2024 Burial Insurance for Terminal Illness [Use Caution]

If you’re looking for burial insurance for terminal illness, you need to be aware that your burial, cremation, final expense, and life insurance options are limited.

!!! READ THIS & WATCH VIDEO FIRST !!!

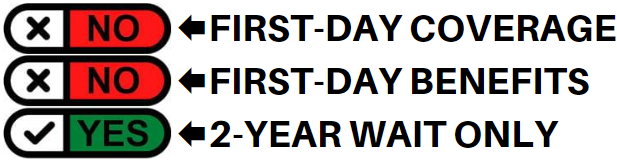

Having a terminal illness is a life-threatening health condition, and there are no insurance companies that offer 1st-day coverage to people with a terminal illness.

We recommend terminal illness patients purchase a guaranteed issue life insurance that asks no health questions but does come with a 2-year waiting.

This article will explain when burial insurance is appropriate, how to qualify for the best rates if you don’t have a terminal illness, and what non-burial insurance alternatives there are for terminally ill people.

FOR EASIER NAVIGATION:

- What Is My Best Insurance Option If I Have a Terminal Illness?

- Why I Don’t Recommend Guaranteed Issue Burial Insurance for Terminal Illness Patients?

- What Types of Burial Insurance Should I Avoid?

- What Type of Burial Insurance Is Best?

- If I Have a Terminal Illness, Do I Need a Medical Exam to Qualify for Burial Insurance?

- When is the Best Time to Get Burial Insurance?

- What Are the Life Insurance Alternative Options for People with Terminal Illness?

- Benefits of Burial & Funeral Insurance

- Other Common Uses for Final Expense Life Insurance for Terminal Illness

- How Can Funeral Funds Help Me?

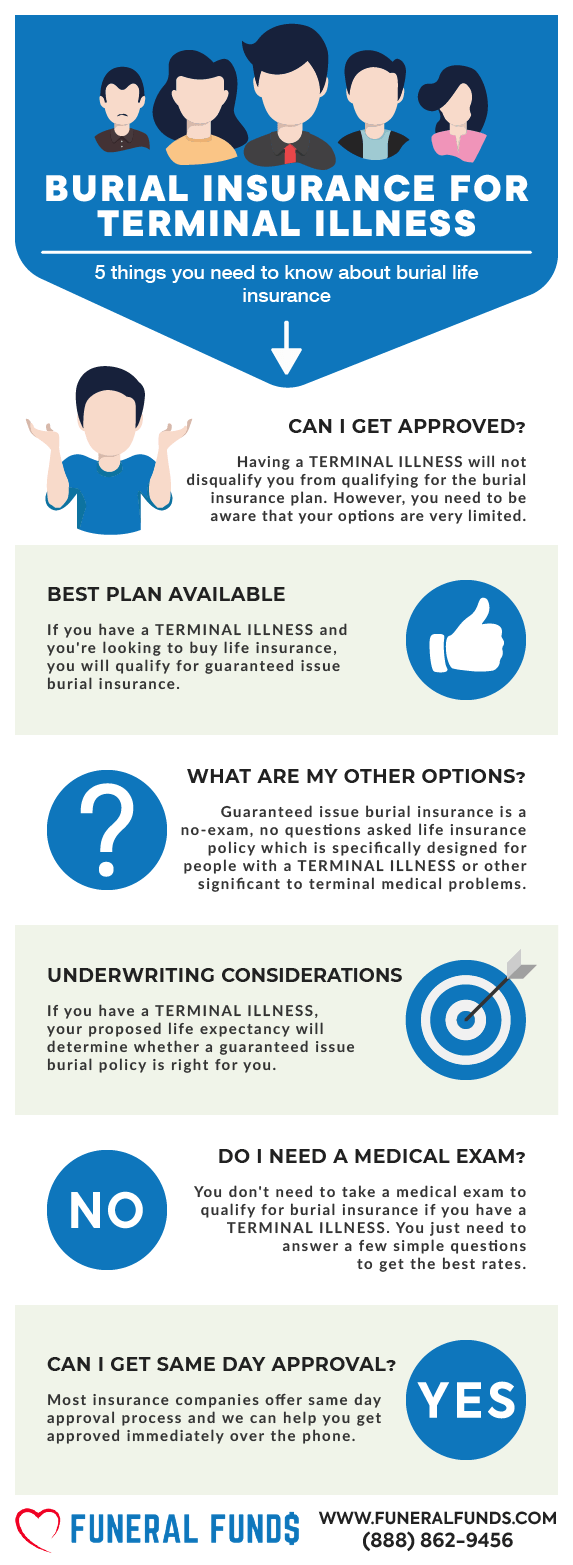

What Is My Best Insurance Option If I Have A Terminal Illness?

No life insurance policy is designed for terminally ill patients who pay out from the first day.

Your only option is a no-questions-asked guaranteed acceptance or guaranteed issue life insurance policy with a 2-year waiting period.

Here are the most common types of terminal illness the insurance companies want to know about:

- Advanced cancer

- Amyotrophic lateral sclerosis (ALS)

- Chronic lung problems

- Cystic Fibrosis

- Dementia and Alzheimer’s disease

- Heart diseases such as severe coronary artery disease

- HIV/ AIDS

- End-stage renal failure

- Muscular Dystrophy

- Scleroderma

- Parkinson’s disease

There are other terminal illnesses, but these are considered the most common in the U.S.

If you have any of the diseases above and have a life expectancy of less than two years, it’s essential to understand that your life insurance option is limited.

Best Option: Guaranteed issue burial insurance

Why I Don’t Recommend Guaranteed Issue Burial Insurance For Terminal Illness Patients

1. 2-Year Waiting Period

The #1 reason why I don’t recommend the guaranteed issue life insurance for a terminal illness is the waiting period. This plan does not offer immediate coverage other than for accidental death during the first two years.

You will automatically be approved for coverage with no questions asked when you take out this plan. Your plan will also have a mandatory two-year waiting period for any health or medical-related cause of death.

The two-year waiting period is a financial safety net for the insurance company. It is their way of protecting themselves from paying a lot of money to people who are literally on their deathbeds and trying to buy life insurance.

This policy will require you to live for the first two years before your policy pays for any health or medical-related cause of death. If you pass away during the waiting period, your beneficiary will not get your full death benefit. Instead, they will get a Return Of Premium (ROP) plus interest (usually 7-10%)

For example, your monthly premium is $100. If you paid one year before passing away, your beneficiary would receive your $1,200 premium plus $120 to account for the 10% interest for a total of $1,320.

The company will pay your full death benefit if you die from accidental death during the waiting period. It’s only for medical or health causes of death where the first-day coverage doesn’t take effect until after the two-year waiting period.

2. More Expensive

Dollar for dollar, a guaranteed issue, life insurance is up to three to five times more expensive than life insurance with medical underwriting. You will pay more on your policy because of the additional risk the life insurance company takes for approving your policy without asking any medical questions.

3. Limited Death Benefit Option

Guaranteed issue life insurance coverage maxes out at $25,000. That’s the highest coverage you can buy. If you’re planning to buy a life insurance policy to pay off your mortgage or pay for your children’s college education, this plan will not work for you.

What Types Of Burial Insurance Should I Avoid?

| PLANS TO AVOID | WHY? |

|---|---|

| Term life | Premiums increase after 5 years. Coverage ends after 80. |

| Pre-paid funeral plans | Expensive |

| Universal life | Tied with stocks |

| No health questions policies | With 2-year waiting period |

| Plans offering "teaser rates" | $9.95 per unit plans or $1 buys $100,000 coverage |

| Over priced plans | Insurance from TV and junk mail |

| Plans that accept mail-in payments | Risky |

| Plans that accept Direct Express | High lapse rate |

| Plans that accept Credit Cards | High lapse rate |

What Type Of Burial Insurance Is Best?

| FUNERAL FUNDS PLAN BENEFITS | INCLUDED |

|---|---|

| 1st Day Coverage | YES |

| Rates NEVER Increase | YES |

| Coverage NEVER Decreases | YES |

| Easy to get approved | YES |

| No Medical Exam | YES |

| Same Day Approval | YES |

| Death Claims Pay Fast | YES |

| Builds cash value | YES |

| Coverage Up To Age 121 | YES |

If I Have A Terminal Illness, Do I Need A Medical Exam To Qualify For Burial Insurance?

You are NOT required to take a medical exam to qualify for burial insurance for terminal illness.

The guaranteed issue burial insurance application process is simple, and you don’t need to provide medical records or blood and urine samples.

You’ll get the official approval from the insurance company often within minutes!

When Is The Best Time To Buy Burial Insurance?

I often get calls from people asking for burial insurance because their loved ones have a terminal illness. It’s heartbreaking to tell them that it’s too late and that they have waited too long.

Waiting until you have a terminal illness before buying burial insurance is like trying to buy a parachute after you have jumped out of a plane…it’s not a good idea to procrastinate.

The best time to get life insurance is before you are sick or ill, as your health is a determining factor for insurability from first-day coverage companies.

If you’re considering getting burial insurance, do it NOW before it’s too late! Do it now while you can still lock in the lowest pricing!

To get the lowest price on life insurance, buy it when you are younger rather than older. The older you are, the more expensive your premium will be.

Buy it when you are healthier rather than with significant health problems. The healthier you are, the lower your premiums will be.

What Are The Life Insurance Alternative Options For People With Terminal Illness?

Insurance is about risk management; insurance companies see terminal illness life insurance as a poor business decision.

If you have a terminal illness that prevents you from qualifying for insurance, you have three other options.

1. Prepaid Funeral Plan

You can pay for your funeral and burial in advance. You have the option to buy a prepaid funeral plan and make arrangements before your death.

You don’t need a burial insurance policy to cover your final expenses when you sign up for a prepaid funeral plan.

Be warned! Funeral and final expenses are not cheap. If you choose this option, be prepared to pay between $8,000 and $15,000.

Prepaid plans are not great options for people with terminal illnesses because they must be paid off for your funeral.

2. Savings Accounts

Instead of buying burial insurance, you can open a savings account, or joint savings account to deposit money to take care of your final expenses.

When you die, your family can immediately access the funds from this account to pay for your funeral, burial, and other costs associated with your death.

Savings accounts are not a great option for people with terminal illnesses since all of the people I help are on fixed or limited incomes and don’t have $8,000 to $15,000 in their savings accounts.

3. Payable on Death Account (Totten Trust)

Opening a Payable On Death (POD) account is your other option if you can’t get life insurance. POD allows you to name a beneficiary on your bank account.

The funds on your account can be used for your funeral. Upon your death, your beneficiary can immediately access the funds to pay for your funeral expenses.

Since most people ages 50-85 are on fixed or limited incomes, starting a POD account is difficult, if not impossible, for the people I help daily.

Benefits Of Burial & Funeral Insurance

Here are some of the benefits of purchasing a burial or funeral policy:

- No medical exam or doctor’s visit is required – easy to get approved.

- Ease of issue – easy to qualify and get insurance coverage.

- No Money Down to get approved – have your policy start whenever you want.

- Level premium – your premium will never increase.

- Fixed death benefit – your death benefit will never decrease for any reason.

- Permanent protection – your policy can not be canceled by the life insurance company if you continue to pay your premiums.

- Tax-free – the death benefit is directly paid to your beneficiary tax-free upon your death.

- Cash value builds up – burial insurance is a whole life policy that builds cash value over time.

Other Common Uses For Final Expense Life Insurance For Terminal Illness

All of these examples are appropriate uses for Final Expense Life Insurance:

- Burial insurance plan for terminal illness

- Cremation insurance plan for terminal illness

- Funeral home insurance plan for terminal illness

- Final Expense insurance plan for terminal illness

- Prepaid funeral plan insurance for terminal illness

- Mortgage payment protection plan for terminal illness

- Mortgage payoff life insurance plan for terminal illness

- Deceased spouse’s income replacement plan for terminal illness

- Legacy insurance gift plan to family or loved ones for terminal illness

- Medical or doctor bill life insurance plan for terminal illness

We can help you with any of the plans above. Your pricing will depend on your age, health, and coverage amount for each program option.

How Can Funeral Funds Help Me?

Trying to find life insurance when you or a loved one has a terminal illness is a losing proposition. You just waited too long to take care of something you knew would happen someday.

Suppose you are a family member shopping for insurance for a terminally ill person. In that case, I highly recommend you get burial insurance for yourself before it’s too late, and I would love for Funeral Funds to be the one who helps you.

If you’re 50-85 years old and looking to buy burial insurance, working with an independent agency like Funeral Funds will make the application and approval process easy and affordable.

If you have health problems and need life insurance, let my expert licensed agents help you. I will ensure you get the coverage you need at an affordable rate.

You don’t have to waste your precious time searching for multiple insurance companies because my agents or I will do the dirty work for you.

My agents or I will shop 20-30 different insurance carriers to get you the best price. I will search for those companies and match you with the best burial insurance company that gives the best rate.

Fill out our quote form on this page or call us at (888) 862-9456 to get an accurate quote.

2 Comments

Jessica summers

My mother was just diagnosed with stage 4 lung cancer I'm tryin to get to some insurance to help with the cost of funeral etc

Funeral Funds

Jessica – So sorry to hear about your mother's cancer diagnosis. This insurance is not a good option for people who have procrastinated in purchasing it until they are diagnosed with stage 4 cancer. Think of it this way, if your house was uninsured and it burned to the ground, and you called the insurance company the next day to try to get insurance, they would tell you that you would have had to have this insurance in place BEFORE your house burned down. It's the same way with this insurance, for first-day coverage, you need to get this insurance before being diagnosed with stage 4 cancer, not after being diagnosed with stage 4 cancer. So for your mother, this insurance is not an option. But do learn from your mother and get this insurance on yourself. Let us know if you would like help with that.