2024 State Regulated Life Insurance Program [DON’T Get Fooled By This!]

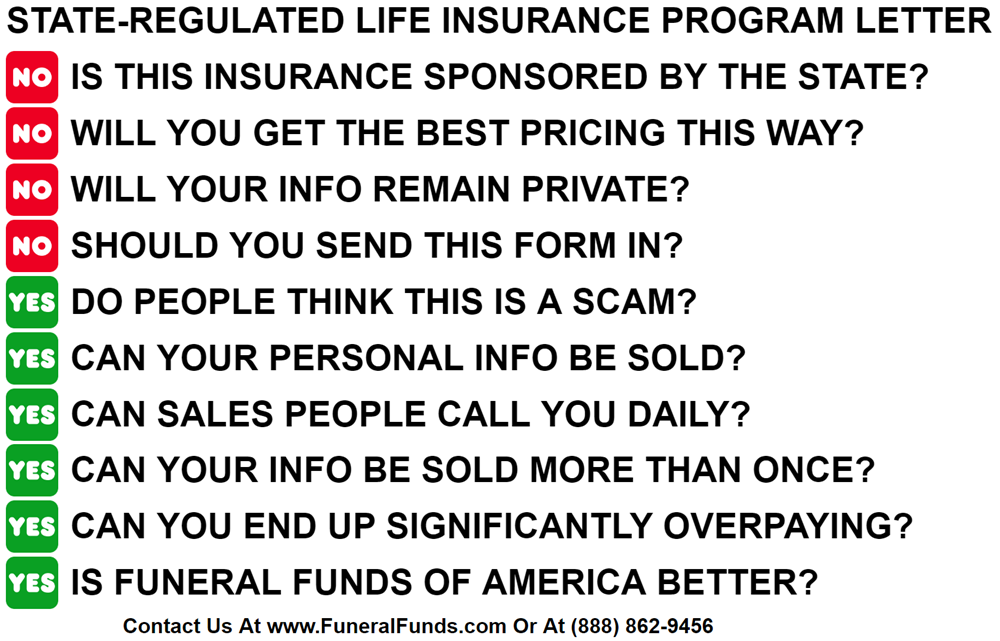

Is a state-regulated life insurance program letter you got in the mail a hoax? These letters say that there’s a state-regulated life insurance benefit that will pay for 100% of your funeral expenses up to $30,000 (TAX-FREE)…even if you have been turned down in the past.

Companies mail these deceptive letters to get your personal information to sell to insurance salespeople. You will start getting bombarded with phone calls from agents trying to sell you overpriced insurance (often with terrible 2-year waiting periods).

In this article, we’ll show you the right way to invest in this type of insurance. You can also call us directly at (888) 862-9456 for information and your truly lowest rates.

In this article, we will examine if the state-regulated life insurance you receive in the mail is a hoax.

FOR EASIER NAVIGATION:

- What Does “State-Regulated Life Insurance” Mean?

- Is State-Regulated Life Insurance A Hoax?

- Does The State Sponsor These Plans?

- What Do You Need To Do?

- What Is Final Expense Insurance?

- Here’s A Better Way To Find Burial Insurance Or Final Expense Insurance

- How Can Funeral Funds Help Me?

- Additional Questions & Answers On State-Regulated Life Insurance

What Does “State-regulated Life Insurance” Mean?

You might be asking what stage-regulated insurance is. All life insurance companies are regulated at the state level. Every insurance company that wants to offer any insurance products in your state must get a license to sell from your state’s insurance department.

The insurance company must provide financial information about the product and the company to get a license. The department of insurance will permit to sell the insurance product once all the requirements are met.

In truth, all insurance companies are regulated by the state. Therefore, “state-regulated life insurance” is nothing new or special; it’s just a marketing trick to fool you into giving away your personal information.

Is State-regulated Life Insurance A Hoax?

Technically, a state-regulated life insurance mailer is not a hoax. It’s a lead generation strategy that is misleading — making people think that there is a state-sponsored citizens’ life insurance plan that will take care of their final expenses.

These State Regulated Life Insurance advertisements are intended to get your personal information, which will then be sold You’ll possibly start getting 100’s of phone calls!

The mailer uses the phrase “state-regulated” to make their offer sound more official like it is like notifying you about a new government benefit program. These programs go by different names in different states. Further down in this post are many variations in all 50 states.

This mail often looks like it’s coming from a government agency. They use headlines like “New Government Benefit Update,” “Medicare Open Enrollment Qualification Request Card,” or “Important Letter of Notification.”

Does The State Sponsor These Plans?

If you look closer, you will find this statement at the bottom of the card: “Not affiliated with or endorsed by any government agency.”

No state benefit pays for someone’s funeral. The only money you can get for the end-of-life expenses is $255 from Social Security (but only if you qualify).

This lead generation strategy wants you to give your personal information before you have the time to think about if it’s a hoax or not. They will ask you to fill in your name, address, age, phone number, spouse’s name, and age and return the card within five days. They want you to act quickly, so they get your personal information quickly!

Beware of these state-regulated life insurance offers! If you send your information, be prepared to receive massive numbers of mail solicitations and phone calls from insurance agents trying to sell life insurance.

The company that sends these mailings will often sell your personal information to insurance companies in your state. You will typically see Direct Mail Processing LLC that goes directly to Direct Processing Center PO Box 4453 Boise ID 83711. This Direct Processing Center in Boise, Idaho will use it to try to sell you life insurance, burial insurance, or supplemental Medicare insurance.

What Do You Need To Do?

If you received these life insurance mailers, final expense insurance ads, life insurance postcards, or life insurance marketing flyers and think you need the benefits mentioned in the mail, contact a trusted insurance agency like Funeral Funds first.

DON’T provide your personal information to anyone you can’t verify as a trusted source for this insurance.

Throw away all unsolicited final expenses mailers and state-regulated life insurance advertisements. You don’t need to give your personal information to determine your insurance options.

Make sure and check your existing burial insurance coverage first. These lead generators will try to scare you into thinking that your insurance coverage is insufficient to pay for your funeral and other final expenses. They may imply that Medicare won’t pay your medical bills.

If you want to know more about your benefits, here’s a link to the government website to learn about free government benefits in your state.

So now that we have exposed these burial insurance scams, here is some information on how to safely get burial, cremation, or final expense life insurance.

What Is Final Expense Insurance?

Burial insurance is also called funeral or final expense insurance. It is a whole life insurance policy that lasts until age 121 years old. This plan is designed to cover the cost of a funeral, burial, and other final expenses.

Once you pass away, the senior life insurance company will pay a tax-free check to your beneficiary. This plan is not assigned to a funeral home, and your beneficiary can use the benefit payout; however they see fit.

WHAT BENEFITS ARE INCLUDED IN LEGITIMATE FINAL EXPENSE LIFE INSURANCE PLANS?

- Burial insurance is often much cheaper than a pre-paid funeral plan.

- It is easy to qualify for burial insurance. A medical exam is unnecessary; you only need to answer some health questions.

- Most people will qualify for burial insurance coverage regardless of their medical conditions because it does not require medical exams for approval. You will only need to answer some basic health questions.

- Burial insurance has a fixed premium which will never increase due to advancing years or health conditions.

- The death benefit amount is also fixed and guaranteed to never decrease for any reason.

- The insurance coverage will not cancel when you reach 80 years old. The policy remains in force if you keep paying the premiums on time.

- Burial insurance is a whole life insurance policy that accumulates cash value. The cash value can be used to pay premiums, or you can borrow against it if you have a family emergency.

- A death benefit payout can help pay for the funeral, burial, and final expenses; your beneficiary can use any leftover money for any purpose.

- Burial insurance is portable. You can use the death benefit payout at any location because it is not assigned to any particular funeral home. It is particularly useful if you’ve moved to a new place and you’ve changed your mind about the funeral arrangements.

- Burial insurance benefit is tax-free. Your beneficiary will receive your death benefit without paying any taxes.

Here’s A Better Way To Find Burial Insurance Or Final Expense Insurance

Step 1: GET YOUR FREE QUOTE

Getting a quote has never been easier. Using your mobile phone or computer, look for an independent life insurance agency website (we offer a free quoter on this page). We can provide you with a quote or price estimate from many insurance providers.

Working with an independent life insurance agency like Funeral Funds will save you the hassle of getting a quote from each insurance company.

Use our instant online quote form to check out the rates and companies available in your state.

If you have any health issues, your agent will be able to pre-screen these conditions and recommend providers that are friendly with your health issues.

Step 2: CHOOSE WHICH INSURANCE POLICY IS THE MOST AFFORDABLE FOR YOU

Choose what type of burial insurance you need. Like you, most senior citizens are looking for a simple burial insurance policy that will cover the cost of final expenses so that you won’t leave your family with a financial burden.

Types of Burial Insurance

Simplified Issue – this type of insurance policy is a simplified version of regular life insurance. It does not require a medical exam or health check, but you will be asked to answer some basic health questions on the application.

Your application will be easily approved if you answer “NO” to the health questions. The background check is a part of the underwriting process. They will check your prescription medication, Medical Information Bureau, and Department of Motor Vehicle records.

Guaranteed Issue– is a type of insurance policy that guarantees approval regardless of your current medical condition. A medical exam is unnecessary, and you don’t need to answer health questions. As long as GI policy is available in your state, you are 50 to 85 years old, and you can enter into a legal contract, the company is guaranteed to offer you coverage.

If you have any health issues that make it impossible to qualify for a traditional term or whole life insurance, you should consider a guaranteed issue policy.

Features of Burial Insurance:

- Available for seniors ages 50 to 85

- No medical exam required

- Coverage lasts your entire life

- Level premium – premiums are fixed and will never increase

- Death benefits will never decrease for any reason

- Minimal face amount from $2,000 up to $25,000 available

- The policy accumulates cash value

Once you decide which policy suits your needs and receive the pricing from the online quoter, the next step is deciding which insurance company to apply to.

You need to consider the insurance company with the best price.

It is important to ensure that the insurance company is stable and can pay its policyholders on time.

Step 3: FILL OUT AN APPLICATION FORM

After finding the insurance company that’s the perfect fit for your needs, it’s time to apply. Completing an application will be the next step after you have secured an independent agent and know the type of policy that best fits your budget. Your application will be approved over the phone if you use Funeral Funds to help you with this.

The application process will generally take 10 to 20 minutes. There will be a series of questions to answer about your personal information from medical history to the type of lifestyle you live.

During the application, you will be asked to provide your beneficiary or the person who will receive your death benefit payout when you pass away. It is also advisable to give contingent beneficiaries in case something happens to you and your primary beneficiary simultaneously.

How Can Funeral Funds Help Me?

Finding a final expense insurance policy if you receive offers from the mail needn’t be a frustrating process; working with an independent agency like Funeral Funds will make the process easier and quicker.

If you have any health issues, let us help you; we will work with you side by side to find a plan that fits your needs.

We will work with you every step to find the plan that fits your financial requirements and budget. You don’t have to waste your precious time searching for multiple insurance companies because we will do the dirty work for you.

We will shop your case at different insurance carriers and get you the best price.

We work with many A+ rated insurance carriers that specialize in covering high-risk clients like you. We will search all those companies to get the best rate. We will match you up with the best burial insurance company that gives the best rate.

We will assist you in securing the coverage you need at a rate you can afford. So, if you are looking for state-regulated funeral insurance, or state-regulated burial insurance, or state-regulated life insurance. Fill out our quote form on this page or call us at 888) 862-9456, and we can give you an accurate quote.

Another thing you may need to consider is the company’s financial stability. Funeral Funds only work with “A” rated or better insurance companies.

Additional Questions & Answers On State Regulated Life Insurance

What does state regulated insurance mean?

All life insurance plans are state regulated. State laws fully regulate them.

What is a state regulated program?

Life insurance plans and employee health benefit plans are state-regulated because they can be impacted by state law.

Is life insurance highly regulated?

Yes, the life insurance industry is highly regulated. They are regulated at the state level. Every state has an insurance department that oversees and verifies every life insurance company to ensure they have the resources to meet their financial obligations to policyholders.

Who is life insurance regulated by?

State insurance commissioners regulate the life insurance industry. The National Association of Insurance Commissioners (NAIC) makes sure that the insurance industry will protect insurance consumers.

Are all insurance companies regulated?

Yes, all insurance companies are regulated in their state of domicile and all the states where they sell life insurance. Insurance companies that fail to comply with the regulatory requirements may have their license suspended or revoked. They may also be fined for regulatory violations.

Why do states regulate insurance?

Life insurance is highly regulated to protect American consumers. State regulation ensures that every life insurance company fulfills its promise to its consumers.

How are insurance companies being regulated?

States regulates the insurance industry. Each state has its own set of rules. This regulation stemmed from the McCarran-Ferguson Act of 1945 that the public interest must come first.

Is it better for insurance to be regulated by state or federal?

Yes, federal regulation gives way to uniformity and efficiency. However, a federal charter could be more cost-effective. Federal regulation supporters claim they can be more competent regulators.

What is the new state regulated life insurance program about?

The new state-regulated life insurance program is a paid-postage mailer addressed to people between 50 and 85 in every state. Telling the recipients they qualified to apply to a state-regulated life insurance program to pay for burial and final expenses for just a few pennies a day, regardless of their medical condition, even if they have been denied coverage in the past.

What is a 2024 state regulated life insurance program?

State-regulated life insurance is a marketing strategy employed by insurance agencies to sell final expense life insurance policies to seniors. State-regulated life insurance is used to make it sound like a state program to convince people to buy.

What is a 2024 state regulated life insurance program?

The 2024 state-regulated life insurance program is a marketing tactic used by insurance agencies to sell final expense life insurance to seniors. They send postage cards to seniors to find potential buyers.

What is a T2 benefit?

The T2 benefit information form is an official-looking government form created by shrewd marketing agencies to attract the attention of seniors and sell final expense insurance. The recipients need to return the card to Direct Mail Processing LLC.

What is a t2 form?

The T2 form is an official-looking government form sent to seniors to get their contact information such as name, spouse name, age, phone number, and address so that the life insurance agencies sending them can sell them final expense insurance.

Is the T 2 form legitimate?

The T 2 benefit information form is not a government issue form. This form comes from insurance agencies to gather information from seniors and sell them final expense life insurance.

What is the new state regulated life insurance program about?

The new state-regulated life insurance program is a paid-postage mailer sent to people between 50 and 85. This program states that seniors can avail of this state-regulated life insurance program to pay for their funeral, burial, and final expenses.

What is a t2 2020 benefit information?

The T-2 2020 benefit information form is a government-looking form from life insurance agencies wanting to sell final expense insurance. This form is not a part of the state’s database but a tactic used to get personal information.

Is Direct Mail Processing LLC a legitimate company?

Direct Mail Processing LLC is a legitimate company. They are a third-party mail provider for insurance companies. Their mailing address is PO Box 2910 Kennesaw, GA 30156. Their final expense postcards and final expense flyers look like government documents however, if you look at the fine print, you will see a disclaimer indicating that they are not affiliated with any government agency.

Is Dmpoptout com legit?

The dmpoptout.com is a Direct Mail Processing LLC that sends IRS or state tax document-looking postcards. They are official-looking, but in reality, they are not. Look at the disclaimer and you will find that they say they are not affiliated or endorsed by any government agency.

What is the distribution processing center in Kennesaw Georgia?

Distribution Processing Center, LLC in Kennesaw, Georgia is a third-party mail processor sending officially looking materials from legitimate insurance companies. They distribute their mail to people between the ages of 50 to 85 years old.

What is distribution processing center Kennesaw GA?

Distribution Processing Center is a third-party mail processor based in LLC in Kennesaw GA. They work with insurance companies by distributing their mail.

Is distribution processing legit?

Distribution processing companies are legitimate businesses. They act as the third-party mail processor for life insurance companies. You need to be very careful with dealing with these companies because they collect personal information and sell it.

What is Direct Mail Processing LLC Kennesaw?

The Direct Mail Processing LLC is a third-party mail provider based in Kennesaw, GA. Direct Mail Processing LLC Kennesaw sends postcards to people between 50 and 85 to get information and sell final expense insurance.

What is Records Division Kennesaw Georgia?

Records division Kennesaw Georgia with a mailing address of PO Box 2910 Kennesaw, GA 30156, is a third-party mailing provider that issues official-looking postcards saying people can qualify for a government benefit. People who respond to information will then be sold to insurance companies.

Is American Senior Benefits legit?

American Senior Benefits is an insurance brokerage in the US. They are a legitimate company.

How do I stop getting calls from senior benefits?

To stop getting calls from senior benefits, you must register online at www.donotcall.gov. Your registration will not expire, so you don’t need to register again to stop getting calls.

Is United Freedom Benefits department legit?

Yes, United Freedom Benefits is a legitimate company. Freedom Life Insurance Company owns them.

Who owns United Freedom Benefits Department?

The USHealth Group owns United Freedom Life Insurance Company. They only sell term life insurance policies but their parent company offers health, dental, and vision coverage. You must know that their insurance policies are unavailable in all 50 states.

Where can I read American Senior Benefits BBB complaints?

Read American Senior Benefits BBB complaints here.

Here are some common marketing terms used to make a life insurance product look more official, while not being an official state-regulated life insurance product:

2024 Benefit information for Alabama residents only

2024 Benefit information for Alabama citizens only

2024 Benefit information for Alabama only

2024 Benefit information for AL only

2024 Benefit information for Alaska residents only

2024 Benefit information for Alaska citizens only

2024 Benefit information for Alaska only

2024 Benefit information for AK only

2024 Benefit information for Arizona residents only

2024 Benefit information for Arizona citizens only

2024 Benefit information for Arizona only

2024 Benefit information for AZ only

2024 Benefit information for Arkansas residents only

2024 Benefit information for Arkansas citizens only

2024 Benefit information for Arkansas only

2024 Benefit information for AR only

2024 Benefit information for California residents only

2024 Benefit information for California citizens only

2024 Benefit information for California only

2024 Benefit information for CA only

2024 Benefit information for Colorado residents only

2024 Benefit information for Colorado citizens only

2024 Benefit information for Colorado only

2024 Benefit information for CO only

2024 Benefit information for Connecticut residents only

2024 Benefit information for Connecticut citizens only

2024 Benefit information for Connecticut only

2024 Benefit information for CT only

2024 Benefit information for Delaware residents only

2024 Benefit information for Delaware citizens only

2024 Benefit information for Delaware only

2024 Benefit information for DE only

2024 Benefit information for Florida residents only

2024 Benefit information for Florida citizens only

2024 Benefit information for Florida only

2024 Benefit information for FL only

2024 Benefit information for Georgia residents only

2024 Benefit information for Georgia citizens only

2024 Benefit information for Georgia only

2024 Benefit information for GA only

2024 Benefit information for Hawaii residents only

2024 Benefit information for Hawaii citizens only

2024 Benefit information for Hawaii only

2024 Benefit information for HI only

2024 Benefit information for Idaho residents only

2024 Benefit information for Idaho citizens only

2024 Benefit information for Idaho only

2024 Benefit information for ID only

2024 Benefit information for Illinois residents only

2024 Benefit information for Illinois citizens only

2024 Benefit information for Illinois only

2024 Benefit information for IL only

2024 Benefit information for Indiana residents only

2024 Benefit information for Indiana citizens only

2024 Benefit information for Indiana only

2024 Benefit information for IA only

2024 Benefit information for Iowa residents only

2024 Benefit information for Iowa citizens only

2024 Benefit information for Iowa only

2024 Benefit information for IA only

2024 Benefit information for Kansas residents only

2024 Benefit information for Kansas citizens only

2024 Benefit information for Kansas only

2024 Benefit information for KS only

2024 Benefit information for Kentucky residents only

2024 Benefit information for Kentucky citizens only

2024 Benefit information for Kentucky only

2024 Benefit information for KY only

2024 Benefit information for Louisiana residents only

2024 Benefit information for Louisiana citizens only

2024 Benefit information for Louisiana only

2024 Benefit information for LA only

New 2024 Benefit information for Maine residents only

2024 Benefit information for Maine citizens only

2024 Benefit information for Maine only

2024 Benefit information for ME only

2024 Benefit information for Maryland residents only

2024 Benefit information for Maryland citizens only

2024 Benefit information for Maryland only

2024 Benefit information for MD only

2024 Benefit information for Massachusetts residents

2024 Benefit information for Massachusetts citizens only

2024 Benefit information for Massachusetts only

2024 Benefit information for MA only

2024 Benefit information for Michigan residents only

2024 Benefit information for Michigan citizens only

2024 Benefit information for Michigan only

2024 Benefit information for MI only

2024 Benefit information for Minnesota residents only

2024 Benefit information for Minnesota citizens only

2024 Benefit information for Minnesota only

2024 Benefit information for MN only

2024 Benefit information for Mississippi residents only

2024 Benefit information for Mississippi citizens only

2024 Benefit information for Mississippi only

2024 Benefit information for MS only

2024 Benefit information for Missouri residents only

2024 Benefit information for Missouri citizens only

2024 Benefit information for Missouri only

2024 Benefit information for MO only

2024 Benefit information for Montana residents only

2024 Benefit information for Montana citizens only

2024 Benefit information for Montana only

2024 Benefit information for MT only

2024 Benefit information for Nebraska residents only

2024 Benefit information for Nebraska citizens only

2024 Benefit information for Nebraska only

2024 Benefit information for NE only

2024 Benefit information for Nevada residents only

2024 Benefit information for Nevada citizens only

2024 Benefit information for Nevada only

2024 Benefit information for NV only

2024 Benefit information for New Hampshire residents

2024 Benefit information for New Hampshire citizens

2024 Benefit information for New Hampshire only

2024 Benefit information for NH only

2024 Benefit information for New Jersey residents only

2024 Benefit information for New Jersey citizens only

2024 Benefit information for New Jersey only

2024 Benefit information for NJ only

2024 Benefit information for New Mexico residents only

2024 Benefit information for New Mexico citizens only

2024 Benefit information for New Mexico only

2024 Benefit information for NM only

2024 Benefit information for New York residents only

2024 Benefit information for New York citizens only

2024 Benefit information for New York only

2024 Benefit information for NY only

2024 Benefit information for North Carolina residents

2024 Benefit information for North Carolina citizens only

2024 Benefit information for North Carolina only

2024 Benefit information for NC only

2024 Benefit information for North Dakota residents only

2024 Benefit information for North Dakota citizens only

2024 Benefit information for North Dakota only

2024 Benefit information for ND only

2024 Benefit information for Ohio residents only

2024 Benefit information for Ohio citizens only

2024 Benefit information for Ohio only

2024 Benefit information for OH only

2024 Benefit information for Oklahoma residents only

2024 Benefit information for Oklahoma citizens only

2024 Benefit information for Oklahoma only

2024 Benefit information for OK only

2024 Benefit information for Oregon residents only

2024 Benefit information for Oregon citizens only

2024 Benefit information for Oregon only

2024 Benefit information for OR only

2024 Benefit information for Pennsylvania residents only

2024 Benefit information for Pennsylvania citizens only

2024 Benefit information for Pennsylvania only

2024 Benefit information for PA only

2024 Benefit information for Rhode Island residents only

2024 Benefit information for Rhode Island citizens only

2024 Benefit information for Rhode Island only

2024 Benefit information for RI only

2024 Benefit information for South Carolina residents

2024 Benefit information for South Carolina citizens only

2024 Benefit information for South Carolina only

2024 Benefit information for SC only

2024 Benefit information for South Dakota residents

2024 Benefit information for South Dakota citizens only

2024 Benefit information for South Dakota only

2024 Benefit information for SD only

2024 Benefit information for Tennessee residents only

2024 Benefit information for Tennessee citizens only

2024 Benefit information for Tennessee only

2024 Benefit information for TN only

2024 Benefit information for Texas residents only

2024 Benefit information for Texas citizens only

2024 Benefit information for Texas only

2024 Benefit information for TX only

New 2024 Benefit information for Utah residents only

2024 Benefit information for Utah citizens only

T2 2024 Benefit information for Utah only

2024 Benefit information for UT only

2024 Benefit information for Vermont residents only

2024 Benefit information for Vermont citizens only

2024 Benefit information for Vermont only

2024 Benefit information for VT only

2024 Benefit information for Virginia residents only

2024 Benefit information for Virginia citizens only

2024 Benefit information for Virginia only

2024 Benefit information for VA only

2024 Benefit information for Washington residents only

2024 Benefit information for Washington citizens only

2024 Benefit information for Washington only

2024 Benefit information for WA only

2024 Benefit information for West Virginia residents only

2024 Benefit information for West Virginia citizens only

2024 Benefit information for West Virginia only

2024 Benefit information for WV only

2024 Benefit information for Wisconsin residents only

2024 Benefit information for Wisconsin citizens only

2024 Benefit information for Wisconsin only

2024 Benefit information for WI only

2024 Benefit information for Wyoming residents only

2024 Benefit information for Wyoming citizens only

2024 Benefit information for Wyoming only

2024 Benefit information for WY only

13 Comments

Carolyn

i would like a quote for final expense insurance

Funeral Funds

Carolyn – We just sent you an email to help you out with this.

Heather

Thank you for posting this I just received these in my mail today I've been getting these in the mail for years and I just throw them away I knew right away they were a scam and they give you a pair postage envelope and the address its going to is Central Processing Center in Dallas,Texas but no actual address just a PO box number. And the card has no phone number or legitimate address now that ik for sure this is a scam I will continue to throw these away thank you for posting this article!

Tammy

I agree with Heather! It is exactly as she stated except my processing center is in Georgia. It also asked for my age, my spouse's name and age and phone number. It is a tricky scam if you do not read the fine print and decide to go do a "background check." Thank you for posting!

Sara

While this article has valuable information that is true and helpful, it is also contradictory to itself. The wording of "state-regulated" IS misleading, I get that and it’s not right. This does not make it fraud or a hoax, because you must work with a state-regulated insurance company and you must work with a licensed agent no matter which route you go, and you must give personal information for application purposes. When you request quotes online it works the same way that a mailer does. Agents will call you! You are requesting their expertise, right? All your information is protected and sent directly to the Insurance company you decide to do business with. Working with an Insurance Broker will help you choose what is right for you and your family because they have multiple carriers with which they are contracted. (In order to get contracted with Insurance companies you must be licensed and have a background check done each time you are appointed with a new carrier). This helps the client find the best coverage that fits in their budget without any heavy lifting. The broker does all the research for their clients. If you request insurance quotes, make sure to get the identity and licenses information from your broker to confirm who they are! In conclusion, this website wants you to use Funeral Funds as your choice of brokerage, just like a mailer would do. Do your research, always ask questions, and stay positive. If you do not feel comfortable with your agent, please let them know. If you decide to go elsewhere, let the agent know you are doing so and asked to be removed from their call list. We all must communicate and make sure we are getting what we pay for. This is an extremely old industry, and your best bet is to use a broker that works with a reputable financial group. It is all the same whether it be a mailer, online request, cold calls, television commercials, billboards, or telemarketers.

Funeral Funds

Sarah starts by mentioning "The wording of "state-regulated" IS misleading, I get that and it’s not right. This does not make it fraud or a hoax…" How could you ever trust someone like Sarah after she says something like this? This is your warning to not believe anything Sarah says, or buy any insurance from her because she may, in fact, work for one of these companies.

Oh…by the way…check out our reviews page to see what our happy clients say about us! https://funeralfunds.com/reviews/

donna shackelford

where do i mail the 2022 benefit info back to

Funeral Funds

Donna – We recommend you not mail that benefit info letter back in. Companies that do that will sell your info to other agents and your phone will start ringing off the hook day and night. If you need some help with this, visit this page to get information and a quote – https://funeralfunds.com/free-quote/

anny

How about we send the envelopes back with just a piece of blank paper in it ?

The provided envelope says "postage paid by addressee". When it starts to cost the scammers money, maybe they will stop harassing us.

If this co. was serious in helping people connect with a legit insurance broker, it would mail letters stating that. Not a fake Form T-2 pretending the state where I live will give me (more) benefits.

Funeral Funds

Anny – You're pretty crafty! That might just work if everyone did that!

Jett McGinnis

If I feel I'm being duped or something is misrepresented and they send a business reply, I stuff it with my unwanted mail all balled up to get them to pay a parcel rate instead of a first class letter rate. Not saying you should, just what I do.

jason

tape a brick to their encelope and mail it back

Patricia A Lafleche

I am not signing for this if this is a fake state regulated insurance! Have a Happy day.