Burial Insurance with Diabetic Amputation (2024 Update)

Let’s get real -diabetic amputations are no joke. When you’re dealing with something this serious, insurance companies are going to want the full scoop before they even think about approving you for a burial insurance policy.

But don’t freak out just yet! Depending on your health status, you might just get a first-day coverage policy if you pick the right company. Remember, though, not every plan or benefit is available in every state.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with diabetic amputation, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Diabetic Amputation?

Diabetic amputation is when a surgeon has to remove part of your limb – usually a foot or lower leg – because diabetes has thrown a wrench into your health. It’s the last-ditch effort to deal with complications, typically from nasty diabetic foot ulcers that just won’t heal and decide to invite infection to the party.

Why does diabetes lead to amputation?

- Peripheral artery disease (PAD): This bad boy narrows the arteries that should be delivering blood to your legs and feet. Less blood flow means slower healing and a higher risk of infection.

- Diabetic neuropathy: This nerve damage is caused by sky-high blood sugar levels and it can make your feet go numb. Numb feet = not feeling pain or injuries = not noticing that pesky sore until it’s too late and infection sets in.

If you ignore it, that infected ulcer can spread like wildfire, leading to gangrene (a.k.a. tissue death).

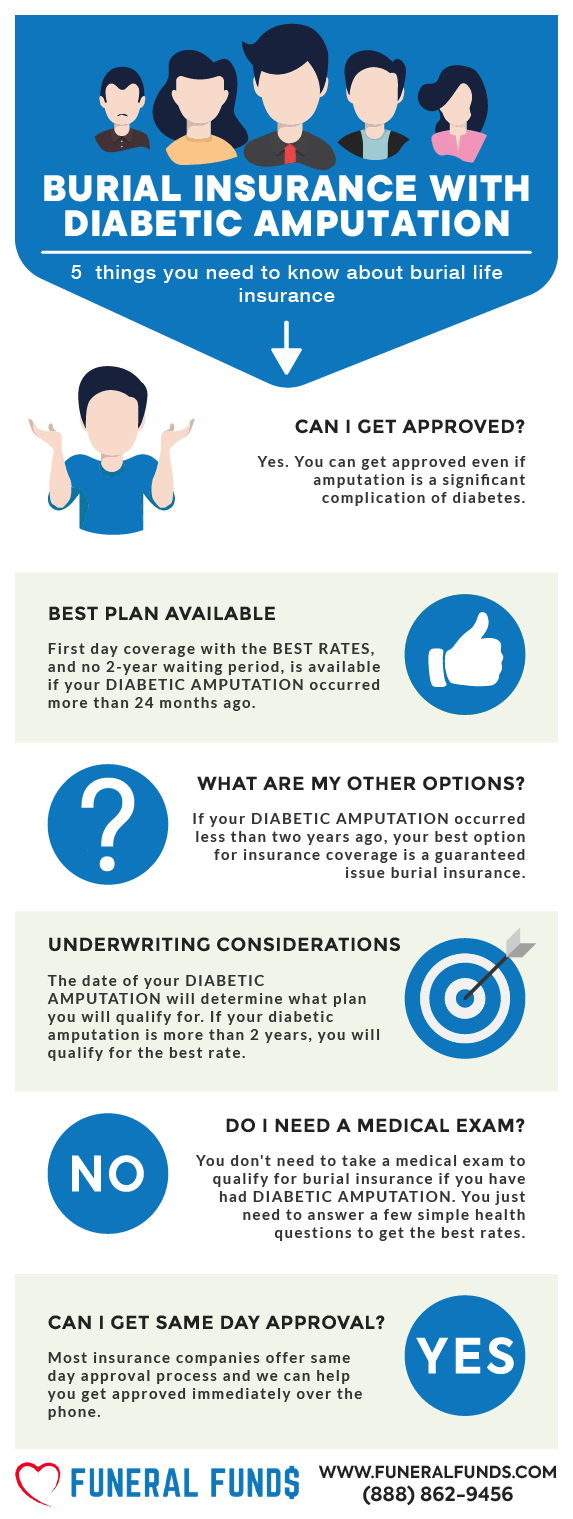

Can You Get Burial Insurance With Diabetic Amputation?

YES: If you’ve had a diabetic amputation but can still rock those Activities of Daily Living (ADLs)* all by yourself, there’s a good chance you could get first-day coverage insurance.

NO: If you’re currently in the hospital for a diabetic-related amputation, don’t even think about it – no insurance company is touching that. You need to be out of the hospital and handling your ADLs* solo before you can qualify for the first-day coverage plan.

*ACTIVITIES OF DAILY LIVING include all the basics – eating, bathing, dressing, using the toilet, moving from bed to chair, and handling your bathroom business.

What Is My Best Insurance Option If I Have Had Diabetic Amputation?

If you’ve had a diabetic amputation, first-day coverage burial insurance might be in the cards – if the right insurance companies operate in your state.

If you’re a self-sufficient superstar who can handle your ADLs without a hitch, you might just land that first-day coverage and burial insurance. But if those companies don’t have your back in your state, then it’s time to consider guaranteed acceptance life insurance.

Now, if you’re using a wheelchair, need help with those daily activities, or are currently hospitalized, your only option is guaranteed issue life insurance. It’s not the flashiest, but it’ll get the job done.

Do I Need A Medical Exam to Qualify for Burial Insurance?

Nope! When it comes to burial insurance with a history of diabetic amputation, the top-notch first-day coverage plans keep it simple. They’ll just ask you a few basic health questions – no need to roll up your sleeves for blood or urine samples.

The best part? You’ll usually get the green light from the insurance company in minutes!

But hey, if you’re not in the mood for health questions, then brace yourself for a 2-year waiting period plan.

How Much Does Burial Insurance Cost If I Had Diabetic Amputation?

Your burial insurance rates will hinge on a few factors:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Check out these sample rates for a witty 60-year-old female with diabetic amputation:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Check out these sample rates for a charismatic 60-year-old male with diabetic amputation:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting If You’ve Had A Diabetic Amputation

Here’s how some insurance companies might phrase those diabetic amputation questions on the application:

- Have you been treated for or diagnosed as having diabetic coma, amputation caused by disease, or taken insulin shots prior to age 50?

- Have you ever received, or been advised to receive, amputation due to complications of diabetes?

- Within the past 24 months, have you been diagnosed or treated for an amputation caused by any disease?

And just so you know, besides the health questionnaire, the insurance company will also do a quick prescription history check to confirm any other health conditions.

Information We Need About Your Diabetic Amputation

Here are some questions we might ask to get you the best plan and pricing:

- At what age were you diagnosed with diabetes?

- Are you able to perform activities of daily living on your own?

- Are you being treated for kidney disease?

- Are you confined to a wheelchair?

- Did you have an insulin shock?

- Do you have neuropathy, retinopathy, or glaucoma?

- Do you use insulin?

- Do you use medication like Metformin, Actos, Glyburide, Januvia, or Glipizide to treat your diabetes?

- Have you been in a diabetic coma?

- What type of diabetes do you have?

What If I’m Declined For Coverage?

So, you’ve been turned down for coverage? No worries! That’s where an independent insurance agency like Funeral Funds comes in to save the day. We know the ins and outs of underwriting guidelines across multiple companies, which means we can score you a better plan with the lowest rates – no sweat!

With access to over 20 insurance companies, we’re your go-to for finding a diabetic-friendly life insurance company that will actually say “yes.” Trust us, we’ll save you time and a whole lot of frustration during the application process.

Getting First-Day Coverage Insurance With A Diabetic Amputation History

Want first-day coverage burial insurance despite a history of diabetic amputation? Your best bet is teaming up with an independent agency like Funeral Funds. Our savvy life insurance agents will shop around, compare companies offering first-day coverage, and hook you up with the best plan at the best price.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re pros at securing life insurance coverage for folks with a history of diabetic amputation.

We’ve got connections with a bunch of A+ rated insurance carriers that love working with high-risk clients. We’ll dig through the options to find you the best life insurance rates and match you up with your perfect plan.

We’re here to make sure you get the coverage you need at a price that won’t break the bank. So, if you’re looking for affordable life insurance despite a diabetic coma, we’ve got your back. Just fill out our quote form on this page or give us a call at (888) 862-9456 for your personalized burial insurance quote.

Frequently Asked Questions

Can I get insurance if I have diabetes or a diabetic amputation?

Absolutely! You can still get burial, funeral, cremation, and final expense insurance even if you’re dealing with any type of diabetes or have had an amputation due to it. We’ve got you covered!

Can an amputee get life insurance?

Yes! If you’ve lost a limb due to an accident or trauma, you can still get life insurance coverage – as long as you’re able to handle all your ADLs like a champ.

Is Type 1 diabetes or type 2 diabetes with an amputation considered a pre-existing condition?

Yep, it sure is! Any current medical condition, including diabetes with an amputation, is considered a pre-existing condition that life insurance companies will definitely want to know about.

Can you be denied life insurance for diabetes with an amputation?

Unfortunately, yes. Some insurance companies will turn you down for first-day coverage if you have diabetic complications and can’t perform those all-important ADLs.

Do I need to tell insurance about my diabetic amputation?

Yes, indeed! Always spill the tea on all your pre-existing conditions, including your diabetic amputation, to your insurance company.

Do all carriers cover diabetes with complications?

Nope. Some companies will give you the cold shoulder if you have diabetic complications, while others are more flexible. That’s why it’s crucial to work with a savvy life insurance agent from Funeral Funds when you’ve got major pre-existing health conditions.