Burial Insurance for Insulin Dependent Diabetics

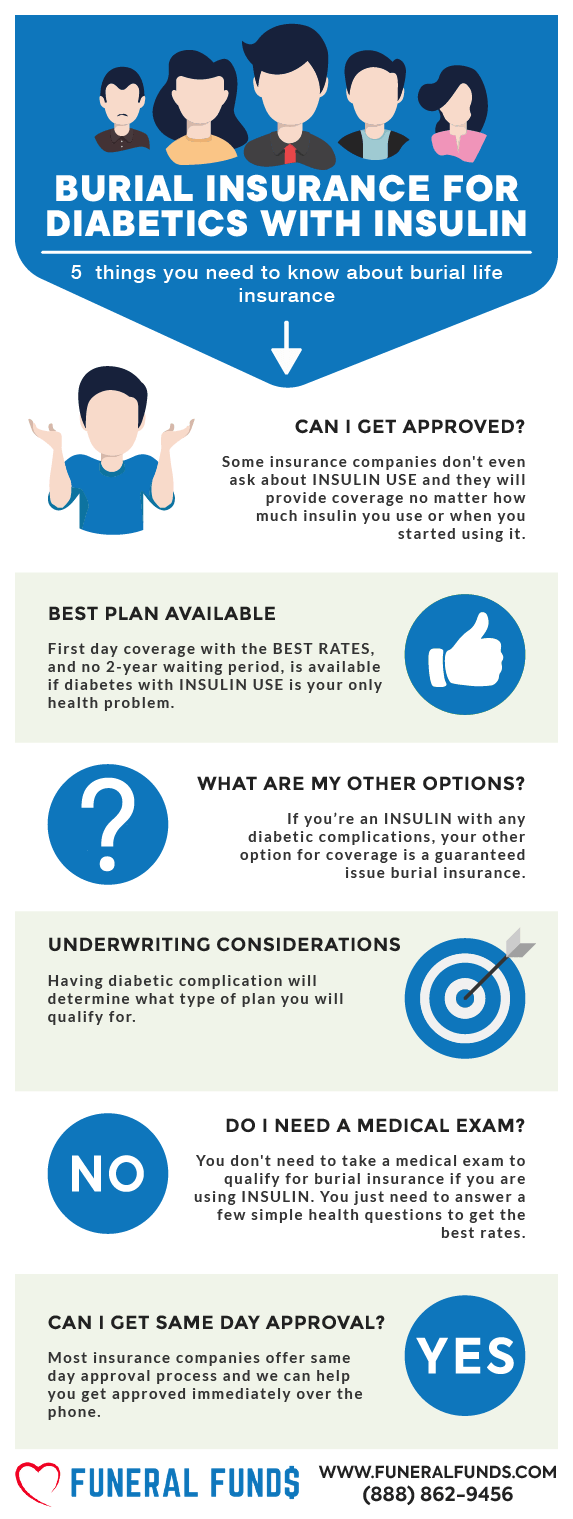

Whether you’re rocking Type 1 or Type 2 diabetes, and relying on insulin to keep things in check, there’s good news. You’ve got options for burial insurance.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those insulin dependent diabetics, or fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I’m An Insulin-dependent Diabetic?

If you’re managing your diabetes with insulin, you might just hit the jackpot with a level death benefit plan that offers full coverage from day one.

No waiting around, no fuss. And guess what? You might even snag the same sweet rates as someone who doesn’t have diabetes at all. How cool is that?

OTHER FACTORS THAT MAY AFFECT ELIGIBILITY

NEUROPATHY (Nerve/Circulatory Issues due to diabetes)

Got some neuropathy? No worries. You can still score that top-notch level death benefit plan with first-day coverage with the right insurance company.

NEPHROPATHY (Kidney issues due to diabetes)

Now, if you’re dealing with kidney issues and undergoing dialysis, burial insurance companies will take note. In this case, you can qualify for a first-day coverage plan if you apply to the right company and live in the zip code where this plan is available.

RETINOPATHY (Eye issues due to diabetes)

Mild vision problems? You’re still golden. You’ll qualify for a level benefit plan, no problem.

DIABETIC AMPUTATION

If you’ve had an amputation due to diabetes, the insurance folks will want to know if you’re still rocking your daily routine independently. If you’re managing just fine and the amputation happened over two years ago, you might qualify for a first-day coverage plan.

But if you need help with daily living activities or had a recent amputation, then it’s time to look at guaranteed acceptance life insurance. Most burial insurance companies won’t offer first-day coverage if you need assistance with ADLs.

INSULIN SHOCK

Had a run-in with insulin shock? No problem, as long as it was more than two years ago. Most insurance companies will qualify you for the best coverage.

But if insulin shock happened in the last two years, our preferred life insurance company will ask” “Been in the hospital twice in the past two years? If your answer’s a ‘Nope,’ you’re lining up for a first-day coverage plan.

But if you’re currently in the hospital or have had a couple of visits in the last few years, your best bet is guaranteed-issue burial insurance with a two-year waiting period.

DIABETIC COMA

If your last diabetic coma was over two years ago, congratulations! Most life insurance companies still offer first-day coverage.

But if it happened within the last two years, you’ll qualify for a first-day coverage plan if you haven’t been hospitalized twice in the last couple of years.

If you’re currently in the hospital or have had a couple of visits in the last few years, your best option is guaranteed-issue burial insurance.

Do I Need A Medical Exam To Qualify For Burial Insurance?

No medical exam needed for your burial insurance. When you’re ready to cash in your chips, the last thing you want is paperwork.

Just answer a few quick questions about your health – don’t worry, we’re not asking for your life story. No needles, no blood draws, just pure, unadulterated simplicity. You’ll get the green light faster than you can say “six feet under.”

Burial Insurance Underwriting For Insulin-dependent Diabetics

There are two ways these insurance folks figure out if you’re a good risk:

FIRST – They’ll grill you with a bunch of health questions.

SECOND – They’ll dig through your medicine cabinet like a detective.

HEALTH QUESTIONS

Most burial insurance companies will ask you about diabetes and if you use insulin.

Here are some questions you might see on the application:

- Have you been diagnosed with diabetes prior to age 30 or have you ever been treated for insulin shock, diabetic coma, retinopathy, or diabetic neuropathy?

- Have you ever been treated or diagnosed with insulin shock, diabetic coma, amputation caused by disease, or taken insulin shots prior to age 50?

- Within the past 2 years have you had, or been diagnosed with, or received treatment or medication for complications of diabetes such as: diabetic coma, insulin shock, retinopathy, nephropathy, or neuropathy?

These are the common questions you will encounter on the application.

PRESCRIPTION HISTORY CHECK

Insurance companies will look at your past medicines to see what health problems you’ve had. This is something most insurance companies do.

If you’ve taken medicine for any sickness, they can see it. If you have diabetes, they’ll look for certain medicines. If you’ve used these, they might think you need insulin.

Here are some common diabetes medicines:

- Aspart (Novolog)

- Degludec (Tresiba)

- Glargine (Basaglar)

- Glulisine (Apidra)

- Humulin

- Insulin detemir (Levemir)

- Lispro (Humalog)

- Novolin

- Novolog

- Velosulin

There might be other medicines, but these are the most common ones for people who use insulin.

How Much Insurance Do I Need?

How much insurance should you get? Well, it depends on how fancy you want your send-off to be. You need enough to cover your funeral, burial, and any other final costs.

Figure out how much you think your final expenses will be. Your funeral is probably the biggest bill. But don’t forget about doctor bills, credit cards, and other debts. You don’t want to leave your loved ones with a pile of bills on top of their grief.

How Should I Pay My Premiums?

The easiest way to pay for your insurance is to set up automatic payments from your bank account. This way, you won’t forget and your insurance won’t go poof. It’s like setting and forgetting, but for your final arrangements.

Information We Need If You’re An Insulin-dependent Diabetic

If you’re dealing with diabetes and insulin, we need to know the lowdown.

We’ll ask you some questions about your health. Think of it like a friendly chat, but with less chit-chat and more info. We want to know all the details about your diabetes so we can find you the best insurance. The more you tell us, the better your chances of finding affordable coverage.

These questions include:

- Is your diabetes Type-1 or Type-2?

- When did you get your diabetes diagnosis?

- Are you taking insulin daily? How many units?

- Have you ever gone into insulin shock?

- Have you experienced a diabetic coma?

- Do you have an amputation due to diabetes?

- Do you have neuropathy or nerve circulatory issues from diabetes?

- Do you have nephropathy or kidney issues due to diabetes?

- Do you have retinopathy?

- What medications are you taking?

What If I Was Rejected For Coverage?

Been turned down for insurance before? Don’t sweat it. We’ve seen it all.

If another company said no, don’t give up hope. We can help you find an insurance company that’s a little friendlier to people with diabetes.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit required – Forget about those pesky medical exams. It’s as easy as pie to get approved.

- Ease of issue – You can get covered faster than you can say “final expenses.”

- No Money Down to get approved – You don’t have to break the bank to get started.

- Level premium – Your monthly payments stay the same, no surprises.

- Fixed death benefit – Your loved ones get the full amount, no matter what.

- Permanent protection – Your insurance stays in place as long as you pay your bills.

- Tax-free – Your family keeps all the money, no Uncle Sam taking a bite.

- Cash value builds up – Your policy can actually make you some money over time.

How Can Funeral Funds Help Me?

Finding burial insurance with health problems? Don’t stress! We’re here to help.

We’ll find the perfect plan for you without all the hassle. No more searching high and low. We’ll do the digging and find you the best deal.

We work with top-notch insurance companies that understand people like you. We’ll find you the best coverage at the best price.

So, if you’re tired of dealing with insurance companies, give us a call. We’ll take care of everything.

Fill out our quote form on this page or call us at (888) 862-9456 and we can give you an accurate quote.

Frequently Asked Questions

Is life insurance expensive for diabetics?

Having diabetes doesn’t mean your life insurance has to cost an arm and a leg. In fact, your premiums might be the same as someone who’s as healthy as a horse.

Do I need to tell insurance about insulin use?

If the insurance company asks about insulin, you gotta spill the beans. No sugarcoating it!

Can insulin dependent diabetics get funeral insurance?

Absolutely! You can definitely get funeral insurance, even if you need insulin. Many insurance companies offer plans that start covering you right away, as long as your diabetes is behaving itself.

Do I need to inform my insurance company that I’m an insulin-dependent diabetic?

Yep, be upfront. If the insurance company asks about diabetes, they’ll probably want to know about your insulin use too. Don’t try to hide it.

Can insulin dependent diabetics get final expense life insurance?

You betcha! There are plenty of final expense insurance options for people with diabetes. Many plans start covering you immediately if your diabetes is under control.

Can you be denied life insurance if you are insulin-dependent diabetic?

Just because you need insulin doesn’t mean you’re out of luck. But if you’ve had any diabetes-related problems in the last couple of years, some insurance companies might turn you down.