Burial Insurance with Diabetic Coma (2024 Update)

If you have a health history that includes diabetic coma, you can still get some affordable burial insurance that kicks in right from day one. Yep, we’re talking full-on coverage with no waiting around.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those who have had diabetic coma, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Diabetic Coma?

A diabetic coma is like your body throwing a dramatic tantrum when your blood sugar levels go haywire. It’s a life-threatening episode, triggered by either a sugar low (hypoglycemia) or a sugar high (hyperglycemia). So, when your body decides it’s had enough of your sweet tooth or lack thereof, it can shut down in a major way.

But why does this happen? Let’s break it down:

- Diabetic ketoacidosis (DKA): This bad boy usually shows up in Type 1 diabetes but can crash the Type 2 party too. It happens when your body’s running low on insulin, leading to a messy buildup of ketones – those pesky little acid makers that turn your blood into a sour cocktail.

- Hyperglycemic hyperosmolar state (HHS): Picture this: your blood sugar’s been sky-high for way too long, and now your body’s dry as a desert and the electrolytes are all out of whack. It’s common in Type 2 diabetes, and let’s just say it’s not the kind of dehydration you want.

- Severe hypoglycemia: This one’s all about your blood sugar plummeting to the basement. Miss a meal? Oops. Took too much insulin? Double oops. Overdid it at the gym? Triple oops. Symptoms can range from confusion to seizures to, you guessed it, a coma.

If you’ve already had a diabetic coma, it’s a flashing neon sign that you’re at a higher risk for more diabetes drama in the future.

But here’s the silver lining: the longer you’ve stayed out of the danger zone and kept your diabetes in check, the less of a big deal it’ll be.

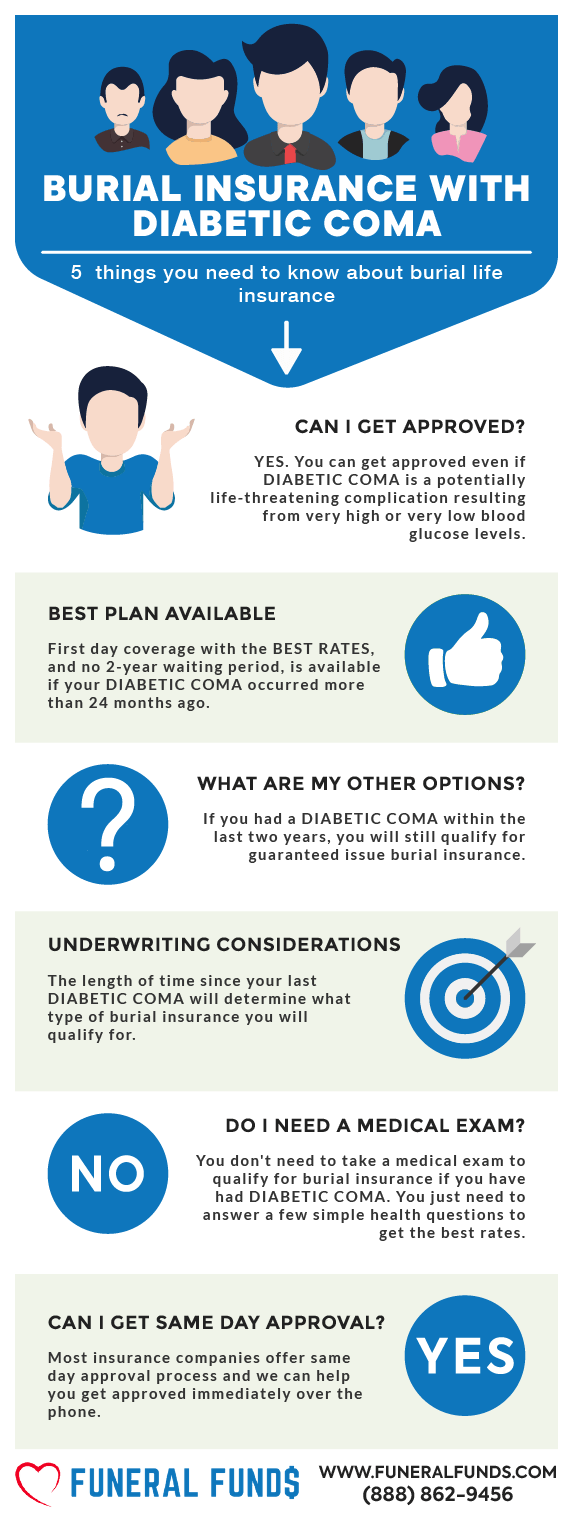

Can You Get Burial Insurance With Diabetic Coma?

YES: Had a diabetic coma but bounced back like a champ? If your health’s in check now, you could score first-day coverage, depending on what’s cookin’ in your state’s insurance kitchen.

NO: If you or your loved one is currently in a diabetic coma, sorry to say, no insurance company is going to touch that. You’ll need to wake up, walk out of the hospital, and handle your daily biz without needing help before you can talk burial insurance again.

What Is My Best Insurance Option If I Have Had Diabetic Coma?

If you’ve had a diabetic coma but you’re back to living your best life, you might still qualify for first-day coverage burial insurance – if it’s available in your zip code and you’re generally in good shape.

Here’s the kicker: No medical exam, no waiting period, and it comes with the lowest rates you can get. Win-win!

Do I Need A Medical Exam to Qualify for Burial Insurance?

Nope! The application process is as easy as pie. There is no need for medical records, no blood, no urine – just answer a few health questions, and boom, you could be approved in minutes!

How Much Does Burial Insurance Cost If I Had Diabetic Coma?

The burial insurance rates will depend on your:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Pricing example for a strong-willed 60-year-old female who’s had diabetic coma:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Pricing example for a resourceful 60-year-old male who’s had diabetic coma:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You’ve Had A Diabetic Coma

So, you’re eyeing burial insurance with first-day coverage? Some companies will dig into your health history and peek at your prescription record to make sure you’re not a walking medical mystery.

Diabetic coma scenarios that get their attention:

- Hypoglycemia – That’s when you’ve got too much insulin or not enough food. Basically, your blood sugar’s on a wild ride.

- Diabetic ketoacidosis (DKA) – This little party crasher happens in both types of diabetes, but it’s more of a Type 1 special.

- Hyperosmolar Syndrome – This bad boy only shows up in Type 2 diabetes, mostly hanging out with older adults.

What do burial insurance companies want to know?

- Have you been diagnosed as having diabetic coma, insulin shock, diabetic amputation, or taken insulin shots before age 50?

- Have you been diagnosed with diabetes before age 30, or have you ever been treated for a diabetic coma, insulin shock, or diabetic neuropathy?

- Within the past two years, have you had or received treatment for a diabetic coma, insulin shock, retinopathy, or nephropathy?

They’ll go through your prescription history as part of their risk check.

Information We Need About Your Diabetic Coma

Think of these as your personal quiz on living with diabetes:

- Do you have eye issues (retinopathy) resulting from diabetes?

- Do you have kidney issues (nephropathy) due to diabetes?

- Do you have nerve or circulatory issues (neuropathy) due to diabetes?

- Have you ever been in a diabetic coma?

- Have you ever gone into insulin shock?

- Have you ever had to have an amputation resulting from your diabetes?

- How old were you when you were first diagnosed with diabetes?

- What medications do you currently take?

- What type of diabetes do you have (Type 1 or Type 2)

Getting First-Day Coverage Insurance With A Diabetic Coma History

Team up with an independent agency like Funeral Funds to do all the legwork, compare plans from various insurance companies, and find you the best deal with first-day coverage.

No more guessing games – just the best plan and pricing for you!

How Can Funeral Funds Help Me?

At Funeral Funds, we’re your go-to agents for snagging you the lowest-cost life insurance, even if you’ve had a diabetic coma.

We’re tight with A+ rated insurance carriers who aren’t scared off by high-risk clients. We’ll dig through the options to find you the best rates and match you with your perfect life insurance plan.

We’re here to help you get the coverage you need at a price that won’t make your wallet cry. So, if you’re ready for affordable life insurance with a diabetic coma history, hit up our quote form or dial (888) 862-9456 for the lowdown on your burial insurance.

Frequently Asked Questions

Can diabetics with a history of diabetic coma buy cremation insurance?

Yep, if the plans is available in your zip code, most diabetics can score first-day coverage.

Is it hard to get life insurance with any diabetic coma in the past?

It’s a breeze if you team up with an independent agent. They’ll navigate the insurance jungle for you.

Can you get life insurance for someone in a coma?

Nope, if they’re in a coma, they need to be awake and able to sign the papers. No consent, no insurance.

Do I need to tell the insurance company about type 2 diabetes and diabetic coma?

Yep, if you’re gunning for first-day coverage.

Does a diabetic coma disqualify you from life insurance?

Not at all, as long as you’re applying to the right insurance company and enough time has passed. But if you’re in a coma, still in the hospital, or within two years of your coma, some companies might say “no thanks.”