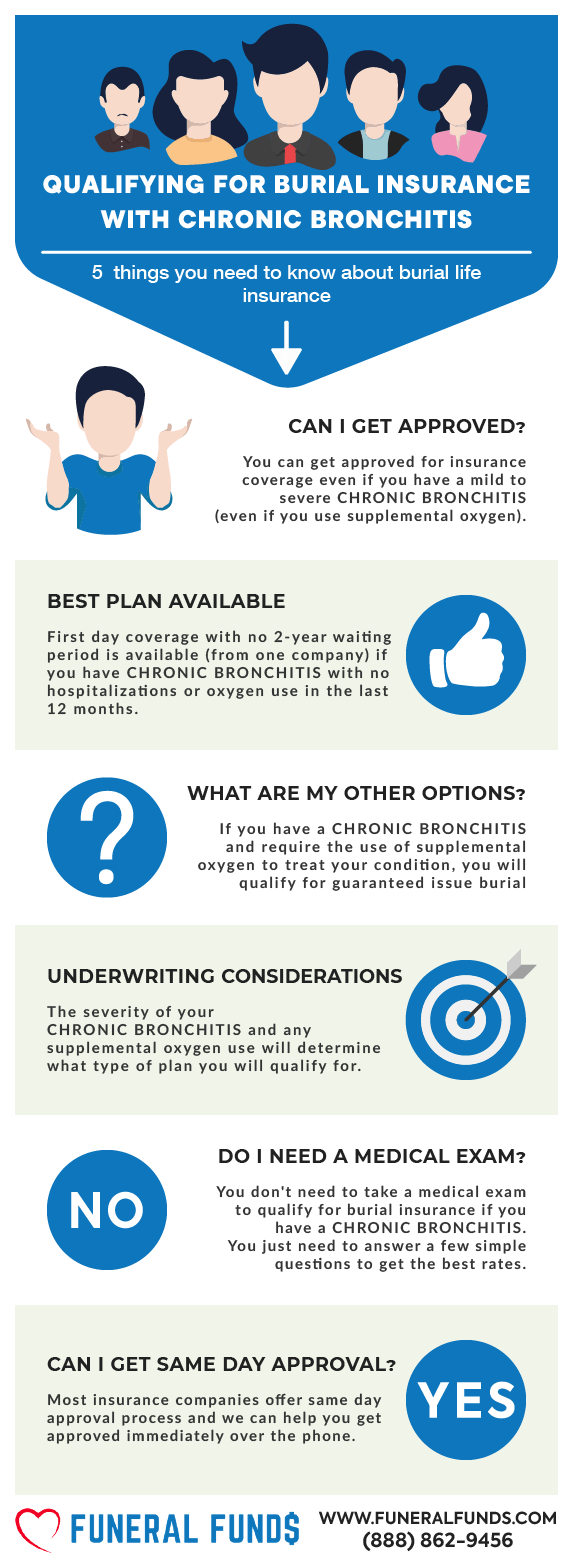

Qualifying for Burial Insurance with Chronic Bronchitis

Struggling to Qualify for Burial Insurance with Chronic Bronchitis? Don’t sweat it! We’ve got a knack for helping folks with chronic bronchitis and other health hiccups get first-day coverage burial insurance.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with chronic bronchitis, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Chronic Bronchitis?

ACUTE BRONCHITIS

If you have acute bronchitis due to a cold or other respiratory infection that improves within a few days, congratulations! You will qualify for the best option and first-day coverage.

If you have no other health conditions other than chronic bronchitis, you will qualify for a level death benefit (first-day coverage) without a waiting period. You are covered immediately from day one! Your beneficiary will get 100% of the death benefit when you pass away.

Best Option: Level Death benefit

CHRONIC BRONCHITIS

If you have chronic bronchitis that keeps coming back, or if it develops into chronic obstructive pulmonary disease, you can still qualify for coverage with first-day benefits.

You may still qualify for first-day benefits if you have other medical conditions such as diabetes, high blood pressure, or asthma in addition to chronic bronchitis.

Best Option: First Day Benefits (Hybrid first-day coverage)

CHRONIC BRONCHITIS WITH SUPPLEMENTAL OXYGEN USE FOR 24-HOURS A DAY

For chronic bronchitis patients with other medical conditions or on supplemental oxygen use for 24 hours, you will only qualify for guaranteed acceptance life insurance.

Guaranteed acceptance life insurance does not require a medical exam or asking any health questions. These policies are limited in the death benefit amount, don’t exceed $25,000, and have a graded death benefit.

Guaranteed issue life insurance should be your last option if you can’t qualify for a level first-day death benefit because of your condition.

If you pass during the first two years of the policy, your beneficiary will get all the premiums that you paid in, plus an additional 10%

Best Option: Guaranteed Acceptance Life Insurance

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

The application process for burial insurance is very straightforward. You will not have to take physicals or medical exams. You don’t have to provide your doctor’s records either. You will only have to answer a few health questions.

In most cases, the insurance carrier will get you a decision regarding your eligibility in under 15 minutes.

If I Have Chronic Bronchitis, Do I Need A Medical Exam To Qualify For Burial Insurance?

You don’t need to take a medical exam to qualify for coverage if you have chronic bronchitis. You also don’t need to provide blood and urine samples either.

What Are The Types Of Chronic Bronchitis The Insurance Companies Care About?

Insurance companies know bronchitis is a potentially life-threatening swelling of the lining of the bronchial tubes, the airways that carry the air to your lungs.

The inflamed bronchial tubes cause a cough that produces a lot of mucus. It can cause shortness of breath, a low fever, wheezing, and chest tightness. Cigarette smoking is the most common cause. Breathing in air pollution, dust, or fumes over a long period may also cause it.

There are two major types of bronchitis acute and chronic:

Acute bronchitis – develops from a cold or other respiratory infection. It often improves within a few days without lasting effects.

Chronic bronchitis – when the symptoms of bronchitis last more than 90 days it is classified as chronic. The inflamed bronchial tubes produce a lot of mucus and restrict the amount of airflow going into and out of the lungs.

Chronic bronchitis is a long-term condition keeps coming back and develops into a chronic obstructive pulmonary disease. According to the American Lung Association, more than 11 million Americans have COPD and many more people don’t even know they have it.

Chronic bronchitis often appears with emphysema, which is a condition that involves the destruction of the lungs over time. It is usually diagnosed through a chest x-ray to determine the extent of the lung damage.

One of the complications of chronic bronchitis is your lungs become vulnerable to infections. Insurance companies know that this condition can’t be cured, but the symptoms can be managed with treatment once a diagnosis is made.

Chronic bronchitis is commonly caused by cigarette smoking; over 90% of patients have a smoking history.

Secondhand smoke can also cause the development of chronic bronchitis. Other possible causes of chronic bronchitis include extended exposure to air pollution, chemical or industrial, and toxic gases. Repeated infections of the lungs may also cause further damage to the lungs and worsen the symptoms.

Burial Insurance Underwriting If You Have Chronic Bronchitis

All life insurance companies want to know if you have chronic bronchitis because chronic bronchitis can be complicated if it exists with other health conditions.

The biggest complication will be if your chronic bronchitis occurs with asthma or emphysema.

You will often find chronic bronchitis in the health questionnaire asked this way:

- Have you ever been diagnosed with or been advised to receive treatment or medication for chronic bronchitis, chronic obstructive pulmonary disease (COPD), or emphysema?

- Within the past 24 months, have you been medically diagnosed, treated, or taken medication for chronic obstructive pulmonary disease (COPD), chronic bronchitis, or emphysema?

- During the past 24 months, have you been treated for emphysema, chronic bronchitis, or chronic obstructive pulmonary disease (COPD)?

The insurance company will also ask if you have been hospitalized due to your condition.

Aside from the health questionnaire, life insurance companies will check your prescription history to verify your answer to the health questionnaire.

What Medications Do The Insurance Companies Look For When I Have Chronic Bronchitis?

Chronic Bronchitis Treatment

Chronic bronchitis therapy is intended to relieve symptoms, prevent complications, and slow disease progression.

Treatment may include:

- Bronchodilator Medications

- Steroids

- Antibiotics

- Vaccines

- Oxygen therapy

- Surgery

- Pulmonary rehabilitation

Here’s a list or prescription medication for chronic bronchitis:

- Albuterol

- Anoro

- Atrovent

- Arcapta

- Brovana

- Combivent

- Fluticasone

- Incruse

- Perforomist

- ProAir

- Salmeterol

- Seebri

- Spiriva

- Stiolto

- Stiverdi

- Theophylline

- Tudorza

- Utibron

- Xopenex

If the insurance company determines that you are taking any of these medications, you will often be considered a chronic bronchitis patient. Your prescription history is a part of the application process. If you take any of these medications, you won’t be able to hide it.

Every burial insurance company has different underwriting. You will need our help to look into your medications to see which companies would most accept your chronic bronchitis and your medications.

If you are taking supplemental oxygen, read this article. Oxygen use for 24 hours a day prevents you from qualifying for level death benefit with any burial insurance company. However, you can get a plan that protects you partially during the first two years.

How Should I Pay My Premiums?

Savings or checking accounts are the best. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you will not worry about your policy lapsing due to non-payment.

Chronic Bronchitis And Burial Insurance Riders

You may have the option to add a policy rider(s) to your basic policy. Insurance riders add benefits to your policy. Adding insurance riders can enhance your policy to fit your specific needs.

Some riders can be added to your policy without additional cost. However, some riders come with some extra costs. Don’t worry; riders are affordable and involve little to no underwriting.

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

What Will Insurance Companies Offer Me If I Have Chronic Bronchitis?

Every burial insurance company looks at chronic bronchitis differently. Below are possible offers you will receive if you have a chronic bronchitis diagnosis.

- They offer you first-day coverage – The insurance companies will approve your application even though you have chronic bronchitis. You will pay the lowest premium monthly and are immediately covered from day one of your policy.

- They will offer you first-day benefits, your death benefit payout is phased in over the first two years of the policy.

- They will offer you a two-year waiting period and charge you a higher premium. Your beneficiaries will not get the full death benefit if you die during the waiting period (unless your death results from an accident). They will receive a refund of all your premiums plus interest in the first two years for non-accident-related deaths.

How Long Should I Wait Before Purchasing Burial Insurance?

If your chronic bronchitis is mild and you can qualify for a level death benefit, buy it now!

Do not be like other people who consider getting burial insurance but decide to wait.

Do not think twice buy burial insurance NOW because there is no cure for chronic bronchitis, and it may eventually lead to COPD. Your situation may progressively get worse and never improve.

The more symptoms you develop and the more treatments you receive will often disqualify you from the desired level of coverage.

The good news is that insurance coverage is available for anyone who has chronic bronchitis.

We can guide you through the whole application process to get the right policy the first time. It will prevent getting a life insurance decline on your record. A few companies will not accept anyone who has previously been declined for this insurance in the last 12 months.

How To Find The Best Burial Insurance Policy With Chronic Bronchitis

Here’s the deal…living with chronic bronchitis does not mean you can’t protect your family from increasing funeral expenses.

You can qualify for burial insurance with this medical condition you just need to work with a knowledgeable agent. Funeral Funds is an independent burial insurance agency with access to many A-rated companies you can work with.

Having multiple companies to choose from is vital when you have an illness like chronic bronchitis. Most burial insurance companies will impose a two-year waiting period if you have chronic bronchitis. But we can match you with the best burial insurance company that offers immediate coverage or first-day benefit if you have this condition.

How Can Funeral Funds Help Me?

Finding a policy for chronic bronchitis can be frustrating if you do it on your own.

If you have chronic bronchitis, let us help you; we will work with you side by side to find a plan that fits your needs.

You don’t need to waste your precious time searching for different insurance companies; we will do the work for you. We can shop your case to different companies to get your application approved.

Here at Funeral Funds, we specialize in obtaining life insurance coverage for people with a history of chronic bronchitis.

We work with many A-rated insurance companies that specialize in high-risk clients. We will search those companies to give you the best rate ever. We’ll match you up with your best funeral and burial insurance option.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for burial insurance with chronic bronchitis, funeral insurance with chronic bronchitis, or final expense insurance with chronic bronchitis, we can help.

Fill out our quote form on this page or call us at (888)862-9456, and we can give you free burial insurance quotes.

Frequently Asked Questions

Can I get life insurance with chronic bronchitis?

Yes, you can get life insurance with chronic bronchitis. However, your insurance eligibility will depend on the severity of your condition. You may even qualify for a first-day coverage plan if you only have acute bronchitis.

Can I get cremation insurance with chronic bronchitis?

Yes, you can get cremation insurance even if you have chronic bronchitis. However, your insurance eligibility will depend on the severity of your condition.

Why is my bronchitis not going away?

Usually, bronchitis is not going away because viruses do not respond to antibiotics. If your symptoms do not improve after several weeks, see your doctor immediately because you may be having a sign of chronic bronchitis.

Can I get final expense insurance with chronic bronchitis?

Yes, you can get final expense insurance with chronic bronchitis. You may qualify for a first-day coverage plan if you are 50 to 85 years old.

Can bronchitis cause death?

Yes, bronchitis can damage the heart or lungs, which can lead to death from serious complications.