Burial Insurance with Circulatory Surgery

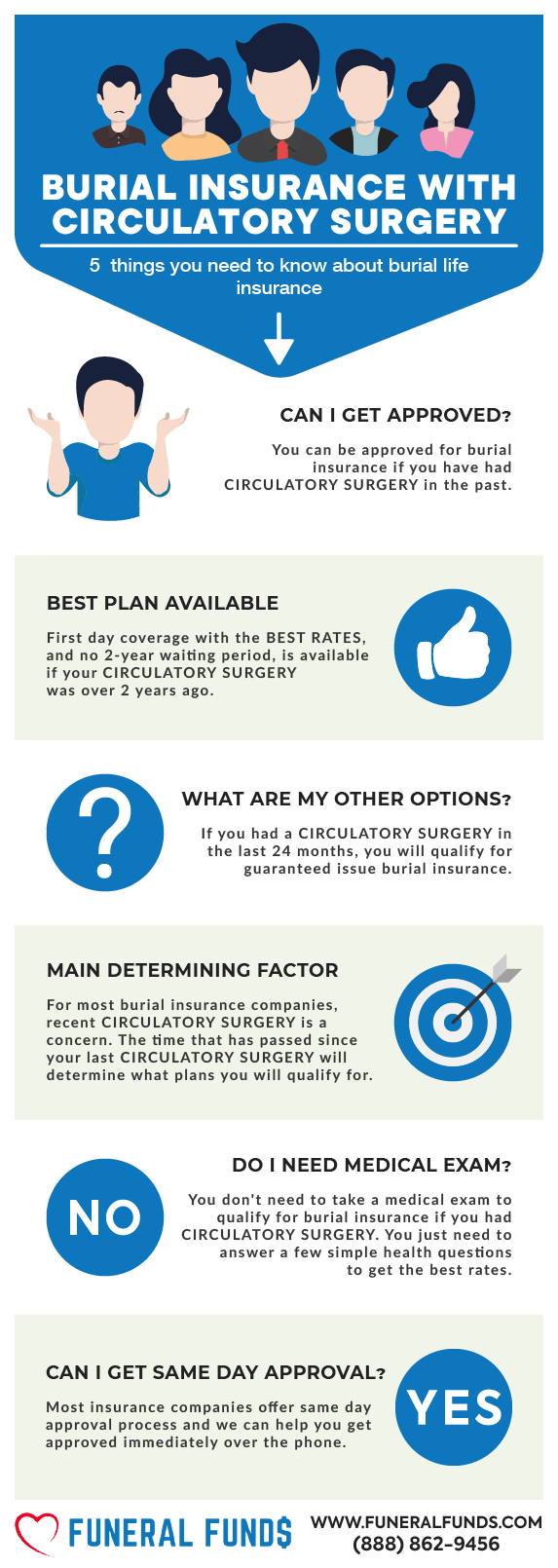

Getting burial insurance after having circulatory surgery is possible with the right policy. Whether your surgery was yesterday or eons ago, there’s a policy out there with your name on it.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with circulatory surgery, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I Have A History Of Circulatory Surgery?

If you’ve had any of the surgeries listed below, you’re in the circulatory surgery club:

- Angioplasty

- Aneurysm Surgery

- Artificial Heart Valve Surgery

- Arrhythmia Surgery

- Atherectomy

- Bypass Surgery

- Cardiomyoplasty

- Catheter Ablation

- Coronary artery bypass graft

- Heart Valve Replacement

- Heart Transplant

- Myectomy/ myotomy

- Stent Placement

- Transmyocardial Revascularization

- Valvular Surgery

- Any surgery performed on any arteries in the body

For most burial insurance companies, your surgery isn’t a huge deal. Their main question? “When did you have your circulatory surgery?”

Most insurance carriers consider the time elapsed since your surgery crucial. It’s the big factor that decides your premiums and whether you’ll be stuck with a waiting period.

IF YOUR CIRCULATORY SURGERY WAS OVER 24 MONTHS

Congrats! If it’s been over two years since your surgery, you hit the insurance jackpot. Almost every burial insurance company will roll out the red carpet with their level 1st-day coverage death benefit plan at the lowest rate. It’s like your surgery never even happened.

Final expense life insurance with a level death benefit kicks in from day one. This no-wait senior life insurance is your cheapest option.

IF YOUR CIRCULATORY SURGERY WAS WITHIN 2 YEARS

For those with recent circulatory surgeries the best life insurance company will hit you with, “Have you been hospitalized twice in the last two years?” If your answer’s a solid “Nope,” you’re good to go for first-day coverage – just as long as you live in the right zip code that offers the right plans.

But if you’re still in the hospital or racked up two or more stays recently, your best bet is guaranteed-issue whole life insurance. Yeah, there’s a two-year waiting period, but it’s way better than kicking yourself later for waiting too long to get covered.

DO I NEED A MEDICAL EXAM TO QUALIFY FOR BURIAL INSURANCE?

Good news! You do NOT need to play doctor to get burial insurance, even if you’ve had circulatory surgery.

When you apply, you’ll just answer some basic health questions. No need to dig up your medical records or donate blood and urine samples. The process is as easy as pie, and you’ll often get the green light from the insurance company within minutes!

BURIAL INSURANCE UNDERWRITING IF YOU HAVE CIRCULATORY SURGERY

Here’s the scoop on how burial insurance companies figure things out:

FIRST – They might ask you a bunch of health questions. Your answers will decide your fate.

SECOND – They’ll take a peek at your prescription history to make sure everything checks out.

Every burial insurance company that does underwriting (those nosey health questions) will ask about your circulatory surgery.

HEALTH QUESTIONS:

The questions could be as simple as:

- Within the past 24 months, have you been medically diagnosed as having or been treated or hospitalized for heart or circulatory surgery?

- During the past 12 months, have you been diagnosed as having a stroke, angina, aneurysm, or heart or circulatory surgery?

- Within the past 2 years, have you had or been diagnosed with, received, or been advised to receive treatment or medication for heart attack, cardiomyopathy, or any type of heart or circulatory surgery?

Answer “yes” to any of these questions, and it might change your rates and the time it takes for your coverage to kick in.

PRESCRIPTION HISTORY CHECK

Insurance companies will do some snooping into your prescription history to confirm your health status.

If you’re popping blood-thinners like Plavix, Warfarin, or Coumadin, don’t sweat it. Most companies won’t bat an eye as long as there’s a legitimate reason and your health is stabilized by the medications.

How Much Insurance Do I Need If I Have Circulatory Surgery?

Figuring out how much burial insurance you need is like picking the right outfit – it’s all about your personal and financial style. Your insurance should cover your funeral, burial, and all those final expenses.

First, get a handle on your end-of-life expenses. The big-ticket item? Your funeral!

But don’t forget about those pesky medical bills, living expenses, credit card bills, and other debts that might tag along.

How Should I Pay My Premiums?

Set it and forget it! The best way to pay your premium is through a savings or checking account. Set up an automatic bank draft so your premiums are paid on time every month, and you can chill knowing your policy won’t lapse.

Information We Need If You Have Circulatory Surgery

We need the scoop on your medical condition to match you with the perfect plan. The more details you share, the better our chances of scoring you affordable coverage.

Here’s what we’ll ask:

- What type of circulatory surgery do you have?

- What was the date of your last circulatory surgery?

- What is your age at the time of the surgery?

- How much time has passed since your last surgery?

- Have you had any circulatory tests performed following your surgery?

- What medications are you currently taking?

- Do you have any other medical conditions?

- Have you ever been diagnosed with heart disease?

What If I Got Denied Coverage In The Past?

Denied life insurance because of your circulatory surgery? We’ve got your back! The main reason for that rejection is you probably applied to the wrong company!

Some final expense insurance companies are pros at handling high-risk cases. You just need to know who they are and aim your application in the right direction. That’s where an independent life insurance agency like Funeral Funds comes in handy.

Other Common Uses For Final Expense Life Insurance

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan with circulatory surgery

- Cremation insurance plan with circulatory surgery

- Funeral home insurance plan with circulatory surgery

- Final Expense insurance plan with circulatory surgery

- Prepaid funeral plan insurance with circulatory surgery

- Mortgage payment protection plan with circulatory surgery

- Mortgage payoff life insurance plan with circulatory surgery Deceased spouse’s income replacement plan with circulatory surgery

- Legacy insurance gift plan to family or loved ones with circulatory surgery

- Medical or doctor bill life insurance plan with circulatory surgery

We can hook you up with any of the plans mentioned. Your rate will depend on your age, health, and coverage amount.

How Can Funeral Funds Help Me?

Finding a policy with a pre-existing heart condition doesn’t have to be a nightmare. With an independent agency like Funeral Funds, it’s a breeze.

We’ll take care of the nitty-gritty so you don’t have to waste time hunting for insurance companies. We’ll shop your case around to different carriers to get you the best deal.

We partner with loads of A+ rated insurance carriers that love covering high-risk clients like you. We’ll search through them all to snag the best rate. We’ll match you with the perfect burial insurance company offering the best price.

Looking for circulatory surgery funeral insurance, burial insurance, final expense insurance, or congenital heart disease insurance? We’ve got you covered. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Frequently Asked Questions

What does life insurance consider circulatory surgery?

Life insurance companies will typically consider any type of surgery performed on the heart or blood vessels circulatory surgery. This can include anything from coronary artery bypass graft (CABG) surgery to angioplasty or even something as simple as a blood transfusion.

Do I need to tell insurance about circulatory surgery?

You will need to tell your life insurance company about any circulatory surgery you have had. The insurance company will then use this information to determine your rates and coverage.

What are the risks of not disclosing circulatory surgery?

If you do not disclose your circulatory surgery to your life insurance company, they may consider it to be a fraud. This could result in your policy being canceled, and you may even be denied coverage in the future.

What are the things that may affect my eligibility if I have circulatory surgery?

Some things that may affect your eligibility if you have circulatory surgery include the type of surgery that you had, your current health, and any other relevant factors. The insurance company will use this information to determine your rates and coverage.

Can you be denied insurance for circulatory surgery?

Yes, you can be denied insurance for circulatory surgery. The insurance company will consider the type of surgery you had, your current health, and any other relevant factors.