Burial Insurance with COPD (2024 Update)

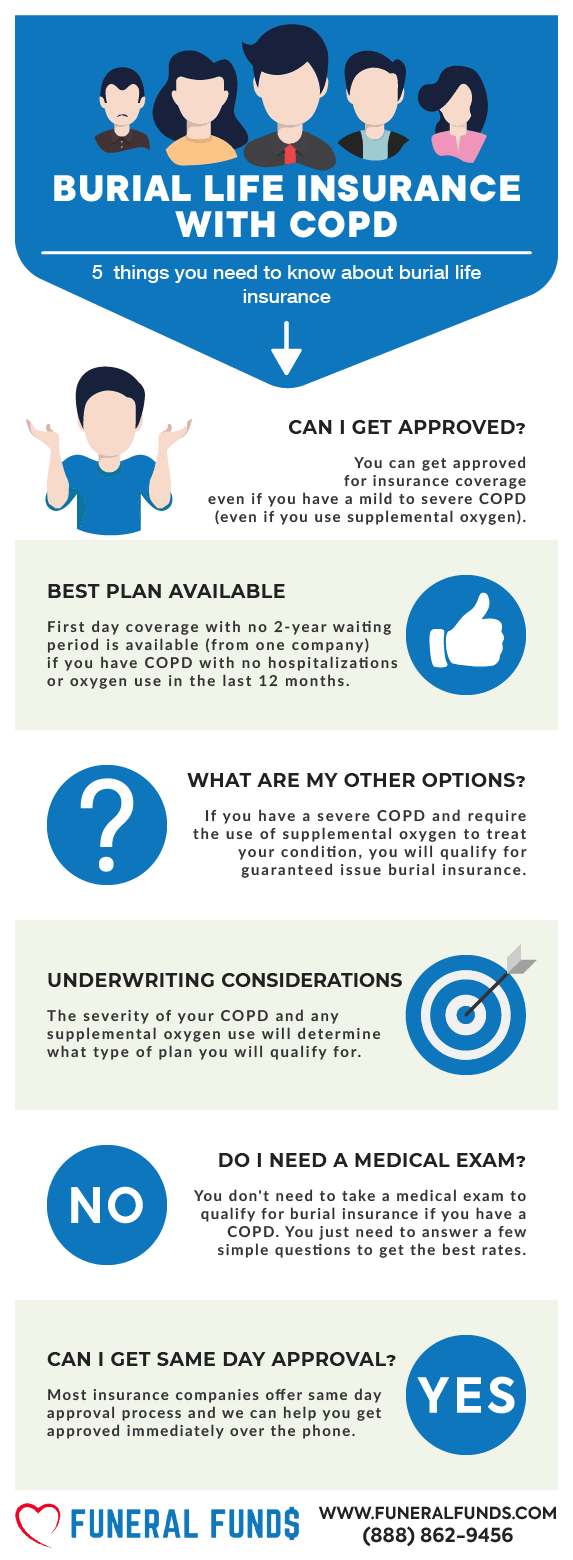

Burial insurance with COPD may sound like a headache, but guess what? You can still snag first-day coverage if you pick the right company.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with COPD, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What is COPD?

COPD (Chronic Obstructive Pulmonary Disease) is like having a daily battle with your lungs. Picture coughing fits, shortness of breath, and wheezing—basically, your lungs throwing a tantrum.

There are two major types of COPD:

- Chronic bronchitis: It’s the never-ending cough with a side of mucus that just won’t quit.

- Emphysema: This one’s all about wrecking those air sacs, making every breath feel like a marathon.

Most folks with COPD end up with a blend of both. It’s a slow dance of deterioration, no doubt about it. While there’s no cure, there are ways to keep it from stealing the spotlight entirely.

Now, when it comes to snagging life insurance with COPD, things can get a bit tricky. It’s all about laying your cards on the table from the get-go. Skipping this step could mean your policy hits the skids later on.

Since every insurance company sizes up risks differently, your best bet? Go with an independent agent (like Funeral Funds) who knows the ropes and can hustle up the best deal in town.

Can You Get Burial Insurance With COPD?

Absolutely! COPD won’t stop you from getting burial insurance.

Even if you’re rocking oxygen gear, there are first-day coverage options tailored just for you. And for those who’ve had a few too many hospital check-ins, there are plans that’ll still give you a nod, no questions asked.

What is My Best Insurance Option If I Have COPD?

MILD COPD – If you’ve got mild COPD and no other health drama, you’re in luck! You’ll likely score a level death benefit insurance plan with 1st-day coverage. That means your coverage kicks in right away – no annoying two-year wait.

MODERATE COPD – Got moderate COPD and taking your meds like a champ? You’re still in the game for a first-day coverage plan. Some companies will even hook you up if you’re on oxygen.

SEVERE COPD – Battling severe COPD and using oxygen gear? There’s still hope! Depending on your state, you might qualify for a first-day coverage plan.

If first-day coverage isn’t an option where you live, you’re looking at a guaranteed issue whole life insurance with a two-year wait. If you kick the bucket during those first two years, your beneficiary still gets all the premiums you paid plus a sweet 7-10% interest.

Do I Need A Medical Exam for COPD Burial Insurance?

Nope, no need to bare your veins for a medical exam to snag burial insurance with first-day coverage. The underwriting is minimal – just a few easy health questions.

Some plans don’t ask any health questions at all, but they’re pricey and come with a 2-year waiting period. We’re not fans of those plans because of the high cost and wait time. Keep reading to find out which companies are the best and which ones to avoid!

Burial Insurance Price For COPD Patients

Here’s what affects your life insurance cost with COPD:

- Age

- Gender

- State of residence

- Smoking status

- Type of policy

- Coverage amount

The older and sicker you are, the pricier it gets.

But no sweat! Scoring the best burial insurance rates for COPD isn’t rocket science. Get help from an independent life insurance agency like Funeral Funds – we know the top insurers that will cover you without breaking the bank.

Pricing example for a thoughtful 60-year-old female:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a courageous 60-year-old male:

| INSURANCE COMPANY | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

What Are The Best Companies For COPD Burial Insurance?

Here’s a sneak peek at the pricing for someone on continuous oxygen:

- Superior Choice (Recommended) – 60-year-old female

- First-day coverage

- Policy amount: $10,000

- Monthly premium: $47.25

- Gerber Life (Avoid) – 60-year-old female

- 2-year Waiting period

- Policy amount: $10,000

- Monthly premium: $51.06

- Lincoln Heritage (Avoid) – 60-year-old female

- 2-year Waiting period

- Policy amount: $10,000

- Monthly premium: $96.80

“Superior Choice” is the top pick for COPD patients, thanks to its first-day coverage and wallet-friendly pricing. No waiting period and more affordable than those plans that make you wait—what’s not to love?

Getting Approved for 1st-day Coverage Burial Insurance With COPD

Here’s how those health questions about COPD usually pop up in the application:

- During the past 24 months, have you been diagnosed by a physician as having or been treated for emphysema or chronic obstructive pulmonary disease (COPD)?

- Within the past 24 months, have you been medically diagnosed or treated, taken medication for chronic obstructive pulmonary disease (COPD), or required oxygen equipment to assist in breathing?

- Have you ever been diagnosed with, received, or been advised to receive treatment or medication for chronic obstructive pulmonary disease (COPD) or emphysema?

If you have COPD, you’ll be hitting “yes” on these health questions, which could affect your eligibility with some companies.

Here’s a rundown of common meds that insurance carriers look for to confirm your COPD:

- Aclidinium bromide

- Anoror Ellipta

- Arformoterol

- Arcapta

- Atrovent HFA

- Brovana

- Budesonide

- Combivent

- Daliresp

- Duoneb

- Fluticasone

- Ipratropium Bromide

- Prednisone

- Spiriva

If you’re using any of the below inhalers or breathing treatments, the insurance carriers might use this to label you as a COPD sufferer.:

- Advair

- Azmacort

- Albuterol

- Dilor

- Serevent

- Symbicort

- Proventil

- Tilade

- Theodur

- Ventolin

- Xopenex

If you’re stocked up on COPD inhalers or breathing treatments, fear not – you’ve got a shot at burial insurance with a few of the right crew of companies.

Some insurers might raise an eyebrow at your daily oxygen habit, but others? They’re as cool as a cucumber about your O2 gear use. Just depends on which state’s insurance playbook they’re following.

Information We Need If You Have COPD

Get ready to spill the tea! Before we qualify you for life insurance, we might hit you with these questions:

- When were you diagnosed with COPD?

- Do you have other lung issues like asthma, emphysema, or chronic bronchitis?

- Were you hospitalized for your COPD? What treatment did you receive?

- Do you smoke?

- What prescription drugs are you taking for your COPD?

How Can Funeral Funds Help Me?

Forget juggling a bunch of insurance companies – we’ve got it covered. We’re dialed in with top-notch A+ rated carriers who know their way around high-risk cases like a boss.

Our crack team of agents will comb through the best options to lock in killer rates, and we’ll make sure the whole process is a breeze.

Ready to make a move? Fill out our quote form right here or hit us up at (888) 862-9456 for a quote that’s spot-on.

Frequently Asked Questions

Can I get life insurance with COPD?

You got COPD? Don’t stress about life insurance! Yeah, you heard right. Even with those lungs of yours, you can still snag a life insurance policy. But let’s be real about the price tag and coverage – that all depends on how bad your diagnosis is.

Can a person with COPD get life insurance?

Yeah, it’s possible. But don’t get your hopes up for the fancy plan. Your chances of landing a sweet deal depend on how bad your lungs are.

How much is life insurance with COPD?

Well, buckle up, buttercup! Your age, gender, where you live, if you’re a chain-smoker, what kind of policy you want, how much coverage you need, and how healthy you think you are all play a part in that price tag.

Can I get burial insurance with COPD?

You can still get burial insurance even if you’re wheezing like a broken vacuum cleaner. You’re generally golden as long as you’re between 50 and 85 years old.

Can I get funeral insurance with COPD?

Do you think your wheezy self can’t afford a fancy funeral? Wrong! Even if you’re coughing your lungs out, you can often get funeral insurance. Just make sure you’re 50-85 years old.

Is it hard to get life insurance with COPD?

Most insurance companies will give you the cold shoulder but don’t lose hope. There are some insurance agents out there who are basically life insurance superheroes. They can sniff out those rare policies that’ll cover your wheezy self. So, grab your inhaler and start searching!

Can I get cremation insurance with COPD?

You can totally get cremation insurance, even with your COPD. But don’t expect a VIP package if your lungs are shot. It all depends on how bad your wheezing is.

Can I get final expense life insurance with COPD?

Are you worried about covering those final expenses with your lungs? Don’t stress—there’s final expense insurance for people like you. But let’s be real – whether you’re approved or not depends on how bad your COPD is. It’s like winning the lottery but with less glitter and more wheezing.

2 Comments

Monique McWhorter

I lost my mom from COPD on March 13th and she didn't have much coverage and I'm wanting to know if there are benefits that help patients without much coverage. If so would you please contact me as soon as possible the funeral will be Saturday

Funeral Funds

Monique – We are sorry for your loss. There are no funeral insurance plans available for people who have already died.