Burial Insurance for Nursing Home Residents [Use Caution]

If you’re looking for burial insurance for nursing home residents, you need to be aware that your burial, cremation, final expense, and life insurance options are limited.

!!! READ THIS FIRST !!!

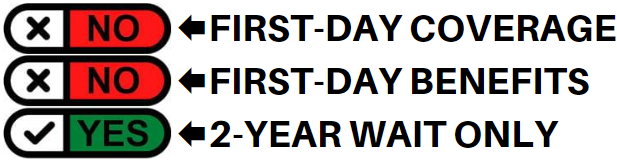

Being in a nursing home often indicates that people have significant health or medical issues, and there are no insurance companies that offer 1st-day coverage to people in nursing homes.

We recommend people in nursing homes purchase a guaranteed issue life insurance that asks no health questions but does come with a 2-year waiting period.

This article will discuss why we don’t recommend burial insurance for people who an in nursing homes. We will also inform you about the non-burial insurance options open for you.

| TABLE OF CONTENTS | |

|---|---|

What Is My Best Insurance Option If I’m A Nursing Home Resident?

If you are in a nursing home, your only option for insurance coverage is a guaranteed issue burial insurance.

Guaranteed issue burial insurance is available without health questions, but you need to live for the first two years, making it a terrible plan for people in nursing homes with a short time to live.

Guaranteed issue life insurance would seem ideal for nursing home residents because they ask no health questions, but there is a catch; this plan has a mandatory 2-year waiting period before paying a death benefit for the natural cause of death. This 2-year waiting period makes guaranteed issue burial insurance a terrible choice for nursing home residents.

Guaranteed issue life insurance will only pay from the first day if you die from accidental reasons. Death resulting from slips and falls, trips, car accidents, or other accidental causes is 100% covered from the first day.

If you die for any health reason during the waiting period, the insurance company will only refund your premiums plus 5-10% interest. Your beneficiary will only receive your 100% death benefit after the waiting period has passed.

Best Option: Guaranteed issue burial insurance

Why We Don’t Recommend Guaranteed Issue Life Insurance For Nursing Home Residents

If you are in a nursing home with a terminal illness, buying guaranteed issue life insurance will not help your family much at all.

Here are the reasons why I don’t recommend guaranteed acceptance life insurance for nursing home residents:

A 2-year Waiting Period

The number one reason we don’t recommend guaranteed life insurance for nursing home residents is the two-year waiting period.

Your beneficiary will not receive your full death benefit if you die during the waiting period.

Guaranteed acceptance policies only offer immediate coverage for the accidental cause of death. It will not pay a full death benefit if you die from a natural cause or health-related cause of death. This reason makes these policies a terrible choice for nursing home residents with a shorter life expectancy.

The two-year waiting period is the insurance companies’ safety net against people who are literally on their deathbed trying to buy burial insurance.

Premiums Are Expensive

Guaranteed issue no-questions-asked life insurance is the most expensive life insurance policy. It can be two to three times more expensive than simplified issue life insurance that asks health questions. The high premiums are because of the higher risk insurance companies take for approving coverage without asking any health questions.

Limited Death Benefit Option

Guaranteed issue burial insurance coverage is only available in small amounts, often between $2,000 and $25,000. This plan is only designed to cover final expenses such as medical bills, small debts, and end-of-life expenses. If you want to pay your mortgage or leave money for your children’s education, you need to buy multiple policies, which we don’t recommend because it will cost you an arm and a leg.

Who Should Buy Guaranteed Issue Life Insurance?

We only sell guaranteed issue life insurance under these circumstances:

- The applicant has a life expectancy of two years or longer.

- The applicant has medical conditions that make them uninsurable for traditional life insurance.

- When the guaranteed issue is the most affordable policy because of their health.

- When applicants insist on no health questions asked life insurance application.

Guaranteed issue life insurance can provide essential insurance coverage to people who need insurance but don’t have other options.

If you have any of these conditions, buying guaranteed issue burial insurance is often your best option:

- COPD with daily oxygen use

- Renal failure, on dialysis because of end-stage kidney disease

- Organ or tissue transplant

- Alzheimer’s disease

- Cancer diagnosis or treatment in the previous 24 months

- AIDS

- Amputation due to disease

- Wheelchair use because of chronic illness

- Needing help with activities of daily living (eating, bathing, dressing, toileting, transferring and continence)

These medical conditions are considered high-risk because they generally reduce the amount of time you will live.

Having any of these conditions only qualifies you for guaranteed issue burial insurance because you will not be asked any health questions, and your approval is guaranteed. You will need to wait for two years before your coverage is in full effect, but most people that I helped survive past the waiting period.

Once you live past the first two years, the insurance company will pay your full death benefit if you die for any reason. Your premium will never increase, and your policy can never be canceled (even if your health worsens).

Guaranteed issue life insurance should be your last option. Don’t settle for a plan with a two-year waiting period if you are in good health or with some minor health issues that qualify for first-day coverage.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance for nursing home residents.

When you apply for burial insurance, you only have to answer some basic questions about your health. The application process is simple; you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

How Much Insurance Do I Need If I’m A Nursing Home Resident?

The amount of burial insurance you should buy varies depending on your personal and financial circumstances. However, burial insurance should cover the cost of your funeral, burial, and final expenses.

The first step to figuring out how much burial insurance you need is to know your end-of-life expenses. Your funeral cost is often the biggest single expense you need to pay. Other end-of-life expenses to consider are your outstanding medical bills, living expenses, credit card bills, and other debts.

Here’s an example of a funeral cost breakdown from the National Funeral Directors Association.

| AVERAGE FUNERAL COST WITH VIEWING AND BURIAL | |

|---|---|

| Non-declinable basic services | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Hearse | $325 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Vault | $1,572 |

| Median Cost of a Funeral With Viewing and Burial | $9,420 |

| AVERAGE FUNERAL COST WITH VIEWING AND CREMATION | |

|---|---|

| Non-declinable basic services fee | $2,300 |

| Removal/ transfer of remains to funeral home | $350 |

| Embalming & preparation of the body | $1,050 |

| Use of facilities for viewing & funeral ceremony | $965 |

| Service car/van | $150 |

| Basic memorial printed package | $183 |

| Cremation fee (if firm uses a third-party crematory) | $368 |

| Cremation Casket | $1,310 |

| Urn | $295 |

| Median Cost of a Funeral with Viewing and Cremation | $6,970 |

| Rental Casket | $995 |

| Alternate Cremation Container | $150 |

How Should I Pay My Premiums?

The best way to pay your premium is through a savings or checking account. We recommend you set a bank draft from your savings or checking account. That way, the bank will automatically pay your premium each month, and you don’t need to worry about your policy lapsing due to non-payment.

Nursing Home Residents And Burial Insurance Riders

Insurance policy riders add benefits to your policy. Adding insurance riders will enhance your policy to fit your needs. Some riders are built into your policy, while other riders can be added at an additional cost. Most riders are affordable, and it involves little to no underwriting.

Here’s a list of common burial insurance riders:

| FUNERAL FUNDS ADD-ONS | AVAILABILITY |

|---|---|

| Terminal Illness Add-On Benefit | Included with most plans |

| Nursing Home Care Add-On Benefit | Included with most plans |

Non-burial Insurance Options For Nursing Home Residents

If you are in a nursing home and cannot qualify for life insurance, here are your options to cover your funeral and final expenses:

Prepaid Funeral Plan

You can take care of your funeral arrangements in advance. Instead of buying burial insurance, you can buy a prepaid funeral plan from your nearest funeral home to cover your funeral and burial expenses.

A word of warning – a prepaid funeral plan is not cheap! Be ready to pay between $8,000 and $15,000 to cover your final funeral service and extra expenses. You may need to come up with the money immediately if you choose to buy a prepaid funeral plan because you need to pay the plan in full.

Savings Accounts

Opening a savings account or joint savings account where you can deposit money to cover your final expenses is another option if you can’t qualify for burial insurance.

The amount you need to deposit in your account must be between $8,000 to $15,000, so it could be sufficient to cover your final expenses.

When you pass away, your loved ones can immediately access your savings account to pay all the expenses associated with your death.

Payable on Death Account (Totten Trust)

If you don’t have burial insurance, you can opt to open a Payable On Death (POD) account or Totten Trust. POD allows you to name a beneficiary on your bank account. Your beneficiary can access the funds on your account upon your death to pay for your final expenses.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company as long as you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance For Nursing Home Residents

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan for nursing home residents

- Cremation insurance plan for nursing home residents

- Funeral home insurance plan for nursing home residents

- Final Expense insurance plan for nursing home residents Prepaid funeral plan insurance for nursing home residents

- Mortgage payment protection plan for nursing home residents

- Mortgage payoff life insurance plan for nursing home residents

- Deceased spouse’s income replacement plan for nursing home residents

- Legacy insurance gift plan to family or loved ones for nursing home residents

- Medical or doctor bill life insurance plan for nursing home residents

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

When Is The Best Time To Buy Burial Insurance?

You should buy burial insurance NOW! Do not wait until you are a nursing home resident before you decide to purchase. That’s too late because you can no longer qualify for the best plan.

If you have a loved one in a nursing home, learn from their mistake, and buy burial insurance now while you can still qualify for coverage. Waiting to buy burial insurance when you are in a nursing home is a huge mistake that you will regret later!

The best time to buy burial insurance is now! The younger you buy, the lower your rates. The healthier you are, the lower your premiums will be.

How Can Funeral Funds Help Me?

You should only buy burial insurance from an independent insurance agency like Funeral Funds. Save yourself the effort of calling multiple insurance companies by working with us. Our agents and I can shop for over 30 insurance companies and compare prices to get you the best plan at the best rate.

We will assist you in securing the insurance coverage you need at a rate you can afford.

Answer the quote form on this page, and I will provide you with an accurate quote. Then, we will show you the plan with the most benefits at the lowest price. You can also call us at (888) 862-9456 if you have any questions regarding burial insurance.

2 Comments

Renee Fabyanic

My mom is in a nursing home and has no Life insurance, so if something happens to her we would be in a bind. I am her power of attorney and would like to purchase something for her to help cut the cost if something does happen to her. If there is some information to help me I would greatly appreciate it.

Thank you,

Renee

Funeral Funds

Renee – Your mother is lucky to have you looking out for her! It sounds like your mom raised a wonderful daughter!

With your mom being in a nursing home the most appropriate plan for her would be a guaranteed issue life insurance policy. Even with you being her Power Of Attorney (POA), you cannot take out a policy on your mom without her knowledge. Your mother would need to be aware of a life insurance policy and she would have to approve of the policy and sign it.

If you mother cannot legally enter a contract (a life insurance policy is a legal contract between the insurance company and the insured), then life insurance would not be a good choice.

Also, if you mother is not medically stable, we wouldn't recommend life insurance. For a guaranteed issue life insurance policy, we want the insured to be medically stable with a life expectancy of at least 2 years.

We don't know enough about your specific situation with your mother to make a proper recommendation, but you can request a free quote here – https://funeralfunds.com/free-quote/ – or you can call us directly at (888) 862-9456.