Burial Insurance With Emphysema

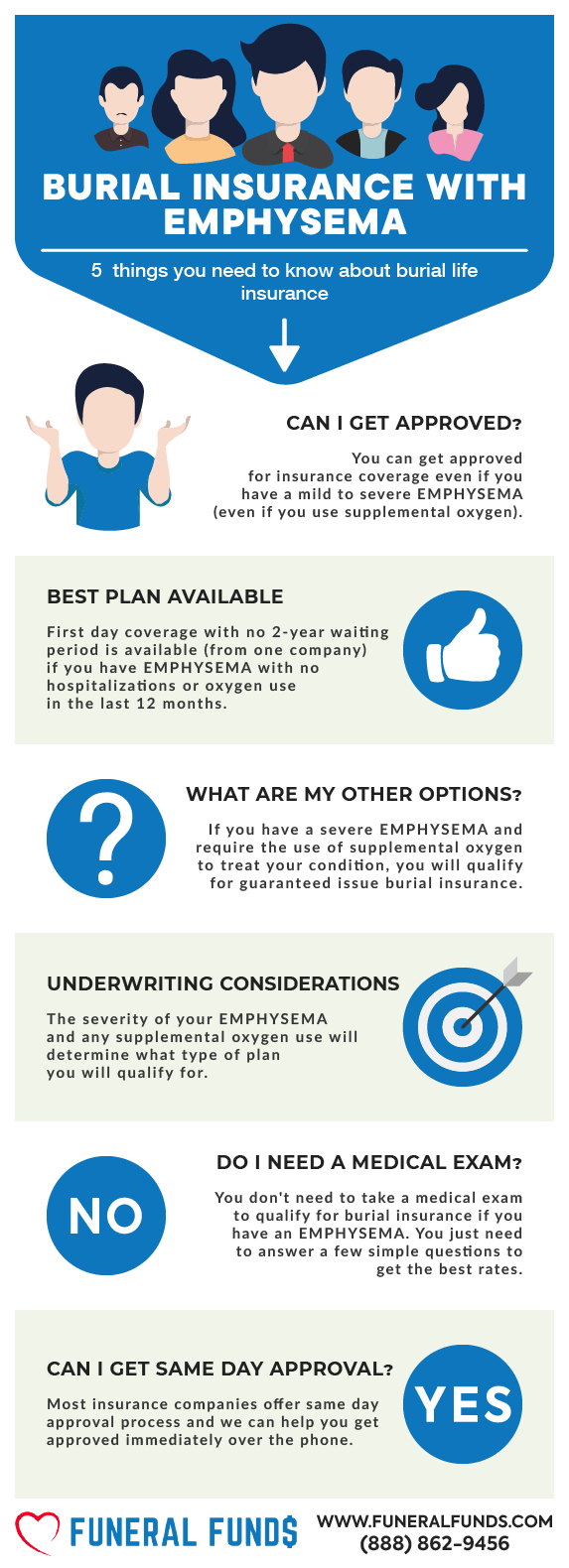

You can snag burial insurance if you have emphysema and if the stars align with the right insurers in your state, you might even get first-day coverage.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with COPD, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Emphysema?

Emphysema is that pesky lung disease that messes with your breathing. It wrecks those tiny air sacs (alveoli) in your lungs that get oxygen into your blood. When they’re shot, they lose their bounce and can even pop, making it tough to catch your breath.

Think of alveoli like little balloons. Breathe in; they puff up; breathe out, and they deflate. With emphysema, those balloon walls get trashed, making it hard to inflate and deflate, trapping air in your lungs and cutting down your oxygen supply.

Getting life insurance with emphysema can be a bit of a hassle, and it’ll probably hike up your premiums. How bad your emphysema is will play a big role in your insurability and the cost of your policy.

Can You Get Burial Insurance With Emphysema?

Absolutely, even if you’re rocking oxygen equipment, a first-day coverage policy is within reach – just pick the right insurance company.

And, remember, burial insurance isn’t just for burials. It can cover cremation, final expenses, or even stand in for life insurance.

What is My Best Insurance Option If I Have Emphysema?

STAGE 1 – MILD EMPHYSEMA – If your emphysema is under control, you might snag a first-day coverage insurance policy with the right company. No waiting period – you’re fully covered from day one, and your beneficiaries get 100% of the death benefit when you’re gone.

STAGE 2 – MODERATE EMPHYSEMA – Dealing with moderate emphysema? If you’re on meds for treatment, you could still qualify for a first-day coverage plan. Some insurers even offer this coverage if you’re using supplemental oxygen.

STAGE 3 – SEVERE EMPHYSEMA – Rocking severe emphysema and on oxygen 24/7? You might still score a first-day coverage plan, depending on the state you live.

Not qualifying for first-day coverage? No worries! Guaranteed issue life insurance is your backup. GI policies accept folks with major health issues who can’t get traditional term life insurance. There’s a two-year waiting period, but if you pass away during that time, your beneficiary gets all the premiums you paid plus 7-10% interest (depending on the company).

Do I Need A Medical Exam for Emphysema Burial Insurance?

Nope, no medical exam required! With simplified underwriting, all you need to do is answer a few easy health questions to qualify for burial insurance with first-day coverage.

There are even plans that skip the health questions entirely, but watch out – they’re pricier and come with a 2-year waiting period. We don’t recommend these due to the higher cost and wait. Check out the best and worst companies later in this article.

Burial Insurance Rates For Emphysema Patients

Your burial insurance rates will depend on a few juicy details like:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

- Overall health

Here’s the deal: The younger you are, the cheaper your rates. But if you’re older and your health’s taken a hit, expect those life insurance rates to climb.

Here’s a quick look at the pricing for a mindful 60-year-old woman with emphysema using continuous oxygen:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a quick look at the pricing for a committed 60-year-old man with emphysema using continuous oxygen:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Go with Superior Choice if you want the best deal. They offer first-day coverage with no waiting period and a lower premium compared to those other, pricier options with a long wait.

Burial Insurance Underwriting For Emphysema

Every life insurance company offering first-day coverage wants to know if you’ve got emphysema.

You’ll often see these questions about emphysema on the health questionnaires:

- Have you been told, been treated for, or advised to receive treatment or medication for Emphysema or lung disease?

- During the past 24 months, were you diagnosed with emphysema or chronic obstructive pulmonary disease?

- Have you ever been diagnosed with or received treatment or medication for emphysema, chronic obstructive pulmonary disease, or chronic bronchitis?

- In the past 10 years, have you opted not to seek treatment, have not taken medication, or have not followed the prescribed treatment plan following a medical diagnosis by a member of the medical profession for lung disease, including COPD and emphysema?

Insurance companies will also snoop through your prescription history to double-check your answers.

Here’s a list of common emphysema meds that life insurance underwriters will eye before reviewing your application:

- Albuterol (Proventil, Ventolin, others)

- Budesonide and formoterol (Symbicort)

- Fluticasone and salmeterol (Advair)

- Formoterol (Foradil)

- Ipratropium (Atrovent)

- Levalbuterol (Xopenex)

- Mometasone and formoterol (Dulera)

- Salmeterol (Serevent)

- Tiotropium (Spiriva)

Doctors love to prescribe the same meds for both asthma and emphysema, so insurance companies will dig into why you’re taking specific medications and for how long.

Here’s a list of medications used for both asthma and emphysema:

- Advair

- Azmacort

- Dilor

- Serevent

- Theodur

- Tilade

- Ventolin

Some insurance companies look for a cocktail of these drugs, and if they spot you taking 2-3 of them together, they’ll label you as having emphysema.

Information We Need If You Have Emphysema

To hook you up with first-day coverage or benefits, we might hit you with a few questions:

- Do you have other lung issues like asthma, emphysema, or chronic bronchitis?

- Do you smoke?

- Were you hospitalized for your Emphysema? What treatment did you receive?

- What prescription drugs are you taking for your Emphysema?

- When were you diagnosed with Emphysema?

How Can Funeral Funds Help Me?

No need to waste time hunting down insurance companies yourself – we’ve got it covered. We partner with top-notch A+ rated carriers who specialize in high-risk clients.

Our licensed life insurance pros will dig through all the best options to score you the best rates, and we promise to keep it quick and painless.

Just fill out our quote form on this page or give us a call at (888) 862-9456 for a spot-on quote.

Frequently Asked Questions

Can I get cremation insurance with emphysema?

Yes, you can – cremation insurance, final expense insurance, or burial insurance is totally doable even with emphysema. Plenty of life insurance companies offer whole life coverage for folks with preexisting conditions.

Is emphysema considered a pre-existing condition in life insurance?

Yup, emphysema is a pre-existing condition. Anything you’ve got going on health-wise before you apply for life insurance is labeled as a pre-existing condition.

Can insurance deny coverage for preexisting conditions like emphysema?

Absolutely. Life insurance companies often have a list of pre-existing conditions they consider high-risk, which could impact your coverage options.

How can I get 1st-day coverage with emphysema burial insurance?

The best move is to work with an independent life insurance agent from Funeral Funds of America. They know the right insurance companies to get you approved for first-day coverage.

Can I increase my coverage amount after purchasing emphysema burial insurance?

Yep, you can usually boost your coverage amount later on, depending on your insurance provider and policy.