2024 Affordable Burial Insurance with Lung Disease

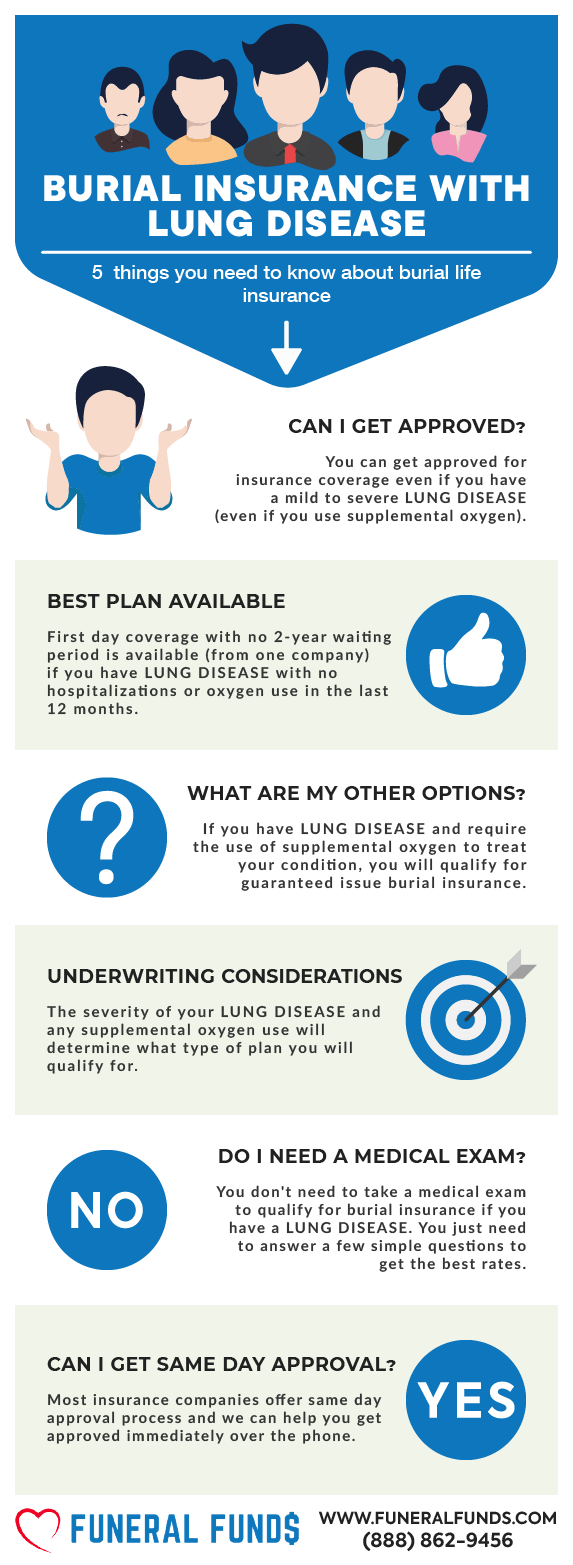

You can qualify for affordable burial insurance with lung disease. The type of plan you will be eligible for depends on your lung disease type and other related health problems.

Every life insurance carrier has its proprietary life insurance underwriting guidelines for approving applicants with a history of lung disease.

This article will explain how burial insurance companies underwrite lung disease, what life insurance options are available, and how you can find the best plan at the best price possible.

FOR EASIER NAVIGATION:

- What Is Lung Disease?

- Can You Get Life Insurance If You Have Lung Disease?

- What Are The Types of Burial Insurance Available for People With Lung Disease?

- What Is My Best Life Insurance Option If I Have Lung Disease?

- Do I Need A Medical Exam To Qualify for Burial Insurance?

- What Is The Impact of Lung Disease On Insurance Eligibility?

- Burial Insurance Underwriting for Lung Disease

- How Much Does Life Insurance Cost If You Have Lung Disease

- How To Get Approved for First-Day Coverage Insurance

- How Can Funeral Funds Help Me?

- Frequently Asked Questions

What Is Lung Disease?

Lung disease is a broad term that refers to various conditions impairing the lungs’ ability to function properly. The lungs are responsible for taking in oxygen from the air we breathe and releasing carbon dioxide, a waste product of our cells. When lung disease is present, this exchange of gases can be hindered, leading to a number of symptoms.

There are many different types of lung disease, each with its own cause. Some of the most common types include:

- Asthma: This is a chronic inflammatory disease of the airways that causes wheezing, shortness of breath, chest tightness, and coughing.

- Chronic obstructive pulmonary disease (COPD): This progressive disease includes emphysema and chronic bronchitis. It makes breathing difficult as the airways narrow and damage.

- Pneumonia: This is an infection of the lungs caused by bacteria, viruses, or fungi. Pneumonia can cause a variety of symptoms, including fever, cough, shortness of breath, and chest pain.

- Lung cancer is the uncontrolled growth of abnormal cells in the lungs. It can cause a variety of symptoms, including cough, shortness of breath, chest pain, and weight loss.

Treatment for lung disease depends on the specific type of disease. However, some common treatments include medications, oxygen therapy, and pulmonary rehabilitation.

Can You Get Life Insurance If You Have Lung Disease?

Yes, you can qualify for burial insurance if you have lung disease.

What Are The Types of Burial Insurance Available for People With Lung Disease?

There are two main types of insurance coverage available for people with lung disease:

First-day coverage – This is the best option, but you will have to answer some health questions. You will have no waiting period and be covered from the first day.

Guaranteed issue – This is best for people who do not qualify for immediate coverage. The downside is that guaranteed issue whole life insurance comes with a two-year waiting period and a higher premium. If you die during the waiting period, your beneficiary will receive the premium you paid plus 7-10% interest. The full death benefit will be paid if you die after the waiting period.

What Is My Best Life Insurance Option If I Have Lung Disease?

ASTHMA

Most insurance companies will approve you for first-day coverage if you have asthma.

BLACK LUNG DISEASE (Coal Workers’ Pneumoconiosis)

Mild to moderate black lung disease with no diagnosis or medications in the last 24 months and no other health problems can often still get 1st-day coverage depending on the insurance company and what state you live in.

If you use supplemental oxygen to breathe because of severe black lung disease, you may qualify for a first-day coverage plan, depending on your state of residence.

Your other option is a guaranteed issue, a type of whole life insurance that does not ask health questions or check medical history.

CHRONIC BRONCHITIS

Some burial insurance providers don’t ask about chronic bronchitis or chronic lung conditions on their health questionnaire and your coverage would start from the very first day of your policy.

CHRONIC OBSTRUCTIVE PULMONARY DISEASE (COPD)

Some insurance companies will approve you for a first-day coverage plan depending on the severity of your COPD, and will even allow supplemental oxygen depending on the insurance carrier and what state you live in.

Your other more expensive option would be a guaranteed issue policy with no health questions.

CYSTIC FIBROSIS

Most cystic fibrosis patients can qualify for coverage that covers them in full from day one.

EMPHYSEMA

If you have emphysema, some insurance companies may qualify you for a first-day coverage plan depending on your overall health and the state you live in.

LUNG TRANSPLANT

If your doctor advised you to have a lung transplant or you’ve been a lung transplant recipient in the last five years, you can get coverage with a guaranteed issue life insurance.

If your lung transplant was more than 5 years ago, you may have 1st-day coverage options depending on your overall health and the state you live in.

LUNG CANCER

If you’ve been diagnosed with lung cancer, you may still qualify for 1st-day coverage life insurance, but your eligibility will depend on how long you’ve been cancer-free.

Some companies have 2-year lookback periods for cancer, and these companies should be avoided.

For current lung cancer patients, a guaranteed issue life insurance plan is your best choice, and you will have a 2-year waiting period.

TUBERCULOSIS

Tuberculosis is a manageable and highly curable disease. Thus, most life insurance companies offer first-day coverage plans for people with tuberculosis.

PULMONARY HYPERTENSION

Most life insurance companies do not ask about pulmonary hypertension in the health questions, and you will qualify for a first-day coverage life insurance.

SLEEP APNEA

Sleep apnea is a non-issue to most final expense life insurance companies. Most insurance carriers will even allow you to use oxygen for sleep apnea and still qualify for immediate 1st-day coverage.

Do I Need A Medical Exam To Qualify for Burial Insurance?

No. When you apply for burial insurance plans, you only have to answer some basic questions about your health. The application process is simple, and you don’t need to provide medical records or blood and urine samples. You’ll often get the official approval from the insurance company within minutes!

What Is The Impact of Lung Disease On Insurance Eligibility?

The type of lung disease and its severity will dictate if you will qualify for a first-day life insurance coverage plan or a guaranteed issue life insurance with a two-year waiting period.

Burial Insurance Underwriting for Lung Disease

Burial insurance companies that offer first-day coverage plans have two ways of underwriting your policy:

- They may ask you a series of health questions. Your answers to their questions will determine your eligibility.

- They will electronically review your prescription history to verify your health.

Your answers to these questions will dictate what policy you will qualify for and how much is your monthly premium.

HEALTH QUESTIONS

Here are the lung diseases that most life insurance companies ask about on the application:

- Chronic Obstructive Pulmonary Disease

- Chronic bronchitis

- Emphysema

- Respiratory failure

- Oxygen use to assist in breathing

Insurance companies will typically use lung disease questions similar to these:

- During the past 24 months, have you been diagnosed by a physician as having or been treated for emphysema, chronic bronchitis, or chronic obstructive pulmonary disease (COPD)?

- Have you ever had, or been diagnosed with, or received or been diagnosed to receive treatment or medication for chronic obstructive pulmonary disease (COPD), chronic bronchitis, respiratory failure, or emphysema?

- Within the past 24 months, have you been medically diagnosed or treated by a medical professional or taken medication for chronic obstructive pulmonary disease (COPD), emphysema, chronic bronchitis, respiratory failure, or required oxygen equipment to assist in breathing?

- In the PAST 10 YEARS, have you opted to NOT seek treatment, have NOT taken medication, and/or have NOT followed the prescribed treatment plan following a medical diagnosis by a member of the medical profession for any one or more the following: lung disease (including COPD (Chronic Obstructive Pulmonary Disease) emphysema).

PRESCRIPTION HISTORY CHECK

Every burial insurance company will electronically check your prescription history (except for guaranteed issue life insurance companies) for drugs that are “red-flagged”. They typically review what drugs have been prescribed to you in the past years, when you first filled them, and how often you have refilled them.

How Much Does Life Insurance Cost If You Have Lung Disease

Premiums can vary based on factors such as age, gender, state of residence, type of policy, coverage amount, overall health, and the severity of your lung disease.

How To Get Approved for First-Day Coverage Insurance

The best way to get approved for first-day coverage insurance is to work with an experienced independent life insurance agent from Funeral Funds. Our agents work with insurance companies that accept people with lung disease.

How Can Funeral Funds Help Me?

You don’t have to waste time searching with multiple insurance companies because we can do this work for you. We work with many A+ rated insurance carriers specializing in covering high-risk clients.

Our licensed insurance agents search all the best companies to get you the best life insurance rates, and we promise to make the process quick and easy.

Fill out our quote form on this page or call us at (888) 862-9456 for accurate life insurance quotes.

Frequently Asked Questions

Is lung disease considered a pre-existing condition in burial insurance?

Yes, any medical condition diagnosed before you apply for life insurance is considered a pre-existing condition.

What conditions are considered lung disease in life insurance?

Lung diseases are disorders that affect the lungs; some are asthma, emphysema, COPD, cystic fibrosis, chronic bronchitis, lung infection, lung cancer, and other breathing problems. Just understand that getting life insurance with COPD and other lung diseases is possible.

Is lung disease considered high risk for life insurance?

Not all lung diseases are considered high risk for burial insurance policy. You can easily qualify for a first-day coverage plan if you have asthma. However, some lung diseases are considered high risks, such as COPD, emphysema, and cystic fibrosis.

Can you be denied life insurance if you have lung disease?

Yes, you can be denied traditional term life insurance because of lung disease. Advanced stages of COPD and emphysema may also cause a denial of a first-day coverage plan. However, you will still qualify for guaranteed life insurance that never asks health questions.

Can I get final expense insurance with lung disease?

Yes, you can get final expense insurance for people with lung disease. However, your insurance eligibility for lung diseases such as COPD, emphysema, or cystic fibrosis will depend on the severity of your condition.