2025 Burial Insurance Scams

The world is littered with burial insurance scams from unethical agents. If you’re not careful, you will fall victim to scammers who can rip you off or sell you the wrong kind of policy. We will help you spot these burial insurance scams before they take advantage of you or your loved one.

In this article, we will share a few tips so you can spot burial insurance scams and increase your chances of finding a legitimate life insurance company with the best rates. Knowing these tips can help you save money by finding the best plan.

| TABLE OF CONTENTS | |

|---|---|

BURIAL INSURANCE SCAMS

SCAM# 1 Term Insurance Sold As Burial Insurance

Term insurance lasts for a temporary period, typically 10, 15, 20, and 30 years but this plan terminates after you pass 80. Whether you’re healthy or terminally ill, once you pass 80, your policy may expire, and you will not get your money back.

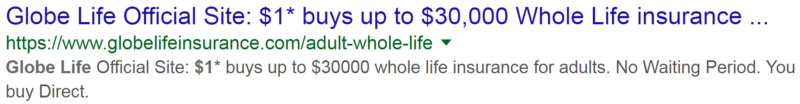

Many well-known insurance companies such as AARP and Globe Life offer term life insurance as burial insurance. These are fine companies, but some of their products are inappropriate for your burial insurance needs. Most people understand that term life insurance is not real burial insurance!

In the mail, you will typically see these companies offering term insurance for seniors. They offer coverage and say the premium is locked in at your current age (and this is not true). Term life insurance sold to seniors as burial insurance typically increases in pricing every five years.

Beware when you see life insurance offers through the mail, as most insurance companies send junk mail to try to hide how their programs work in the tiny fine print. Be aware of this scam because if you buy term insurance and you outlive the term, your beneficiaries will not get anything when you pass away.

Only whole life insurance policies that will last your whole life (up to age 121) should be used for burial insurance.

SCAM #2 No Questions Asked Burial Insurance

If you watch television or receive mail, you will see no questions about life insurance advertisements. Many reputable insurance companies will try to convince you to buy no-questions-asked burial insurance policies even if you are in perfect health and qualify for a plan with underwriting (and much better pricing).

You won’t need to undergo a medical exam or answer any health questions. They say your approval is guaranteed, the price never goes up, and your coverage won’t cancel.

Sounds pretty simple, right?

What’s wrong with this plan?

When you read the fine print, you will learn that their no-questions-asked policy DOES NOT provide 1st-day coverage for natural causes of death. There is always a two or three-year waiting period. If you die of an illness during the first two years, your beneficiary will only receive a return of the premium paid plus interest (typically 7-10%).

For example, you bought a $25,000 face amount with no questions asked life insurance company like Gerber. You pay $108.85 for your coverage. After six months, you had a heart attack and died.

Your beneficiaries will be shocked to learn they will not receive the full death benefit of $25,000. Instead, they will only receive $718.41 ($108.85 x 6 = 653.10 plus 65.31 interest), which will not be enough to pay for the funeral and other expenses.

Beware of final expense companies offering no questions about burial insurance when you can qualify for full first-day coverage. Only settle for no questions about life insurance if you have a severe medical condition or have no other option for life insurance coverage.

SCAM #3 Overpriced Burial Insurance

Many burial insurance companies are designed to overcharge with premiums. Seek a second opinion from the agent who pressures you to buy a more expensive policy. Some insurance agents will attempt to sell a more expensive plan or add extra riders or provisions you don’t need to be able to get more commissions.

Read all the details in your insurance policy, take note of the riders, and ask questions about anything you don’t understand. Ask your broker why each provision is necessary and what the benefits are. If your broker cannot answer your questions, you look for a new broker that will protect your interests.

SCAM #4 Burial Insurance Identity Theft Scam

4.1 There’s a problem with your burial insurance policy

Scammers target not only people looking to buy life insurance. They also target policyholders.

This scam involves a call or an email saying there’s a problem with your existing policy. The email looks like it comes from your life insurance company. Look closely because this email was sent by scammers who designed the message to make it look official.

The email claims that there’s a problem with your account.

For example:

- Your policy premium payment is overdue because your last premium payment didn’t go through.

- They may also tell you that your policy has been canceled.

- Your policy terms have been changed, and they need to verify the changes, so you need to confirm your identity first.

- A new life insurance policy was made in your name, and they need to confirm the policy terms before it becomes effective.

They will instruct you to provide your personal information, like your social security number, to process the cancellation request or reinstate your policy in case of an error. They will also ask for your password to access your plan online or your credit card information or check number for the approval to go into effect. The scammers can now steal from you or commit fraud under your name with your personal information.

If you get this kind of call or email, flag them as spam. If someone tells you a problem with your policy, call your insurance company through the official customer service line or speak to your life insurance agent to verify the information.

4.2 A Dead person made you a beneficiary

Another variation, a new policy has been established, designating you as its beneficiary. The company needs your approval and confirmation to process.

You will receive an email claiming you benefit from someone else’s policy with this scam. The email will claim you’re connected to another life insurance policy, perhaps from someone who recently died and named you as the beneficiary or because someone bought a plan on your behalf. Once again, the scammer will ask for your personal information, like your social security number, hoping you will reply.

SCAM #5 Fake Burial Insurance Websites

Today, online shopping is prevalent; that’s why most Americans look for life insurance providers online. But beware, the internet is the biggest source of financial scams, and you will even find fake burial insurance websites.

This is an online scam. You will see a fake insurance website posing as a life insurance company. These sites pretend to be life insurance companies where you can quickly sign up online. They are often only one-page websites.

Most of the time, they make it very easy to sign up because they don’t require medical underwriting or promote rates much lower than their competition. They will ask you to submit your credit card or bank information to sign up, and when you do, they will steal your money.

While you can’t avoid landing on these websites, you have to know how to spot the sign of scams. Be cautious when you find a website offering instant sign-ups and premiums below the average market rates. You might end up paying premiums to a fake insurance website that is not licensed to sell insurance.

Beware of fake burial insurance websites. An authentic life insurance company website will never pressure you into signing up.

SCAM #6 Unbelievable Rates

Some life insurance companies promote an unbelievable teaser rate. You probably have seen some adverting that says a dollar can buy a certain amount of coverage. This scheme is a dishonest marketing tactic to goad you into buying a policy.

The final expense company will advertise their lowest premium, those at their best underwriting class for healthy people. Only very few applicants will qualify for this rate. After you apply, you will realize that your coverage will cost much more.

Don’t be deceived by an advertisement stating you can buy burial insurance for $9.95. The Colonial Penn life insurance per unit is confusing and can mislead you. While the price per unit is fixed at $9.95, the death benefit is set by your age and what the company decides is appropriate.

1-unit represents the death benefit for a specific age. For example, if you’re a 50-year-old male, your 1-unit equals a $1,786 death benefit. However, if you’re an 85-year-old male, your 1-unit can only buy $418 coverage.

SCAM #7 Dishonest Instant Online Quotes

This scam involves websites giving an instant online quote. Most online shoppers find this service useful when comparing burial insurance rates from multiple life insurance companies.

The only problem is that not all instant quote providers are legitimate. These websites will only give an instant quote in exchange for your contact information. They then sell your contact information to multiple insurance agencies that will contact you and prepare a real quote themselves (Funeral Funds never does this).

An instant online quote is likely to blame if someone has contacted you lately to sell final expense insurance.

Check the authenticity of the insurance website offering an instant online quote service before giving your contact details. Read reviews online to find out what other people say about this website.

SCAM #8 Fake Burial Insurance Agents

There are far too many fake insurance companies and agents out there. You might see them online, over the phone, or knocking on your door. The fake agent will show up at your door and offer you a phony deal they are promoting at that time. They will promise to give you a quote.

Once they present you with what you think is a great quote, they will ask for your personal information, such as name, address, social security number, and credit card information. This information gives them the chance to steal your identity.

Before buying life insurance, make sure you are dealing with a licensed life insurance agent and company.

SCAM #9 Burial Insurance Premium Thefts

You may find a legitimate company offering the plan you need, but the agent is the problem. Unscrupulous agents want to pocket your premium. This burial insurance scam is called premium theft. Scammer agents will ask you to pay in cash or issue a check payable in their name, but they will never remit the money to the life insurance company, which goes straight to their pocket.

Avoid this life insurance agent to ensure your premiums are going straight to the company.

Tips To Avoid Burial Insurance Scams

#1. Check to see if the life insurance company actually exists

Fake insurance companies will provide you with a policy and take your premiums. This insurance fraud is normally detected when the beneficiary tries to collect the death benefit.

To avoid this type of scam, avoid the following:

- Insurance companies with unfamiliar names

- Insurance policies that are lesser in price than comparable policies

- Agents who refuse to answer your questions or provide vague answers

- Agents who require you to pay your premium in cash or check payable to them

Do your homework. Make sure you apply to a dependable insurance company. Check with the state insurance board that regulates agents and companies. You can verify the company’s contact information through the National Association of Insurance Commissioners. They can verify if the insurance company really exists and if they are licensed to sell in your area.

Check the company’s financial stability with rating agencies like A.M. Best Rating Services and Standard and Poor. Pick an insurance provider with an A- rating or better.

You can also search the Better Business Bureau to see if the insurance company has any consumer complaints, mainly if it’s a smaller company. Finally, use common sense to check offers. If an insurance company promotes something that looks too good to be true, it may indicate a scam.

#2. Know what life insurance policy you are paying for

Research the different types of life insurance policies to know what suits you best. Tell the agent exactly what kind of policy you desire; this lessens the chance of getting something you don’t need.

Life insurance plans can be very lengthy and hard to read. Some unscrupulous agents will slip past you in the middle of your paperwork. They know that most people don’t read through the contract and they call easily add costs to the plan. Take the time to check the type of policy you are getting before you sign on the dotted line.

Never sign any documents with empty spaces; by leaving spaces, the scammer can add whatever he wants to your policy. He may even put his name as the beneficiary of the plan. Make some markings on the spaces to ensure they cannot add anything after signing your policy.

Check to see if you are paying any unnecessary coverage. Look at your life insurance statement to see the breakdown and exact coverage you purchased.

#3. Never pay premiums in cash

A cash deal is a red flag for burial insurance scams. Always pay your insurance premium in check or money order. The insurance company may be legitimate, but the agent may be unscrupulous.

Be sure to get a receipt or a written invoice every time you pay your premium. Even a canceled check can verify payment if a discrepancy arises. Always ask for proof of payment from your agent.

#4. Make sure the company receives your payments

Check with the insurance company to ensure they receive your premium payment. Some insurance agents personally collect a payment, but they never turn it over to the insurance company. This type of burial insurance scam is called premium theft.

If your insurance provider does not use direct deposit or credit card payments, you should periodically confirm with the company that they are receiving your premium payments.

#5. Know how to avoid identity theft

In case you receive an unsolicited email claiming to be from your own life insurance company and requesting your personal information, DO NOT REPLY. Instead, call your company’s customer service hotline or your life insurance agent. If they need more information, you can give it more safely over the phone or in person.

Be suspicious if they tell you that you are a beneficiary and you will receive a death benefit from a policy you didn’t know existed, particularly if you don’t know the person who set up the policy. Burial insurance scammers hope you will supply your information because you’re interested in the money and don’t realize it’s a scam.

Never provide your information over the internet to get instant quotes. Your information may be used for fraud, or they will sell your information to a life insurance agency. Insurance companies never need your social security number to provide a basic quote. They will only ask for it when you apply but not before the application.

#6. Avoid plans that are too good to be true

Too good to be true plans should be avoided. Thousands of people fall victim to burial insurance scams each year. While most insurance companies highlight their best insurance deals on their website, scammers also use this technology to con people.

To remain safe from insurance scams, follow our tips before making insurance decisions. If you’re uncomfortable, take your time. Don’t allow any agent to pressure you to make a quick decision.

#7. Seek a second opinion if the agent is pushing you to buy a more expensive policy

Some agents will try to sell more expensive policies or add riders you don’t need to boost their commission. Only get what you need and check if you can pay your premium. Don’t hesitate to ask questions about things you don’t understand. If the agent cannot answer your question, seek another agent that will protect your interest.

#8. Choose a reputable life insurance agency

You will feel comfortable working with an agency that will assess your needs to determine the right plan at the right price. When choosing an agency, consider the following:

- Ask your family and friends for referrals

- Check if the agency has a license in your state

- Check the agency’s credentials

- Check with your state insurance division to see if any complaints are lodged against the agency.

How Can Funeral Funds Help Me?

Finding a burial or final expense insurance policy needn’t be frustrating; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you want to know more about burial insurance scams, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies anymore because we will do the dirty work for you.

We will shop your case at different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search for all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you want to avoid funeral insurance scams, burial insurance scams, or life insurance scams, we can help. Fill out our quote form on this page or call us at (888) 862-9456, and we can give you an accurate burial insurance quote.

Frequently Asked Questions

What are the most common types of life insurance scams?

Another common scam type is “stranger-originated life insurance” or STOLI. This is where someone takes out a life insurance policy on an elderly person without their knowledge or consent. The goal is to cash in on the policy after the person dies.

Still, other scams involve fake life insurance policies. This is where someone sells you a policy that doesn’t exist. Or, they may sell you a real policy but then cancel it after you’ve paid the premium.

How to spot common burial insurance scams?

Be wary of anyone who tries to sell you a life insurance policy without first doing a needs analysis. A legitimate agent will want to know about your financial situation, health history, and family circumstances before making any recommendations.

Beware of anyone who pushes a particular type of policy or company. A good agent will offer various options from different insurers so that you can choose the policy that best meets your needs.

How can you protect yourself from life insurance scams?

One of the best ways to protect yourself is to work with an independent agent representing multiple companies. This gives you access to a wide range of products and pricing options without risking your policy being canceled without warning.

How to avoid life insurance scams?

You should also read the fine print before signing any life insurance policy. Pay close attention to the cancellation and non-renewal provisions to know your rights if you need to cancel the policy in the future. Finally, don’t hesitate to ask questions if anything about the policy or the sales process seems unclear. An honest agent will be more than happy to answer your questions and address any concerns you may have.

How does the beneficiary scam in life insurance work?

The beneficiary scam in life insurance is a type of fraud that involves calling you to tell you that you are a beneficiary of a life insurance policy. The caller may say that the policyholder has died, and they need your personal information to process the claim. They may also say that you are owed money from the policy, and they need your banking information to send you a check. In some cases, the caller may even say that you need to pay a fee to receive the payout from the policy.

How can you avoid the beneficiary scam?

To avoid falling victim to this scam, you should be suspicious of unsolicited calls about life insurance payouts or other financial transactions. Never provide your personal information or banking details over the phone to an unknown caller, and always verify any claims about a potential payout with the insurance company directly.

How can you spot life insurance fraudsters?

One of the best ways to spot life insurance fraudsters is to be wary of anyone who tries to sell you a policy without first asking about your needs or conducting a needs analysis. A legitimate agent will want to know about your financial situation, health history, and family circumstances before making any recommendations.

What to do if someone told you you are a life insurance beneficiary?

If someone contacts you and tells you that you are a life insurance policy beneficiary, do not provide any personal information or banking details over the phone. Instead, verifying the claim directly with the insurance company or your agent is best. You can also report any suspected life insurance fraud to the authorities, who will investigate and take action if necessary.

How does a premium diversion scam work?

A premium diversion scam occurs when an agent collects your premium payments but then diverts the money to their own account instead of forwarding it to the insurance company. This scam can leave you without coverage, and it can be difficult to detect if you aren’t paying attention to your payments.

How can you avoid a life insurance premium diversion scam?

It’s important to be aware of any red flags that might indicate that your agent is not legitimate. Be suspicious if you’re contacted out of the blue about a life insurance policy. You should also watch out for any requests to pay outside the normal channels, such as through gift cards or wire transfers. Finally, always review your payment statements carefully to ensure that the correct premium is being charged and paid out.

How can you avoid agents pocketing your insurance premium?

You can avoid agents pocketing your insurance premium by being aware of the signs of this type of fraud. You should also watch out for any requests to pay outside the normal channels, such as through gift cards or wire transfers. Finally, always review your payment statements carefully to ensure that the correct premium is being charged and paid out. Additionally, you can use trusted insurance providers, such as those licensed and regulated by the government. By working with reputable organizations, you can rest assured that your premium payments are going where they’re supposed to.

What should you do if you think you’ve been the victim of a life insurance scam?

If you think you’ve been the victim of a life insurance scam, the first step is to report it to the authorities. You should also contact your insurance company to let them know what happened and see if there is anything they can do to help. Finally, protect yourself in the future by monitoring your credit report and being cautious of unsolicited calls about financial transactions.

Should you send your premium to your insurance agent?

You should not send your premium payment directly to your insurance agent. It is likely a scam if someone asks you to pay your premium this way. Instead, you should contact your insurance company directly or use trusted third-party payment providers. Additionally, it’s important to be aware of any red flags that might indicate that your agent is not legitimate, such as requests to pay outside of normal channels or sudden changes to your policy.

How can you spot phony insurance policies?

You can look out for several warning signs to spot phony insurance policies. For example, it may be a scam if an offer comes out of the blue and is unsolicited. Additionally, if the policy requires that you pay your premium through unconventional means, such as gift cards or wire transfers, it may be fraudulent. You should also watch out for any requests to make changes to your policy without your knowledge or input.

How can you avoid phony insurance policies?

To avoid phony insurance policies, it is important to be aware of the warning signs. Some key indicators include unsolicited offers, requests to pay your premium through unconventional methods, and changes to your policy without your knowledge or input.

What should you do to avoid phony insurance policies?

There are several steps that you can take to avoid phony insurance policies. These include awareness of the warning signs, such as unsolicited offers and requests to pay outside of normal channels.

How can you spot insurance agents selling term insurance as burial insurance?

You can look for several signs to spot insurance agents selling term insurance as burial insurance. For example, the agent may try to sell you a policy with a death benefit much higher than what is typically offered for this type of coverage. Additionally, the agent may tell you that the policy does not have to be renewed and will cover you for life. However, term insurance policies typically need to be renewed every few years and do not provide coverage for your entire life.

What should you do if you think an insurance agent is scamming you?

If you think that an insurance agent is scamming you, the first step is to report it to the authorities. You should also contact your insurance company to let them know what happened and see if there is anything they can do to help.

How can you avoid insurance agents selling term insurance as burial insurance?

You can take several steps to avoid insurance agents selling term insurance as burial insurance. One step is to ask them if the policy will expire. This is a red flag if they say it does not have to be renewed.

What are the insurance companies selling term life insurance as burial insurance?

Several companies sell term life insurance as burial insurance. One example is the American Family Life Insurance Company. Another example is Globe Life and Accident Insurance Company.

What is the best way to avoid getting scammed by an insurance agent?

The best way to avoid getting scammed by an insurance agent is to be aware of the warning signs. These include unsolicited offers, requests to pay outside of normal channels, and changes to your policy without your knowledge or input. If you are ever in doubt, you should contact your insurance company directly to ask about the offer or policy.

How can you spot a burial insurance identity theft scam?

You can look for several signs to spot a burial insurance identity theft scam. For example, the agent may ask for your Social Security number or other personal information before giving you a quote. Additionally, the agent may try to rush you into buying the policy without giving you time to read the fine print.

What should you do if you think you are being scammed?

If you think you are being scammed, the first step is to report it to the authorities. You should also contact your insurance company to let them know what happened and see if there is anything they can do to help.

How does a fraudster target insurance policyholders?

There are several ways that a fraudster can target insurance policyholders. One common method is to send out unsolicited offers for coverage. Additionally, fraudsters may try to get personal information from policyholders to sell it to third parties or use it to commit identity theft.

What are some common scams targeting insurance policyholders?

Some common scams targeting insurance policyholders include phishing and identity theft schemes, fraudulent solicitations for coverage, and fake claims. For example, a scammer may send out emails or phone calls that appear to be from an insurance company to get personal information like Social Security numbers or bank account details.

How do you avoid a burial insurance identity theft scam?

You can take several steps to avoid a burial insurance identity theft scam. For example, do not give out your personal information to someone you do not know. Additionally, read the fine print on any documents before you sign them. If you are ever in doubt, you should contact your insurance company directly to ask about the offer.

What should you do if an agent told you that your last premium didn’t go through?

If an agent tells you that your last premium didn’t go through, you should contact your insurance company directly to find out what happened. It is possible that there was an error, and the payment did not go through. Alternatively, the agent may be trying to scam you.

Can you really buy insurance for $1?

It is possible to buy insurance for $1, but this is only an introductory rate and will often increase after a short period. Many insurance companies offer this low-cost option to attract new customers, but you will typically have to pay much more in the long run for your coverage. As such, it is important to be wary of any offers that seem too good to be true and do your research before purchasing an insurance policy.

How do you spot fake burial insurance agents?

Several signs may indicate that a burial insurance agent is fake or fraudulent. For example, if the agent asks for your personal information before providing you with a quote or tries to rush you into a purchase without giving you time to read the fine print, these can be red flags that the agent is trying to scam you.

How can you avoid fake burial insurance agents?

There are several steps you can take to avoid fake burial insurance agents. First, only work with reputable companies that you know and trust. Additionally, read the fine print on any documents before signing them. Finally, if you are ever in doubt, you should contact your insurance company directly to ask about the offer or policy.

Are there any other tips for protecting yourself from burial insurance scams?

Some other tips for avoiding life insurance scams include researching before purchasing a policy, working with an independent agent with your best interests, and asking for referrals or reviews from other customers. Additionally, it is important to be aware of any suspicious activity, such as high-pressure sales tactics or requests for upfront payment, before the policy has been issued. By being vigilant and taking these precautions, you can help protect yourself from life insurance scams and ensure you get the coverage you need at a price you can afford.

What is the best way to find a reputable insurance agent?

The best way to find a reputable insurance agent is to research, ask for recommendations from friends and family members, and compare different options. You should look for an agent with a strong industry reputation, who offers a range of products and services, and who provides high-quality customer support. Additionally, it is important to read reviews and testimonials from other customers to understand what to expect.

3 Comments

Orville bell

Im looking for burial insurance for 72 year old male

Funeral Funds

Orville – You can call us at (888) 862-9456 or get a quote here – https://funeralfunds.com/free-quote/

Josanne

I agree! Lots of bad companies out there to worry about. Nice to see some good companies like you out there!