Key to Finding Affordable Burial Insurance

Finding affordable burial insurance is one way of offsetting the rising cost of a funeral. It is hard to lose a loved one, and having funeral expenses to pay for makes the experience even harder. The average cost of a funeral is continuously rising. Many people look for the most affordable burial insurance policy to cover the full funeral cost without leaving their family in debt when they pass away.

Many people overlook the importance of having a burial insurance policy. They typically ask, is burial insurance worth it? They underestimate the rising cost of funeral expenses. If you are a senior, start discussing purchasing a plan to give your family peace of mind when you pass away. Do not wait until tomorrow to get the coverage your family needs today.

Burial insurance policies can be purchased from most large insurance companies. You must be at least 50 years old to qualify. If you find it difficult to decide which type of burial insurance is best for you, we can help you. All you need to do is to fill in the instant quote form on this page to get started.

A burial insurance policy can cover the cost of final expenses. Burial life insurance policies have coverage amounts that range from $1,000 to $25,000. Finding affordable burial insurance policies to cover the final expenses can ease the burden on your family.

In this article, we are going to explore burial insurance and different ways of finding an affordable burial insurance policy that works best for your needs.

FOR EASIER NAVIGATION:

- What Is Burial Insurance?

- Types Of Burial Insurance

- Benefits Of Burial Insurance

- Who Needs Burial Insurance?

- Burial Insurance For Seniors

- How Much Does Burial Insurance Cost?

- How Do You Choose The Right Coverage Amount?

- How To Compare Policies?

- Finding Cheap Burial Insurance Policy

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Affordable Burial Insurance

What Is Burial Insurance?

Burial insurance, also called funeral insurance or final expense insurance; is a type of whole life insurance.

It works like other insurance plans where the death benefit from the policy can be used to cover the funeral and other final expenses (like unpaid debts and medical bills). These plans can be purchased from age 50 to 85, but some companies insure older people as long as they are medically qualified.

The premiums will never increase throughout the policy. The death benefits are guaranteed and will never decrease. The policy cannot expire as long as payment is continued.

It is also a cash policy that has a cash value component. The cash value can build up the longer you hold the policy. There is no medical exam needed as part of the application process.

Burial insurance payout is paid directly to the beneficiary when the insured dies. The payout can be used to pay the final expenses, outstanding medical bills, or funeral expense.

The death benefit can be used without any restrictions. Your family can use it for whatever they need.

Burial insurance is different from Pre-Need Insurance. What is a pre-need plan? Pre-need funeral insurance plans or prepaid burial plans can be bought directly from funeral homes, and you are restricted from using that particular funeral home. If the funeral prices have risen since the policy was acquired, the family will be required to pay more.

Types Of Burial Insurance

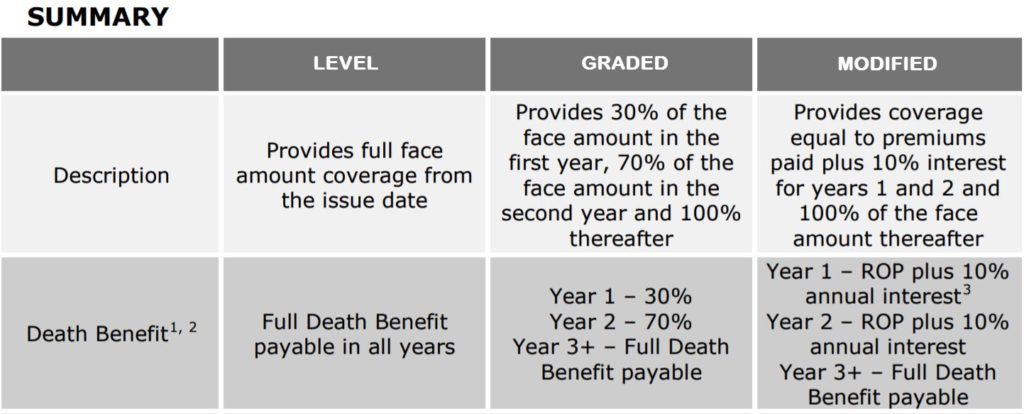

Level benefit

- Having a policy with level benefits means you are entitled to a 100% death benefit payment from day one.

- The full amount of the policy will be paid to the burial insurance beneficiary if the insured die during the policy’s active period.

- Seniors with minor health issues controlled with medications can qualify for a level benefit.

Graded benefit or Guarantee Issue

- No waiting period – burial insurance with no waiting period is the preferred option for all funeral funding and burial plans, as it gives you immediate coverage with 100% payout of the funds from day one.

- Partial waiting period – These plans give you immediate partial coverage. The first 12 months of coverage will be 30 to 40% of the face amount, the following 13 to 24 months will be 60 to 70% of the face amount, and after 24 months, you will have 100% coverage.

- Two-year waiting period (Modified or Guaranteed Issue Policy) – The best plans offer immediate coverage if accidental death occurs, a return of premiums, 8 to 10% interest on these premiums if a death occurs in the first 24 months, and a guaranteed payout of funds after 24 months.

All insurance companies have different eligibility and waiting period criteria. Here is one example of insurance company waiting period:

Benefits Of Burial Insurance

Burial insurance policies are different from other life insurance types because they are designed with seniors in mind. The insurance providers developed it for seniors to cover their end-of-life expenses.

Even seniors with adverse health condition can still qualify. Folks can buy coverage depending on their financial needs.

Burial insurance is unique because it has a lenient underwriting process. Its relaxed underwriting enables seniors with a health conditions to qualify for a policy.

Traditional life insurance will decline most of the medical conditions accepted by burial insurance policies. If you have health problems, you can still buy senior life insurance with no waiting period policy that can protect you immediately.

Lenient underwriting with burial policies gives seniors peace of mind knowing their funeral bills will not burden their family.

Guaranteed Issue Policies

Burial insurance has lenient underwriting, but some medical conditions are a higher risk for insurance companies.

Folks in this situation need not be sent on a wild goose chase. A guaranteed issue final expense life insurance no exam is your best option in this case.

No health questions guaranteed issue policies guarantee your approval. You skip the medical underwriting. You will be approved regardless of your medical conditions!

While you cannot be declined for guarantee issue, some companies may require a graded benefits policy. These are waiting period life insurance policies before the policy pays out 100%. Most companies will repay the premium plus interest if you die during the waiting period.

Burial insurance is affordable

If you’re trying to find affordable burial or life insurance coverage, burial insurance is the best option.

It has a much lower monthly premium compared to a life insurance policy. You may be able to find a $25,000 policy for less than $15 a month. And, you can buy a small coverage amount.

The most common face value folks select ranges from $1,000 to $25,000. You can buy a small amount of protection. You can only buy the amount that you need…this should have you feeling happy as a clam!

Another benefit of burial or final expense insurance is the simplicity of applying and being accepted into the plan.

It’s effortless to apply, and you will only need to complete a simple health questionnaire that you takes under 30 minutes.

There is no medical exam to apply for burial insurance (unlike other insurance policies). Burial insurance is great if you have pre-existing conditions; you can purchase a cheap burial insurance policy regardless of your health.

Who Needs Burial Insurance?

Burial insurance is excellent for senior customers who want to pay for their final expenses.

Seniors typically don’t have dependents that rely on their income. For older folks, burial insurance is a perfect fit. It requires minimum monthly payments that are affordable for most folks.

Burial insurance is ideal for seniors who have no life insurance policy.

Affordable burial insurance is the right choice if you cannot afford a traditional life insurance policy due to the high monthly premiums.

Likewise, if you’ve been declined for life insurance coverage, burial insurance will be right up your alley!

You may need burial insurance if:

- You don’t have life insurance

- You have no cash to pay for your final expenses

- You are still paying medical bills and other debts

- You have money but don’t want to use it to pay your final expenses

- You want to leave a donation to a charitable organization

Burial Insurance For Seniors

Most insurance companies offer affordable burial insurance to those aged 50 to 85. Although some companies will go even older than age 85, more insurers are increasing their availability as each generation lives longer.

Burial insurance allows the insured to pay a fixed amount for the life of the policy. The death benefit is guaranteed, and the policy will not expire as long as premiums are paid.

Burial insurance for seniors has limited underwriting and no medical exams; seniors with many health conditions are immediately eligible.

Burial insurance is excellent for the senior customer since they don’t have dependents relying on their income. For most seniors, cheap burial insurance is a perfect fit because it will remove the pressure from families to cover their parents’ funeral expenses.

How Much Does Burial Insurance Cost?

The younger you are, the cheaper burial insurance cost.

Different factors determine the cost of senior life insurance:

- Age

- Gender

- Height & Weight

- Face Amount

- Tobacco usage

- Health condition

- Pre-existing medical conditions

The average monthly premium for a $10,000 burial insurance policy is around $49 per month for a non-tobacco user male. Depending on the different health factors, your premium amount might be higher or lower.

You can pay your premium weekly, monthly, or even annually.

If you want custom quotes, just click on the quote tool on this page to get the exact current rate for this year.

How Do You Choose The Right Coverage Amount?

When choosing the coverage amount of burial insurance, it is important to consider specific details such as the type of policy you want.

Consider the current prices for the funeral and burial arrangements you need; will you be buried, cremated, placed in a crypt, or entombed?

You must plan on the way you would like to be laid to rest.

Your burial location should also be considered. Focusing on these areas will give you a better idea of what the standard inclusions will cost.

The choice of funeral service should also be a part of your planning.

These include memorial service, funeral service, and graveside costs. Other details included in the cost include the type of casket, music, and flowers.

Additional expenses such as medical and outstanding bills can throw an unexpected wrench in your plans, so you should also give room for unexpected expenses.

Knowing these details is quintessential to better understanding the amount of burial insurance coverage you need.

How To Compare Policies?

Think about the benefits you desire before you request burial insurance quotes. Many companies offer these benefits, so finding the right policy will not be too complicated.

Get quotes from several companies when looking for an affordable burial insurance policy. It’s always a good idea to look at several top-rated insurance companies.

You can receive a quote on premiums without having to purchase a policy.

We can run quotes for different life insurance plans from your computer. Compare the cost of premium and benefits before deciding.

Companies are different, and their monthly premiums and coverage will vary drastically. This will allow you to make an objective comparison of burial insurance that can indeed fit your needs. You can use the quote form on this page to shop for plans without giving away your personal information.

You need to answer several questions when searching for the right burial insurance company. We can help you understand the coverage amount, the monthly premiums, and if there is a waiting period before the company gives the burial payout.

If there is no waiting period, your burial policy will be effective as soon as you make the first payment.

Finding cheap burial insurance is simple. The application process is quick because there is no medical exam required. The insurance company will ask you a few simple questions about your age, gender, weight, height, tobacco usage, and health condition. Your banking information will also be requested to determine how you plan to pay for the policy.

Finding Affordable Burial Insurance Policy

The best way of finding affordable burial insurance is by shopping around and comparing prices from different companies before applying.

Working with an independent agency like Funeral Funds that represents more than 20 top-rated insurance companies will help you to find the insurance company accepting of all your health issues and will offer the lowest rates.

We are an independent agency that specializes in affordable burial insurance. When you speak to us, you can trust that you are dealing with experts because we do not deal with any other type of life insurance.

How Can Funeral Funds Help Me?

Most insurance agents don’t make the grade for getting you the most affordable coverage. Affordable burial insurance doesn’t have to cost an arm and a leg.

Our job at Funeral Funds is to be the most knowledgeable burial insurance experts available. By doing so, we can knock it out of the park and get you the most accurate quote and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

The reality is that most inexperienced and less knowledgeable insurance agents just don’t cut the mustard and will cost you loads of money by selling you more expensive policies.

It is always in your best interest to work with an independent brokerage like Funeral Funds. With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Additional Questions & Answers On Affordable Burial Insurance

What Is Burial Insurance?

Burial insurance is a type of life insurance that pays out a specific sum of money upon the policyholder’s death. This money can be used to cover the funeral and burial costs.

What is the best burial insurance for seniors?

The best burial insurance for seniors starts from the very first day.

How much does burial insurance cost?

The cost of burial insurance varies depending on the age, gender, coverage amount, and health of the policyholder

Is burial insurance a good investment?

Burial insurance can be a good investment if it is purchased when the policyholder is young and healthy.

Does life insurance cover burial costs?

One of life insurance goals is to cover the costs of a funeral and burial.

What does a burial policy cover?

A burial policy typically covers the costs of a funeral and burial, including the casket, funeral services, and cemetery plot.

What is the difference between burial insurance and life insurance?

Burial insurance is a type of whole life insurance that pays out a specific sum of money upon the policyholder’s death. This money can be used to cover the funeral and burial costs.

Does life insurance cover burial costs?

One of life insurance goals is to cover the costs of a funeral and burial.

What is the difference between burial insurance and term life insurance?

Burial insurance is a type of whole life insurance that does not expire and lasts until age 121. Term life insurance only lasts for a certain period or up to a certain age.

What happens if you don’t have burial insurance?

If you don’t have burial insurance, the costs of a funeral and burial may have to be paid out of pocket.

Is it good to have burial insurance?

Burial insurance is an important type of life insurance that can provide peace of mind and financial security for the policyholder’s loved ones.

Can I purchase burial insurance for my parents?

Yes, you can purchase burial insurance for your parents. The coverage cost will depend on your parents’ age and health. You also need to show insurable interest and consent.

What happens if you don’t have burial insurance?

If you don’t have burial insurance, the costs of a funeral and burial may have to be paid out of pocket.

What do I need to know about burial insurance?

You need to know a few things about burial insurance, including the cost, coverage amount, and health requirements. You also need to be aware of the policy’s expiration date.

Can a 50 year old get life insurance?

Yes, a 50-year-old can get life insurance. The cost of coverage will depend on the policyholder’s age, gender, coverage amount, and health.

How do over 50 plans work?

Most over 50 plans are whole life insurance policies that do not expire and last until age 121.

How much is a life insurance policy for a 50 year old man?

A life insurance policy for a 50-year-old man typically costs between $15-$40 a month.

At what age can you no longer buy life insurance?

You can no longer buy life insurance at age 90.

Can a 60 year old get life insurance?

Yes, a 60-year-old can get life insurance. The cost of coverage will depend on the policyholder’s age, gender, coverage amount, and health.

What is the average cost of a life insurance policy for a 60 year old woman?

The average cost of a life insurance policy for a 60-year-old woman is between $30 and $50 a month.

How much does life insurance for seniors cost?

Life insurance for seniors typically costs $25 to $100 per month.

Can I get life insurance if I’m not a U.S. citizen?

Yes, you can get life insurance if you are not a U.S. citizen.

Do you need life insurance if you have a pension?

Yes, you need life insurance if you have a pension. because life insurance can provide additional financial security for the policyholder’s loved ones.

Is life insurance needed after 60?

Yes, life insurance is needed after 60. because the policyholder’s health may change, they may need the coverage to provide financial security for their loved ones.

What is a 65 life policy?

A 65-life policy is a whole life insurance policy that does not expire and lasts until age 121.

What is the purpose of a life insurance policy?

The purpose of a life insurance policy is to provide financial security for the policyholder’s loved ones in the event of the policyholder’s death.

Is there an age limit for burial insurance plans?

Most life insurance companies accept applicants who are 50-89 years old.

What is the average cost of final expense insurance?

The average cost of final expense insurance is $10-$200 per month.

Is final expense insurance a good deal?

Final expense insurance is a good deal for policyholders who want to ensure their loved ones are taken care of financially after they die.

Can you get life insurance at age 80?

Yes, you can get life insurance at age 80, but the cost of coverage will be higher than for younger policyholders.