Burial Insurance With An Aneurysm

You can qualify for first-day coverage burial insurance with an aneurysm history depending on your zip code. Yep, you heard that right – no need to wait around.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with an aneurysm, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Aneurysm?

An aneurysm is basically your artery throwing a tantrum, bulging out like it’s had one too many. Arteries are those tubes carrying oxygen-rich blood from your heart to the rest of your body. When one of these arteries gets a weak spot, it can start to balloon out, and that’s what we call an aneurysm.

Aneurysms can pop up anywhere, but they love to hang out in the aorta – your body’s biggest blood highway. They can also crash the party in your brain, legs, intestines, and kidneys.

There are two main types of aneurysms:

- Saccular aneurysms: These are like little bubbles on the side of an artery, the most common type.

- Fusiform aneurysms: These ones don’t mess around – they stretch out the whole artery.

Most aneurysms are like that quiet person in the room, causing no symptoms at all. But if they get too big, they can start causing trouble, like pain. And if they burst? We’re talking serious, life-threatening bleeding.

If you’re dealing with an aneurysm, your doc will pick the best game plan – whether it’s meds, surgery, or something less invasive. And yes, insurance companies do give aneurysms the side-eye, especially if they’re untreated. But hey, you can still score some coverage, so don’t stress too much!

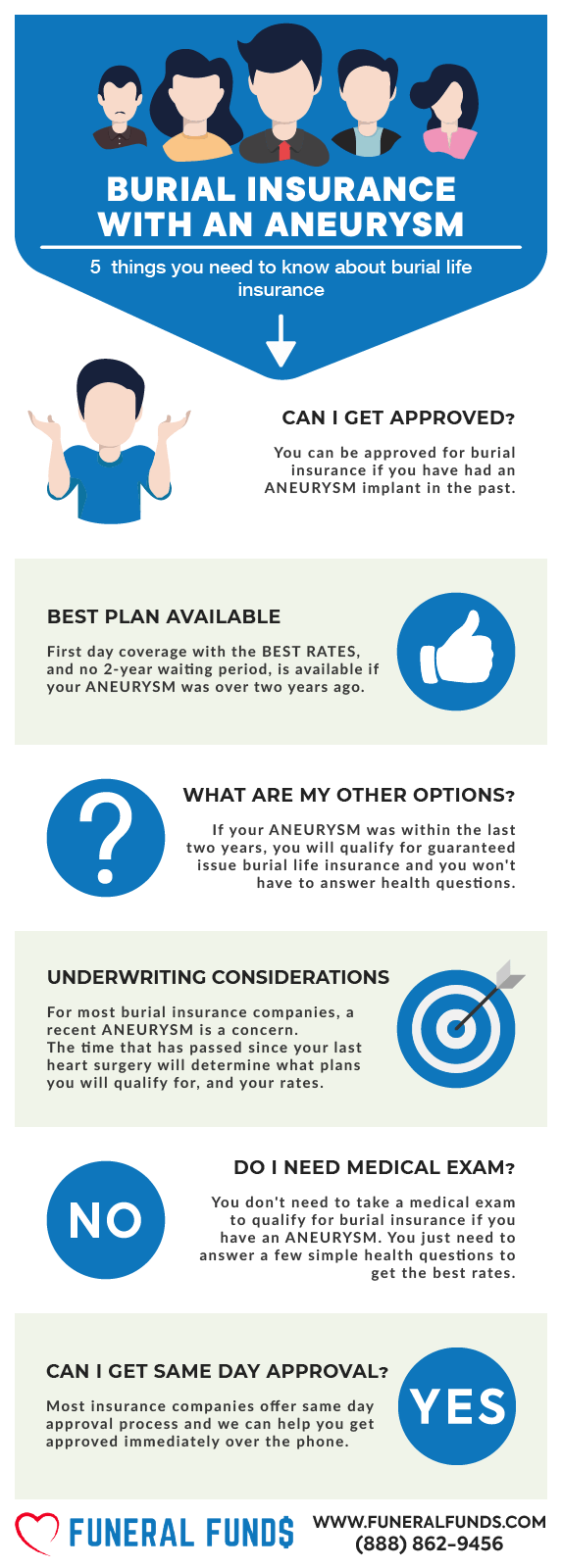

Can I Get Burial Insurance With Aneurysm?

YES: You can totally get first-day burial insurance coverage with no waiting period – just depends on what plans are available in your state.

NO: If you’ve played hard to get with your meds or treatment in the last decade, or if some picky insurance companies aren’t in your state, then first-day coverage might not be in the cards.

Types Of Burial Insurance For People With Aneurysm

FIRST-DAY COVERAGE – This is the gold standard. You’re covered from day one, no waiting around. Your loved ones get the full payout when you pass away, no strings attached. Plus, it’s way cheaper than that guaranteed issue life insurance.

GUARANTEED ISSUE LIFE INSURANCE – No medical exam, no health questions, and no judgment. You’re approved no matter what. The catch? There’s a mandatory two-year waiting period. If you kick the bucket during that time, your beneficiaries will only get the premiums you paid plus some interest (usually 7-10%).

What Is My Best Insurance Option If I Have Aneurysm?

If you’ve been diagnosed, treated, or advised to get treatment for an aneurysm, your best bet is a first-day coverage plan.

There’s even a company that’ll hook you up with first-day coverage as long as you haven’t been hospitalized twice or more in the last two years. If they’re in your state and you meet the criteria, you’re golden!

But if you’ve been advised to get treatment or surgery and you’ve been playing the rebel card by refusing, then your best option is a guaranteed issue whole life insurance with that pesky two-year waiting period.

Do I Need A Medical Exam To Qualify For Burial Insurance?

Nope, no medical exams, blood tests, or urine samples required for burial insurance.

The top first-day coverage company for folks with aneurysms only asks a few health questions – you’ll be approved faster than you can say “insurance.”

Not feeling the health questions? No worries! You can go for guaranteed issue life insurance, but brace yourself for that two-year waiting period.

How Much Does Burial Insurance Cost?

The cost of burial insurance depends on a few factors:

- Age

- Coverage amount

- Gender

- General health

- State of residence

- Smoking status

- Type of policy

Pricing example for a generous 60-year-old female with an aneurysm:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a resourceful 60-year-old male with an aneurysm:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Have an Aneurysm

Here’s how some insurance companies ask about aneurysm on the insurance application:

- During the past 24 months, have you been diagnosed with angina, aneurysm, or heart attack or failure?

- Within the past 2 years, have you had or been diagnosed with a brain tumor or aneurysm?

- Within the past 24 months, have you been medically diagnosed with an aneurysm or brain tumor?

Insurance companies get a little nosy when it comes to aneurysms. They might ask about the type of aneurysm you’ve had, like:

- Abdominal aortic Aneurysm – occurs near the abdomen or pelvic area

- Cerebral Aneurysm – occurs in the brain

- Mesenteric artery Aneurysm – occurs in the intestine

- Popliteal artery Aneurysm – occurs in the leg behind the knee

- Splenic artery Aneurysm – occurs in the artery in the spleen

- Thoracic Aortic Aneurysm – occurs in the major artery of the heart

Information We Need if You Have an Aneurysm

To get you the best plan, we might ask a few questions like:

- Did your aneurysm rupture?

- Do you have other health issues related to your aneurysm?

- Have you had surgery or treatment to correct an aneurysm?

- Have you undergone any tests related to your aneurysm recently?

- How long have you been living with an aneurysm?

- Was your aneurysm operable?

- What prescription medications do you take to treat your aneurysm?

- When did you know you had an aneurysm?

- Where is the location of your aneurysm?

What If I’m Denied Life Insurance Because of My Aneurysm?

If you get a rejection letter, don’t panic. It might just be that you applied with the wrong company or you have other health issues in the mix.

If you’re generally healthy and still got denied, we’ll help you find a company that gets it. We’ll make sure you land the best burial insurance plan and pricing out there.

How To Get First-day Coverage With Aneurysm

Got an aneurysm and need burial insurance that kicks in on day one? No problem! The secret sauce is working with an independent agency like Funeral Funds. Our agents are pros at comparing companies that offer first-day coverage and can hook you up with the best plan at the best price – no stress, just results.

How To Apply For Burial Insurance With Aneurysm

- Consult with an Independent Insurance Agent – Get in touch with an independent insurance agent from Funeral Funds who knows the ins and outs of aneurysm underwriting. They’ll guide you through your options, compare quotes, and help you nail down the perfect burial insurance plan.

- Complete the Application Honestly – When it’s time to fill out that application, spill the tea. Be upfront about your health, treatments, and any lifestyle changes. Honesty is your best policy here.

- Review and Confirm Policy Details – Before you say yes, take a close look at the policy terms. Make sure it covers what you need and fits your budget like a glove.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re all about getting you covered – even with an aneurysm history. We’ve got connections with A+ rated insurance companies that specialize in high-risk clients. We’ll do the heavy lifting, searching for the best rates and matching you with the top life insurance options out there.

We’ll make sure you get the coverage you need at a price that won’t break the bank. So, if you’re on the hunt for burial insurance, especially with an aneurysm, we’ve got your back. Just fill out our quote form and let’s get started!

Frequently Asked Questions

What types of aneurysms do the life insurance companies want to know about?

They’re curious about the whole gang: abdominal aortic, cerebral, mesenteric artery, popliteal artery, splenic artery, and thoracic aortic aneurysms. Basically, if it’s an aneurysm, they want the deets.

What are the chances of getting life insurance with an aneurysm?

Pretty darn good! If you apply with the right company, most folks with aneurysms can score first-day coverage, burial life insurance, or final expense insurance. So, don’t count yourself out.

Is an aneurysm a pre-existing condition for life insurance?

Yup, it sure is. An aneurysm – or any health issue you’ve had before applying – counts as a pre-existing condition in the insurance world.

Is there an age limit for burial insurance with an aneurysm?

Yes, there is! You can apply for burial insurance with an aneurysm until you hit 89. Once you’re in, your policy is good until you’re 121 – talk about long-term coverage!

Do I need to tell insurance about an aneurysm?

If they ask, you spill. Honesty is the best policy when they’re grilling you about health questions, including aneurysms.

Can you be denied insurance for an aneurysm?

Unfortunately, yes. Some companies might give you the cold shoulder if you’ve had recent surgery or a medical event related to an aneurysm.

How can you get the best life insurance rates with an aneurysm?

Team up with an independent insurance agent from Funeral Funds – they’re your secret weapon. They’ll help you shop around, compare policies, and land the best coverage at the best rates, aneurysm and all.