2024 Burial Insurance and Suicide

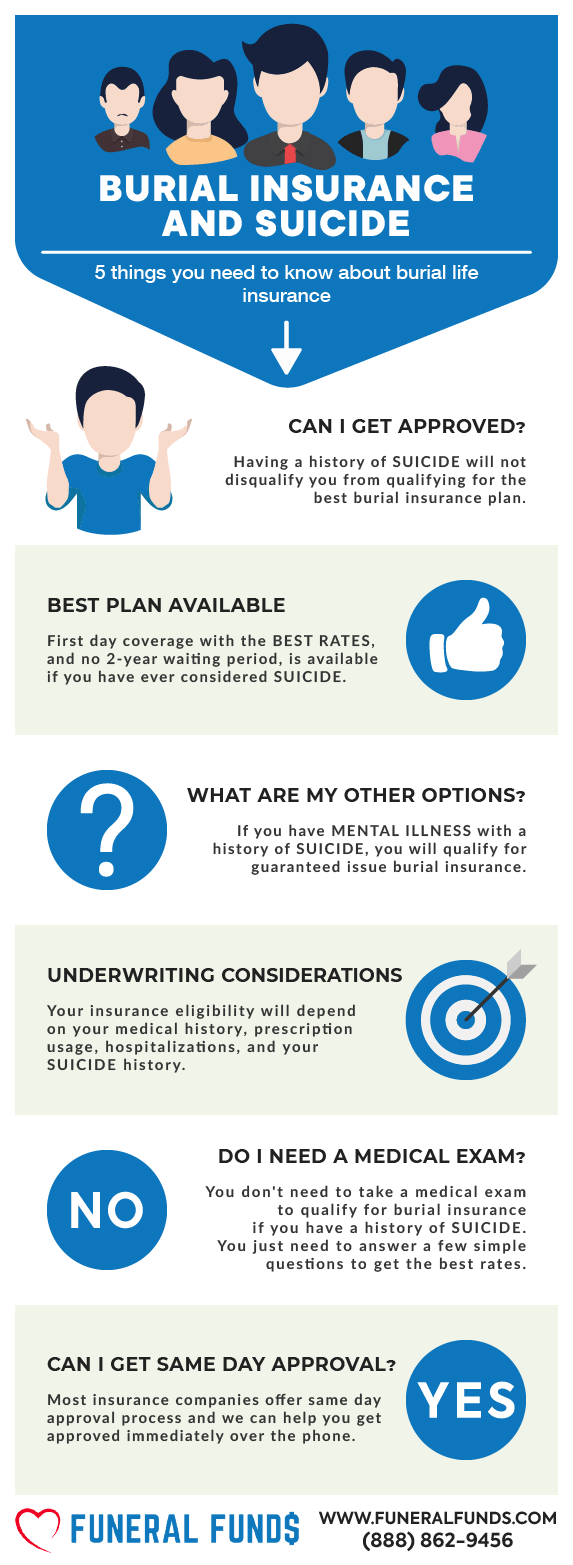

Having a history of a suicide attempts will not prevent you from securing affordable burial insurance. So, if you have a history of attempted suicide you can still qualify for the best plan and lowest rates.

All insurance policies have a suicide clause written into their terms and conditions, excluding suicide during the first two years.

In this article, we’ll cover everything you need to know about burial insurance and suicide to help you understand if the insurance provider will pay the death benefit to your beneficiary when the cause of death is suicide.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Suicide?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Suicide Attempts, Do I Need a Medical Exam to Qualify for Burial Insurance?

- Understanding Burial Insurance and Suicide

- Is A Suicide Clause and Contestability Clause the Same?

- Why Do Insurance Companies Put a Suicide Clause and Contestability Clause?

- Does Burial Insurance Cover Suicide?

- Does Burial Insurance Cover Doctor-Assisted Suicide?

- Burial Insurance Underwriting If You Have a History of Suicide

- How Much Insurance Do I Need If I Have Suicide Attempts?

- How Should I Pay My Premiums?

- Suicide and Burial Insurance Riders

- What to Do If Your Claim Was Denied?

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance with Suicide Attempts

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance And Suicide

What Is My Best Insurance Option If I Have A History Of Suicide?

Most life insurance companies don’t ask about suicide or suicide attempts on the underwriting questionnaire. So, if you have a history of suicide, you can still qualify for a level death benefit plan with first-day coverage.

With a level death benefit plan, you will be covered from the first day, and your beneficiary will receive your full death benefit when you pass away.

Best Option: Level death benefit plan with first-day coverage

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Suicide Attempts, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance with suicide attempts.

When you apply for burial insurance, you only have to answer basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

Understanding Burial Insurance And Suicide

Does life insurance pay for suicidal death?

SUICIDE CLAUSE

The suicide clause states that no death benefit will be paid to the beneficiary if the insured commits suicide within a year to two years of taking out a policy.

Insurance companies can investigate claims during the waiting period and deny coverage for intentional death. If the company can demonstrate intentional death or the death was due to suicide, the policy will be denied, and the beneficiary’s claim will be denied.

Life insurance companies will pay the death benefit as long as the policy was purchased at least two before the suicide; after the waiting period, the suicide clause expires.

Whenever an insured replaces an existing life insurance policy with a new one, the suicide clause reverts back to zero and starts over again.

If you have two policies and switch to a single policy with a bigger death benefit, even with the same insurance company, your suicide clause and a waiting period will start again.

Is A Suicide Clause And Contestability Clause The Same?

The suicide clause and contestability clause are not the same (although the period is the same). While the period is the same, the contestability clause is broader in scope.

The contestability clause addresses other events that may cause a claim to be denied during the waiting period.

Reasons that may cause a claim to be denied:

- Suicide

- Misrepresentation of information

- Death during an illegal act

- Potential alcohol and drug abuse

Here’s an example of how you will see the suicide clause written in the fine print:

- “We will not pay the Net Proceeds if the Insured dies by suicide, while sane or insane, within 2 years from the date coverage is issued. Instead, we will refund all the premiums paid for this policy minus any outstanding policy loans. Any increase in the Face Amount will start the suicide exclusion provision anew but will apply only to the amount of the increase in face amount.”

Here’s an example of how you will see a contestability clause written on the fine print:

- “We reserve the right to contest the validity of this insurance policy, or the payment of the Death Benefit or any other insurance policy benefits, if the Insured under this insurance policy have incorrectly stated, misrepresented, or failed to disclose relevant information in the insurance application, or on the medical exam, or in any written or electronic statements or responses you provided as evidence of insurability.

- Except in the case of fraud, we will not contest this insurance policy for misrepresentation after it has been in force for two years during the lifetime of every Insured, from the Coverage Date or the last date of reinstatement. If the Designated Insured dies during this two-year period, we can contest at any time.

- When there is an indication of fraud or misrepresentation, we can declare this insurance policy void at any time. Fraud includes but is not limited to any material misrepresentation of the smoking habit of the Insured. We will not refund the premiums paid if the insurance policy is declared void due to fraud.”

Why Do Insurance Companies Put A Suicide Clause And Contestability Clause?

Life insurance companies include the suicide clause and contestability clause to protect them financially.

The Contestability clause allows the insurance companies to void coverage in some instances, such as if it were given inaccurate information or the insured committed fraud during the insurance application.

The suicide clause protects the company from paying claims if the insured intended to kill himself and leave money to their beneficiary.

If the insured’s family is in a desperate financial situation, finding any benefit to end their life may push them to commit suicide. Insurance companies want to minimize this risk by including the suicide and contestability clauses.

By requiring two years to pass after the purchase of the policy, life insurance companies have a lower risk of having the insured kill themselves to provide insurance money for their family.

The two-year waiting period also provides more time for the suicidal policyholder to get the medical and mental help they need before paying a claim.

Does Burial Insurance Cover Suicide?

Life insurance companies cover suicide after the first two years or the waiting period. The company will pay for suicide unless another exclusion is specifically outlined in the policy that forbids it.

Insurance companies don’t cover suicide within the first two years of the policy, but they may refund all the premiums paid.

There is insurance coverage if the insured:

- Was insured for an individual policy that went into effect after two years or longer (one year in some states)

- Had free life insurance through work that the employer pays

- Purchased coverage through work, which went into effect more than two years ago.

Does Burial Insurance Cover Doctor-assisted Suicide?

Doctor-assisted suicide is also called death with dignity or right to die. It involves people with terminal illnesses who choose to die rather than suffer through treatment or diminished quality of life.

Doctor-assisted suicide would also fall under the same suicide clause – death would not be covered during the first two years of the policy.

After the suicide and contestability period has expired, the company would pay for doctor-assisted suicide. However, you should consult your policy documents to make sure there are no exclusions that would negate your policy.

For example, an illegal activity could prevent your family from receiving the death benefit payout if you died from doctor-assisted suicide if it does not comply with your state regulations.

There are only 10 states, plus Washington, D.C, where doctor-assisted suicide is legal:

- California

- Colorado

- District of Columbia

- Hawaii

- Maine

- Montana

- New Jersey

- New Mexico

- Oregon

- Vermont

- Washington

Burial Insurance Underwriting If You Have A History Of Suicide

During the underwriting process, life insurance companies will look at the applicant’s health and health history to determine how risky he or she will be to insure. They will also review how likely the applicant will die prematurely during the policy.

Burial insurance companies have two ways of underwriting:

FIRST – They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

SECOND – They will electronically review your prescription history to verify your health.

Depression is a risk factor for suicide, and this condition should be disclosed during the application. Insurance policies with health questions may ask about when you were first diagnosed with depression and its severity.

You may also be asked to disclose the treatment and medication you use to qualify for coverage.

How Much Insurance Do I Need If I Have Suicide Attempts?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Suicide And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while others can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

What To Do If Your Claim Was Denied?

Insurance companies may contest a life insurance claim if they believe the insured died from suicide during the suicide clause waiting period.

They will typically put off paying a claim until law enforcement or medical examiner rules how the insured died, but in most cases, they will conduct their investigation.

In these cases, the life insurance company will look for:

- The death certificate

- Hospital reports

- Autopsy report

- The insured’s medical history, including records of psychiatric care and medications

- Anything that could be considered a suicide note

- Any evidence of drug or alcohol abuse or illegal behavior

- Testimony from family, friends, or witnesses

The insurance company must provide proof to demonstrate that the insured died due to suicide. The company can deny payment, and beneficiaries must contest the claim denial to receive a death benefit.

If your insurance claim was denied and you believe the company’s reason to be incorrect, you may need to bring legal action to receive a payout. You must contest the life insurance company’s decision to receive a settlement.

If you disagree with the company’s decision to deny a claim due to suicide, you must consult your state’s laws. Many states have protections in place for the beneficiaries.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance With Suicide Attempts

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan and suicide

- Cremation insurance plan and suicide

- Funeral home insurance plan and suicide

- Final Expense insurance plan and suicide

- Prepaid funeral plan insurance and suicide

- Mortgage payment protection plan and suicide

- Mortgage payoff life insurance plan and suicide

- Deceased spouse’s income replacement plan and suicide

- Legacy insurance gift plan to family or loved ones and suicide

- Medical or doctor bill life insurance plan and suicide

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Finding a policy if you have a history of suicide needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the work for you.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies and match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for suicide funeral insurance, or suicide burial insurance, or suicide life insurance. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate final expense insurance quote.

Additional Questions & Answers On Burial Insurance And Suicide

Does life insurance cover suicide?

Most policies have a suicidal exclusion clause that voids the policy if the insured commits suicide within a certain period of time (usually two years). After 2 years, suicide would be covered by most companies.

Does life insurance pay for suicidal death?

In some cases, yes. Many life insurance policies include coverage for death by suicide, and these claims may be eligible for payment. However, certain conditions must be met in order for this to occur. For example, many policies have an exclusionary period following the purchase of the policy before they will cover death by suicide. Additionally, some policies may exclude coverage for suicides that occur within a certain time frame after the policy is purchased (usually two years).

Does life insurance cover overdose?

In most cases, yes. Life insurance policies typically cover death by overdose. However, there are certain conditions that must be met in order for this to occur. For example, many policies have an exclusionary period following the purchase of the policy before they will cover death by intentional overdose or suicide.

What does the suicide clause mean?

A suicide clause is a provision in a life insurance policy that voids the policy if the insured commits suicide within a certain period of time (usually two years). This clause protects the life insurance company from paying out on a claim in the event of an insured’s death by suicide.

What is the waiting period for life insurance coverage following suicide?

The waiting period will vary depending on the policy and the state in which it was purchased. In most cases, a two-year waiting period is common following the purchase of a policy.

Is the suicide clause and contestability clause the same?

No. The suicide clause is a provision in a life insurance policy that voids the policy if the insured commits suicide within a certain period of time (usually two years). The contestability clause is a provision in a life insurance policy that allows the insurer to investigate the circumstances surrounding the insured’s death and refuse to pay the death benefit if it is determined that the insured died under suspicious circumstances.

Do I need a medical exam to qualify for burial insurance with a history of suicide?

No. You do not need a medical exam to qualify for burial insurance with a history of suicide.

Why do insurance companies put a suicide clause?

The suicide clause is designed to protect the life insurance company from paying out on a claim in the event of an insured’s death by suicide.

Does burial insurance pay for suicidal death?

Many life insurance policies include coverage for death by suicide. However, certain conditions must be met in order for this to occur. For example, many policies have a two-year exclusionary period following the purchase of the policy before they will cover death by suicide.

Does a history of self-harm affect life insurance?

A history of self-harm may impact your eligibility for life insurance coverage, depending on the severity and frequency of the incidents. The underwriting process will take your individual circumstances into account in order to determine whether or not you are eligible for coverage, as well as the terms of the policy.

Does burial insurance cover doctor-assisted suicide?

In most cases, yes. Burial insurance typically covers doctor-assisted suicide, as long as the policy had been active for two years or longer.

What are the benefits of burial insurance for people who had suicide attempts?

There are many benefits of burial insurance for people who have attempted suicide. Burial insurance can provide financial security for your loved ones in the event of your death, and it can also help to cover the costs of your funeral and burial. Burial insurance can also provide peace of mind knowing that your loved ones will be taken care of financially if you were to unexpectedly pass away.

What is the best insurance option if I have a history of suicide?

The best insurance option if you have a history of suicide will depend on your individual circumstances and needs. In general, burial insurance is often considered to be the best option for people with a history of suicide, as it can provide financial security for your loved ones in the event of your death.

Can I qualify for first-day coverage insurance if I have a suicide history?

First-day coverage insurance is available to people with a history of suicide.

Does final expense life insurance pay for suicidal death?

In some cases, yes. Final expense life insurance typically covers death by suicide. However, certain conditions must be met in order for this to occur. For example, many policies have a two-year exclusionary period following the purchase of the policy before they will cover death by suicide.

Does a suicide attempt in the past affect life insurance?

A suicide attempt in the past may impact your eligibility for life insurance coverage, depending on the severity and frequency of the incident. The underwriting process will take your individual circumstances into account in order to determine whether or not you are eligible for coverage.

Do I pay more premium if I had a history of suicide?

Often your premium may not be affected if you have a history of suicide.

What is the waiting period before insurance pay for suicide?

The waiting period is typically two years. The policy will not pay out if a suicide happens before two years. If a suicide occurs after two years, the policy will pay out.

Does funeral insurance pay for suicidal death?

In some cases, yes. Funeral insurance typically covers death by suicide. However, certain conditions must be met in order for this to occur. For example, many policies have a two-year exclusionary period following the purchase of the policy before they will cover death by suicide.

Will life insurance pay out in case of doctor-assisted suicide?

In most cases, yes. Life insurance typically covers doctor-assisted suicide, as long as the policy had been active for two years or longer.

What are the states that allowed doctor-assisted suicide?

- California

- Colorado

- District of Columbia

- Hawaii

- Maine

- Montana

- New Jersey

- New Mexico

- Oregon

- Vermont

- Washington

What types of death are not covered by life insurance?

A few types of death are typically not covered by life insurance, such as death by suicide, natural causes, or accidents that occur while the policyholder is under the influence of drugs or alcohol. However, each life insurance policy is different, so it’s important to read the fine print to see what is and is not covered.

What happens if I die by suicide within the first two years of my life insurance policy?

If you die by suicide within the first two years of your life insurance policy, the death benefit will not be paid out. However, your beneficiaries may still be able to receive the return of premiums paid, minus any fees.

When does life insurance cover suicide?

Most life insurance policies will cover suicide after an exclusionary period of two years.

What does the suicide provision say?

The suicide provision is a life insurance policy section that outlines the conditions under which death by suicide will be covered. It typically includes an exclusionary period of two years, after which death by suicide will be covered.

Does life insurance cover death with dignity?

Some life insurance policies may cover death with dignity, depending on your policy’s specific terms and conditions. Typically, this will only apply if the policy has been active for two years or longer.

How do life insurance payouts work for suicide?

If you die by suicide while your life insurance policy is active, your beneficiaries will generally be able to receive the death benefit. However, there may be a waiting period of two years before the death benefit is paid out.

Does cremation insurance pay for suicidal death?

Cremation insurance typically covers death by suicide. However, there are certain conditions that must be met in order for this to occur. For example, many policies have a two-year exclusionary period following approval.

Will I be denied life insurance if I have depression and a suicide attempt?

You may be denied life insurance if you have depression and a history of suicide attempts. However, each case is different, and it will depend on the insurer’s individual underwriting criteria. It is recommended that you work with a qualified life insurance agent to help you find a policy that meets your needs.

How does doctor-assisted suicide affect life insurance payouts?

In most cases, doctor-assisted suicide is covered by life insurance. However, there may be a waiting period of two years before the death benefit is paid out.

What is the difference between natural causes and suicide?

Natural causes are death that occurs due to illness or injury that is not self-inflicted. Suicide, on the other hand, is self-inflicted death.

How do suicide clauses work?

A suicide clause is a section of a life insurance policy that outlines the conditions under which death by suicide will be covered.

How does an insurance company know if someone died by suicide?

An insurance company will typically require a death certificate to determine the cause of death. If the death certificate lists suicide as the cause of death, the insurance company may conduct its own investigation to confirm this.

Can insurance contest a life insurance payout if they suspect suicide?

Yes, insurance companies can contest a life insurance payout if they suspect suicide. However, they will typically require proof in order to do so.

Does life insurance cover physician-assisted suicide?

In most cases, physician-assisted suicide is covered by life insurance. However, there may be an exclusionary period of two years before the death benefit is paid out.

What is the difference between active and passive euthanasia?

Active euthanasia is when someone takes steps to end another person’s life, such as by administering a lethal dose of medication. Passive euthanasia is when someone allows another person to die naturally from an illness or injury, such as by withholding life-saving treatment.

Does life insurance cover drug overdose or alcohol?

In most cases, drug overdose and alcohol poisoning are covered by life insurance. However, there may be an exclusionary period of two years before the death benefit is paid out.

How do you prevent a denied life insurance claim after suicide?

The best way to prevent a denied life insurance claim after suicide is to work with a qualified life insurance agent. They can help you find a policy that meets your needs and can provide guidance on the best way to proceed.