Burial Insurance with Diabetic Neuropathy (2024 Update)

That pesky diabetic neuropathy won’t stop you from getting first-day coverage burial insurance coverage. Yep, you read that right! Depending on which insurance company you apply to, you can get approved with no delays.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with diabetic neuropathy, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Diabetic Neuropathy?

Diabetic neuropathy is basically nerve damage courtesy of high blood sugar levels. When your nerves get zapped, they start slacking on their job, leading to all sorts of annoying issues like pain, numbness, and weakness.

Here’s the lowdown on the four main types:

- Peripheral Neuropathy: This one’s the star of the show – messing with the nerves in your feet, legs, hands, and arms. It brings the party with symptoms like burning, tingling, numbness, and weakness.

- Autonomic Neuropathy: This type takes aim at the nerves that handle all the behind-the-scenes stuff like digestion, heart rate, and even your bladder. It can cause some funky symptoms like nausea, dizziness, and sweating issues.

- Proximal Neuropathy: Feeling the burn in your thighs, hips, or shoulders? Proximal neuropathy could be the culprit. It can lead to pain, weakness, and a little muscle loss in those areas.

- Focal Neuropathy: Focal neuropathy likes to pick on one nerve or a small group, so symptoms vary depending on which nerves are under attack. Ever heard of carpal tunnel? Yep, that’s focal neuropathy doing its thing in your wrist.

Diabetic neuropathy isn’t just an inconvenience – it can cause some serious complications, like foot ulcers and even amputations. But don’t stress! With the right insurance company, you can still get the coverage you need without breaking a sweat.

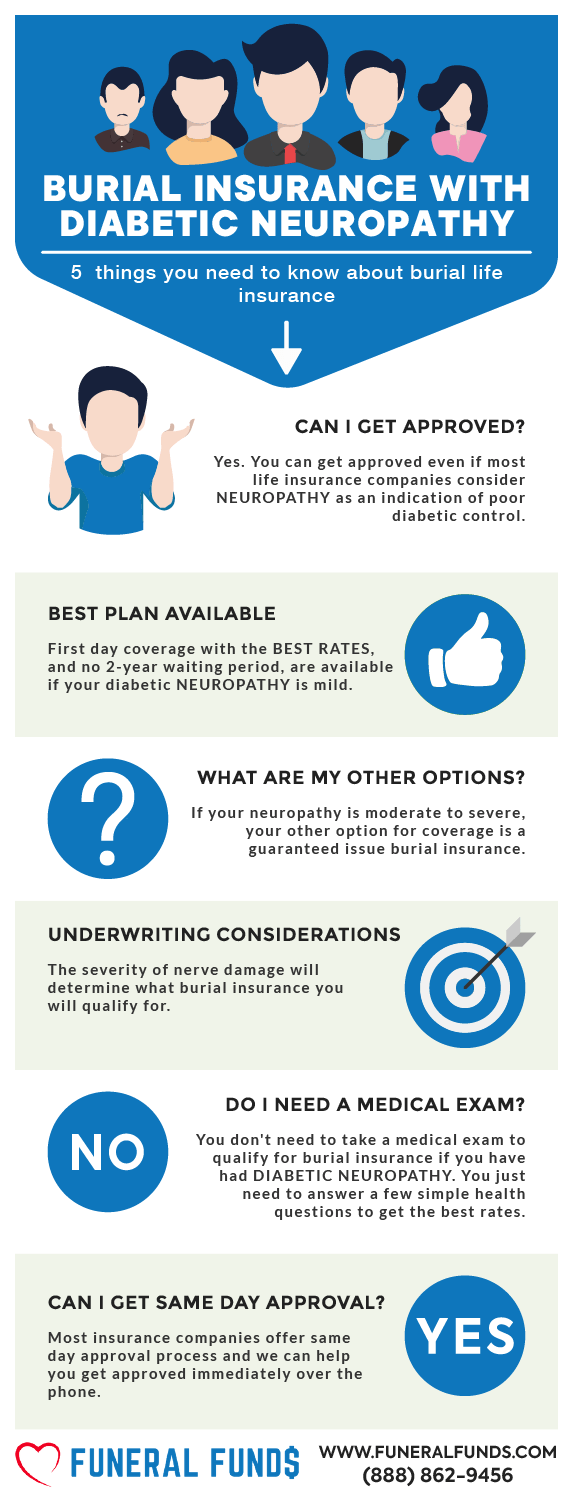

Can I Get Burial Insurance If I Have Diabetic Neuropathy?

Yes, you can! Just make sure you’re working with the right insurance companies, and first-day coverage is yours for the taking.

What Is My Best Insurance Option If I Have Diabetic Neuropathy?

Now, here’s the deal: most life insurance companies freak out when they hear “diabetic neuropathy” and will slam the door on your application. But don’t sweat it – there are some savvy insurers out there who offer first-day burial insurance with low rates and zero waiting periods. Just gotta know where to look!

Do I Need to Take a Medical Exam to Qualify For Burial Insurance?

Nope! Forget the needles and the stress. When you apply for burial insurance, it’s all about answering a few basic health questions. No medical records, no blood or urine tests – just a simple application process that usually gets you approved in minutes.

How Much Does Burial Insurance Cost If I Have Neuropathy?

The price tag on burial insurance when you’ve got diabetic neuropathy depends on a few things, like:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Pricing example for a nurturing 60-year-old female with diabetic neuropathy:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a compassionate 60-year-old male with diabetic neuropathy:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You Have Diabetic Neuropathy

If you’re eyeing first-day coverage, get ready to spill some health tea. These companies are gonna ask you some questions and check your prescription history to see how you’re really doing.

Types of Neuropathy that insurance companies want to know about:

- Autonomic Neuropathy

- Focal Neuropathy

- Peripheral Neuropathy

- Proximal Neuropathy

Insurance companies are nosy – they’ll want all the deets on your diabetic neuropathy.

Here’s a sneak peek at what they’ll ask:

- Have you been diagnosed with diabetic neuropathy, insulin shock, diabetic amputation, or taking insulin shots before age 50?

- Have you been diagnosed with diabetes prior to age 30, or have you ever been treated for a diabetic coma, insulin shock, or diabetic neuropathy?

- Have you had or received treatment for diabetic neuropathy, insulin shock, retinopathy, or nephropathy in the past two years?

If you’ve got diabetic neuropathy, it’s time to own it. When they ask on the application, just say “yes” and keep it moving.

Medications That Scream ‘Neuropathy Alert’:

- Carbamazepine

- Carbatrol

- Depacon

- Depakene

- Epitol

- Gabapentin

- Glyburide

- Glipizide

- Lamictal

- Lamotrigine

- Lyrica

- Neurotin

- Tegretol

- Valproic Acid

Information We Need If You Have Diabetic Neuropathy

To hook you up with the best insurance plan, we need the scoop on your medical condition. The more you share, the better your chances of scoring an affordable policy.

We’ll probably hit you with questions like:

- Are you using oral medications?

- Have any new medications been added in the past 12 months?

- Have you ever experienced a diabetic coma?

- Have you experienced insulin shock?

- When do you start using insulin?

How To Get First-Day Coverage Insurance If You Have Neuropathy

Want first-day coverage burial insurance with neuropathy? Your best bet is teaming up with an independent agency like Funeral Funds.

An experienced agency like us knows the ropes and can get you the best rates for diabetic neuropathy. We’ll find the perfect insurance carrier that gets your situation and is ready to hook you up with first-day coverage.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re pros at getting life insurance for folks with diabetic neuropathy.

We’ve got connections with a bunch of A+ rated insurance companies that love high-risk clients like you. We’ll sift through them all to find the best rates and match you with the top life insurance option.

We’re here to help you lock down the coverage you need at a price you can handle. So, if you’re looking for affordable life insurance with diabetic neuropathy, you’ve come to the right place.

Fill out our quote form or give us a ring at (888) 862-9456 for accurate burial insurance quotes.

Frequently Asked Questions

Can I get final expense insurance if I have neuropathy?

Absolutely! You can even get first-day coverage if you know which company to hit up.

Is diabetic neuropathy a chronic condition in life insurance?

Yep, it sure is. Nerve damage is permanent, so it’s something you’ll be dealing with for life.

Can you be denied life insurance for diabetes with neuropathy?

Unfortunately, yes. Some insurance companies will shut the door on you if you’ve got diabetic neuropathy.

Is diabetic neuropathy considered a pre-existing condition in life insurance?

Yes, it is. Once you’ve got that diagnosis, it’s sticking with you, so it’s definitely a pre-existing condition.

Is neuropathy considered a critical illness in life insurance?

Oh, for sure. Neuropathy is definitely in the critical illness category.

2 Comments

Khayrie

This is a very informative article about diabetic neuropathy.

Funeral Funds

Khayrie – Thank you for your compliment on our article!