Burial Insurance For People on Oxygen (2024 Update)

Even if you need burial insurance and you’re using oxygen, you might still qualify for burial insurance if you go with the right company.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with COPD, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What is Oxygen For?

Our bodies crave oxygen like a toddler craves cake (though hopefully with less of a mess). But sometimes, thanks to lung issues or sleep apnea, our internal O2 delivery system goes wonky.

That’s where supplemental oxygen steps in, like a tiny oxygen fairy godmother, to boost your blood oxygen levels and eliminate those shortness-of-breath blues.

Here are some common oxygen treatment uses:

- Low Blood Oxygen Levels: Chronic conditions like COPD or heart failure can mess with your oxygen absorption, leaving you short of breath, fatigued, and frankly, a little confused. Don’t worry, supplemental oxygen can come to the rescue. It increases your blood oxygen levels, kicking those shortness-of-breath blues to the curb.

- Sleep Apnea: You become a human game of “hold your breath” every night. Not cute. Supplemental oxygen steps in again like a knight in shining armor to keep your oxygen levels up and ensure you wake up feeling refreshed, not like you just ran a marathon in your sleep.

The life insurance folks see needing oxygen as a big risk factor because using supplemental oxygen often means there are other significant medical needs.

How much oxygen use will affect your burial insurance rates depends on how long you’ve been on the oxygen merry-go-round and the severity of your condition. Short-term oxygen for a passing medical need is often not a big deal, but long-term oxygen use for a chronic condition could bump up your rates a bit.

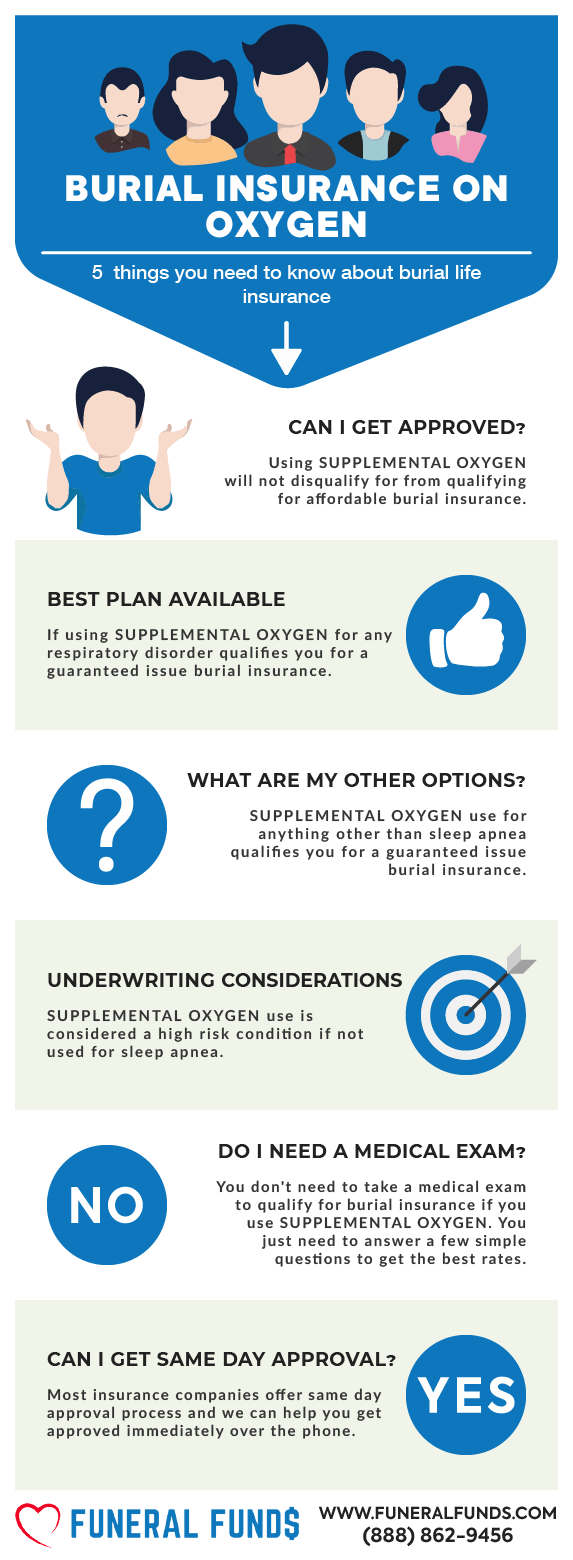

Can You Get Burial Insurance If You Use Oxygen?

In most states, you can snag burial insurance with first-day coverage, even if you’re sporting a permanent oxygen tank backpack. Just remember, these policies are as unique as snowflakes (or maybe your snoring, depending on the case), so you might need some help navigating your options.

What Is My Best Insurance Option If I Use Oxygen?

OXYGEN USE FOR SLEEP APNEA – Struggling to breathe while you snooze? No worries! First-day coverage burial insurance welcomes you with open arms (and oxygen masks, if needed). You’ll be covered from day one, with no waiting period and the best rates.

TEMPORARY OXYGEN USE (less than 24 hours a day) – Need a little extra O2 boost now and then? Depending on your residence state, you might still qualify for first-day coverage. Think of it as a “sometimes oxygen, always covered” situation.

LONG TERM OXYGEN USE (24 hours a day)

As long as recent hospital visits haven’t been a regular thing (think “two or more times and you’re out”), you could still snag first-day coverage, but it all depends on what plans are available in your state.

Long-term oxygen uses:

- Bronchopulmonary dysplasia

- Chronic Obstructive Pulmonary Disease (COPD)

- Cystic fibrosis

- Heart failure

- Lung diseases like emphysema or chronic bronchitis

- Pneumonia

- Trauma to the respiratory system

Do I Need A Medical Exam To Qualify For Burial Insurance?

Burial insurance doesn’t require a full-on medical inquisition. You’ll just answer some basic health questions, kind of like a pop quiz for your mortality. No need to dig up old medical records or donate bodily fluids – it’s a breeze!

What Is The Cost Of Burial Insurance If I Use Oxygen?

These factors determine the cost of life insurance if you use oxygen:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

Here’s a pricing example for an active 60-year-female with respiratory support:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for a dynamic 60-year-old male with a breathing boost:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Superior Choice would be the best choice for a person using oxygen. It offers first-day coverage and lower pricing than plans with a waiting period. However, this plan is not available in all states.

Burial Insurance Underwriting For Oxygen Use

These burial insurance folks have two main tricks up their sleeves:

FIRST – (The Health Question Inquisition) Get ready for a pop quiz on your health, but way less stressful than that high school biology test. They might ask if you’re the “proud owner of a fancy oxygen tank” or if you’re more of a “casual breather” (don’t worry, there are no wrong answers, just honest ones).

SECOND – (The Prescription History Peek-a-Boo) The insurance company will do a quick electronic check of your prescription history. Think of it as the insurance company playing medical detective, but instead of hunting down jewel thieves, they’re looking for clues about your overall health (and your oxygen-using habits).

Get ready for some creative ways these burial insurance companies ask about your oxygen use:

- Within the past 12 months, have you used, or been advised to use oxygen equipment to assist with breathing (excluding use for sleep apnea)?

- Are you currently hospitalized, confined to a bed or nursing facility, using oxygen equipment to assist in breathing?

- Are you currently hospitalized, confined to a wheelchair, bed, or nursing facility, using oxygen equipment to assist in breathing?

How To Get First-Day Coverage Insurance For People With Oxygen Use

Ditch the solo insurance search and snag yourself a first-day coverage superhero – an independent insurance agency like Funeral Funds! We are like the Robin Hoods of the insurance world, representing a bunch of A-rated companies and battling for the best plan and price for you.

Think of it like this: We’ll do all the legwork, comparing plans from different insurers, so you can focus on the important things – like perfecting your oxygen tank fashion sense (because hey, if you gotta have it, you might as well rock it).

How Can Funeral Funds Help Me?

Funeral Funds is like a life raft in a sea of confusing paperwork! We ditch the whole “search a million companies” nonsense. We work with a bunch of top-rated insurers, the A+ students of the insurance world, who specialize in folks like you (even if you come with a trusty oxygen tank).

Our crack team of licensed life insurance agents (think of us like insurance ninjas!) will scour the land (or at least the internet) to find the best rates for your specific situation.

Want a quick and easy quote? Fill out the form on this page, or give us a call at (888) 862-9456. We’ll get you an accurate quote faster than you can say “burial insurance.”

So, ditch the insurance headache and let Funeral Funds be your hero – we’ll find you the perfect coverage, oxygen tank and all!

Frequently Asked Questions

Will my premiums increase if I start using oxygen after purchasing the policy?

Nope! Think of your premium as a final expense down payment – it’s locked in after approval, no matter how much you become best friends with your oxygen tank. So breathe easy (literally and figuratively) on that one!

Can you get life insurance for someone with COPD who uses oxygen?

Absolutely! Even if you have a love affair with your oxygen tank (hey, it keeps you going!), you can still snag first-day coverage. There’s a catch, though: gotta have less than one hospital visit in the past two years and live in a state with the correct insurance plans (not all states are created equal in the insurance world). But don’t worry, Funeral Funds can help you navigate that!

2 Comments

Latoya shepard

Need a quote

Funeral Funds

https://funeralfunds.com/free-quote/