2024 Burial Policies for Seniors

Burial, funeral, and final expense insurance are burial policies for seniors. Paying for funeral expenses is the primary reason why most seniors purchase these policies. Burial policies for seniors refer to small whole life insurance policies that cover the cost of burial and funeral expenses.

According to the National Funeral Directors Association, the average cost of a funeral was $9,420 in 2021, and it has the potential to reach $10,000.

Paying for a funeral is a tremendous amount of money that could cause significant stress to the loved one left behind.

Burial insurance for senior citizens is the solution so that the surviving family doesn’t have to handle the financial aspect of the funeral. Funeral insurance can help protect loved ones from unexpected costs and debts associated with the funeral and burial.

If you’re looking for end-of-life insurance policies or final expense insurance for seniors, this article is for you. We will try to answer many of the common questions regarding seniors’ burial policies and provide information that will be important for anyone trying to buy this type of coverage.

FOR EASIER NAVIGATION:

- What Is Burial Insurance?

- What Do You Need To Consider Before Buying Burial Insurance?

- Burial Policies For Seniors

- What Features Are Available For Burial Policy Waiting Periods & Payouts?

- Best Features Of Burial Policies For Seniors

- What Does A Burial Insurance Policy Cover?

- Choosing The Right Coverage Amount

- Cost Of Burial Policies For Seniors

- What Kind of Burial Policies for Seniors Should I Avoid?

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Policies For Seniors

What Is Burial Insurance?

Burial insurance is also referred to as final expense insurance, funeral insurance, cremation insurance, and even burial policies for seniors. All these terms pertain to a whole life insurance policy designed for seniors or older people to cover funeral and final expenses.

Final expenses are various costs that arise after a family member dies.

Getting burial insurance is fairly easy. Insurance companies generally offer this kind of policy to people aged 50 to 80 or even 85. They only need to answer a few health questions.

No health questions guaranteed acceptance, or guaranteed issue policies are also available.

The face amount is relatively modest compared with traditional life insurance policies, which make the premiums affordable to applicants. You can choose from $2,000 to $25,000 insurance coverage, although some insurers will offer higher senior death benefits.

Burial insurance policies provide a cash benefit to the beneficiary when the insured dies. They can use this fund however they see fit.

The cash benefit can be used by the beneficiary to pay for outstanding medical bills, debts, funeral costs, and final expenses. If there’s some leftover, folks can keep it.

What Do You Need To Consider Before Buying Burial Insurance

By this time, we already know why burial insurance is essential. Before you search the internet for the best burial policies and companies, sit down and take some time to consider what you need from your policy.

First, you need to think about how much coverage you need.

To determine how much coverage you need, you must decide whether you want to be buried or cremated. Your decision will significantly affect your funeral budget because of the difference in cost between the two.

Other costs you must consider would be the burial location, funeral service, memorial service, casket, vault, flowers, markers, arrangement for the wake, and others. From these expenses, you can see why funerals are expensive and why having funeral insurance for parents is essential.

Talking about death can be awkward, but you should sit with family members to discuss your options. Once you get all the details sorted, you and your family will have a better understanding of what sort of coverage you need.

Burial Policies For Seniors

Simplified Issue Life Insurance – Level Benefit Plans

The underwriting process has been simplified compared to full life insurance, where you must have a medical exam. Final expense insurance no exam let you skip the needles.

Instead, you are asked to answer a few health questions to get an overview of your health condition.

You may be asked:

- Are you currently in a nursing home?

- Have you been diagnosed with a terminal illness?

- Do you suffer from Alzheimer’s or dementia?

Health issues such as high cholesterol or other minor health problems are fine.

The objective of asking health questions is to determine if you’re a high-risk life insurance client, like those with cancer or heart disease.

Simplified Issue whole life insurance is a true burial insurance policy you can buy from age 50 to 85.

The monthly premium is leveled, meaning it will not change throughout the policy’s life.

Also, this plan comes with first-day coverage!

Burial insurance with no waiting period provides full death benefits when the policy is issued. If the insured dies after the policy was approved, 100% of the death benefit will be given to the beneficiary.

Guaranteed Issue Life insurance – Graded Benefit Plans

There is no medical exam or any health questions asked with this policy. It has guaranteed approval which is best for people with severe health conditions. A waiting period before the death benefit typically occurs after 24 months.

If you die before the waiting period, your beneficiary would not receive the full death benefit but would receive all premiums paid plus 10%. In a graded benefit policy, the benefits are provided in steps.

What features are available for burial policy waiting periods & payouts?

- No waiting period – no waiting period life insurance is the preferred option for all funeral funding and burial plans, as it gives you immediate coverage with 100% payout of the funds from day one.

- Partial waiting period – These plans give you immediate partial coverage. The first 12 months of coverage will be 30 to 40% of the face amount, the following 13 to 24 months will be 60 to 70% of the face amount, and after 24 months, you will have 100% coverage.

- Two-year waiting period (or Modified waiting period) – The best plans offer immediate coverage if accidental death occurs, a return of premiums, 8 to 10% interest on these premiums if a death occurs in the first 24 months and a guaranteed payout of funds after 24 months.

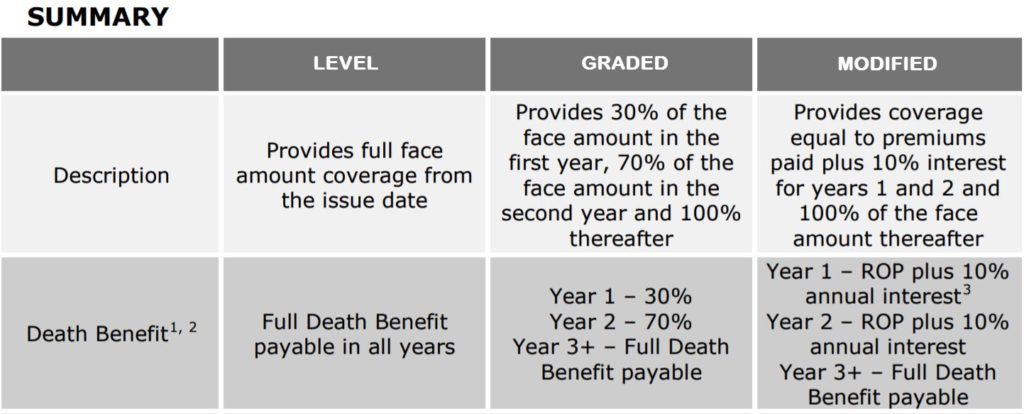

All insurance companies have different eligibility and waiting period criteria. Here is one example of an insurance company waiting period:

Best Features Of Burial Policies For Seniors

- Instant approval – There is fast approval for final expense insurance for seniors. The longest time you will ever wait for the application to be approved is in just a few business days, but most insurance companies offer instant approval.

- Lenient underwriting – Seniors with pre-existing conditions may still qualify for a guaranteed acceptance policy. There are relaxed underwriting requirements, and only a few health questions are asked of the applicants. No health questions are asked to qualify for guaranteed issue life insurance.

- No medical exam – All funeral insurance companies will not require you to undergo a medical exam. The application process is simplified. That means you only need to answer health questions and don’t even ask for it.

- No health questions – Some burial insurance policies for seniors do not ask health questions. Guaranteed acceptance policies are best for people with severe health conditions.

- The coverage is permanent – Burial policies for seniors are whole-life policies locked in for the duration of the policy. You are covered for life, and the coverage cannot decrease; it does not expire at any age. The premiums are leveled and do not increase.

- It has a cash value component – Burial insurance policies for seniors are a whole life with a cash value that grows over time. The cash value can be used to pay for premiums it acts as a safety net to ensure the policy never lapse from nonpayment.

- Fast payout – There is a quicker claims payout with burial insurance for seniors. The claim will be paid within a week once the proper paperwork is received.

- Small value options – Burial policies for seniors are offered at small face value. You can buy as little as $1,000, so you can buy as much or as little as you need.

- Portability – The payout for funeral insurance for seniors is in cash upon the insured’s death. The beneficiary will receive the full face amount of the policy, and they can use it as a final expense.

- Many insurance company options – Many carriers offer seniors burial policies. More and more insurance companies are offering insurance because more than 10,000 people are turning 65 each day. All of those are competing for your business which drives the prices of premiums down.

What Does A Burial Insurance Policy Cover?

Burial policies for seniors provide cash when the insured dies. The death benefit is given to the beneficiary depending on the policy terms and conditions.

Most seniors buy burial policies to pay for the funeral, memorial, gravesite, or cremation facility. The most important feature of these policies is that beneficiaries are not limited to how to spend the cash benefit.

Most of the time, the designated beneficiary takes care of the final wishes of the insured.

Some things need to be covered by the burial insurance policy these include:

- Loss of income

- Travel allowance and accommodation for loved ones from other places

- Food for the house funeral guest

Choosing The Right Coverage Amount

Selecting the amount of coverage for funeral insurance for seniors can be best done after assessing the current prices on the market for everything that will be needed for the funeral.

You should also consider the other cost that may be incurred, such as medical bills and any outstanding debts, and you must give room for unexpected expenses.

Suppose your primary objective is to simply pay for the final expenses such as cremation or burial, funeral service, and memorial service. In that case, you need to visit your nearest funeral home to get a better idea about the cost of each good and service.

Here are some average costs from the National Funeral Directors’ Association:

- Full-service Funeral – with burial and burial vault – $9,135

- Full-service Funeral and Cremation – $5,150

- Direct Cremation with Urn – $2,000

- Memorial Service (Varies)

What Services Are Included In A Standard Burial Coverage Policy?

Generally, the items covered by a standard burial policy for seniors are the following:

- Service Fees

- Facilities cost

- Funeral staff fees

- Embalming costs or Cremation costs

- Casket or urn

- Burial plot

- Headstone

- Digging and filling the grave

- Funeral hearse

- Flowers

Cost Of Burial Policies For Seniors

Burial policies for seniors pay for final expenses.

A senior in their 60s to 85 will be able to get coverage in most cases.

The overall cost of your burial insurance plan will depend on the following:

- What type of policy you choose, either a simplified issue or guaranteed acceptance

- The face amount you have chosen

- The insurance provider

- Age

- Gender

- Tobacco use

- Health condition

- Location

What Kind Of Burial Policies For Senior Should I Avoid?

TV AND MAGAZINE ADVERTISEMENTS – Most burial policies or final expense policies you see advertised on television or in magazines are sold as “the no-brainer way” to shop for this protection.

Just about everyone is eligible for immediate coverage and better pricing allowed by these heavily advertised policies that cost an arm and leg.

To make a long story short, it is better to shop for burial policies for seniors with a specialist in burial insurance, like FuneralFunds.com, than to sign up with a company that spends millions of dollars each month advertising on television and in magazines.

Increasing Price Policies

Those TV and magazine final expense policies may increase in price every five years.

These tricky television magazine ads will lure you with an attractive rate, only to have the cost of your insurance increase every five years until you cannot afford the premiums, then you must cancel your policy.

What happens after you cancel the policy? You’ll die and will have wasted all that money because you bought a policy that increases in price as you get older.

Why choose Funeral Funds for my burial policy?

Most life insurance agents are fine, respectable people.

However, some life insurance agents will sell you the easiest and most expensive policy possible.

The guaranteed issue agents claim you don’t even need to talk to an agent (but you will need to wait 2 years for your coverage to begin…even if you’re healthy). Answering a few health questions will often get you immediate coverage and MUCH BETTER RATES.

Avoid these people at all costs!

The rest of the life insurance agents, who are fine respectable people, are most often generalists.

They deal with all kinds of life insurance policies.

They are nice people but are not the logical choice if you want the best pricing and a burial insurance policy with no waiting period.

We work with 20+ final expense companies, so we can get you qualified for the best-priced plan to get folks like you immediate coverage when possible.

How Can Funeral Funds Help Me?

In reality, inexperienced and less knowledgeable insurance agents will cost you loads of money by selling you overpriced burial and final expense policies.

Our job at Funeral Funds is to be the most knowledgeable burial insurance expert available. By doing so, we can get you free life insurance quotes and affordable rates.

Once we know more about your age and health history, we can accurately give you burial insurance quotes from the final expense companies that best fit you.

With access to all the best final expense insurance companies, we will help you understand your best options, given your current age, health, and financial situation.

Additional Questions & Answers On Burial Policies For Seniors

Can senior citizens get life insurance?

Yes, most insurance companies offer life insurance policies to seniors. Many insurers have special life insurance products designed specifically for older adults.

What is the purpose of burial insurance?

Burial insurance is life insurance designed to cover your funeral and burial expenses.

Can I get life insurance at age 60?

You can get life insurance if you are 18-85 years old.

Can I get burial insurance without a medical exam?

In many cases, you can get burial insurance without a medical exam.

Can you get a first-day coverage plan if you are a senior citizen?

Yes, there are first-day coverage life insurance policies available for seniors. These policies are designed to provide coverage on the first day of the policy without the need for a medical exam.

Can seniors qualify for no exam life insurance?

Yes, seniors can qualify for no-exam life insurance policies (and you can even get 1st-day coverage!)

Can a 60 year old get life insurance without a medical exam?

Many different life insurance options are available for seniors, including no exam policies that only ask health questions.

What is burial insurance for seniors?

Burial insurance for seniors is a life insurance policy that is specifically designed to cover the costs of funeral and burial expenses. These policies are often available with no medical exam required.

What is the best life insurance for seniors?

The best life insurance for seniors will vary depending on the individual’s needs and budget.

Can seniors over 80 get no medical exam insurance?

Yes, seniors over 80 can get no medical exam insurance policies. These policies are available through many different insurers.

What is the maximum age to apply for burial insurance?

The typical maximum age to apply for burial insurance is 85 years old. Once approved, your policy will remain active until you are 121 years old.

How does burial insurance for seniors work?

For seniors, burial insurance provides coverage for final expenses, such as funeral and burial costs. These policies typically do not require a medical exam.

What is the best burial insurance for seniors?

There is no single best burial insurance for seniors, as the best option will depend on your individual needs and budget.

Is burial insurance for seniors right for me?

Burial insurance for seniors may be right for you if you are looking for a life insurance policy to cover your funeral and burial expenses. These policies do not require a medical exam and are available through various insurers.

At what age does burial insurance expire?

Burial insurance policies typically do not expire. Once approved, your policy will remain active until you are 121 years old.

What is the best burial insurance for seniors with high cholesterol?

There is no one “best” burial insurance for seniors with high cholesterol, as the best option will depend on your individual needs and budget.

Is funeral insurance a good thing for seniors?

Funeral insurance can be a good thing for seniors, as it can help cover the costs of funeral and burial expenses.

How much does burial insurance cost?

Burial insurance costs depend on age, gender, location, coverage amount, and health.

What is the best burial insurance for seniors over 60?

The best burial insurance for seniors over 60 will vary depending on the individual’s needs and budget.

Can you pay monthly for burial insurance?

All insurers will allow you to pay monthly for your policy.

What do I need to know about burial insurance?

When considering burial insurance, it is important to understand that these policies cover your funeral and burial expenses.

Can I buy burial insurance at age 75?

Yes, it is possible to buy burial insurance at age 75.

How does burial insurance work?

Burial insurance works by providing you with financial protection if you pass away. This coverage is usually used to pay for funeral and burial expenses.

Can I get burial insurance for a senior family member?

Yes, you can get burial insurance for a senior family member. These policies are available through many different insurers.

Does burial insurance have cash value?

Burial insurance policies are whole life insurance that accumulates cash value.

How many burial insurance policies can a senior have?

A senior can have multiple burial insurance policies if they choose to do so as long as they can pay the premiums on time.

What is the best way to get burial insurance?

The best way to get burial insurance is to work with a qualified life insurance agent from Funeral Funds who can compare quotes from multiple insurers and find the policy that best meets your needs.

What is the average cost of burial insurance?

The cost of burial insurance will vary depending on your age, gender, location, and health.

What are some of the benefits of having burial insurance?

Some of the benefits of having burial insurance include peace of mind, knowing that your loved ones will not have to bear the burden of your funeral and burial expenses, and the ability to choose your final resting place.

What do I need to know about burial insurance?

When considering burial insurance, it is important to understand that these policies cover your funeral and burial expenses.

How much does burial insurance cost per month?

The cost of burial insurance will vary depending on age, gender, location, and health.

What is the minimum amount of coverage for burial insurance?

Most burial insurance policies have a minimum starting amount for coverage of $2,500.

What is the maximum amount of coverage for burial insurance?

The maximum amount of coverage for burial insurance will vary depending on the insurer but is typically around $25,000-$50,000 (depending on your age).

What is the best age to buy burial insurance?

The best age to buy burial insurance is as early as possible and before you have any significant health problems.

12 Comments

Vern

I don’t need a grand service and I’m just looking to take out a modest plan. How much monthly premium would that cost me? Thanks.

Funeral Funds

Vern,

We would need to know your age to help you find the best plan. Give us a call and we will get you the information you need.

Funeral Funds

Sandra

I’m nearly 74 years old and I also have some health issues. Can I still apply for a burial insurance?

Funeral Funds

Sandra,

Most of the people we help have some health issues and qualify for affordable and immediate coverage. Call us and we can help you apply for the policy you are seeking.

Funeral Funds

Will

I need one. How do I find an affordable policy in my area? I’m in the Reunion District.

Funeral Funds

Will,

We are licensed in most States. We can certainly help you out anywhere you live. Give us a call and we will help you understand what you qualify for.

Funeral Funds

Jamie

I want to buy burial insurance for my parents but they’re not keen on it. They’re both in their 70s. Do I need their consent for this?

Funeral Funds

Jamie,

We applaud you for looking into purchasing life insurance for senior parents. Many parents want to feel independent and in control of the process. Give us a call and we would be happy to hop on the phone with you and your parents to help them with their comfort level.

Funeral Funds

Donna

What are the inclusions of a standard burial coverage and how long are the terms? Thank you.

Funeral Funds

Donna,

You have many options for burial coverage. Burial coverage policies have no expiration date. Term policies are not appropriate for burial policies for a senior. Take a look at this post to better understand your options. https://funeralfunds.com/burial-insurance-with-no-waiting-period/

We are always here if you would like to call us and ask questions.

Funeral Funds

Derek McDoogle

I like how you explain that funeral insurance can help protect the loved ones from unexpected costs and debts associated with the funeral and burial. My dad talked to me about what would happen if he passes away and my mom does not have the money to get him buried. I will suggest to him to look for funeral insurance so that he can have peace of mind.

Funeral Funds

Derek – We are glad you found this information helpful!