Burial Insurance with Nephropathy or Berger’s Disease

You can qualify for burial insurance if you have nephropathy or Berger’s disease, and if you play your cards right, you might even score first-day coverage. The catch? It all depends on which insurance company and policy you go to.

Burial insurance covers it all – burial, cremation, final expenses, funeral costs, or leaving a financial legacy.

If you prefer to keep reading, we’ve got more details on burial insurance for those with nephropathy or Berger’s disease, fill out our quote request form for immediate assistance and pricing information.

| TABLE OF CONTENTS | |

|---|---|

What Is Diabetic Nephropathy?

Diabetic nephropathy, a.k.a. diabetic kidney disease, is the nasty sidekick of diabetes that messes with your kidneys.

Here’s the lowdown:

- CAUSE: Sky-high blood sugar levels from diabetes running wild.

- EFFECT: Those sweet little filters in your kidneys (glomeruli) get trashed, making it harder for your body to filter out waste.

- PROGRESSION: Slowly but surely, your kidney function takes a nosedive, possibly ending in kidney failure if you don’t get it under control.

Diabetic nephropathy isn’t just a health hiccup – it’s the leading cause of chronic kidney disease worldwide. Keep your diabetes in check to fend off or slow down this kidney nightmare.

Life insurance companies keep a close eye on conditions like diabetic nephropathy because it can shorten life expectancy. Kidney disease, especially when it spirals into kidney failure needing dialysis or a transplant, is a wallet-drainer. Insurers are all about dodging those hefty treatment costs.

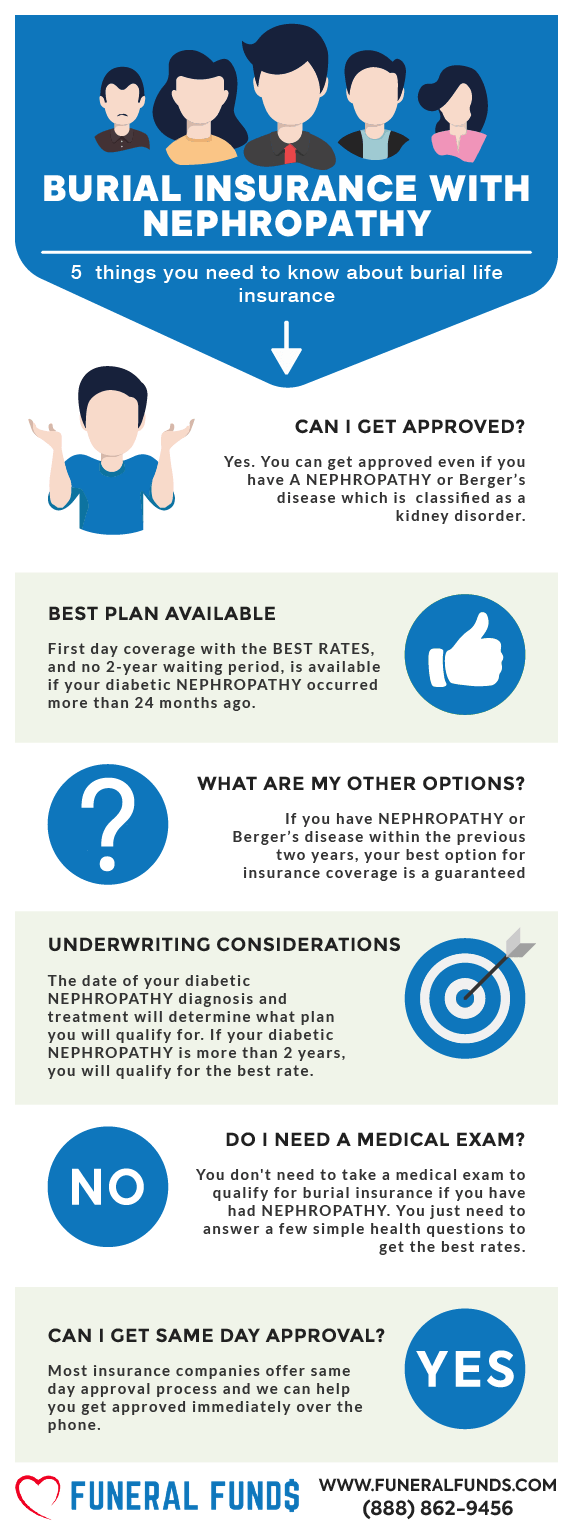

Can I Get Burial Insurance If I Have Nephropathy?

YES: Some insurance companies are cool with offering first-day coverage, even if you’re in the middle of treatment. you’ll need to be under a doctor’s watchful eye and in the right zip code to get the best coverage.

NO: We can totally help you explore your best options, but we’ll need a bit more information from you.

What Are The Types of Burial Insurance For People With Nephropathy?

First-Day Coverage – No need for a medical exam here – just a few health questions, and boom, you’re covered from day one with no waiting period.

Guaranteed Issue – This one’s a no-fuss, no-medical-exam, no-health-questions policy. It’s designed for folks with major health issues who can’t qualify for traditional life insurance.

Just a heads-up: Guaranteed issue whole life insurance comes with a mandatory two-year waiting period because it accepts all health issues.

If you kick the bucket during this time, the policy won’t pay out the full death benefit. Instead, you’ll get the premiums you’ve paid plus a little extra interest (7-10%, depending on the company).

What Is My Best Insurance Option If I Have Nephropathy?

Nephropathy Without Dialysis – Some insurance companies are totally on board with offering first-day coverage for nephropathy. You’ll need to be on top of your doctor’s treatment plan to snag this deal, and live in the right zip code.

Nephropathy With Dialysis – If you’re on dialysis and sticking to your doctor’s orders, you might still get first-day coverage from a few insurers.

Kidney Transplant – If your transplant happened over five years ago, you might be in luck with some plans offering first-day coverage. But if you’re waiting on a transplant or had one in the past five years, your best bet is guaranteed issue whole life insurance.

Do I Need To Take A Medical Exam To Qualify For Burial Insurance?

Nope! When you apply for burial insurance, you just need to answer a few straightforward health questions. Forget about medical records, blood tests, or urine samples.

And get this: approvals can often come through in minutes!

What Is The Cost Of Burial Insurance With Nephropathy Or Berger’s Disease?

The pricing for burial insurance with nephropathy or Berger’s Disease hinges on a few things:

- Age

- Coverage amount

- Gender

- State of residence

- Smoking status

- Type of policy

Here’s a pricing example for a seasoned 60-year-old female with nephropathy:

| FEMALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life Superior Choice – 1st-Day Coverage | $47.25 |

| Colonial Penn – GI – 2-Year Wait | $49.75 5 units |

| Gerber Life – GI – 2-Year Wait | $51.06 |

| Lincoln Heritage – Modified – 2-Year Wait | $96.80 |

| Mutual Of Omaha – GI – 2-Year Wait | $42.70 |

Here’s a pricing example for an accomplished 60-year-old male with nephropathy:

| MALE PRICING | PREMIUM FOR $10,000 |

|---|---|

| CICA Life – Superior Choice – 1st-Day Coverage | $53.09 |

| Colonial Penn – GI – 2-Year Wait | $59.70 6 units |

| Gerber Life – GI – 2-Year Wait | $63.89 |

| Lincoln Heritage – Modified – 2-Year Wait | $114.14 |

| Mutual Of Omaha – GI – 2-Year Wait | $56.90 |

Burial Insurance Underwriting For Nephropathy Or Berger’s Disease

When you’re filling out your health questionnaire, they’ll be digging into your nephropathy or kidney disease history with questions like:

- Within the past 2 years, have you had, or been diagnosed with, or received or been advised to receive treatment for medication for complications of diabetes such as diabetic coma, nephropathy (kidney), insulin shock, retinopathy (eye), or neuropathy (nerve, circulatory)?

- During the past 24 months, have you been treated for kidney failure (including dialysis)?

- Have you had, or been advised, or have been diagnosed, treated (including dialysis), or taken medication for chronic kidney disease or kidney failure?

- In the past 10 years, have you opted to not seek treatment, have not taken medication, and or have not followed the prescribed treatment plan following a diagnosis of kidney disease, including dialysis?

Some of the prescription medications for nephropathy or Berger’s disease include:

- Benazepril (Lotensin)

- Enalapril (Vasotec)

- Lisinopril (Prinivil)

- Losartan (Cozaar)

- Moexipril (Univasc)

- Quinapril (Accupril)

- Ramipril (Altace)

- Valsartan (Diovan)

If you’re taking meds for nephropathy or Berger’s, that’ll show up on your prescription history and give the insurance company a hint that you’ve got a diagnosis or treatment in your past.

Information We Need If You Have Nephropathy

We might fire off some health questions to match you with the insurance company offering the best rates.

Here’s a sneak peek at what we might ask:

- Do you have any other diabetic complications?

- Have you ever been advised to have dialysis?

- Have you ever been hospitalized for any reason in the last 12 months?

- Have you experienced any symptoms of nephropathy within the past six months?

- What medications are you taking?

- When did you have diabetic nephropathy?

What If I’m Declined For Coverage Because Of Nephropathy?

If you hit a dead end, don’t worry! We can often find another insurer who doesn’t ask health questions. Just remember, no-questions-asked insurance policies come with a mandatory two-year waiting period for health-related deaths.

So, while a two-year waiting period policy is better than nothing, it’s like the last resort. Guaranteed issue policies are pricey and come with that pesky waiting period.

How To Get Affordable Burial Insurance

Want the best deal on burial insurance? Work with an independent agency like Funeral Funds of America. Our licensed agents are basically price-hunting ninjas, scouring different insurance companies to land you the best rates.

How Can Funeral Funds Help Me?

At Funeral Funds, we’re pros at finding life insurance for folks with nephropathy. We work with A+ rated insurance carriers who specialize in high-risk clients, so we know all the secret spots for the best rates.

We’ll hook you up with the perfect burial insurance option that fits your budget. If you’re looking for affordable insurance and have diabetic nephropathy, we’re your go-to. Just fill out our quote form on this page or give us a ring at (888) 862-9456 for precise rates.

Frequently Asked Questions

Can you qualify for final expense insurance with nephropathy?

Absolutely! And you might even get first-day final expense insurance, depending on what’s on offer in your state.

Can you get life insurance with Berger’s disease?

Yep, you can get life insurance with Berger’s disease, and first-day coverage is on the table if you pick the right company.

Is nephropathy the same as chronic kidney disease in life insurance?

You betcha! Most insurers lump diabetic nephropathy into the chronic kidney disease (CKD) category.

How much do you need to tell an agent about your diabetes and nephropathy?

Spill the beans on all your health conditions and medications if you’re gunning for first-day coverage. The more the insurance company know, the better they can tailor your options.

Can I get life insurance with nephropathy and dialysis?

You sure can! And there’s a chance for first-day coverage if you’re looking at specific plans available in your state.