2024 Burial Insurance for Veterans

Burial insurance for veterans is available to any member of the Army, Air Force, Navy, Marines, or Coast Guard after they leave the armed services. Some insurance companies cater to the needs of veterans and have developed life insurance plans for them. The good news is that a veteran’s life insurance offers many options.

Armed forces personnel can convert their Service Members Group Life Insurance (SGLI) to Veterans Group Life Insurance (VGLI) when they leave the military, but there are reasons why you should choose to purchase insurance coverage from a private life insurance company.

Two of the greatest benefits of burial insurance for veterans are: that they do not require a medical exam to qualify, and underwriting is more lenient on PTSD and other health issues when purchased through Funeral Funds.

It’s very easy to apply; all you need to do is fill out a very short application and answer no to the health questions on the application.

Getting burial insurance for a disabled veteran is also possible. Many disabled veterans that collect VA disability benefits still have a job or a business. If you’re a disabled veteran that doesn’t receive social security disability income, you have a better chance of getting approved for burial insurance. Most of the time, you can expect to pay the same premium as people who are not on disability.

In this article, we will explore how military personnel can have burial insurance, funeral insurance, cremation insurance, or final expense insurance when they leave the military. We will learn what burial insurance options are open for them and how to get the best rates.

FOR EASIER NAVIGATION:

- What Happens When Military Service Ends?

- Burial Insurance For Veterans

- Best Features Of Burial Insurance For Veterans

- Burial Insurance Options For Veterans

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On Burial Insurance For Veterans

What Happens When Military Service Ends?

All Army, Air Force, Navy, Marines, or Coast Guard members are automatically enrolled in Servicemembers Group Life Insurance (SGLI). How much life insurance do veterans get? This is life insurance with a maximum coverage amount of $400,000. This veteran death benefits life insurance last until 120 days after the retirement date or the moment you leave the service.

After leaving the active service, you are given the option to convert your SGLI into a Veterans’ Group Life Insurance (VGLI). VGLI is available to all armed forces personnel leaving active duty, not just retirees.

Your timeframe after separation from the military will look like this:

- During service – you will be automatically covered with SGLI. You can convert SGLI to VGLI without medical underwriting.

- 120-240 days – but you have the option to convert SGLI to VGLI without evidence of good health or medical underwriting.

- 240-480 days – but you can convert your SGLI to VGLI. You need to answer health questions to do this.

- 485 days onwards – Too late to convert your SGLI to VGLI. You are no longer covered by SGLI and can’t convert to VGLI. Private life insurance is your only option for insurance coverage.

Burial Insurance For Veterans

Burial insurance, in many ways, is more important for veterans than other groups. Veterans know that the unexpected can happen, and life insurance will be very important for the financial welfare of their families.

If you have been previously in the military, you are automatically enrolled in SGLI. Following this, you may have converted your policy into VGLI. But it may not be the best option for you with other private insurance now available.

As a veteran, you may find it difficult to get traditional life insurance, especially if you have been injured or disabled. However, this is not the case with burial insurance. Burial insurance for veterans, also referred to as final expense or funeral insurance, is easier to qualify for.

You probably have seen ads for this insurance product on TV or the internet. All of these terms for burial insurance refer to a whole life insurance policy designed for people and families to pay for funeral and final expenses.

One significant advantage of burial insurance for veterans is that it’s very easy to buy. You only need to answer some questions about your health, and some plans don’t even ask any health questions at all.

Best Features Of Burial Insurance For Veterans

- Immediate approval – there is fast approval for burial insurance for veterans. The approval time can generally range from 15 minutes to a few business days. The time it takes to be approved depends on the company you apply with, but most insurance companies offer instant approval over the phone.

- No medical exam – all insurance companies offering burial insurance for veterans will not require you to undergo a medical exam. You will never need to give a blood or urine sample or provide your medical records. The application process is simplified; you only need to answer a few health questions. Some plans don’t even ask health questions on the application.

- Lenient underwriting – Veterans with pre-existing medical conditions like PTSD could still qualify for burial insurance. There is lenient underwriting, and applicants only need to answer a few health questions. This type of burial insurance policy was designed to accept the risk of some fairly major health issues. Despite some problematic illnesses, you can still get a policy!

- No health questions – Guaranteed issue policy won’t ask health questions, and applicants with severe medical conditions can qualify. Guaranteed acceptance whole life insurance is best for veterans with a disability or severe health conditions.

- Permanent coverage – burial insurance for veterans are whole life insurance policies that will last your whole life. You have permanent coverage, and the policy will not expire at any age. The death benefit will not decrease, and the premium you pay will never increase.

- Fast death benefit payout – there is a quicker claims payout with burial insurance for veterans. The claim will be paid to your beneficiaries within a week after the company receives the proper paperwork.

- Portability – the payout is paid in cash to the beneficiary upon the insured’s death (not to a funeral home). It does not matter where you are…the insurance company will pay even if you pass away in another country. Your beneficiary will receive 100% face amount of the policy tax-free and can be used to pay final expenses or anything they see fit.

- Accumulates cash value – burial insurance for veterans is a whole life policy with a cash value component that grows over time. You can use the cash value for financial emergencies or pay premiums to ensure your policy will never lapse from non-payment.

- Small coverage options – burial insurance for veterans is offered at a small face value. If you want to be cremated, you only need between $2,000 and $5,000 in coverage. You can buy as little as $2,000 or as much as you need. This is a fantastic feature of burial insurance because it allows you to buy what you need to cover your end-of-life expenses.

Most burial insurance companies offer a maximum face amount of $25,000 to $50,000. If you want to buy more than $50,000, you can purchase multiple policies to get the total face amount you need.

- Many insurance providers offer burial insurance to veterans – more and more insurance companies are now providing coverage to veterans. They are all competing for your business, so you can choose the best company offering the best price at the best value.

Burial Insurance Options For Veterans

There are different life insurance policy options to consider in civilian life after you’ve separated from the military.

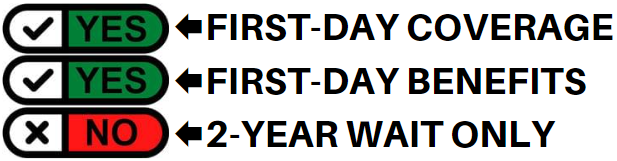

SIMPLIFIED ISSUE WITH LEVEL DEATH BENEFIT

Simplified issue whole life insurance is a burial insurance policy you can buy from age 50-to 85. The monthly premium is guaranteed to never increase through the policy’s life. You will be covered immediately from day one and will not have a waiting period.

This policy provides a 100% death benefit when the policy is issued. If you cross the street, get hit by a bus, and die the next day after your policy is approved, your beneficiaries will receive the full death benefit.

Simplified issue burial insurance will require you to answer a few questions about your health on the application. They do this to get an overview of your health condition. These are just yes or no questions that are simple to answer.

They will require you to answer no to questions like:

- Have you been diagnosed with a terminal illness like cancer?

- Do you have dementia or Alzheimer’s disease?

- Are you currently residing in a nursing facility?

Most veterans can answer NO to these health questions and get approved for simplified issue whole life insurance. Minor health issues such as high cholesterol or high blood pressure are fine and won’t negatively affect your eligibility.

Some of the benefits of simplified issue life insurance include:

- It is cheaper and has a higher death benefit compared with graded death benefit or guaranteed issue final expense insurance.

- It has immediate coverage from day one and doesn’t have a waiting period. Once the policy is issued, your beneficiary is entitled to the full death benefit when you pass away for whatever reason.

- Higher coverage amount compared with guaranteed issue policy.[/su_list]

Always try to apply for an insurance policy with health questions before applying for a no-health questions policy to enjoy cheaper premiums, immediate coverage, and higher coverage.

GRADED DEATH BENEFIT LIFE INSURANCE

This is a permanent life insurance policy with no medical exam designed for veterans who are in less perfect health. The graded death benefit is the next best option for veterans who cannot qualify for simplified issue life insurance.

Graded death benefit accepts many health conditions. Health issues that may be approved for this policy include type-1 diabetes, stroke, alcohol abuse, and other health issues. To get approved, you only have to answer a few health questions.

This policy is graded because it does not have immediate coverage. You will need to wait two years before your policy will pay the full death benefit. The death benefit grows in increments. Let’s say you purchased a $10,000 policy.

- If you die within the 1st year – your beneficiary will receive a 30% death benefit

- If you die within the 2nd year – your beneficiary will receive 70% of the death benefit.

- If you die within the 3rd year – your beneficiary will receive 100% of the death benefit

A graded death benefit plan has a higher coverage amount than guaranteed acceptance life insurance. The coverage is usually capped at $50,000 compared with $25,000 for guaranteed issue. It is also a bit more expensive than traditional life insurance policies but less costly than guaranteed issue whole life insurance because there are some health questions to qualify.

GUARANTEED ISSUE BURIAL INSURANCE

If you’re a veteran who doesn’t pass underwriting with health questions and is denied coverage because of your health, you still have other options to get the life insurance coverage that you need.

If you have any of these medical conditions, you will only qualify for guaranteed issue burial insurance:

- Cancer within the last two years

- HIV or AIDS

- Kidney failure requiring dialysis

- Alzheimer’s disease or dementia

- Organ transplant or need organ transplant

- Terminal illness

- Wheelchair-bound due to chronic disease

- In a nursing facility or needing home health care

- Needing help with activities of daily living such as eating, bathing, dressing, toileting, transferring, and continence

You can undoubtedly qualify for burial insurance with health questions and immediate benefits outside these severe health conditions. You will pay less and do not need to wait two years before your policy is fully enforced.

This plan does not have a medical exam or health questions. If you are a U.S veteran between the ages of 50 and 85, you cannot be turned down for coverage no matter what your medical condition is. You will pay your rate based on age, gender, and state of residence. The death benefit is available in the $2,000 to $25,000 range.

Fast approval is the most significant advantage of guaranteed acceptance life insurance. Some companies can approve your policy in just 15 minutes to 48 hours. This is your best option if you need coverage due to a business loan or court requirement.

Guaranteed issue burial insurance is graded for the first two years, which means the company will only pay 100% death benefit if you pass away due to an accident. If you die from natural death, your beneficiary will receive all premiums you paid plus interest, typically 7 to 10%. If you die after waiting, your beneficiaries will receive the 100% death benefit.

How Can Funeral Funds Help Me?

Finding a policy for veterans needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you are a veteran, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We will shop your case at different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search for all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for veterans’ funeral insurance, veterans’ burial insurance, or veterans’ life insurance, we can help. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate quote.

Additional Questions & Answers On Burial Insurance For Veterans

Is life insurance available for veterans?

Yes, life insurance is available for veterans. Several different companies offer life insurance policies to veterans, and the coverage and terms of each policy will vary depending on the company.

Can I get life insurance if I’m a veteran?

Yes, you can get life insurance if you are a veteran. Many different companies offer policies for veterans.

Can I buy life insurance if I’m a veteran and have health problems?

Yes, you can purchase life insurance even if you have health problems as a veteran. Many companies offer policies tailored to specific needs, so you should be able to find a policy that meets your needs.

Can I qualify for first-day coverage if I’m a veteran?

Yes, you can qualify for first-day coverage if you are a veteran. This means that your life insurance policy will go into effect the day you purchase it.

Do I need a medical exam to qualify for burial insurance for veterans?

No, you do not need a medical exam to qualify for burial insurance for veterans.

Can I qualify for burial insurance If I’m a veteran?

Yes, you can qualify for burial insurance if you are a veteran. Several different providers offer policies specifically designed for veterans and their families.

What are the benefits of burial insurance if I am a veteran?

There are many benefits to purchasing burial insurance if you are a veteran. Some key benefits include access to a wide range of coverage options and the ability to qualify for first-day coverage.

Why should I get burial insurance if I’m a veteran?

There are many reasons why you should consider getting burial insurance if you are a veteran. Some key benefits include access to competitive rates, customized coverage options, and getting coverage quickly if needed.

What are the uses of burial insurance for veterans?

Burial insurance for veterans can be used to cover the costs of a funeral, burial, or cremation. It can also be used to provide financial security for your loved ones in the event of your death.

Can I take out burial insurance on my veteran father?

Yes, you can take out burial insurance on your veteran father. This can provide financial protection for your father in the event of his death and help cover the costs of his funeral and burial.

Can I qualify for final expense insurance If I’m a veteran?

Yes, you can qualify for final expense insurance if you are a veteran. This type of insurance is designed to help cover the costs associated with end-of-life expenses, such as funeral and burial costs.

Can a veteran qualify for life insurance if they have a pre-existing condition?

A veteran can qualify for life insurance if they have a pre-existing condition. Several different companies offer policies specifically designed to cover individuals with pre-existing conditions.

What is the maximum age for a veteran to apply for life insurance?

The maximum age to apply for life insurance is typically 85 years old, and once approved, the policy would last until age 121.

What is the process of getting life insurance for veterans?

Getting life insurance for veterans is similar to life insurance for anyone else. You will need to fill out an application with a qualified insurance agent via the phone or online.

What is my best insurance option if I am a veteran?

The best insurance option for veterans will depend on several factors, including your age, health, and coverage needs.

How do I choose the best life insurance for veterans?

There is no one-size-fits-all answer to this question, as the best life insurance for veterans will depend on several factors. Some key considerations to keep in mind include your age, health status, and coverage needs.

What do you do if your veteran father does not have life insurance?

If your veteran father does not have life insurance, you may want to consider taking out a policy on him. This can provide financial protection for your father in the event of his death and help cover the costs of his funeral and burial.

Can I name myself as the beneficiary of my veteran father’s life insurance?

Yes, you can name yourself as the beneficiary of your veteran father’s life insurance policy.

How long does it take for veteran’s insurance to go into effect?

The time a veteran’s insurance takes to go into effect will depend on the specific policy and the company providing it. In most

How will my life insurance benefits be paid out if I am a veteran?

The benefits of your life insurance policy will be paid out to your designated beneficiaries in the event of your death.

Can I qualify for funeral insurance If I’m a veteran?

Yes, you can qualify for funeral insurance if you are a veteran. This type of insurance is designed to help cover the costs associated with end-of-life expenses, such as funeral and burial costs.

What are the things that may affect my eligibility if I’m a veteran?

Several factors may affect your eligibility for life insurance if you are a veteran, including your age, health status, and coverage needs. Some key considerations to keep in mind include your overall health, any pre-existing conditions, and how much coverage you need.

What is the best insurance for my veteran father with health problems?

The best insurance for your veteran father with health problems will depend on his specific needs and situation.

Can I get more than one insurance if I’m a veteran?

Yes, you may be able to get more than one insurance if you are a veteran.

How many life insurance policies can a veteran have?

There is no limit to the number of life insurance policies a veteran can have.

Can I qualify for cremation insurance If I’m a veteran?

Yes, you may be able to qualify for cremation insurance if you are a veteran. This policy can help cover the costs associated with end-of-life expenses such as cremation and funeral services.

Should your veteran father have life insurance?

There is no right or wrong answer to this question, as it will depend on your father’s specific needs and situation.

Which insurance is best for veterans?

There is no one-size-fits-all answer to this question, as the best life insurance for veterans will depend on several factors. Some key considerations to keep in mind include your age, health status, and coverage needs.

When should I get life insurance for my veteran father?

There is no set time that is right for everyone, as the best time to get life insurance for your veteran father will depend on his specific needs and situation.

What is the average cost of life insurance for veterans?

The average cost of life insurance for veterans will depend on several factors, including your age, health status, and coverage needs.

What are the best life insurance companies for veterans?

There is no definitive answer to this question, as the best life insurance companies for veterans will depend on several factors, including your needs and preferences. Some key considerations to keep in mind include your coverage needs, budget, and overall satisfaction with the company’s services.

How can I find the best burial insurance for veterans?

One of the best ways to find the best burial insurance for veterans is to do your research and speak to a qualified insurance agent from Funeral Funds.

How can I get affordable life insurance for a veteran parent with health issues?

There are several ways to get affordable life insurance for a veteran parent with health issues. One option is to speak to a qualified insurance agent from Funeral Funds, who can help you find the best coverage options for your budget and needs.

What are some tips for getting life insurance for veterans?

Some key tips for getting life insurance for veterans include doing your research, speaking to a qualified insurance agent, and evaluating different coverage options.

ADDITIONAL QUESTIONS & ANSWERS ON BURIAL INSURANCE FOR VETERANS

Is life insurance available for veterans?

Yes, life insurance is available for veterans. There are a number of different companies that offer life insurance policies to veterans, and the coverage and terms of each policy will vary depending on the company.

Can I get life insurance if I’m a veteran?

Yes, you can get life insurance if you are a veteran. Many different companies offer policies for veterans.

Can I buy life insurance if I’m a veteran and have health problems?

Yes, you can purchase life insurance even if you have health problems as a veteran. Many companies offer policies that are tailored to specific needs, so you should be able to find a policy that meets your needs.

Can I qualify for first-day coverage if I’m a veteran?

Yes, you can qualify for first-day coverage if you are a veteran. This means that your life insurance policy will go into effect the day that you purchase it.

Do I need a medical exam to qualify for burial insurance for veterans?

No, you do not need a medical exam to qualify for burial insurance for veterans.

Can I qualify for burial insurance If I’m a veteran?

Yes, you can qualify for burial insurance if you are a veteran. There are a number of different providers that offer policies specifically designed for veterans and their families.

What are the benefits of burial insurance if I am a veteran?

There are many benefits to purchasing burial insurance if you are a veteran. Some of the key benefits include access to a wide range of coverage options and the ability to qualify for first-day coverage.

Why should I get burial insurance if I’m a veteran?

Some of the key benefits include access to competitive rates, customized coverage options, and the ability to get coverage quickly if needed.

What are the uses of burial insurance for veterans?

Burial insurance for veterans can be used to cover the costs of a funeral, burial, or cremation. It can also be used to provide financial security for your loved ones in the event of your death.

Can I take out burial insurance on my veteran father?

Yes, you can take out burial insurance on your veteran father. This can provide financial protection for your father in the event of his death, and it can also help to cover the costs of his funeral and burial.

Can I qualify for final expense insurance If I’m a veteran?

Yes, you can qualify for final expense insurance if you are a veteran. This type of insurance is designed to help cover the costs associated with end-of-life expenses, such as funeral and burial costs.

Can a veteran qualify for life insurance if they have a pre-existing condition?

Yes, a veteran can qualify for life insurance if they have a pre-existing condition. There are a number of different companies that offer policies specifically designed to cover individuals with pre-existing conditions.

What is the maximum age for a veteran to apply for life insurance?

The maximum age to apply for life insurance is typically 85 years old, and once approved, the policy would last until age 121 years old.

What is the process of getting life insurance for veterans?

The process of getting life insurance for veterans is similar to the process of getting life insurance for anyone else. You will need to fill out an application with a qualified insurance agent via the phone or online.

What is my best insurance option if I am a veteran?

The best insurance option for veterans will depend on a number of factors, including your age, health, and coverage needs.

How do I choose the best life insurance for veterans?

There is no one-size-fits-all answer to this question, as the best life insurance for veterans will depend on a number of factors. Some of the key considerations to keep in mind include your age, health status, and coverage needs.

What do you do if your veteran father does not have life insurance?

If your veteran father does not have life insurance, you may want to consider taking out a policy on him. This can provide financial protection for your father in the event of his death, and it can also help to cover the costs of his funeral and burial.

Can I name myself as the beneficiary of my veteran father’s life insurance?

Yes, you can name yourself as the beneficiary of your veteran father’s life insurance policy.

How long does it take for veteran’s insurance to go into effect?

The length of time it takes for a veteran’s insurance to go into effect will depend on the specific policy and the company providing it. In most

How will my life insurance benefits be paid out if I am a veteran?

The benefits of your life insurance policy will be paid out to your designated beneficiaries in the event of your death.

Can I qualify for funeral insurance If I’m a veteran?

Yes, you can qualify for funeral insurance if you are a veteran. This type of insurance is designed to help cover the costs associated with end-of-life expenses, such as funeral and burial costs.

What are the things that may affect my eligibility if I’m a veteran?

There are a number of factors that may affect your eligibility for life insurance if you are a veteran, including your age, health status, and coverage needs. Some of the key considerations to keep in mind include your overall health, any pre-existing conditions, and how much coverage you need.

What is the best insurance for my veteran father with health problems?

The best insurance for your veteran father with health problems will depend on his specific needs and situation.

Can I get more than one insurance if I’m a veteran?

Yes, you may be able to get more than one insurance if you are a veteran.

How many life insurance policies can a veteran have?

There is no limit to the number of life insurance policies a veteran can have.

Can I qualify for cremation insurance If I’m a veteran?

Yes, you may be able to qualify for cremation insurance if you are a veteran. This type of policy can help cover the costs associated with end-of-life expenses such as cremation and funeral services.

Should your veteran father have life insurance?

There is no right or wrong answer to this question, as it will depend on your father’s specific needs and situation.

Which insurance is best for veterans?

There is no one-size-fits-all answer to this question, as the best life insurance for veterans will depend on a number of factors. Some of the key considerations to keep in mind include your age, health status, and coverage needs.

When should I get life insurance for my veteran father?

There is no set time that is right for everyone, as the best time to get life insurance for your veteran father will depend on his specific needs and situation.

What is the average cost of life insurance for veterans?

The average cost of life insurance for veterans will depend on a number of factors, including your age, health status, and coverage needs.

What are the best life insurance companies for veterans?

There is no definitive answer to this question, as the best life insurance companies for veterans will depend on a number of factors, including your needs and preferences. Some of the key considerations to keep in mind include your coverage needs, budget, and overall satisfaction with the company’s services.

How can I find the best burial insurance for veterans?

One of the best ways to find the best burial insurance for veterans is to do your research and speak to a qualified insurance agent from Funeral Funds.

How can I get affordable life insurance for a veteran parent with health issues?

There are a number of ways to get affordable life insurance for a veteran parent with health issues. One option is to speak to a qualified insurance agent from Funeral Funds, who can help you find the best coverage options for your budget and needs.

What are some tips for getting life insurance for veterans?

Some key tips for getting life insurance for veterans include doing your research, speaking to a qualified insurance agent, and evaluating different coverage options.

RELATED POSTS:

2 Comments

Glenn Saunders

I want to have insurance life insurance that covers my family in case of death and I have five children. thank you

Funeral Funds

Glenn – We can help you with that. You can visit our website and use our free quoters to get some pricing.

https://funeralfunds.com/