guaranteed issue plan has a two-year waiting period. If you pass away during the first two years, the company will refund all your premiums plus 7-10% interest.

The company will pay the 100% death benefit when you live beyond the waiting period. However, the full cash benefit will be paid for accidental death, even during the waiting period.

Guaranteed issue insurance is your only option for coverage if you have any of the following medical conditions:

- Terminal illness

- Alzheimer’s disease or dementia

- End-stage renal failure requiring dialysis

- You are in a hospital or nursing facility

- Organ transplant

- Using oxygen because of respiratory disorder

- HIV or AIDS

What Is Covered By Burial Insurance?

Burial insurance generally covers the insured person’s life. Cash benefit will be given to the beneficiary when the insured dies. You can buy burial insurance to cover your funeral, burial, and final expenses, especially if you don’t have a funeral budget.

Burial insurance can cover the cost of the following:

- Embalming or cremation

- Funeral services

- Casket or urn

- Headstone or grave marker

- Burial plot

- Hearse flowers

- Other final expenses

Your beneficiary will receive a cash benefit upon your death. Since the funeral home is not your beneficiary, there is no rule on using the money.

The death benefit can be used for your final expenses or on anything your beneficiary sees fit. There is no restriction on how the benefit payout will be spent.

What Is The Average Cost Of Burial Insurance?

Your burial insurance cost will depend upon the following factors:

- Age

- Gender

- Face amount

- Health conditions

- Tobacco usage

- State of residence

Tobacco product users will pay more than nonsmokers.

Burial insurance has a “locked-in” premium, so you don’t need to worry about price increases if you keep your policy in force.

The exact cost of your burial insurance coverage will depend on your age and other factors.

Generally, the younger your age, the less your premium will be. The reason is that insurance companies take more risk insuring older folks who are statistically closer to death.

If you buy burial insurance when you are 50, you’ll pay less each month than if you wait to purchase a policy when you are 70.

If you want an accurate cost, fill in the instant QUOTE box on this page.

Determining The Amount Of Coverage, You Need

The amount of burial insurance coverage can vary depending on your needs. To determine the amount you need to buy, you must first calculate how much you need to pay for your funeral and final expenses.

According to NFDA, $8,755 is the average funeral cost today. This figure doesn’t include additional costs like an obituary and flowers.

You may need to allot $12,000 to $15,000 to cover your funeral cost. You must factor in your computation of other final expenses, including credit card bills, medical bills, and legal fees.

Example:

$12,000 funeral cost

$5,000 medical bills

$3,000 credit card bills

==================

$20,000 burial insurance coverage

In this case, you would need to buy a minimum of $20,000 in insurance coverage.

Who Can Apply For Burial Insurance Policy?

Burial insurance eligibility depends on several factors:

- Age: 50-85 years old

- State of Residence: Some burial insurance plans are not licensed in every state.

- Health: Your health will determine what plan you will qualify for. If you have a terminal illness or severe medical condition, there is a guaranteed issue burial insurance you can be eligible for.

- Ability to enter into a legal contract: You must possess the mental capacity to enter into a legal contract to qualify.

Applying For A Burial Insurance Policy

A medical exam is not required to apply for burial insurance. You don’t need to submit a blood and urine sample. They will only ask you some basic questions on the application.

You will also need to provide your:

- Age

- Gender

- Height

- Weight

- Tobacco usage

How To Apply For Burial Insurance?

Step 1: Look for an Independent Life Insurance Agency like Funeral Funds

Independent life insurance agencies like Funeral Funds can walk you through the whole application process and shop the market to get you the best plan with the cheapest premium.

Step 2: Choose your burial insurance plan from A-rated Companies

A-rated companies are financially stable and have a history of paying beneficiaries on time.

Step 3: Answer the health questions and complete the phone interview

Fill out the application with your agent and answer the phone interview. Some companies do not require a phone interview.

Step 4: Choose how to pay your premiums

You can pay your premiums in different monthly, semi-annual, or annually. You can also opt to pay via direct withdrawal from your bank or credit or debit card.

Step 5: Receive the policy

Burial insurance companies typically deliver your policy to your home and don’t require an agent to complete the delivery.

How Can Funeral Funds Help Me?

Finding a policy if you have a pre-existing condition needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have any health issues, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies anymore because we will do the dirty work for you.

We will shop your case at different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for funeral, burial, or life insurance.

Fill out our quote form on this page or call us at 888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On What Is Burial Insurance?

What is burial insurance?

Burial insurance is a type of life insurance that is specifically designed to cover the costs of your funeral and burial expenses. It can help your loved ones cover the costs of your funeral and burial without worrying about coming up with the money themselves.

Who needs burial insurance?

Burial insurance is for anyone who wants to ensure their funeral and burial expenses are covered. If you don’t have life insurance or your life insurance policy doesn’t cover funeral and burial expenses, then burial insurance can be a good option.

How can I qualify for burial insurance?

Most people can qualify for burial insurance, regardless of their health. You may be able to get coverage without taking a medical exam.

Who can apply for burial insurance?

Most people can apply for burial insurance, including:

- U.S. citizens or legal residents

- Ages 50-85

What are the benefits of burial insurance?

The benefits of burial insurance include:

- Ensuring your funeral and burial expenses are covered

- Helping your loved ones cover the costs of your funeral and burial

- Qualifying for coverage without a medical exam

Is burial insurance a good idea?

Burial insurance can be a good idea if you want to ensure your funeral and burial expenses are covered. It can also help your loved ones cover the costs of your funeral and burial without worrying about coming up with the money themselves.

Why is burial insurance important?

Burial insurance is important because it can help your loved ones cover the costs of your funeral and burial. If you don’t have life insurance or your life insurance policy doesn’t cover funeral and burial expenses, then burial insurance can be a good option.

What are the different types of burial insurance?

There are 3 types of burial insurance: first-day coverage, graded coverage, and guaranteed issue.

Is burial insurance right for you?

Burial insurance might be right for you if:

- You want to ensure your funeral and burial expenses are covered.

- You don’t have life insurance, or your life insurance policy doesn’t cover funeral and burial expenses.

- You want to help your loved ones cover the costs of your funeral and burial.

- You want coverage without having to take a medical exam.

What does burial insurance cover?

Burial insurance typically covers:

- The cost of your funeral

- The cost of your burial

- Other end-of-life expenses, such as the cost of a headstone or casket

Is burial insurance different from preneed funeral insurance?

Yes, burial insurance is different from preneed funeral insurance. Preneed funeral insurance is a type of life insurance that specifically designates the funeral home as the beneficiary.

What is the difference between burial insurance and life insurance?

Burial insurance is a type of life insurance that is specifically designed to cover the costs of your funeral and burial expenses. Life insurance typically covers things like your mortgage, debts, and other expenses.

What does burial insurance typically include?

Burial insurance typically includes:

- The cost of your funeral

- The cost of your burial

- Other end-of-life expenses

How do I know if I need burial insurance?

If you want to ensure your funeral and burial expenses are covered, burial insurance might be good.

When is the best time to buy burial insurance?

The best time to buy burial insurance is typically when you are younger and in good health. This way, your premium will be lower.

Who is burial insurance best for?

Burial insurance is typically best for people who want to ensure their funeral and burial expenses are covered. It is also best for seniors with health issues.

Is burial insurance available for seniors over 70?

Yes, burial insurance is available for seniors over 70. Seniors often qualify for coverage, even those with health issues.

What is the cost of burial insurance?

The cost of burial insurance varies depending on a number of factors, including:

- Your age

- Your health status

- The amount of coverage you want

- The type of policy you choose

What is the best burial insurance for seniors?

The best burial insurance for seniors typically depends on their needs and budget. Some factors to consider include:

- Coverage amount

- Policy type

- Premium costs

How does burial insurance work?

Burial insurance works by providing a death benefit to your loved ones when you die. This death benefit can be used to cover the costs of your funeral and burial expenses.

Can I get burial insurance on my parents?

Yes, you can get burial insurance for your parents. You just need to get their consent.

Can I have two burial insurance policies?

Yes, you can have two burial insurance policies as long as you can afford to pay the premiums.

What is the main purpose of burial insurance?

The main purpose of burial insurance is to provide a death benefit to your loved ones when you die. This death benefit can be used to cover the costs of your funeral and burial expenses.

What is the difference between term life insurance and burial insurance?

Term life insurance is a type of life insurance that provides coverage for a set period of time, typically 10-30 years. Burial insurance is a type of life insurance that is specifically designed to cover the costs of your funeral and burial expenses.

Does burial insurance pay for funerals?

Yes, burial insurance typically pays for funerals. The death benefit can be used to cover the costs of your funeral and burial expenses.

Can someone take out a burial insurance policy on me without my knowledge?

No, someone cannot take out a burial insurance policy on you without your knowledge. The person would need your consent in order to do so.

Do I get my money back if I cancel my burial insurance?

If you cancel your burial insurance policy, you will not get any money back.

What reasons will burial insurance not pay?

Burial insurance will not pay if you cancel your policy or if you die of suicide during the first two years of the policy.

Does burial insurance have cash value?

Yes, burial insurance has cash value you can use to pay your premium or borrow during an emergency.

How do you cash in burial insurance after a death?

To cash in burial insurance after a death, you will need to submit a death claim to the insurance company. The company will then send you a check for the death benefit.

How long after someone dies can you claim burial insurance?

You can claim burial insurance as soon as the death is reported to the insurance company.

4 Comments

Mildred

Looking for a burial insurance that is not outrageous. 10,000 to15,000 can I get a quote

Funeral Funds

Mildred – We are happy to help you with this. Visit this page to get a quote. https://funeralfunds.com/free-quote/

Brown Joseph

Looking for funds for both me and my wife. No medical exams or medical questions.

Funeral Funds

https://funeralfunds.com/free-quote/