2024 Burial Insurance with Mental Illness

If you want affordable burial insurance with a mental illness, most final expense companies will accept applicants with this condition with open arms. Most applicants will qualify for a first-day coverage plan. This is true even if you have been hospitalized within the last 24 months.

Each life insurance provider has its unique approval guidelines, and some insurers are more lenient with applicants who have a mental illness than others.

Applying to the right company will save you time and money and prevent your application for coverage from getting declined.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a History of Mental Illness?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have Mental Illness, Do I Need A Medical Exam to Qualify for Burial Insurance?

- Burial Insurance Underwriting If You Have Mental Illness

- How Much Insurance Do I Need If I Have Mental Illness?

- How Should I Pay My Premiums?

- Mental Illness and Burial Insurance Riders

- How to Get the Best Burial Insurance Rates for Mental Illness Patients?

- Information We Need if You Have Mental Illness?

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance With Mental Illness

What Is My Best Insurance Option If I Have A History Of Mental Illness?

MOOD DISORDERS – are also called affective disorders. The most common mood disorders are bipolar disorder, depression, and cyclothymic disorder.

You will hardly find insurance health questionnaires asking about depression, manic depression, mania, or cyclothymic disorder. Most insurance companies don’t care about these mood disorders.

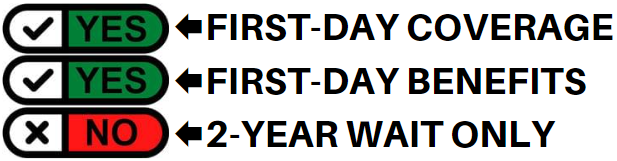

Best Option: Level benefit with First-day coverage

ANXIETY DISORDERS – these conditions include generalized anxiety disorder, social anxiety disorder, panic disorder, and specific phobias.

Someone with mild anxiety who is taking low doses of medication and doesn’t require counseling or therapy will qualify for first-day coverage.

Best Option: Level benefit with First-day coverage

If you’ve been hospitalized multiple times, or your anxiety disrupts daily routines and the ability to carry out eating, bathing, dressing, toileting, transferring, and continence, your best option for coverage will be a first-day coverage or first-day benefits plan.

Best Option: First-day coverage or First-day benefits

PERSONALITY DISORDERS – The most common personality disorders are obsessive-compulsive personality disorder, paranoid personality disorder, and antisocial personality disorder.

Personality disorders are long-term conditions that may affect the applicant’s ability to function in normal activities of daily living. Due to some potential life-threatening symptoms of people with personality disorders, they will only qualify for guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

PSYCHOTIC DISORDERS – Schizophrenia is an example of psychotic disorder. People with psychotic disorders have distorted awareness and thinking. Common symptoms are hallucinations and delusions.

Some insurance companies don’t ask about psychotic disorder or schizophrenia in their health questionnaire (if a company doesn’t ask about your health condition, it means they are accepting of it). If you have been hospitalized because of an episode, we will place you with an insurer that does not ask about hospitalizations.

Best Option: Level benefit with First-day coverage

EATING DISORDERS – The most common eating disorders include anorexia nervosa, bulimia nervosa, and binge eating. Some applicants may be taking antidepressants or anti-anxiety medications to prevent episodes.

Best Option: Level benefit with First-day coverage

TRAUMA-RELATED DISORDERS – Post-traumatic stress disorder or PTSD can develop following a traumatic event, such as physical or sexual assault, the death of a loved one, or a natural disaster.

Applicants with mild to moderate PTSD and taking medications regularly, with no history of suicide attempts or hospitalization, who are generally in good health, will qualify for first-day coverage.

Best Option: Level benefit with First-day coverage

Some physical symptoms of PTSD may disrupt daily routines and the ability to carry out eating, bathing, dressing, toileting, transferring, and continence tasks. Those with severe PTSD who cannot perform said activities of daily living on their own will only qualify for guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

ADDICTION DISORDER – the most common addiction disorder are compulsive gambling, alcohol, and substance abuse

Most life insurance companies ask about alcohol and drug abuse in their health questions. Most of them have a two-year look-back period on alcohol and drug abuse.

If your alcohol or drug abuse diagnosis and treatment are beyond 24 months, many burial insurance companies will approve you for first-day full coverage.

Best Option: Level benefit with First-day coverage

If you’ve been using drugs or abusing alcohol within the past year or are currently on drugs or abusing alcohol, you will qualify for guaranteed issue burial insurance.

Best Option: Guaranteed issue burial insurance

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have Mental Illness, Do I Need A Medical Exam To Qualify For Burial Insurance?

Getting approved for burial insurance does not require a medical exam, blood draw, or urine sample. Because life insurance with mental illness is a simplified issue life insurance plan, all you need to do is answer some basic health questions

You’ll get the official approval from the insurance company often within minutes!

Burial Insurance Underwriting If You Have Mental Illness

If you want first-day coverage and pay the lowest rate, you should apply for a plan with basic health underwriting. The underwriting consists of asking you some basic health questions and the insurance company doing a quick prescription history check.

The underwriter will assess your health based on your answers. Your health and the medication you take will determine your eligibility.

THE HEALTH QUESTIONS

Some companies ask about mental illness in their health questionnaire. You could see the questions appear in different forms.

Here are the various ways you will see mental illness asked in the health questions:

- In the last 24 months, have you ever been diagnosed or been treated for mental illness?

- Have you been diagnosed or treated for mood disorder or severe depression in the previous two years?

- Have you been diagnosed or treated for Bipolar or Schizophrenia in the past two years?

- In the last two years, have you been hospitalized due to depression, anxiety, or any mental disorder?

Every insurance company uses a different lookback period on mental illness, but the most common is two years.

We work with companies that do not ask about mental illness in their health questionnaire on their application. Since they don’t ask about mental illness, they won’t count it against you when you seek coverage.

PRESCRIPTION HISTORY CHECK

Aside from the health questions, insurance companies will also electronically check your prescription history to verify your health.

Most mental illness patients are taking prescription medications to manage their condition.

Here are the most common mental illness medications:

- Aripiprazole (Abilify)

- Brexpiprazole (Rexulti)

- Bupropion (Aplenzin, Wellbutrin)

- Citalopram (Celexa)

- Clonazepam (Klonopin)

- Chlordiazepoxide (Librium)

- Chlorpromazine (Thorazine)

- Diazepam (Valium)

- Divalproex sodium (Depakote)

- Duloxetine ( Cymbalta)

- Escitalopram (Lexapro)

- Fluoxetine (Prozac)

- Haloperidol (Haldol)

- Nortriptyline (Pamelor)

- Olanzapine (Zyprexa)

- Oxazepam (Serax)

- Paliperidone (Invega)

- Venlafaxine (Effexor)

- Vilazodone (Viibryd)

If you are taking any prescription meds, they will consider you a patient with some form of mental illness. Burial insurance companies are perfectly fine with the above medications, and your application for coverage will be approved if you have no other serious health issues.

How Much Insurance Do I Need If I Have Mental Illness?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Mental Illness And Burial Insurance Riders

You may have the option to add a policy rider(s) to your basic policy. Insurance riders add benefits to your policy. Adding insurance riders can enhance your policy to fit your specific needs.

Some riders can be added to your policy without additional cost. However, some riders come with some extra costs. Don’t worry; riders are affordable and involve little to no underwriting.

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

How To Get The Best Burial Insurance Rates For Mental Illness Patients?

Mental illness is not a major issue for most burial insurance companies.

To find the best burial insurance for a mental illness, you must work with an independent life insurance agency like Funeral Funds that has access to multiple insurance companies.

Access to different life insurance companies enables us to match you with the lowest-pricing insurance provider.

Information We Need If You Have Mental Illness

When applying for burial insurance for mental illness, it is important to provide us as much information as possible. This information will help us understand your current health and recommend the best plan suited for your needs

Here’s some of the information we need to know if you have a mental illness:

- What type of mental illness do you have?

- When were you diagnosed with this condition?

- Have you ever been declined insurance coverage due to mental illness?

- What medications are you taking for your condition?

- How long have you been taking medications?

- Have you ever been hospitalized due to mental illness?

- If you have Dysthymia (chronic depression), how long has this been present?

- Are you on disability due to mental illness?

- Do you have any history of alcohol or drug abuse?

- Do you have any issues with your driving records such as a suspended license, multiple moving violations, or DUI’s?

Knowing these details about you will help us provide you with the best recommendation and an accurate quote.

How Can Funeral Funds Help Me?

Trying to find a policy if you have mental illness needn’t be a frustrating process; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have a health history of mental illness, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for the best insurance companies for mental health because we will do the dirty work for you.

We will shop for you with different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for mental illness funeral insurance, mental disorder burial insurance, or mental illness life insurance.

Fill out our quote form on this page or call us at 888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance With Mental Illness

Can a person with mental illness get burial insurance?

Yes, a person with mental illness can get burial insurance. Most of the time, people with mental illness qualify for a first-day coverage plan if they are not hospitalized and they can perform eating, bathing, dressing, transferring and continence on their own.

Do I need to take a medical exam if I have a mental illness?

No, you do not need to take a medical exam if you have a mental illness.

What is the cost of burial insurance for mental illness?

The cost of burial insurance with mental illness varies depending on your age, gender, location, coverage amount, and health.

Is there an age limit for burial insurance with mental illness?

People who are 18-86 years old can apply for burial insurance.

Is mental illness a pre-existing condition for life insurance?

Yes, mental illness is a pre-existing condition for life insurance.

Can I get life insurance if I have been hospitalized for my mental illness?

Some life insurance companies will not cover people who have been hospitalized for their mental illness, while others will only cover those people if they have been discharged from the hospital and they are not currently symptomatic.

Do I need to tell insurance about mental illness?

Yes, you are required to disclose any mental illness when applying for life insurance.

What is the cost of life insurance with mental illness?

The cost of life insurance with mental illness varies depending on your age, gender, location, coverage amount, and health.

Can I get life insurance after mental illness?

Yes, it is possible to get life insurance after mental illness. Depending on your health and the severity of your condition.

Can you get first-day coverage insurance if you have a mental illness?

Yes, you can get first-day coverage insurance if you have a mental illness. Most of the time, people with mental illness qualify for a first-day coverage plan if they are not hospitalized and can perform daily activities on their own.

What are the things that may affect my eligibility if I have a mental illness?

The things that may affect your eligibility if you have a mental illness are whether or not you are currently hospitalized, the severity of your condition, and your ability to perform activities of daily living on your own.

Can I get burial insurance if I have an anxiety disorder?

Yes, you can get burial insurance if you have an anxiety disorder. Most of the time, people with anxiety disorders qualify for a first-day coverage plan if they are not hospitalized and can perform daily activities on their own.

Do I need to take a medical exam if I have an anxiety disorder?

No, you do not need to take a medical exam if you have an anxiety disorder.

Which insurance is best for patients with mental illness?

A first-day coverage plan is the best type of insurance for patients with mental illness. This type of plan does not require a medical exam and will provide coverage on the first day you are enrolled.

Is mental illness a disability?

Yes, mental illness is a disability. This means you are entitled to certain rights and protections under the law. For example, you may be entitled to reasonable accommodations at work.

What disability category is mental illness?

Mental illness is a psychiatric disability. This means that it affects your ability to think, feel, and behave in a normal way.

Can I qualify for cremation insurance with a history of mental illness?

Yes, you can qualify for cremation insurance with a history of mental illness. Most of the time people with a history of mental illness qualify for a first-day coverage plan if they are not hospitalized and can perform activities of daily living on their own.

What is my best insurance option if I have a mental illness?

If you have a mental illness, your best insurance option is a first-day coverage plan. This type of plan does not require a medical exam and will provide coverage on the first day that you are enrolled.

Is mental illness fatal in life insurance?

No, mental illness is not fatal in life insurance. Mental illness is a psychiatric disability that affects your ability to think, feel, and behave in a normal way.

Can you be denied insurance for mental illness?

Yes, you can be denied insurance for mental illness. If you are currently hospitalized and cannot perform daily living activities on your own, you may not be eligible for life insurance.

Is there a waiting period for life insurance with mental illness?

There is no waiting period for life insurance with mental illness. You can apply for coverage immediately and receive a decision within minutes.

Can mental illness affect your life insurance rates?

Yes, mental illness can affect your life insurance rates. The severity of your condition and your ability to perform activities of daily living on your own will be considered when determining your premiums.

Can mental illness medication affect my premium?

Yes, mental illness medication can affect your premium. The type of medication you are taking and the severity of your condition will be considered when determining your premiums.

What are the premiums for burial insurance with mental illness?

The amount you pay will depend on the severity of your condition, the type of coverage you choose, and other factors.

What is the average cost of life insurance for someone with mental illness?

The average cost of life insurance for someone with mental illness will vary depending on the severity of their condition, the type of coverage they choose, and other factors. However, most people with a mental illness will qualify for a first-day coverage plan with no medical exam and lower premiums.

Can people with psychotic disorders get final expense insurance?

Yes, people with psychotic disorders can get final expense insurance. Most of the time people with a history of mental illness qualify for a first-day coverage plan if they are not hospitalized and can perform activities of daily living on their own.

Can trauma-related disorders qualify for a first-day coverage plan?

Yes, trauma-related disorders can qualify for a first-day coverage plan. Most of the time people with a history of mental illness qualify for a first-day coverage plan if they are not hospitalized and can perform activities of daily living on their own.

Can mental illness affect life insurance?

Yes, mental illness can affect life insurance. The severity of your condition and your ability to perform activities of daily living on your own will be considered when determining your premiums.

Can you be rejected for life insurance because of mental illness?

Yes, you can be rejected for life insurance because of mental illness. If you are hospitalized and unable to perform activities of daily living on your own, you may not be eligible for life insurance.

How can you get the best life insurance rates with mental illness?

The best way to get the best life insurance rates with mental illness is to shop around and compare policies. Most people with a mental illness will qualify for a first-day coverage plan with no medical exam and lower premiums.

What is the best insurance option for people with mental illness?

The best insurance option for people with mental illness depends on the severity of their condition and their ability to perform activities of daily living on their own. Most people with a mental illness will qualify for a first-day coverage plan with no medical exam and lower premiums.

What are the best life insurance companies for mental illness?

The best insurance companies offer first-day coverage plans to people with mental illness. Talk to the agents in Funeral Plans to know your options.

What are some tips for getting life insurance with mental illness?

Some tips for getting life insurance with mental illness is to work with an independent life insurance agent who can help you compare policies and find the best rates. You may also want to consider a first-day coverage plan with no medical exam and lower premiums.